EDENRED : First-half 2023 results - Thanks to the sound execution

of its Beyond22-25 plan, Edenred confirms its strong growth

momentum, quarter after quarter

First-half 2023 results

Thanks to the sound execution of its

Beyond22-25 plan, Edenred

confirms its strong

growth momentum, quarter

after quarter

Edenred reports a strong

increase in earnings compared with first-half 2022

- Total

revenue of €1,163 million in first-half 2023, up

26.1% as reported (+25.5% like-for-like)

- Operating

revenue of €1,081 million, up 20.0% on a

like-for-like basis, including a 19.6% rise in the second

quarter

- Other

revenue of €82 million, versus €31

million in first-half 2022, driven by business growth and

higher interest rates

- EBITDA of

€483 million, up 32.5% as reported (+35.2% like-for-like)

- EBITDA

margin of 41.5%, up 3.1 percentage points

like-for-like

- Net profit,

Group share of €202 million, up

18.8%

- Strong cash

generation: funds from operations before other income and

expenses (FFO) of €338 million, up 12,9%

- Net

debt: €1.85 billion at end-June 2023

after the acquisition of Reward Gateway in May 2023 for

approximately €1.3 billion

Edenred has significantly strengthened its range of

employee engagement solutions with two acquisitions

- Acquisition of

Reward Gateway, a fast-growing platform, leader in

the United Kingdom and Australia and also present in the United

States, with the aim of rolling out the offering in another six

major countries in Continental Europe

- Acquisition of

GOintegro, a leading platform in Latin America,

active in seven countries

Edenred continues to

extend its value proposition

- An enhanced digital

experience to encourage engagement and use of its solutions

- New high

value-added Beyond Food, Beyond Fuel and Beyond Payment services

for clients, partner merchants and users

- Ongoing investments

in the technology infrastructure of its platform, in particular

through the development of API1 connections to aggregate and

distribute third-party solutions

By continuing to roll out its

Beyond22-25 strategic plan,

Edenred expects to achieve new record results in 2023

-

EBITDA expected to total between €1,020 million and

€1,090 million for full-year 2023 vs. €836 million for

full-year 2022.

*** Bertrand

Dumazy, Chairman and Chief Executive

Officer of Edenred, said: “The robust growth Edenred has

seen in recent periods continued apace in first-half 2023. Thanks

to the hard work and talent of our 12,000 employees, this growth is

proving ever more profitable, while we continue investing in our

technology assets. We are pressing ahead with our Beyond22-25

strategic plan to further penetrate our markets, enhance the

experience of our clients, partner merchants and users, and enrich

our offering of increasingly relevant solutions. During the first

half, we notably strengthened our position as the most trusted

global Employee Benefits platform by acquiring Reward Gateway,

which operates in the UK, Australia and the US, and GOintegro in

Latin America. The acquisition of these two leading employee

engagement platforms will enable us to provide HR departments with

an even more comprehensive range of solutions, making their

organizations more attractive so they can attract and retain top

talent. We also plan to expand Reward Gateway’s coverage to a

selection of key countries in Continental Europe.Lastly, thanks to

the agility of our platform, we are starting to distribute

third-party services, such as salary advance solutions, to better

meet the expectations of a fast-changing world of work. After this

strong first half, our outlook for the second half of the year is

just as promising, as we target EBITDA of between €1,020 million

and €1,090 million for full-year 2023.” |

FIRST-HALF 2023 RESULTS

At its meeting on July 24, 2023, the Board of

Directors reviewed the Group’s interim consolidated financial

statements for the six months ended June 30, 2023.

Key financial metrics:

|

(in € millions) |

First-half 2023 |

First-half 2022 |

% change

(reported) |

% change

(like-for-like) |

| Operating

revenue |

1,081 |

891 |

+21.3% |

+20.0% |

| Other

revenue |

82 |

31 |

+166.4% |

+185.2% |

|

Total revenue |

1,163 |

922 |

+26.1% |

+25.5% |

|

EBITDA |

483 |

365 |

+32.5% |

+35.2% |

|

EBIT |

399 |

295 |

+35.2% |

+40.3% |

|

Net profit, Group share |

202 |

170 |

+18.8% |

|

- Total revenue:

€1,163 million

Total revenue for first-half 2023 amounted to

€1,163 million, up 26.1% as reported compared with first-half

2022. This increase includes unfavorable currency effects (-2.0%)

and a positive scope effect (+2.7%) mainly linked to the

acquisition of Reward Gateway, consolidated since May 2023. On a

like-for-like basis, total revenue was up 25.5%.In the second

quarter, total revenue climbed 25.5% as reported and 25.2%

like-for-like, following on from the growth seen in the first

quarter. The scope effect was positive over the period, adding 4.3%

to revenue, while the currency effect was an unfavorable 4.0%.

