Altcoins: Analyzing Key Signs For A Potential Boom – Or Bust

06 Giugno 2024 - 11:39AM

NEWSBTC

Altcoins are generating significant buzz among cryptocurrency

watchers, as rumors of a potential Bitcoin breakout circulate.

After weeks of sluggish trading, a recent surge of capital has

revitalized the king of coins. This raises a pressing question:

will altcoins ride the wave, or are they doomed to be left behind?

Related Reading: AVAX Primed To Break $100 Barrier As Bullish Signs

Emerge Whispers Of A Bitcoin Bonanza Data from Farside Investors

reveals a significant shift in investor sentiment. Nearly $890

million flowed into Bitcoin exchange-traded funds (ETFs) on June

4th, a clear sign of renewed interest. This surge in buying could

act as a catalyst, sparking a wave of speculation and propelling

Bitcoin prices upwards. However, the question remains: how will

this newfound focus on Bitcoin impact the broader cryptocurrency

market? Historically, strong Bitcoin rallies have often been

followed by altcoin seasons, periods where alternative

cryptocurrencies experience explosive growth. But is this time

different? Altcoin Season: Just Over The Horizon? The Altcoin

Season Index, a metric that gauges market sentiment towards

altcoins, currently sits at a lowly 31. This stands in stark

contrast to the readings of 80 observed just six months ago. This

suggests that altcoins are not yet basking in the reflected glory

of Bitcoin’s potential rise. Experts believe that even with a

Bitcoin surge, only a select few altcoins are likely to outperform

the market leader. To truly unleash an altcoin season, the Altcoin

Season Index would need to climb above 75, a sign of widespread

bullishness across the entire altcoin ecosystem. Why Altcoins Might

Struggle To Shine The sheer number of altcoins compared to previous

cycles also throws a wrench into the altcoin season equation. In

2017 and 2021, for instance, the altcoin market was a much smaller

pond. When Bitcoin surged, investor money flowed more readily into

a smaller pool of altcoins, leading to significant price increases

across the board. Today, the landscape is vastly different. With

thousands of altcoins vying for investor attention, any gains

during an altcoin season might be concentrated in just a handful of

high-performing projects, leaving the vast majority behind. Bitcoin

Dominance: A Key Indicator To Watch Another crucial factor to

consider is Bitcoin Dominance (BTC.D). This metric reflects

Bitcoin’s market capitalization as a percentage of the total crypto

market cap. Historically, a significant decline in BTC.D has

coincided with altcoin seasons. In early 2021, for example, the

coin’s dominance level plummeted from 70% to 40%, paving the way

for a period of explosive altcoin growth. Related Reading: Altcoin

Alert: Notcoin (NOT) Poised For 5x Growth, Analyst Says Currently,

however, BTC.D is on the rise, suggesting that altcoins are not yet

the center of attention. Investors looking for altcoin

opportunities should keep a close eye on this metric, as a

sustained downtrend in BTC.D could be a harbinger of an approaching

altcoin season. Featured image from Indiana Daily Student, chart

from TradingView

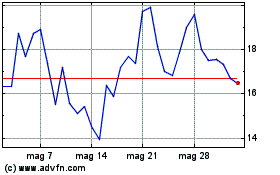

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Dic 2023 a Dic 2024