Wendel announces the successful placement of Bureau Veritas shares

as part of a prepaid 3-year forward sale representing approximately

6.7% of Bureau Veritas share capital

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH

DISTRIBUTION WOULD BE PROHIBITED BY APPLICABLE LAW

Wendel announces the successful placement

of Bureau Veritas shares as part of a prepaid 3-year forward sale

representing approximately 6.7% of Bureau Veritas share capital and

increases its financial flexibility by reducing the pro

forma1 loan-to-value

ratio to approximately 17%

Wendel today announces the successful placement

of 30,357,140 shares of Bureau Veritas (representing approximately

6.7% of Bureau Veritas’ share capital2) at a price of

€27.25 per share (the “Offering Price”).

As indicated in the press release published

yesterday, Wendel entered into a prepaid 3-year forward sale

agreement with BNP Paribas (the “Forward Bank”) over 30,357,140

shares of Bureau Veritas (the “Forward Sale Transaction”).

Simultaneously with the Forward Sale

Transaction, Wendel entered into a call spread transaction to

benefit from up to c.15% of the stock price appreciation over the

next three years on the equivalent number of shares underlying the

Forward Sale Transaction, with BNP Paribas and Morgan Stanley

Europe SE (the “Call Spread Banks”) (the “Call Spread Transaction”,

and together with the Forward Sale Transaction, the

“Transactions”), highlighting Wendel’s strong belief in Bureau

Veritas’ value creation potential. The Offering Price will be used

as a reference price for the Transactions.

The Transactions will immediately generate net

cash proceeds of approximately €750 million to Wendel, which will

further support the acceleration of its transition towards a dual

model based on Principal Investments and Asset Management to drive

higher performance and enhanced shareholder returns, while

continuing to benefit from the prospects of Bureau Veritas.

Pro forma of the proceeds generated by the

announced Transactions and taking into account the upcoming closing

of the acquisition of Monroe Capital, Wendel’s loan-to-value (LTV)

ratio is expected to come down to approximately 17%.

As part of the Transactions, BNP Paribas and

Morgan Stanley (the “Joint Global Coordinators” and together with

the Forward Bank and the Call Spread Banks, the “Banks”) conducted

a private placement of 30,357,140 shares corresponding to the

number of shares underlying the Forward Sale Transaction through an

accelerated bookbuild offering (the “Offering”). The Bureau Veritas

shares sold through the Offering were borrowed by the Forward Bank

in the market. As part of the Call Spread Transaction, the Call

Spread Banks bought 5.4 million shares in the Offering to hedge

their positions.

Settlement and delivery of the Offering will

take place on March 14, 2025.

As per the terms of the Transactions, the shares

underlying the Forward Sale Transaction that are owned by Wendel

have been pledged in favour of BNP Paribas. Wendel will, subject to

the share pledge, retain the full ownership of the 30,357,140

shares and associated double voting rights until the physical

settlement of the Forward Sale Transaction (i.e., until March 17,

2028). Wendel reiterates its support to Bureau Veritas’ management

and its Leap|28 strategic plan.

As part of the Transactions, Wendel agreed to

enter into a lockup undertaking of 180 days from the date of

the settlement of the Offering, subject to customary

exemptions3.

Wendel is advised by Cleary Gottlieb Steen &

Hamilton LLP and d’Angelin & Co.

The Banks are advised by Clifford Chance

LLP.

Laurent Mignon, Wendel Group CEO said:

"Wendel immediately increases its financial

flexibility and pursues its diversification strategy, thanks to a

transaction enabling it to sell forward around a quarter of its

Bureau Veritas shares with a term of three years. This forward sale

also allows us to maintain a significant exposure to the growth of

the Bureau Veritas share price, as well as 26.5% of the capital and

41.2% of the voting rights. Very confident in the outlook for

Bureau Veritas, which Wendel has supported since 1995, we will

continue to support it in its value creation strategy as described

in its LEAP|28 plan. "

This press release is for information

purposes only and does not, and shall not, constitute an offer to

sell or a solicitation of an offer to buy or subscribe any

securities nor a solicitation to offer to purchase or to subscribe

securities in any jurisdiction and does not constitute a public

offer in any jurisdiction, including in France.

The sale of shares of Bureau Veritas and the

Transactions do not constitute a public offering and such shares

will not be offered or sold in the United States of America,

Australia, Japan and any other jurisdiction where a registration

process or an approval would be required by applicable laws and

regulations.

No communication or information relating to

the Transactions may be distributed or transmitted to the public in

any jurisdiction where a registration or an approval is required.

No action has been or will be taken in any jurisdiction in which

such registration or approval would be required. The Transactions,

and the offer or sale of Bureau Veritas shares may be subject to

legal and regulatory restrictions in certain jurisdictions. None of

Wendel, the Banks or any of their respective affiliates assumes any

liability in connection with the breach by any person of such

restrictions.

United States of America

This press release does not constitute or

form a part of any offer or solicitation to purchase or subscribe

for securities nor of any offer or solicitation to sell securities

in the United States. Securities may not be offered or sold in the

United States absent registration under the U.S. Securities Act of

1933, as amended (the “Securities Act”), or pursuant to an

exemption from, or in a transaction not subject to, registration

thereunder. The Bureau Veritas shares described in this press

release have not been, and will not be, registered under the

Securities Act or the securities laws of any state of the United

States. None of Wendel, the Banks or any of their respective

affiliates intends to register any portion of the proposed Offering

in the United States or to conduct a public offer of securities in

the United States.