- Operating revenue: €1,081

million

Operating revenue for the first six months of

2023 came to €1,081 million, up 21.3% as reported. This rise

takes into account unfavorable currency effects (-1.4%) and a

positive scope effect (+2.7%) mainly linked to the acquisition of

Reward Gateway. On a like-for-like basis, operating revenue grew by

20.0% versus first-half 2022.

Second-quarter operating revenue totaled

€562 million, up 20.9% as reported and up 19.6% like-for-like.

The strong sales momentum of previous quarters was confirmed across

all business lines. It reflects both growth in revenues generated

by existing clients and continued market penetration with new

clients of all sizes, largely thanks to the enhanced attractiveness

of Edenred’s solutions amid reduced purchasing power, a talent war,

and a drive for better control over fleet expenses.

- Operating revenue by

business line

|

(in € millions) |

First-half 2023 |

First-half 2022 |

% change

(reported) |

% change

(like-for-like) |

|

Benefits & Engagement |

662 |

528 |

+25.5% |

+22.8% |

| Mobility |

282 |

252 |

+12.0% |

+14.9% |

|

Complementary Solutions |

137 |

111 |

+22.5% |

+18.0% |

|

Total |

1,081 |

891 |

+21.3% |

+20.0% |

The Benefits &

Engagement business line, which accounted for 61% of the

Group’s business, generated €662 million in operating revenue in

first-half 2023, representing like-for-like growth of 22.8% (+25.5%

as reported), including a 22.7% like-for-like rise (+27.3% as

reported) in the second quarter.

This strong growth was driven by the continued

success of Edenred’s digital Ticket Restaurant® offering, popular

with both large corporate accounts and SMEs. In addition, with

public authorities in many countries raising the statutory maximum

face value of benefits since the beginning of 2022, companies are

continuing to gradually increase the amounts granted to their

employees to help protect their purchasing power. Further increases

in maximum face values were decided by public authorities in

first-half 2023, including in France, Portugal and the Czech

Republic.

Performance was also boosted by the continued

success of Beyond Food solutions. During the first half of the

year, Edenred further expanded its range of employee engagement

platforms thanks to the acquisitions of Reward Gateway and

GOintegro2. They strengthen Edenred’s position in this market, both

geographically (United Kingdom, Australia, United States and Latin

America) and in terms of the range of services offered. Edenred’s

offering now covers a unified suite of modules ranging from

employee discounts and rewards and recognition solutions to

well-being and social event solutions.The Group is also leveraging

its digital platform to distribute third-party solutions, as

illustrated by the partnership entered into in May 2023 with

Stairwage, France’s leading salary payment on demand solution.

The Mobility business line,

which accounts for 26% of the Group’s business, generated

€282 million in operating revenue in first-half 2023,

representing like-for-like growth of 14.9% (+12.0% as reported),

including a rise of 14.2% in the second quarter on a like-for-like

basis (+8.5% as reported).

This sustained performance reflects the

commercial success of the Beyond Fuel offering for fleet managers

in both Europe and Latin America, notably driven by maintenance and

toll solutions. These innovative products, such as the fully

digital UTA One Next® solution, simplify fleet management and

improve profitability, winning over clients of all sizes. However,

growth was held back by the decline in fuel prices at the pump to a

level significantly lower than in the second quarter of 2022,

particularly in Brazil.

Complementary Solutions, which

includes Corporate Payment Services, Incentive & Rewards and

Public Social Programs, generated operating revenue of

€137 million in first-half 2023, representing 13% of the Group

total. In first-half 2023, this business line was up 18.0%

like-for-like (+22.5% as reported), of which 17.3% like-for-like in

the second quarter (+20.0% as reported).

This business line’s growth reflects the strong

business momentum of Corporate Payment Services in North America,

driven by new contract wins in segments such as property

management, energy and golf clubs. Edenred Pay USA (formerly

Edenred CSI) also received a boost from the integration of IPS

(acquired in October 2022), which has enhanced its offering of

payments with invoice automation solutions.

