false

--12-31

0001675149

0001675149

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

Alcoa Corporation

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

1-37816 |

81-1789115 |

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(IRS Employer

Identification No.)

|

| 201 Isabella Street, Suite 500 |

|

| Pittsburgh, Pennsylvania |

|

15212-5858 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number,

Including Area Code: (412) 315-2900

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

AA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

INTRODUCTORY NOTE

As previously disclosed, on March 11, 2024 (Eastern

Daylight Time) / March 12, 2024 (Australian Eastern Daylight Time), Alcoa Corporation, a Delaware corporation (“Alcoa”)

entered into a Scheme Implementation Deed, as amended and restated by the Deed of Amendment and Restatement, dated as of May 20, 2024

(the “Agreement”), by and among Alcoa, AAC Investments Australia 2 Pty Ltd, an Australian proprietary company limited

by shares and an indirect wholly owned subsidiary of Alcoa (“Alcoa Bidder”), and Alumina Limited, an Australian public

company limited by shares and listed on the Australian Securities Exchange (“Alumina Limited”).

On August 1, 2024, the transactions (collectively,

the “Transaction”) contemplated by the Agreement were consummated by way of a court-approved scheme of arrangement

(the “Scheme”) under Part 5.1 of Australia’s Corporations Act 2001 (Cth), pursuant to which Alcoa Bidder acquired

all Alumina ordinary shares on issue and outstanding (the “Alumina Shares”) and Alumina Limited became a direct wholly-owned

subsidiary of Alcoa Bidder and indirect wholly-owned subsidiary of Alcoa. Under the Scheme, the holders of Alumina Shares (the “Scheme

Participants”) received, for each such Alumina Share, 0.02854 Alcoa CHESS Depositary Interests (“New Alcoa CDIs”),

each such New Alcoa CDI representing an ownership interest in a share of Alcoa common stock, except that, (i) in the case of Alumina Shares

represented by American Depositary Shares, each of which represented 4 Alumina Shares, the applicable depositary (or its custodian) received,

in lieu of the New Alcoa CDIs, for each Alumina Share, 0.02854 shares of Alcoa common stock, (ii) where the Scheme Participant resides

in certain jurisdictions (each, an “Ineligible Foreign Shareholder”), the shares of Alcoa common stock were transferred

to a sale nominee (the “Sale Nominee”), and such Ineligible Foreign Shareholder will receive its pro rata share of

the net cash proceeds of the sale by the Sale Nominee of shares of Alcoa common stock that all such Ineligible Foreign Shareholders would

have otherwise been entitled to receive in the form of New Alcoa CDIs and (iii) where the Scheme Participant is a certain affiliate of

CITIC Group (the “CITIC Participant”), such CITIC Participant received, in lieu of the New Alcoa CDIs, for each Alumina

Share, 0.02854 shares of newly-issued non-voting convertible preferred stock, par value $0.01 per share, of Alcoa, which non-voting convertible

preferred stock is convertible into shares of Alcoa common stock on a one-for-one basis (the “New Alcoa Preferred Stock”).

In connection with the Transaction, Alcoa issued 78,772,422 shares of Alcoa common stock (including 78,403,132 shares of Alcoa common

stock underlying the New Alcoa CDIs) and 4,041,989 shares of New Alcoa Preferred Stock.

The issuance of Alcoa common stock and New Alcoa

Preferred Stock upon implementation of the Scheme was exempt from registration pursuant to Section 3(a)(10) of the Securities Act. The

proxy statement, filed with the U.S. Securities and Exchange Commission (the “SEC”) on June 6, 2024 (the “Proxy

Statement”), and the supplemental disclosures to the Proxy Statement included in the Form 8-K filed with the SEC on July 8,

2024, contain additional information about the Transaction, including the issuance of Alcoa common stock and New Alcoa Preferred Stock.

The shares of Alcoa common stock issued in the

Transaction are listed on the New York Stock Exchange and the New Alcoa CDIs are quoted on the Australian Stock Exchange.

The foregoing description of the Agreement is

not complete and is qualified in its entirety by reference to the Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report

and which is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

The information set forth in the Introductory

Note of this Current Report is incorporated into this Item 2.01 by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant. |

On August 1, 2024 and as a result of the completion

of the Transaction, Alumina Limited, which is party to a Syndicated Revolving Cash Advance Facility Agreement by and among Alumina Limited,

Australia and New Zealand Banking Group Limited, Westpac Banking Corporation and Commonwealth Bank of Australia, dated as of December

2, 2013, as amended (the “Facility Agreement”), became an indirect wholly-owned subsidiary of Alcoa. Under the Facility

Agreement, Alumina Limited has a $500 million revolving facility with tranches maturing in October 2025, January 2026, July 2026 and June

2027. As of August 1, 2024, Alumina Limited had drawn $100,000,000 under the tranche maturing in October 2025, $150,000,000 under the

tranche maturing in January 2026, $135,000,000 under the tranche maturing in July 2026 and $0 under the tranche maturing in June 2027.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth in the Introductory Note of this Current

Report is incorporated into this Item 3.02 by reference.

| Item 3.03 | Material Modification to Rights of Security Holders. |

In connection with the Transaction, on July 31, 2024, Alcoa filed a

Certificate of Designation with the Secretary of State of the State of Delaware, pursuant to which 4,041,989 shares of New Alcoa Preferred

Stock were issued. The Certificate of Designation provides, among other things, the following items:

Ranking: The liquidation preference

of the New Alcoa Preferred Stock will equal $0.0001 per share. The New Alcoa Preferred Stock will rank senior to the Alcoa common stock

in the event of a distribution of assets upon dissolution, liquidation or winding up of Alcoa to the extent of its liquidation preference.

Otherwise, the New Alcoa Preferred Stock will rank, as to the payment of dividends and distribution of assets upon dissolution, liquidation

or winding up of Alcoa, (i) senior to any class or series of capital stock of Alcoa thereafter created specifically ranking by its terms

junior to any shares of New Alcoa Preferred Stock, (ii) pari passu with the Alcoa common stock and any class or series of capital

stock of Alcoa created (x) specifically ranking by its terms on parity with the New Alcoa Preferred Stock or (y) that does not by its

terms rank junior or senior to the New Alcoa Preferred Stock and (iii) junior to any class or series of capital stock of Alcoa thereafter

created specifically ranking by its terms senior to any shares of the New Alcoa Preferred Stock.

Cash Dividend/Distribution Rights:

Holders of the New Alcoa Preferred Stock will participate in cash dividends or distributions (subject to certain exceptions for distributions

in kind) alongside the Alcoa common stock on an as-converted basis.

Voting: The holders of the New

Alcoa Preferred Stock will have no voting rights, except as may be required by applicable law and except as set forth below.

