Bitcoin Slips Below $80,000—Here’s What Could Happen Next

11 Marzo 2025 - 6:30AM

NEWSBTC

Bitcoin’s price has continued its downward trend, struggling to

regain momentum after reaching its all-time high of $109,000 in

January. Over the past week, Bitcoin has declined by 14.6%, with

its price dropping an additional 4.4% in the last 24 hours. As of

today, Bitcoin is trading at $79,766, pushing it nearly 27% below

its ATH. Amid this price performance, CryptoQuant analyst

ibrahimcosar has closely examined Bitcoin’s price movements,

focusing on the CME gap phenomenon, which has historically played a

role in Bitcoin’s short-term fluctuations. Related Reading: Crypto

Pundit Dumps Bitcoin Holdings Sub-$100,000, Lists Reasons Why It’s

Time To Short What To Expect From Bitcoin Based On CME Gap In his

latest analysis, Ibrahim highlighted how BTC opened at $82,110 on

the CME, creating a gap up to the $86K level. According to him,

this price gap could provide clues about Bitcoin’s next move,

potentially leading to a short-term attempt at reclaiming $86K–$90K

in the coming days. The CME gap refers to the difference between

BTC’s closing price on the Chicago Mercantile Exchange (CME) before

the weekend and its opening price after the weekend. These gaps

often get filled as BTC’s price moves back to the levels where the

trading pause occurred. Ibrahim notes that Bitcoin previously

formed a $10,000 gap on February 28, which was quickly filled

within 19 hours. Now, with BTC currently trading around $79K–$80K,

the analyst suggests that another gap has formed above the current

price range, indicating that Bitcoin may attempt to fill the

$86K–$90K region within the next one to two days. However, he

cautions that this does not necessarily signal a full reversal in

BTC’s downtrend. Instead, he maintains that Bitcoin’s broader trend

remains uncertain, and its price action through March and early

April will be key in determining whether a stronger recovery is on

the horizon. Key Support Levels and Market Sentiment Another market

analyst, ShayanBTC, has pointed to $83,000 as a critical support

level, based on Bitcoin’s interaction with the Realized Price of

3-6 Month UTXOs. This metric tracks the average acquisition price

of mid-term holders and has historically acted as a significant

support or resistance zone. Shayan disclosed that BTC recently

tested this level, and holding above it could signal strong

investor confidence, potentially reinforcing bullish sentiment.

However, Bitcoin’s decline below $80,000 suggests that this $83,000

support level has already been breached. If Bitcoin fails to regain

ground above this threshold, market sentiment could shift towards

fear, leading to increased selling pressure from mid-term holders.

In this scenario, BTC could enter a distribution phase, where short

to mid-term investors sell their holdings, further driving the

price downward. Ibrahim has identified the $78,000–$80,000 region

as the next key support zone, which may determine BTC’s near-term

trajectory. Featured image created with DALL-E, Chart from

TradingView

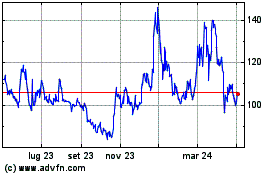

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Feb 2025 a Mar 2025

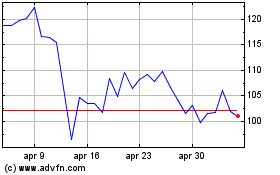

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2024 a Mar 2025