Complementary Solutions’ performance also

reflects the success of the Group’s innovative programs, such as

insurance for involuntary job loss, which already has 270,000 users

following its January 2023 launch within the C3Pay super-app in the

United Arab Emirates.

- Operating revenue by

region

|

(in € millions) |

2023 |

2022 |

% change

(reported) |

% change

(like-for-like) |

| Europe |

677 |

551 |

+22.9% |

+21.2% |

| Latin

America |

312 |

270 |

+15.0% |

+14.7% |

|

Rest of the World |

92 |

70 |

+33.1% |

+30.5% |

|

Total |

1,081 |

891 |

+21.3% |

+20.0% |

In Europe, operating revenue

amounted to €677 million in first-half 2023, an increase of 21.2%

like-for-like and of 22.9% as reported. Second-quarter operating

revenue rose by 21.9% like-for-like and by 25.7% as reported.

Europe represented 63% of Group operating revenue.

In France, operating revenue

amounted to €169 million in first-half 2023, representing an

increase of 12.0% like-for-like and 12.8% as reported. In the

second quarter, operating revenue growth was 10.5% like-for-like

and 12.0% as reported. This performance reflects sustained growth

in Benefits & Engagement solutions, thanks to the commercial

success of the Ticket Restaurant® offer with large corporate

accounts and SMEs. Beyond Food solutions also posted a robust

performance, particularly the ProwebCE employee engagement

platform.Mobility solutions contributed to this performance,

propelled by ongoing high demand, notably in the SME segment.

Operating revenue in Europe excluding

France totaled €508 million in first-half 2023, up 24.7%

like-for-like and up 26.7% as reported. Second-quarter operating

revenue for the region rose by 26.0% like-for-like (+30.5% as

reported), lifted in particular by the contribution of the United

Kingdom’s Reward Gateway following first-time consolidation.

Benefits& Engagement enjoyed strong momentum across the region,

once again turning in a robust performance, boosted by the strong

business traction of Ticket Restaurant® and the increase in amounts

granted by clients to their employees amid rising maximum face

values. Beyond Food solutions continued to enjoy solid growth in

the second quarter. The region’s excellent performance also

reflects the success of the Beyond Fuel strategy, driven in

particular by the launch of the UTA One Next® single European toll

box and growing demand for the tax refund services offered by

Edenred EBV Finance to European transportation companies.

Operating revenue in Latin

America amounted to €312 million, up 14.7% like-for-like

(+15.0% as reported), with a 13.6% like-for-like increase and a

9.3% reported increase in the second quarter. The region

represented 29% of Group operating revenue.

In Brazil, operating revenue

increased by 8.1% like-for-like in first-half 2023, reflecting

gains of 5.9% in the second quarter. This growth reflects very good

business momentum in Benefits & Engagement, spurred by the

growing contribution of the Itaú Unibanco partnership in the SME

segment. In Mobility, the strong sales performance was mitigated by

the sharp drop in fuel prices at the pump compared with the second

quarter of 2022, when prices were at their highest for the year.

Performance was propelled in particular by the success of the

Beyond Fuel strategy, which continues to prove its worth quarter

after quarter, thanks to maintenance and toll management

solutions.

In Hispanic Latin America,

operating revenue rose by 30.1% like-for-like in the first half,

with a 31.9% increase in the second quarter. This solid performance

reflects both Mobility’s continued penetration of the SME segment

in Argentina and Mexico, and the strong momentum enjoyed by

Benefits & Engagement.

In the Rest of the World,

operating revenue amounted to €92 million in first-half 2023,

up 30.5% like-for-like and up 33.1% as reported. The region

represented 8% of Group operating revenue. This strong growth was

driven notably by the sustained business momentum of Edenred Pay

USA’s corporate payment solutions, as well as by the success of

digital solutions offered in countries including the United Arab

Emirates and Taiwan.

- Other revenue: €82

million

Other revenue represented €82 million in

first-half 2023, a rise of 166.4% as reported (+185.2%

like-for-like). This first-half performance represents another

significant increase, reflecting the impact of business growth on

the float3 as well as favorable changes in interest rates in all

regions where the Group operates. In the eurozone, the series of

interest rate hikes that began in July 2022 continued into the

first half of 2023, while interest rates in non-eurozone European

countries and in Latin America were higher than a year earlier.