So long as any shares of New Alcoa

Preferred Stock are outstanding, Alcoa may not, without the affirmative vote or written consent of at least a majority of the outstanding

shares of New Alcoa Preferred Stock, voting as a single and separate class, amend, alter or repeal any provision of the Certificate of

Designation or Certificate of Incorporation of Alcoa or Alcoa’s bylaws (by any means, including by merger, consolidation, reclassification,

or otherwise) so as to, or in a manner that would, change the rights or preferences of the New Alcoa Preferred Stock.

Mergers; Reorganizations: In

the event of a merger, reorganization, sale of substantially all assets of Alcoa or similar event where the Alcoa common stock is exchanged

for securities and cash (a “Reorganization Event”), the New Alcoa Preferred Stock will be automatically converted into

the types and amounts of securities and cash that is or was receivable in such Reorganization Event by a holder of the number of shares

of Alcoa common stock into which such share of New Alcoa Preferred Stock was convertible immediately prior to such Reorganization Event

in exchange for such shares of Alcoa common stock; however, if after giving effect to such conversion, Bestbuy Overseas Co. Ltd. and its

affiliates (“CITIC”) would collectively hold more than 4.9% of any class of voting securities of another entity that

is impermissible for CITIC to hold under the Bank Holding Company Act of 1956 (the “BHCA”), then, at Alcoa’s

election, Alcoa may redeem the portion of New Alcoa Preferred Stock that would cause CITIC and its affiliates to collectively hold more

than 4.9% of any class of voting securities of another entity that is impermissible for CITIC to hold under the BHCA at a cash price per

share of New Alcoa Preferred Stock equal to the product of the Applicable Conversion Rate (as defined below) and the “fair market

value” of the Alcoa common stock.

The holders of the New Alcoa Preferred

Stock will not have any separate class vote on any Reorganization Event.

Conversion: In the event of

a Convertible Transfer (as defined below) to certain non-affiliates of a holder of New Alcoa Preferred Stock, each share of such holder’s

New Alcoa Preferred Stock will convert into shares of Alcoa common stock at a rate of one share of New Alcoa Preferred Stock to one share

of Alcoa common stock (the “Applicable Conversion Rate”) no later than the second business day after Alcoa receives

a valid notice of Convertible Transfer and conversion from the holder.

A “Convertible Transfer”

is a transfer by the holder of New Alcoa Preferred Stock: (i) to Alcoa; (ii) in a widely distributed public offering of the Alcoa common

stock issuable upon conversion of the New Alcoa Preferred Stock; (iii) in a transaction or series of related transactions in which no

one transferee (or group of associated transferees) acquires 2% or more of any class of Alcoa’s then outstanding voting securities;

or (iv) to a transferee that controls more than 50% of every class of Alcoa’s then outstanding voting securities without giving

effect to such transfer.

Subject to certain limitations, CITIC

will have the right to elect to convert its shares of New Alcoa Preferred Stock into shares of Alcoa common stock at the Applicable Conversion

Rate if an action by Alcoa (e.g., a new stock issuance) has the effect of reducing CITIC’s voting percentage in Alcoa common

stock.

The foregoing description of the Certificate of

Designation does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Designation,

which is filed as Exhibit 3.1 to this Current Report and is incorporated into this Item 3.03 by reference. The information set forth in

the Introductory Note of this Current Report is also incorporated into this Item 3.03 by reference.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

Pursuant to the Agreement, Alcoa is required to

appoint two existing Alumina Limited board members who are Australian residents or citizens to join the board of directors of Alcoa (the

“Board”), and whose identity is mutually agreed by Alcoa and Alumina Limited, effective on and from the implementation

date of the Scheme. On July 31, 2024 and in connection with the Transaction, the Board increased the size of the Board from ten to twelve

directors and appointed John Bevan and Alistair Field (the “New Alcoa Directors”), who were directors of Alumina Limited prior

to the consummation of the Transaction, as additional members of the Board, effective as of 5:00 p.m. on August 1, 2024 (the “Effective

Date”). In connection therewith, the Board also appointed John Bevan and Alistair Field to serve as members of the Safety, Sustainability

and Public Issues Committee, effective on the Effective Date.

Each of the New Alcoa Directors will participate

in Alcoa’s non-employee director compensation program, which is described on page 24 of Alcoa’s proxy statement for its 2024

Annual Meeting of Stockholders, filed with the SEC on March 19, 2024. In connection with their appointments to the Board, each New Alcoa

Director will receive a pro-rated annual cash retainer and a pro-rated grant of restricted stock units (“RSUs”). The

RSU awards granted to each of the New Alcoa Directors will generally vest on the date of Alcoa’s 2025 Annual Meeting of Stockholders.

In addition, Alcoa will enter into its standard form of indemnification agreement with each of the New Alcoa Directors. The New Alcoa

Directors do not have any direct or indirect material interest in any transaction or proposed transaction required to be reported under

Item 404(a) of Regulation S-K.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On July 31, 2024, the Board approved the Amended and Restated Bylaws

of Alcoa Corporation, effective as of such date (the “Amended and Restated Bylaws”). Among other updates, the Amended

and Restated Bylaws:

| · | remove the “acting in concert” definition and amend provisions in Section 2.9(C)(1)(a)—(c)

and Section 9.1(E)(2), so that a stockholder does not have any requirement to disclose information with respect to “others acting

in concert” in a stockholder’s notice provided in connection with any nominations or business at an annual meeting of stockholders; |

| · | clarify that, if the first public announcement of the date of a special meeting to nominate directors

is less than 100 days prior to the date of such special meeting, a stockholder notice to nominate directors must be delivered by the 10th

day following the day on which the public announcement is first made of the date of the special meeting, removing the proviso that the

nominees of the Board also be included in that public announcement; |

| · | remove from the required information in stockholder nomination notices information relating to (i) performance-related

fees payable to the stockholder, and (ii) equity interests or derivative instruments held by the stockholder in a competitor company; |

| · | clarify that the form of written questionnaire required for a person nominated by a stockholder for election

or reelection to the Board be the same as that required of the Board’s director nominees; |

| · | remove the provision regarding the expectation that a director tender his/her resignation upon a determination

by the Board that the information provided to Alcoa in the nomination materials contained materially misleading statements or omissions; |

| · | remove the ability of stockholders to elect a chairman to preside at a stockholder meeting in circumstances

where (i) no chairman is designated by the Board, (ii) the Chairman of the Board or the Chief Executive Officer is absent or unable to

act, (iii) if both of the foregoing are absent or unable to act, the President is absent or unable to act, and (iv) if the President is

absent or unable to act, a Vice President is absent or unable to act; and |

| · | permit the chairman of a stockholder meeting to restrict entry to the meeting beyond restricting only

after the time fixed for the commencement thereof. |

The foregoing description of the Amended and Restated

Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated Bylaws,

which is filed as Exhibit 3.2 to this Current Report and is incorporated into this Item 5.03 by reference.