European Economic Area

With respect to any member state of the

European Economic Area (the “Member States”), no action has been or

will be taken in order to permit an offer of securities to the

public which would require the publication of a prospectus in any

Member State. As a result, the Bureau Veritas shares can only be

offered or sold and will only be offered or sold in any Member

State to (a) to qualified investors as defined in Regulation (EU)

2017/1129 of the European Parliament and of the Council of June 14,

2017 (as amended, the “EU Prospectus Regulation”) or (b) in

accordance with the other exemptions of Article 1(4) of the EU

Prospectus Regulation. This press release is not a prospectus

within the meaning of the EU Prospectus Regulation. For the

purposes of this paragraph, the expression "offer of securities to

the public" means a communication, in any form and by any means of

sufficient information on the terms of the offer and the securities

to be offered so as to enable an investor to decide to purchase the

securities.

France

The Bureau Veritas shares will not be

offered or sold or caused to be offered or sold, directly or

indirectly, to the public in France other than to qualified

investors (investisseurs qualifiés) as defined in Article 2(e) of

the EU Prospectus Regulation, and in accordance with French laws

and regulations, including Article L. 411-2 1° of the French

monetary and financial code (Code monétaire et financier) and no

offering material or other advertising documentation relating to

the Offering have been distributed or caused to be distributed or

will be distributed or caused to be distributed to the public in

France (other than to qualified investors (investisseurs

qualifiés)).

United Kingdom

With respect to the United Kingdom, no

action has been or will be taken in order to permit a public offer

of the securities which would require the publication of a

prospectus in the United Kingdom. As a result, the Bureau Veritas

shares can only be offered or sold and will only be offered or sold

in the United Kingdom to persons who are both "qualified investors"

as defined in Regulation (EU) 2017/1129 of the European Parliament

and of the Council of June 14, 2017, as amended, as it forms part

of domestic law by virtue of the European Union (Withdrawal) Act

2018 (the “UK Prospectus Regulation”) and: (i) who have

professional experience in matters relating to investments falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the

“Order”) or (ii) who fall within

Article 49(2)(A) to (D) of the Order, or (iii) to whom it may

otherwise lawfully be communicated. This press release is not a

prospectus within the meaning of the UK Prospectus

Regulation.

The Banks are acting exclusively for Wendel

and no-one else in connection with the Transactions. The Banks will

not regard any other person as their client in relation to the

Transactions and will not be responsible to anyone other than

Wendel for providing the protections afforded to their respective

clients, nor for providing advice in relation to the Transactions,

the contents of this announcement or any transaction, arrangement

or other matter referred to herein.

No prospectus or offering document has been

or will be prepared in connection with the Transactions. Any

investment decision in connection with the Transactions must be

made on the basis of publicly available information. Such

information has not been independently verified. The information

contained in this announcement is for background purposes only and

does not purport to be full or complete.

Each of the Banks, Wendel and their

respective affiliates expressly disclaim any obligation or

undertaking to update, review or revise any forward-looking

statement contained in this announcement whether as a result of new

information, future developments or otherwise. In connection with

the Transactions, the Banks and any of their affiliates may take up

a portion of the shares referred to herein as a principal position

and in that capacity may retain, purchase, sell, offer to sell for

their own accounts such shares and other securities of Bureau

Veritas or related investments in connection with the Transactions

or otherwise.

In addition, the Banks and any of their

affiliates may enter into financing arrangements (including swaps

or contracts for differences) with investors in connection with

which the Banks and any of their affiliates may from time to time

acquire, hold or dispose of shares. Accordingly, references to the

shares being issued, offered, subscribed, acquired, placed or

otherwise dealt in should be read as including any issue or offer

to, or subscription, acquisition, placing or dealing by, the Banks

and any of their affiliates acting in such capacity. The Banks do

not intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligations to do so.

None of the Banks, Wendel nor any of their

respective affiliates nor any of their or their affiliates’

directors, officers, employees, advisers or agents accepts any

responsibility or liability whatsoever for or makes any

representation or warranty, express or implied, as to the truth,

accuracy or completeness of the information in this announcement

(or whether any information has been omitted from the announcement)

or any other information relating to Wendel or Bureau Veritas,

their subsidiaries or associated companies, whether written, oral

or in a visual or electronic form, and howsoever transmitted or

made available or for any loss howsoever arising from any use of

this announcement or its contents or otherwise arising in

connection therewith.

This announcement may include statements

that are, or may be deemed to be, “forward-looking statements”.

These forward-looking statements may be identified by the use of

forward-looking terminology, including the terms “believes”,

“estimates”, “plans”, “projects”, “anticipates”, “expects”,

“intends”, “may”, “will” or “should” or, in each case, their

negative or other variations or comparable terminology, or by

discussions of strategy, plans, objectives, goals, future events or

intentions. Forward-looking statements may and often do differ

materially from actual results. Any forward-looking statements are

subject to risks relating to future events and other risks,

uncertainties and assumptions. Forward-looking statements speak

only as of the date they are made.

1 Pro forma of the announced Transactions and

taking into account the upcoming closing of the acquisition of

Monroe Capital.

2 On the basis of an outstanding share capital of Bureau Veritas

composed of 453,879,520 shares as of February 28, 2025.

3 Such exemptions to include the right for Wendel to transfer

shares in connection with the exercise of the bonds exchangeable

into Bureau Veritas shares due 2026 and other circumstances allowed

under the terms and conditions of such bonds.

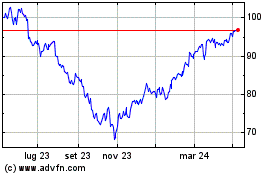

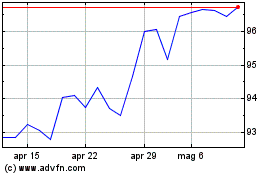

Grafico Azioni Wendel (EU:MF)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Wendel (EU:MF)

Storico

Da Mar 2024 a Mar 2025