For the six months ended June 30, 2023,

EBITDA came in at €483 million, representing growth of 32.5%

as reported and 35.2% like-for-like. The EBITDA margin was 3.1

percentage points higher like-for-like, at a record first-half

level of 41.5%. This performance demonstrates Edenred’s ability to

capitalize on the operating leverage of its platform business

model, while maintaining a high level of investment in innovation

and technology. EBITDA also benefited from the contribution of

other revenue, which was up sharply in the first half.

Net profit, Group share amounted to

€202 million versus €170 million in first-half 2022, an

18.8% increase primarily driven by growth in EBITDA.Net profit

takes into account other income and expenses for a net expense of

€18 million (net expense of €9 million in first-half 2022), with

the increase owing mainly to the costs of acquiring Reward Gateway.

It also includes a net financial expense of €58 million (net

financial expense of €17 million in first-half 2022), representing

an additional €41 million as a result of the rise in interest rates

impacting the cost of debt, the financial expense linked to the

debt raised to fund the acquisition of Reward Gateway, and the

negative impact of hyperinflation in Argentina and Turkey. Lastly,

net profit takes into account an income tax expense of

€102 million (income tax expense of €84 million in first-half

2022), and non-controlling interests for a negative €17 million

(negative €16 million in first-half 2022).

- Strong cash flow

generation

Edenred leveraged its strongly cash-generative

business model to deliver record-high funds from operations before

other income and expenses (FFO) of €338 million in first-half

2023, up 12,9% as reported.

At June 30, 2023, Edenred had net debt of

€1,851 million, versus €1,056 million at end-June 2022.

The increase in net debt comes as a result of the £1.15 billion4

acquisition – the Group’s largest ever – of Reward Gateway in May

2023, financed by a €1.2 billion two-tranche bond issue in June

2023, and by €0.1 billion in available cash. It also reflects free

cash flow generation of €868 million over the twelve months

ended June 30, 2023, €281 million returned to shareholders,

and a negative €3 million impact of currency effects and

non-recurring items.

- A solid financial

position

Edenred enjoys a solid financial position with a

high level of liquidity. In April 2023, Standard & Poor’s

raised the Group’s rating to A- Strong Investment Grade with a

stable outlook. This rating was confirmed following the acquisition

of Reward Gateway, announced in May 2023.

- Commitment to ESG and

extra-financial performance

In the first half of 2023, Edenred further

strengthened its commitment to social and environmental

responsibility by becoming an official supporter of the Task Force

on Climate-Related Financial Disclosures (TCFD), joining 4,000

companies and organizations worldwide that have expressed their

support for the TCFD’s recommendations.The Group’s ESG policy has

also been recognized by other external bodies. For example, Edenred

is now included in Axylia’s Vérité40 index, obtaining an A carbon

score. This rating reflects Edenred’s commitment to protecting the

environment by reducing its carbon impact, with the aim of

achieving net zero carbon by 2050 in line with SBTi targets5, as

well as supporting its clients in promoting a healthy, balanced

diet and in their transition to sustainable mobility.

OUTLOOK

In line with the good performance recorded in

the first half of the year, Edenred will continue to roll out its

Beyond22-25 strategy, fully leveraging its B2B2C

digital platform model.

In particular, Edenred will capitalize on its

strong business momentum to further develop its offering in still

largely underpenetrated markets, notably in the SME segment. As the

operating environment continues to be shaped by a talent war,

reduced purchasing power and greater consideration among fleet

managers of the risks and opportunities of the energy transition,

the attractiveness of Edenred solutions will keep serving as a

powerful growth driver.

In line with its objectives, Edenred will also

work to further extend its offering beyond food, beyond fuel and

beyond payment, as illustrated perfectly by the integration and

international expansion of newly acquired employee engagement

platforms Reward Gateway and GOintegro. In addition, by harnessing

the flexibility of its platform model, the Group will seek to form

new partnerships to broaden its offering, aggregating third-party

products on its platform as well as having its own solutions

distributed via indirect channels.

Lastly, by continuing to invest in its

first-in-class technology assets, Edenred intends to further

enhance the user experience, notably by developing data-powered

solutions and services.

By seizing all these opportunities, the Group

will continue to generate sustainable and profitable growth. The

Group expects to generate full-year EBITDA of between €1,020

million and €1,090 million in 2023, versus €836 million in

2022.