The information set forth in Item 3.03 of this Current Report is incorporated

into this Item 5.03 by reference.

On August 1, 2024, Alcoa issued a press release announcing the consummation

of the Transaction. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(a) Financial Statements of Business Acquired.

The audited financial statements of Alumina Limited for the years ended

December 2023, 2022 and 2021 and the related report of PricewaterhouseCoopers, Alumina Limited’s independent registered public accounting

firm, and the condensed interim consolidated financial statements of Alumina Limited for the quarter ended March 31, 2024, appearing in

Annex C to Alcoa’s Proxy Statement on Schedule 14A, filed with the SEC on June 6, 2024, are incorporated herein by reference as

Exhibit 99.2.

The consent of PricewaterhouseCoopers to the incorporation by reference

in certain of Alcoa’s registration statements of its report included in Exhibit 99.2 is filed as Exhibit 23.1 hereto.

(b) Pro Forma Financial Information.

The following unaudited pro forma condensed combined financial information

is filed as Exhibit 99.3 hereto and is incorporated herein by reference.

| · | Unaudited Pro Forma Condensed Combined Statement of Operations for the Quarter Ended March 31, 2024; |

| · | Unaudited Pro Forma Condensed Combined Statement of Operations for the Year Ended December 31, 2023; |

| · | Unaudited Pro Forma Condensed Combined Balance Sheet as of March 31, 2024; and |

| · | Notes to the Unaudited Pro Forma Combined Financial Information. |

(d) Exhibits

|

Exhibit

Number

|

Description of Exhibit |

| |

|

| 2.1 |

Deed of Amendment and Restatement of the Scheme Implementation Deed, dated as of May 20, 2024, by and among Alcoa Corporation, AAC Investments Australia 2 Pty Ltd and Alumina Limited (incorporated by reference to Exhibit 2.1 to Alcoa Corporation’s Current Report on Form 8-K filed with the SEC on May 20, 2024) |

| |

|

| 3.1* |

Certificate of Designation |

| |

|

| 3.2* |

Amended and Restated Bylaws of Alcoa Corporation, as adopted on July 31, 2024 |

| |

|

| 23.1* |

Consent of PricewaterhouseCoopers, the independent registered public accounting firm for Alumina Limited |

| |

|

| 99.1* |

Press Release issued by Alcoa Corporation |

| |

|

| 99.2 |

Historical audited financial statements of Alumina Limited for the years ended December 31, 2023, 2022 and 2021 and condensed interim consolidated financial statements of Alumina Limited for the quarter ended March 31, 2024 (incorporated by reference to Alcoa Corporation’s Proxy Statement on Schedule 14A, filed with the SEC on June 6, 2024) |

| |

|

| 99.3* |

Unaudited pro forma condensed combined financial information of Alcoa Corporation |

| |

|

| 104 |

Cover Page Interactive Data File, formatted in inline XBRL. |

_____________________

*Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 1, 2024 |

ALCOA CORPORATION |

| |

|

| |

By: |

/s/ Marissa P. Earnest |

| |

|

Name: Marissa P. Earnest

Title: Senior Vice President, Chief Governance Counsel and Secretary |

Exhibit 3.1

CERTIFICATE OF DESIGNATION OF

SERIES A CONVERTIBLE PREFERRED STOCK OF

ALCOA CORPORATION

(Pursuant to Section 151 of

the General Corporation Law of the State of Delaware)

ALCOA CORPORATION, a corporation organized and

existing under the laws of the State of Delaware (hereinafter, the “Corporation”), hereby certifies that the following

resolution was duly adopted by the Board of Directors of the Corporation (the “Board”) (or a duly authorized committee

thereof) as required by Section 151 of the General Corporation Law of the State of Delaware, as it may be amended:

NOW, THEREFORE, BE IT RESOLVED, that pursuant to

the authority expressly granted to and vested in the Board in accordance with the provisions of the Amended and Restated Certificate of

Incorporation of the Corporation, there is hereby created and provided out of the authorized but unissued preferred stock, par value $0.01

per share, of the Corporation (“Preferred Stock”), a new series of Preferred Stock, and there is hereby stated the

number of shares to be included in such series and fixed the designations, powers, rights and preferences of the shares of such series,

and the qualifications, limitations and restrictions, including, without limitation, voting rights (if any), dividend rights, dissolution

rights, conversion rights, exchange rights and redemption rights, of such series as follows:

Section I. Designation.

There shall be a series of Preferred Stock that

shall be designated as “Series A Convertible Preferred Stock,” par value $0.01 per share (the “Non-Voting Preferred

Stock”) and the number of shares constituting such series shall be 10,000,000. The designations, powers, rights and preferences

and the qualifications, limitations and restrictions of the Non-Voting Preferred Stock shall be as set forth herein. The Non-Voting Preferred

Stock shall be issued in book-entry form on the Corporation’s share ledger, subject to the rights of holders to receive certificated

shares under the DGCL.

Section II. Definitions. For purposes hereof,

the following terms shall have the following meanings, unless the context otherwise requires:

“Additional Issuance” has the

meaning specified in Section III(b)(i).

“Additional Issuance Conversion Date”

means the second Business Day following delivery of a valid Additional Issuance Notice.

“Additional Issuance Notice”

has the meaning specified in Section III(b)(ii).

“Additional Shares of Common Stock”

has the meaning specified in Section VII(c).

“Affiliate” means, with respect

to any Person, any other Person that, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under

common control with, such specified Person (as used in this definition, the term “control” means the possession, directly

or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through ownership of voting

securities, by contract or otherwise). Notwithstanding the foregoing, (a) neither the Corporation nor any of its Affiliates shall be deemed

to be an Affiliate of CITIC or its Affiliates and (b) neither CITIC nor any of its Affiliates shall be deemed to be an Affiliate of the

Corporation or any of its Affiliates.

“Applicable Conversion Rate”

means the Initial Conversion Rate, subject to adjustment pursuant to Sections VII for any such event occurring subsequent to the initial

determination of such rate.

“Authorized Repurchases” means

the number of shares of Common Stock calculated by dividing the dollar amount of the remaining unused balance of any publicly disclosed

share repurchase program of the Corporation by the Fair Market Value.

“BHCA” means the Bank Holding

Company Act of 1956, as amended.

“BHCA Affiliate” has the meaning

assigned to the term “affiliate” in, and shall be interpreted in accordance with, 12 U.S.C. § 1841(k).

“Board” has the meaning specified

in the preamble.