SIGNIFICANT EVENTS IN THE SECOND

QUARTER

- Edenred accelerates the

extension of its Benefits &

Engagement solutions in the Employee Engagement

arena by acquiring leading platform Reward Gateway

Edenred announced the acquisition of 100% of the

share capital of Reward Gateway, a leading Employee Engagement

platform with strong positions in the UK and in Australia, and also

present in the United States. Reward Gateway offers a unified suite

of solutions ranging from employee savings, rewards &

recognition to well-being and corporate social animation,

empowering Human Resources departments to build the right

combination of engagement tools.By consolidating Reward Gateway’s

strong leading positions and extending its geographical scope in

selected key countries, Edenred will accelerate the strengthening

of its Employee Benefits value proposition in line with its status

of most trusted global Employee Benefits & Engagement

platform.

- Edenred successfully issues

€1.2 billion in dual-tranche bonds

Edenred announced the success of its

dual-tranche bond issue for a total amount of €1.2 billion.

The issue will be used to finance a significant part of the

£1.15 billion acquisition of Reward Gateway which was fully

paid in cash by Edenred.Placed with a diverse base of international

institutional investors, the bond issue was approximately three

times oversubscribed. The great success of this issue highlights

the market’s confidence in Edenred credit quality.

Edenred’s inclusion in the CAC 40 index is

recognition of the Group’s stock market performance since its IPO

on July 2, 2010. After radically disrupting its business model,

Edenred has today become the everyday platform for people at work,

operating in 45 countries.And because it reflects both the Group’s

market capitalization and share liquidity, inclusion in the CAC 40

index is also a testament to investors’ confidence in the

Beyond22-25 strategic plan and the Group’s prospects for generating

sustainable and profitable growth.

- Edenred joins the Euronext

Tech Leaders initiative dedicated to leading, high-growth tech

companies

Joining Euronext Tech Leaders is recognition of

Edenred’s top-tier positioning, as 70% of its revenue is generated

in markets where the Group is market leader. It also acknowledges

the success and scale of Edenred’s technology leadership, with

investments of close to €2 billion in technology since 2016 (€385

million in 2022), increasing the proportion of digital business

volume to close to 95% today.

UPCOMING EVENTS

October 19, 2023: Third-quarter 2023

revenueFebruary 27, 2024: Full-year 2023 results

▬▬

About Edenred

Edenred is a leading digital platform for

services and payments and the everyday companion for people at

work, connecting 60 million users and 2 million partner

merchants in 45 countries via close to 1 million corporate

clients.

Edenred offers specific-purpose payment

solutions for food (such as meal benefits), incentives (such as

gift cards, employee engagement platforms), mobility (such as

multi-energy, maintenance, toll, parking and commuter solutions)

and corporate payments (such as virtual cards).

True to the Group’s purpose, “Enrich

connections. For good.”, these solutions enhance users’

well-being and purchasing power. They improve companies’

attractiveness and efficiency, and vitalize the employment market

and the local economy. They also foster access to healthier food,

more environmentally friendly products and softer mobility.

Edenred’s 12,000 employees are committed to

making the world of work a connected ecosystem that is safer, more

efficient and more responsible every day.

In 2022, thanks to its global technology assets,

the Group managed some €38 billion in business volume, primarily

carried out via mobile applications, online platforms and

cards.

Edenred is listed on the Euronext Paris stock

exchange and included in the following indices: CAC 40, CAC 40 ESG,

CAC Large 60, Euronext 100, Euronext Tech Leaders, FTSE4Good and

MSCI Europe.

The logos and other trademarks mentioned and

featured in this press release are registered trademarks of

Edenred S.E., its subsidiaries or third parties. They may not

be used for commercial purposes without prior written consent from

their owners.

▬▬

CONTACTS

|

Communications

Department Emmanuelle Châtelain +33 (0)1 86

67 24 36 emmanuelle.chatelain@edenred.com Media

Relations Matthieu Santalucia+33 (0)1 86 67 22

63matthieu.santalucia@edenred.com |

Investor

Relations Cédric Appert+33 (0)1 86 67 24

99cedric.appert@edenred.com Baptiste Fournier +33 (0)1 86 67

20 73 baptiste.fournier@edenred.com |

APPENDICES

Glossary and list of references

needed for a proper understanding of financial

information

a) Main terms

- Like-for-like, impact of changes in the scope of

consolidation, currency effect:

Like-for-like or organic growth corresponds to

comparable growth, i.e., growth at constant exchange rates and

scope of consolidation. This indicator reflects the Group’s

business performance.

Changes in activity (like-for-like or organic

growth) represent changes in amounts between the current period and

the comparative period, adjusted for currency effects and for the

impact of acquisitions and/or disposals.

The impact of acquisitions is eliminated from

the amount reported for the current period. The impact of disposals

is eliminated from the amount reported for the comparative period.

The sum of these two amounts is known as the impact of changes in

the scope of consolidation or the scope effect.

The calculation of changes in activity is

translated at the exchange rate applicable in the comparative

period and divided by the adjusted amount for the comparative

period.

The currency effect is the difference between

the amount for the reported period translated at the exchange rate

for the reported period and the amount for the reported period

translated at the exchange rate applicable in the comparative

period.

Business volume comprises total issue volume of

Benefits & Engagement solutions, Incentive and Rewards, Public

Social Program solutions and Corporate Payment Services, plus the

transaction volume of Fleet & Mobility Solutions and other

solutions.

Issue volume is the total face value of the

funds preloaded on all of the payment solutions issued by Edenred

to its corporate and public sector clients.

Transaction volume represents the total value of

the transactions paid for with payment instruments, at the time of

the transaction.

b) Alternative performance measurement

indicators included in the June 30,

2023 Interim Financial

Report

The alternative performance measurement

indicators outlined below are presented and reconciled with

accounting data in the Annual Financial Report.

|

Indicator |

Reference note in Edenred’s

2023 condensed interim

consolidated financial statements |

|

Operating revenue |

Operating revenue corresponds to:

- operating revenue generated by

prepaid vouchers managed by Edenred,

- and operating revenue from

value-added services such as incentive programs, human services and

event-related services.

- It corresponds to the amount billed

to the client company and is recognized on delivery of the

solutions.

|

|

Other revenue |

Other revenue is interest generated by investing cash over

the period between:

- the issue date and the

reimbursement date for vouchers,

- and the loading date and the

redeeming date for cards.