“Business Day” means any day,

other than a Saturday, Sunday or other day on which banking institutions in the City of New York, New York are required or authorized

by Law to be closed.

“Certificate of Designation”

means this Certificate of Designation of the Non-Voting Preferred Stock of the Corporation.

“Certificate of Incorporation”

means the Amended and Restated Certificate of Incorporation of the Corporation (as amended and/or restated from time to time).

“CITIC” means Bestbuy Overseas

Co. Ltd.

“Class of Voting Security” shall

be interpreted in a manner consistent with how “class of voting shares” is defined in 12 C.F.R. Section 225.2(q)(3) or any

successor provision.

“Closing Date” means, with respect

to any shares of Non-Voting Preferred Stock, the date that such shares of Non-Voting Preferred Stock are issued.

“Common Equivalent Dividend Amount”

has the meaning specified in Section IV(a).

“Common Stock” means the common

stock, par value $0.01 per share, of the Corporation.

“Conversion Date” means either

the Additional Issuance Conversion Date or a Convertible Transfer Conversion Date, as applicable.

“Conversion Shares” has the

meaning specified in Section III(a)(ii).

“Convertible Transfer” means

a Transfer by the Holder (a) to the Corporation; (b) in a widely distributed public offering of Common Stock issuable upon conversion

of the Non-Voting Preferred Stock; (c) in a transaction or series of related transactions in which no one transferee (or group of associated

transferees) acquires two percent (2%) or more of any Class of Voting Securities of the Corporation then outstanding; or (d) to a transferee

that controls more than fifty percent (50%) of every Class of Voting Securities of the Corporation then outstanding without giving effect

to such Transfer.

“Convertible Transfer Conversion Date”

means the date that a Convertible Transfer is consummated, which shall occur no later than the second Business Day following delivery

of a valid Notice of Convertible Transfer and Conversion.

“Convertible Transfer Notice Documents”

has the meaning specified in Section III(a)(ii).

“Corporation” means Alcoa Corporation.

“DGCL” means the General Corporation

Law of the State of Delaware, as it may be amended.

“Exchange” has the meaning specified

in Section IX(a).

“Exchange Notice” has the meaning

specified in Section IX(a).

“Exchange Property” has the

meaning specified in Section VIII(a).

“Exchanged Common Shares” has

the meaning specified in Section IX(a).

“Fair Market Value” means the

volume-weighted average price (as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source mutually selected

by the Holder and the Corporation) on the NYSE of the Common Stock for the five (5) prior trading days.

“Government Entity” means any

(a) federal, state, local, municipal, foreign or other government; (b) governmental entity of any nature (including, without limitation,

any governmental agency, branch, department, official, committee or entity and any court or other tribunal), whether foreign or domestic;

or (c) body exercising or entitled to exercise any administrative, executive, judicial, legislative, police, regulatory, or taxing authority

or power of any nature, whether foreign or domestic, including, without limitation, any arbitral tribunal and self-regulatory organizations.

“Holder” means the Person in

whose name any shares of Non-Voting Preferred Stock are registered, which may be treated by the Corporation as the absolute owner of such

shares of Non-Voting Preferred Stock for the purpose of making payment and settling conversion and for all other purposes.

“Initial Conversion Rate” means,

for each share of Non-Voting Preferred Stock, one share of Common Stock.

“Junior Securities” has the

meaning specified in Section VI(a).

“Law” means, with respect to

any Person, any legal, regulatory and administrative laws, statutes, rules, Orders and regulations applicable to such Person.

“Liquidation Preference” means,

for each share of Non-Voting Preferred Stock, an amount equal to $0.0001 (as adjusted for any split, subdivision, combination, consolidation,

recapitalization or similar event with respect to the Non-Voting Preferred Stock).

“Maximum Conversion” has the

meaning specified in Section IX(b).

“Non-BHCA Affiliate” means a

Person that is both (a) not CITIC and (b) not a BHCA Affiliate of the Holder or CITIC.

“Non-Voting Preferred Stock”

has the meaning specified in Section I.

“Notice of Convertible Transfer and Conversion”

has the meaning specified in Section III(a)(ii).

“NYSE” means the New York Stock

Exchange.

“Order” means any applicable

order, injunction, judgment, decree, ruling, or writ of any Government Entity.

“Parity Securities” has the

meaning specified in Section VI(a).

“Person” means an individual,

corporation, partnership, limited partnership, limited liability company, syndicate, person (including a “person” as defined

in Sections 13(d)(3) and 14(d) of the Exchange Act), trust, association or entity or government, political subdivision, agency or instrumentality

of a government.

“Recent Outstanding Common Shares”

means the number of shares of Common Stock outstanding as set forth on the balance sheet of the Corporation in its most recent periodic

filing with the SEC.

“Record Date” means, with respect

to any dividend, distribution or other transaction or event in which the holders of Common Stock have the right to receive any cash, securities

or other property or in which Common Stock is exchanged for or converted into any combination of cash, securities or other property, the

date fixed for determination of holders of Common Stock entitled

to receive such cash, securities or other property (whether such date is fixed by the Board or a duly authorized committee of the Board

or by statute, contract or otherwise).

“Reorganization Event” has the

meaning specified in Section VIII(a).

“SEC” means the Securities and

Exchange Commission.

“Senior Securities” has the

meaning specified in Section VI(a).

“Share Repurchase” has the meaning

specified in Section IX(a).

“Subject Preferred Share” has

the meaning specified in Section III(a)(i).

“Transfer” by any Person means,

directly or indirectly, to sell, transfer, assign, pledge, hypothecate, encumber or similarly dispose of or transfer (by merger, disposition,

operation of law or otherwise), either voluntarily or involuntarily, or to enter into any contract, option or other arrangement, agreement

or understanding with respect to the sale, transfer, assignment, pledge, encumbrance, hypothecation or other disposition or transfer (by

merger, disposition, operation of Law or otherwise), of any interest in any equity securities beneficially owned by such Person.

“Voting Security” has the meaning

set forth in 12 C.F.R. Section 225.2(q) or any successor provision.

Section III. Conversion.

(a) Conversion upon Convertible Transfer.

(i) Upon the terms and in the manner

set forth in this Section III, on any Convertible Transfer Conversion Date for any Convertible Transfer to a Non-BHCA Affiliate, each

share of Non-Voting Preferred Stock subject to such Convertible Transfer (each, a “Subject Preferred Share”) will be

converted into a number of fully-paid and non-assessable shares of Common Stock equal to the Applicable Conversion Rate. The Subject Preferred

Shares so converted will be cancelled as described in Section XIII below.

(ii) To effect a Convertible Transfer,

a Holder shall deliver to the Corporation a written notice (the “Notice of Convertible Transfer and Conversion”) that

(1) identifies the proposed transferee and manner and date of Transfer (which shall be two (2) Business Days following delivery of the

Notice of Convertible Transfer and Conversion), the number of Subject Preferred Shares to be converted and the corresponding number of

shares of Common Stock to be transferred (the “Conversion Shares”), (2) certifies that such Transfer is a Convertible

Transfer and that the proposed transferee is a Non-BHCA Affiliate, (3) notifies the Corporation that such Holder is tendering the Subject

Preferred Shares for conversion in accordance with this Certificate of Designation and (4) provides instructions for delivery of the Conversion

Shares to the proposed transferee on the Convertible Transfer Conversion Date (collectively, the “Convertible Transfer Notice

Documents”). The Notice of Convertible Transfer and Conversion must be received by the Corporation by 4:00 p.m. Eastern Time

two (2) Business Days prior to the Convertible Transfer Conversion Date.

(iii) Following receipt of valid Convertible

Transfer Notice Documents, on the Convertible Transfer Conversion Date, the Corporation shall effect the conversion of the Subject Preferred

Shares by delivering the Conversion Shares in accordance with the instructions provided in the Notice of Convertible Transfer and Conversion.

(b) Conversion upon Additional Issuance.

(i) If any action by the

Corporation, which may include the issuance of additional Common Stock (any such action, an “Additional

Issuance”), has the effect of reducing the percentage of a Class of Voting Securities held by CITIC (together with its

BHCA Affiliates), then CITIC may elect to convert each share of the Non-Voting Preferred Stock into a number of fully-paid and

non-assessable shares of Common Stock equal to the Applicable Conversion Rate so long as

such conversion does not allow CITIC (together with its BHCA Affiliates) to acquire a higher percentage of the Class of Voting Securities

than (x) 4.9% or (y) if lower, the percentage of the Class of Voting Securities CITIC (together, with its BHCA Affiliates) controlled

immediately prior to such conversion.

(ii) Upon CITIC’s (or its Affiliates)

election to convert the Non-Voting Preferred Stock pursuant to Section III(b)(i), CITIC shall deliver to the Corporation a written notice

(the “Additional Issuance Notice”) that notifies the Corporation that such Holder is tendering the Non-Voting Preferred

Stock for conversion in accordance with Section III(b)(i) of this Certificate of Designation. Any such conversion shall be settled by

the Corporation on the second Business Day following delivery of a valid Additional Issuance Notice in accordance with Section XVI.

(c) Immediately upon a conversion pursuant

to Section III(a) or Section III(b), the rights of the Holders with respect to the shares of the Non-Voting Preferred Stock so converted

shall cease and the Persons entitled to receive the shares of Common Stock upon the conversion of such shares of Non-Voting Preferred

Stock shall be treated for all purposes as having become the record and beneficial owners of such shares of Common Stock. In the event

that a Holder shall not by written notice designate the name in which shares of Common Stock and/or cash, securities or other property

(including payments of cash in lieu of fractional shares) to be issued or paid upon conversion of the shares of Non-Voting Preferred Stock

should be registered or paid or the manner in which such shares should be delivered, the Corporation shall be entitled to register and

deliver such shares, and make such payment, in the name of the Holder and in the manner shown on the records of the Corporation.

(d) No fractional shares of Common Stock

shall be issued upon any conversion of shares of Non-Voting Preferred Stock. If more than one share of Non-Voting Preferred Stock shall

be surrendered for conversion at any one time by the same Holder, the number of full shares of Common Stock issuable upon conversion thereof

shall be computed on the basis of the aggregate number of shares of Non-Voting Preferred Stock so surrendered. Instead of any fractional

shares of Common Stock which would otherwise be issuable upon conversion of any shares of Non-Voting Preferred Stock, such fractional

share will be rounded as follows: (i) if the fractional share is less than 0.5 shares, it will be rounded down to zero; and (ii) if the

fractional entitlement is equal to or more than 0.5 shares, it will be rounded up to one.

(e) All shares of Common Stock which may

be issued upon conversion of the shares of Non-Voting Preferred Stock will, upon issuance by the Corporation, be duly authorized, validly

issued, fully paid and non-assessable, and not issued in violation of any preemptive right or Law.

(f) Effective immediately prior to the

applicable Conversion Date, dividends or distributions shall no longer be declared on the shares of Non-Voting Preferred Stock subject

to conversion and such shares of Non-Voting Preferred Stock shall cease to be outstanding, in each case, subject to the rights of Holders

to receive any declared and unpaid dividends or distributions on such shares and any other payments to which they are otherwise entitled

pursuant to Section IV.

Section IV. Dividend Rights.

(a) With respect to any Non-Voting Preferred

Stock, from and after the Closing Date for such Non-Voting Preferred Stock to but excluding the applicable Conversion Date for such Non-Voting

Preferred Stock, (i) the Holders shall be entitled to receive, when, as and if declared by the Board or any duly authorized committee

of the Board, but only out of assets legally available therefor, all dividends or distributions (excluding any dividends or distributions

that would adjust the Applicable Conversion Rate pursuant to Section VII or would constitute, or be part of, a Reorganization Event) declared

and paid or made in respect of the shares of Common Stock, at the same time and on the same terms as holders of Common Stock, in an amount

per share of Non-Voting Preferred Stock equal to the product of (x) the Applicable Conversion Rate then in effect and (y) any per share

dividend or distribution, as applicable, declared and paid or made in respect of each share of Common Stock (the “Common Equivalent

Dividend Amount”), and (ii) the Board or any duly authorized committee thereof may not declare and pay any such dividend or

make any such distribution in respect of Common Stock unless the Board or any duly authorized committee of the Board declares and pays

to the Holders, at the same time and on the same terms as holders of Common Stock, the Common Equivalent Dividend Amount per share of

Non-Voting Preferred Stock.

Notwithstanding any provision in this Section

IV(a) to the contrary, no Holder of a share of Non-Voting Preferred Stock shall be entitled to receive any dividend or distribution made

with respect to the Common Stock where the Record Date for determination of holders of Common Stock entitled to receive such dividend

or distribution occurs prior to the date of issuance of such share of Non-Voting Preferred Stock.

(b) Each dividend or distribution declared

and paid pursuant to paragraph (a) above will be payable to Holders of record of shares of Non-Voting Preferred Stock as they appear in

the records of the Corporation at the close of business on the same day as the Record Date for the corresponding dividend or distribution

to the holders of shares of Common Stock.

(c) Except as set forth in this Certificate

of Designation, the Corporation shall have no obligation to pay, and the holders of shares of Non-Voting Preferred Stock shall have no

right to receive, dividends or distributions at any time.

(d) No interest or sum of money in lieu

of interest will be payable in respect of any dividend payment or payments on shares of Non-Voting Preferred Stock that may be in arrears.