The interest represents a component of operating revenue and as

such is included in the determination of total revenue. |

|

EBITDA |

This aggregate corresponds to total revenue (operating

revenue and other revenue) less operating expenses. |

|

EBIT |

This aggregate is the "Operating profit before other income

and expenses", which corresponds to total revenue (operating

revenue and other revenue) less operating expenses, depreciation,

amortization (mainly intangible assets, internally generated or

acquired assets) and non-operating provisions. It is used as the

benchmark for determining senior management and other executive

compensation as it reflects the economic performance of the

business. EBIT excludes the net profit from equity-accounted

companies and excludes the other income and expenses booked in the

“Operating profit including share of net profit from

equity-accounted companies”. |

|

Other income and expenses |

See Note 10.1 of consolidated financial statements |

|

Funds from operations (FFO) |

See consolidated statement of cash flows (Part 1.4) |

c) Alternative performance measurement

indicators not included in the June 30,

2023 Interim Financial

Report

|

Indicator |

Definitions and reconciliations with

Edenred’s 2023

condensed interim consolidated financial

statements |

|

Free cash flow |

Free cash flow corresponds to cash generated by operating

activities less investments in intangible assets and property,

plant and equipment. |

Operating revenue

|

|

Q1 |

Q2 |

|

H1 |

|

In €

millions |

2023 |

2022 |

2023 |

2022 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

|

Europe |

324 |

270 |

353 |

281 |

|

677 |

551 |

|

France |

86 |

76 |

83 |

74 |

|

169 |

150 |

|

Rest of Europe |

238 |

194 |

270 |

207 |

|

508 |

401 |

|

Latin America |

150 |

123 |

162 |

148 |

|

312 |

270 |

|

Rest of the world |

45 |

33 |

47 |

36 |

|

92 |

70 |

|

|

|

|

|

|

|

|

|

|

Total |

519 |

426 |

562 |

465 |

|

1,081 |

891 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Q1 |

Q2 |

|

H1 |

|

In

% |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

|

|

|

|

|

|

|

|

|

Europe |

+20.1% |

+20.5% |

+25.7% |

+21.9% |

|

+22.9% |

+21.2% |

|

France |

+13.5% |

+13.5% |

+12.0% |

+10.5% |

|

+12.8% |

+12.0% |

|

Rest of Europe |

+22.7% |

+23.3% |

+30.5% |

+26.0% |

|

+26.7% |

+24.7% |

|

Latin America |

+21.9% |

+16.0% |

+9.3% |

+13.6% |

|

+15.0% |

+14.7% |

|

Rest of the world |

+35.5% |

+35.5% |

+30.8% |

+26.0% |

|

+33.1% |

+30.5% |

|

|

|

|

|

|

|

|

|

|

Total |

+21.8% |

+20.4% |

+20.9% |

+19.6% |

|

+21.3% |

+20.0% |

Other revenue

|

|

Q1 |

Q2 |

|

H1 |

|

In €

millions |

2023 |

2022 |

2023 |

2022 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

|

Europe |

22 |

5 |

27 |

6 |

|

49 |

11 |

|

France |

4 |

2 |

5 |

1 |

|

9 |

3 |

|

Rest of Europe |

19 |

3 |

21 |

5 |

|

40 |

8 |

|

Latin America |

12 |

7 |

12 |

10 |

|

24 |

17 |

|

Rest of the world |

4 |

1 |

5 |

2 |

|

9 |

3 |

|

|

|

|

|

|

|

|

|

|

Total |

38 |

13 |

44 |

18 |

|

82 |

31 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Q1 |

Q2 |

|

H1 |

|

In

% |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

|

|

|

|

|

|

|

|

|

Europe |

+382.7% |

+390.2% |

+319.8% |

+321.2% |

|

+346.5% |

+350.5% |

|

France |

+156.2% |

+156.2% |

+242.7% |

+242.7% |

|

+198.4% |

+198.4% |

|

Rest of Europe |

+487.6% |

+498.7% |

+341.9% |

+343.7% |

|

+399.3% |

+404.7% |

|

Latin America |

+55.0% |

+55.0% |

+30.6% |

+49.4% |

|

+41.2% |

+51.8% |

|

Rest of the world |

+279.3% |

+356.3% |

+199.9% |

+377.2% |

|

+233.4% |

+368.4% |

|

|

|

|

|

|

|

|

|

|

Total |

+189.3% |

+198.4% |

+149.2% |

+175.2% |

|

+166.4% |

+185.2% |

Total revenue

|

|

Q1 |

Q2 |

|

H1 |

|

In €

millions |

2023 |

2022 |

2023 |

2022 |

|

2023 |

2022 |

|

|

|

|

|

|

|

|

|

|

Europe |

346 |

275 |

380 |

287 |

|

726 |

562 |

|

France |

90 |

78 |

88 |

75 |

|

178 |

153 |

|

Rest of Europe |

256 |

197 |

292 |

212 |

|

548 |

409 |

|

Latin America |

161 |

130 |

175 |

158 |

|

336 |

287 |

|

Rest of the world |

49 |

34 |

52 |

38 |

|

101 |

73 |

|

|

|

|

|

|

|

|

|

|

Total |

557 |

439 |

606 |

482 |

|

1,163 |

922 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Q1 |

Q2 |

|

H1 |

|

In

% |

Change reported |