Notwithstanding any provision in this Certificate

of Designation to the contrary, Holders shall not be entitled to receive any dividends or distributions on any shares of Non-Voting Preferred

Stock on or after the applicable Conversion Date in respect of such shares of Non-Voting Preferred Stock that have been converted as provided

herein, except to the extent that any such dividends or distributions have been declared by the Board or any duly authorized committee

of the Board and the Record Date for such dividend occurs prior to such applicable Conversion Date (in which case, for the avoidance of

doubt, Holders shall not be entitled to receive any such dividends or distributions in respect of the shares of Common Stock to which

such shares of Non-Voting Preferred Stock have been converted).

Section V. Voting.

(a) Except as otherwise may be required

by Law or as set forth in paragraph (b) below, the Holders shall not be entitled to vote on any matter submitted to a vote of the shareholders

of the Corporation.

(b) So long as any shares of Non-Voting

Preferred Stock are outstanding, the Corporation shall not, without the written consent or affirmative vote at a meeting called for that

purpose by holders of at least a majority of the outstanding shares of Non-Voting Preferred Stock, voting as a single and separate class,

amend, alter or repeal any provision of (A) this Certificate of Designation or (B) the Certificate of Incorporation or the Corporation’s

bylaws that would alter, modify or change the powers, preferences or special rights of the Non-Voting Preferred Stock, in each case, by

any means, including, without limitation, by merger, consolidation, reclassification, or otherwise (other than in connection with a Reorganization

Event where the shares of Non-Voting Preferred Stock will be converted in accordance with Section VIII) so as to, or in a manner that

would, change the rights or preferences of the Non-Voting Preferred Stock.

(c) Notwithstanding the foregoing, the

Holders shall not have any voting rights set out in paragraph (b) above if, at or prior to the effective time of the act with respect

to which such vote would otherwise be required, all outstanding shares of Non-Voting Preferred Stock shall have been converted into shares

of Common Stock.

Section VI. Rank; Liquidation.

(a) With respect to distributions of assets

upon liquidation, dissolution or winding up of the Corporation, whether voluntarily or involuntarily, except subject to (b) below, the

Non-Voting Preferred Stock shall rank (i) senior to all of the Common Stock to the extent (and only to the extent) set forth in (b) below;

(ii) senior to any class or series of capital stock of the Corporation hereafter created specifically ranking by its terms junior to any

shares of Non-Voting Preferred Stock (“Junior Securities”); (iii) on parity with any class or series of capital stock

of the Corporation created (x) specifically ranking by its terms on parity with the Non-Voting Preferred Stock or (y) that does not by

its terms rank junior or senior to the Non-Voting Preferred Stock (“Parity Securities”) (other than Common Stock or

any future class or series of common stock of the Corporation); and (iv) junior to any class or series of capital stock of the Corporation

hereafter created specifically ranking by its terms senior to any shares of Non-Voting Preferred Stock (“Senior Securities”).

(b) Subject to any superior liquidation

rights of the holders of any Senior Securities of the Corporation and the rights of the Corporation’s existing and future creditors,

upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, each Holder shall be entitled to be paid

out of the assets of the Corporation legally available for distribution to shareholders, (i) prior and in preference to any distribution

of any of the assets or surplus funds of the Corporation to the holders of the Common Stock and Junior Securities and pari passu

with any distribution to the holders of Parity Securities (other than Common Stock or any future class or series of common stock of the

Corporation), an amount equal to the sum of the Liquidation Preference for each share of Non-Voting Preferred Stock held by such Holder

and (ii) after the payment of the amount set forth in (i) above and pari passu with any distribution to the holders of Parity Securities

(including Common Stock or any future class or series of common stock of the Corporation), the amount the Holders would have received

if, immediately prior to such voluntary or involuntary liquidation, dissolution or winding up of the Corporation, the Non-Voting Preferred

Stock had converted into Common Stock (based on the then effective Applicable Conversion Rate and without giving effect to any limitations

on conversion set forth herein). Holders shall not be entitled to any further payments in the event of any such voluntary or involuntary

liquidation, dissolution or winding up of the affairs of the Corporation other than what is expressly provided for in this Section VI

and will have no right or claim to any of the Corporation’s remaining assets.

(c) In the event the assets of the Corporation

available for distribution to shareholders upon any voluntary or involuntary liquidation, dissolution or winding up of the Corporation

shall be insufficient to pay in full the amounts payable with respect to all outstanding shares of the Non-Voting Preferred Stock contemplated

by Section VI(b), the Holders and the holders of any Parity Securities shall share ratably in any distribution of assets of the Corporation

in proportion to the full respective liquidating distributions to which they would otherwise be respectively entitled (it being understood

that, for purposes of the foregoing, Parity Securities shall not include Common Stock).

(d) For purposes of this Section VI, the

sale, conveyance, exchange or Transfer (for cash, shares of stock, securities or other consideration) of all or substantially all of the

property and assets of the Corporation shall not be deemed a voluntary or involuntary dissolution, liquidation or winding up of the affairs

of the Corporation, nor shall the merger, consolidation or any other business combination transaction of the Corporation into or with

any other corporation or Person or the merger, consolidation or any other business combination of any other corporation or Person into

or with the Corporation be deemed to be a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Corporation.

Section VII. Anti-Dilution Adjustments.

(a) In the event the Corporation shall

at any time prior to an applicable Conversion Date issue Additional Shares of Common Stock, then the Applicable Conversion Rate shall

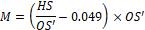

be adjusted, concurrently with such issue, to a rate determined in accordance with the following formula:

(b) For purposes of the foregoing formula,

the following definitions shall apply:

(i) “CR0”

shall mean the Applicable Conversion Rate in effect immediately before the close of business on the Record Date or effective date, as

applicable, for such issuance of Additional Shares of Common Stock;

(ii) “CR1”

shall mean the Applicable Conversion Rate in effect immediately after the close of business of the Record Date or effective date, as applicable,

of such issuance of Additional Shares of Common Stock;

(iii) “OS0”

shall mean the number of shares of Common Stock outstanding immediately prior to such issuance of Additional Shares of Common Stock; and

(iv) “OS1”

shall mean the number of shares of Common Stock outstanding immediately following such issuance of Additional Shares of Common Stock.

(c) For the purposes of this Section VII,

“Additional Shares of Common Stock” shall mean all shares of Common Stock issued by the Corporation after the Closing

Date and prior to an applicable Conversion Date as a distribution, dividend, stock split, stock combination or other similar recapitalization

with respect to the Common Stock (in each case excluding an issuance solely pursuant to a Reorganization Event).

(d) Notwithstanding the foregoing, if any

distribution, dividend, stock split, stock combination or other similar recapitalization with respect to the Common Stock as described

above is declared or announced, but not so paid or made, then the Applicable Conversion Rate in effect will be readjusted, effective as

of the date the Board, or any officer acting pursuant to authority conferred by the Board, determines not to pay such distribution or

dividend or to effect such stock split or stock combination or other similar recapitalization, to the Applicable Conversion Rate that

would then be in effect had such dividend, distribution, stock split, stock combination or similar recapitalization not been declared

or announced.

Section VIII. Reorganization Event.

(a) Upon the occurrence of a Reorganization

Event prior to an applicable Conversion Date, each share of Non-Voting Preferred Stock outstanding immediately prior to such Reorganization

Event shall, without the consent of Holders, automatically convert into the types and amounts of securities and cash that is or was receivable

in such Reorganization Event by a holder of the number of shares of Common Stock into which such share of Non-Voting Preferred Stock was

convertible immediately prior to such Reorganization Event in exchange for such shares of Common Stock (such securities and cash, the

“Exchange Property”), provided that if (x) the Exchange Property consists of Voting Securities of another Person and

(y) after giving effect to such automatic conversion, CITIC and its Affiliates would collectively hold more than 4.9% of any Class of

Voting Securities of such Person that is impermissible for CITIC to hold under the BHCA, then, at the Corporation’s election, the

Corporation may redeem the portion of the Holder’s Non-Voting Preferred Stock that would cause CITIC and its Affiliates to collectively

hold more than 4.9% of any Class of Voting Securities of such Person that is impermissible for CITIC to hold under the BHCA at a cash

price per share of Non-Voting Preferred Stock equal to the product of the Applicable Conversion Rate and the Fair Market Value of the

Common Stock. The Holders shall not have any separate class vote on any Reorganization Event. A “Reorganization Event”

shall mean:

(i) any consolidation, merger, conversion

or other similar business combination of the Corporation with or into another Person (other than a transaction in which the holders of

the voting securities of the surviving corporation in such transaction immediately following the transaction are substantially the same

as the holders of Common Stock immediately prior to such transaction), in each case pursuant to which the Common Stock will be converted

into cash, securities, or other property of the Corporation or another Person;

(ii) any sale, Transfer, lease, or conveyance

to another Person of all or substantially all of the consolidated assets of the Corporation and its subsidiaries, taken as a whole, in

each case pursuant to which the Common Stock will be converted into cash, securities, or other property of the Corporation or such Person

(other than a transaction in which the holders of the voting securities of such Person immediately following the transaction are substantially

the same as the holders of Common Stock immediately prior to such transaction); or

(iii) any statutory exchange of the

outstanding Common Stock for securities of another Person (other than in connection with a merger or acquisition but not in a transaction

in which the holders of the voting securities of such Person immediately following the transaction are substantially the same as the holders

of Common Stock immediately prior to such transaction).

(b) In the event that holders of the shares

of the Common Stock have the opportunity to elect the form of consideration to be received in such Reorganization Event, the Corporation

shall ensure that the Holders have the same opportunity to elect the form of consideration in accordance with the same procedures and

pro ration mechanics that apply to the election to be made by the holders of the Common Stock. The amount of Exchange Property receivable

upon conversion of any Non-Voting Preferred Stock shall be determined based upon the Applicable Conversion Rate in effect on the date

on which such Reorganization Event is consummated.

(c) The Corporation (or any successor)

shall, within 20 days of the occurrence of any Reorganization Event, provide written notice to the Holders of Non-Voting Preferred Stock

of such occurrence of such event and of the type and amount of the cash, securities or other property that constitutes the Exchange Property.

Section IX. Common Stock Share Repurchase Program.

(a) Following March 11, 2024, if the Corporation

repurchases its Common Stock, commences a new share repurchase program for Common Stock or modifies a share repurchase program in existence

as of such date for Common Stock to increase the size of such share repurchase program (a “Share Repurchase”), CITIC

shall be entitled, upon the terms and subject to the conditions hereof, to surrender Common Stock to the Corporation in exchange for the

delivery to CITIC of a number of shares of such Non-Voting Preferred Stock that is equal to the product of (x) the applicable Exchanged

Common Shares (as defined below) multiplied by (y) the Applicable Conversion Rate. Any exchange of Common Stock for Non-Voting

Preferred Stock pursuant hereto is defined herein as an “Exchange.” Subject to Section IX(b) and (c), CITIC may effect

an Exchange within 10 Business Days following a determination by CITIC that a Share Repurchase has or would have the effect of increasing

the calculation of the percentage of outstanding shares of Common Stock held by CITIC (together with its BHCA Affiliates) above 4.9% by

submitting a written request (an “Exchange Notice”) including the following information: (i) the number of shares of

Common Stock held by CITIC (together with its BHCA Affiliates) as of the date of the Exchange Notice, (ii) the percentage of outstanding

shares of Common Stock held by CITIC (together with its BHCA Affiliates) as described below, (iii) the proposed number of shares of Common

Stock to be surrendered by CITIC in exchange for Non-Voting Preferred Stock in the Exchange (the “Exchanged Common Shares”),

(iv) the calculation of the applicable Maximum Conversion (as defined below) and (v) the calculation of the percentage of outstanding

shares of Common Stock held by CITIC (together with its BHCA Affiliates) following the settlement of the applicable Exchange. For purposes

of calculating the percentage of outstanding shares of Common Stock held by CITIC (together with its BHCA Affiliates) referenced in clause

(ii) of the immediately preceding sentence, CITIC shall use the Recent Outstanding Common Shares minus the Authorized Repurchases

calculated as of the date immediately preceding the Exchange Notice.

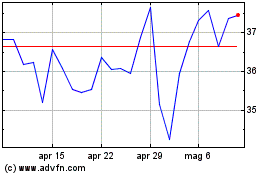

(b) The number of Exchanged Common Shares

in an Exchange in connection with a Share Repurchase shall not exceed the number of shares of Common Stock determined in accordance with

the following formula and rounded to the nearest share (the “Maximum Conversion”):

For purposes of the foregoing formula, the following

definitions shall apply:

(i) “M” shall mean

the Maximum Conversion;

(ii) “HS” shall mean

the number of shares of Common Stock held by CITIC (together with its BHCA Affiliates) as of the date of the Exchange Notice; and

(iii) “OS'”

shall mean the Recent Outstanding Common Shares minus the Authorized Repurchases as of the date immediately preceding the Exchange

Notice.

(c) Notwithstanding anything to the contrary

herein, CITIC shall not be entitled to Exchange into a number of shares of Non-Voting Preferred Stock that would exceed 5,000,000 shares

in the aggregate.