Change L/L |

Change reported |

Change L/L |

|

Change reported |

Change L/L |

|

|

|

|

|

|

|

|

|

|

Europe |

+26.2% |

+26.8% |

+32.2% |

+28.5% |

|

+29.3% |

+27.7% |

|

France |

+16.2% |

+16.2% |

+16.4% |

+14.8% |

|

+16.3% |

+15.5% |

|

Rest of Europe |

+30.2% |

+31.0% |

+37.7% |

+33.3% |

|

+34.1% |

+32.2% |

|

Latin America |

+23.8% |

+18.2% |

+10.6% |

+15.8% |

|

+16.6% |

+16.9% |

|

Rest of the world |

+43.3% |

+45.7% |

+37.5% |

+40.0% |

|

+40.3% |

+42.7% |

|

|

|

|

|

|

|

|

|

|

Total |

+26.8% |

+25.7% |

+25.5% |

+25.2% |

|

+26.1% |

+25.5% |

EBITDA et EBIT

|

In € millions

|

H1 2023 |

H1 2022 |

|

Change reported |

Change L/L |

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

332 |

242 |

|

+37.2% |

+36.5% |

|

France |

64 |

55 |

|

+15.6% |

+15.3% |

|

Rest of Europe |

268 |

187 |

|

+43.6% |

+42.8% |

|

Latin America |

130 |

120 |

|

+8.8% |

+11.6% |

|

Rest of the world |

23 |

18 |

|

+29.9% |

+68.8% |

|

Others |

(2) |

(15) |

|

+79.2% |

+86.4% |

|

|

|

|

|

|

|

|

EBITDA |

483 |

365 |

|

+32.5% |

+35.2% |

|

In € millions

|

H1 2023 |

H1 2022 |

|

Change reported |

Change L/L |

|

|

|

|

|

|

|

|

|

|

|

|

Europe |

288 |

205 |

|

+40.6% |

+41.3% |

|

France |

52 |

44 |

|

+17.9% |

+17.6% |

|

Rest of Europe |

236 |

161 |

|

+46.7% |

+47.8% |

|

Latin America |

104 |

99 |

|

+4.0% |

+8.5% |

|

Rest of the world |

15 |

11 |

|

+45.7% |

+121.6% |

|

Others |

(8) |

(20) |

|

+60.8% |

+66.5% |

|

|

|

|

|

|

|

|

EBIT |

399 |

295 |

|

+35.2% |

+40.3% |

Summarized balance sheet

|

In € millions |

June 30,

2023 |

Dec.31,

2022 |

June 30,

2022 |

|

In € millions |

June 30,

2023 |

Dec.31,

2022 |

June 30,

2022 |

|

ASSETS |

|

LIABILITIES |

|

Goodwill |

2,948 |

1,605 |

1,608 |

|

Total equity |

(548) |

(613) |

(806) |

|

Intangible assets |

973 |

738 |

728 |

|

|

|

|

|

|

Property. plant & equipment |

167 |

157 |

155 |

|

Gross debt and other financial liabilities |

4,587 |

3,341 |

3,706 |

|

Investments in associates |

63 |

67 |

59 |

|

Provisions and deferred tax |

223 |

168 |

181 |

|

Non-current derivative instruments |

8 |

4 |

|

|

|

|

|

|

|

Other non-current assets |

162 |

160 |

|

|

|

|

|

|

|

Float (Trade receivables. net) |

1,356 |

1,562 |

1,397 |

|

Vouchers in circulation (Float) |

5,732 |

5,840 |

5,184 |

|

Working capital excl. float (assets) |

1,980 |

1,731 |

1,711 |

|

Working capital excl. float (liabilities) |

2,574 |

2,438 |

2,235 |

|

Restricted cash |

2,273 |

2,120 |

2,011 |

|

|

|

|

|

|

Cash & cash equivalents |

2,728 |

3,030 |

2,650 |

|

|

|

|

|

|

TOTAL ASSETS |

12,568 |

11,174 |

10,500 |

|

TOTAL PASSIF |

12,568 |

11,174 |

10,500 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

June 30,

2023 |

Dec.31,

2022 |

June 30,

2022 |

| |

|

|

|

|

Total working capital |

5,060 |

4,985 |

4,311 |

| |

|

|

|

|

Of which float: |

4,376 |

4,278 |

3,787 |

From net profit. Group share to Free cash

flows

|

In € millions |

June 2023 |

June 2022 |

|

Net profit attributable to owners of the

parent |

202 |

170 |

|

Non-controlling interests |

17 |

16 |

|

Dividends received from equity-accounted companies |

3 |

10 |

|

Difference between income tax paid and income tax expense |

6 |

10 |

|

Non-cash impact from other income and expenses |

110 |

93 |

|

= Funds from operations before other income and expenses

(FFO) |

338 |

299 |

|

Decrease (Increase) in working capital |

(120) |

(628) |

|

Recurring decrease (Increase) in restricted cash |

(128) |

419 |

|

= Net cash from (used in) operating

activities |

90 |

90 |

|

Recurring capital expenditure |

(79) |

(66) |

|

= Free cash flows (FCF) |

11 |

24 |

1 Application Programming Interface2 Reward Gateway has been

consolidated in Edenred’s financial statements since May 2023 and

GOintegro since late June 20233 The float corresponds to a portion

of the operating working capital from the preloading of funds by

corporate clients.4 Approximately €1.3 billion.5 Science Based

Targets initiative, on scopes 1, 2 and 3A.

- 2023 07 25 - Edenred - H1 2023 Results - PR

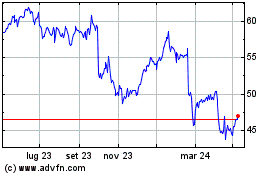

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Ott 2024 a Nov 2024

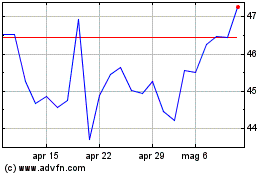

Grafico Azioni Edenred (EU:EDEN)

Storico

Da Nov 2023 a Nov 2024