(d) The Corporation shall effect the Exchange

on the second Business Day following delivery of a valid Exchange Notice.

Section X. Reservation of Stock.

(a) The Corporation shall at all times

reserve and keep available out of its authorized and unissued Common Stock or shares acquired or created by the Corporation, solely for

issuance upon the conversion of shares of Non-Voting Preferred Stock as provided in this Certificate of Designation, free from any preemptive

or other similar rights, such number of shares of Common Stock as shall from time to time be issuable upon the conversion of all the shares

of Non-Voting Preferred Stock then outstanding.

(b) The Corporation hereby covenants and

agrees that, for so long as shares of the Common Stock are listed on the NYSE or any other national securities exchange or automated quotation

system, the Corporation will, if permitted by the rules of such exchange or automated quotation system, list and keep listed, so long

as the Common Stock shall be so listed on such exchange or automated quotation system, all the Common Stock issuable upon conversion of

the Non-Voting Preferred Stock; provided, however, that if the rules of such exchange or automated quotation system

permit the Corporation to defer the listing of such Common Stock until the first conversion of Non-Voting Preferred Stock into Common

Stock in accordance with the provisions hereof, the Corporation covenants to list such Common Stock issuable upon conversion of the Non-Voting

Preferred Stock in accordance with the requirements of such exchange or automated quotation system at such time.

Section XI. Exclusion of Other Rights.

Except as may otherwise be required by Law, the

shares of Non-Voting Preferred Stock shall not have any voting powers, preferences or relative, participating, optional or other special

rights, other than those specifically set forth herein (as this Certificate of Designation may be amended from time to time). The shares

of Non-Voting Preferred Stock shall have no preemptive or subscription rights.

Section XII. Severability of Provisions.

If any voting powers, preferences or relative,

participating, optional or other special rights of the Non-Voting Preferred Stock and qualifications, limitations and restrictions thereof

set forth in this Certificate of Designation (as this Certificate of Designation may be amended from time to time) are invalid, unlawful

or incapable of being enforced by reason of any rule of Law, all other voting powers, preferences and relative, participating, optional

and other special rights of Non-Voting Preferred Stock and qualifications, limitations and restrictions thereof set forth in this Certificate

of Designation (as so amended) which can be given effect without the invalid, unlawful or unenforceable voting powers, preferences or

relative, participating, optional or other special rights of Non-Voting Preferred Stock and qualifications, limitations and restrictions

thereof shall, nevertheless, remain in full force and effect, and no voting powers, preferences or relative, participating, optional or

other special rights of Non-Voting Preferred Stock or qualifications, limitations and restrictions thereof herein set forth shall be deemed

dependent upon any other such voting powers, preferences or relative, participating, optional or other special rights of Non-Voting Preferred

Stock or qualifications, limitations and restrictions thereof unless so expressed herein.

Section XIII. No Reissuance of Non-Voting Preferred

Stock.

Any converted or redeemed shares of Non-Voting

Preferred Stock shall be retired and cancelled and may not be reissued as shares of such series, and the Corporation may thereafter take

such appropriate action (without the need for shareholder action) as may be necessary to reduce the authorized number of shares of Non-Voting

Preferred Stock accordingly and restore such shares to the status of authorized but unissued shares of Preferred Stock.

Section XIV. Additional Authorized Shares.

Notwithstanding anything set forth in the Certificate

of Incorporation or this Certificate of Designation to the contrary, the Board or any authorized committee of the Board, without the vote

of the Holders, may increase or decrease the number of authorized shares of Non-Voting

Preferred Stock or other stock ranking junior or senior to, or on parity with, the Non-Voting Preferred Stock as to dividends and the

distribution of assets upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the Corporation.

Section XV. Determinations.

The Corporation shall be solely responsible for

making all calculations called for hereunder. Absent fraud or manifest error, such calculations shall be final and binding on all Holders.

The Corporation shall have the power to resolve any ambiguity and its action in so doing, as evidenced by a resolution of the Board, shall

be final and conclusive unless clearly inconsistent with the intent hereof. Amounts resulting from any calculation will be rounded, if

necessary, to the nearest one ten-thousandth, with five one-hundred thousandths being rounded upwards.

Section XVI. Notices.

All notices, demands or other communications to

be given or delivered under or by reason of the provisions of this Certificate of Designation shall be in writing and shall be deemed

to have been given or made when (a) delivered personally to the recipient, (b) delivered by means of electronic mail (provided

that no “error message” or other notification of non-delivery is generated) or (c) one (1) Business Day after being sent to

the recipient by reputable overnight courier service (charges prepaid). Such notices, demands and other communications shall be sent to

(i) if to the Corporation, 201 Isabella Street, Suite 500, Pittsburgh, Pennsylvania 15212-5858, Attention: Executive Vice President and

General Counsel, (ii) if to any Holder, to such Holder at the address listed in the stock record books of the Corporation, or, in each

case, to such other address or to the attention of such other person as the recipient party has specified by prior written notice to the

sending party.

Section XVII. Taxes.

The Corporation and each Holder shall bear their

own expenses in connection with any conversion contemplated by Section III.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation has caused

this Certificate of Designation to be executed by a duly authorized officer as of the 31st day of July, 2024.

| |

ALCOA CORPORATION |

| |

|

| |

|

| |

By: |

/s/ William F. Oplinger |

| |

|

Name: William F. Oplinger |

| |

|

Title: President and Chief Executive Officer |

[Signature Page to the Certificate

of Designation]

Exhibit 3.2

AMENDED AND RESTATED BYLAWS

OF

ALCOA CORPORATION

Incorporated under the Laws of the State of

Delaware

These Amended and Restated

Bylaws (as amended, the “Bylaws”) of ALCOA CORPORATION, a Delaware corporation, are effective as of July 31, 2024 and

hereby amend and restate the previous bylaws of ALCOA CORPORATION, which are hereby deleted in their entirety and replaced with the following:

ARTICLE

I

OFFICES AND RECORDS

Section 1.1 Delaware

Office. The registered office of ALCOA CORPORATION (the “Corporation”) in the State of Delaware shall be located

in the City of Wilmington, County of New Castle, and the name and address of its registered agent is The Corporation Trust Company, 1209

Orange Street, Wilmington, Delaware 19801.

Section 1.2 Other Offices.

The Corporation may have such other offices, either inside or outside the State of Delaware, as the Board of Directors of the Corporation

(the “Board of Directors”) may from time to time designate or as the business of the Corporation may require.

Section 1.3 Books and Records.

The books and records of the Corporation may be kept inside or outside the State of Delaware at such place or places as may from time

to time be designated by the Board of Directors.

ARTICLE

II

STOCKHOLDERS

Section 2.1 Annual Meeting.

The annual meeting of the stockholders of the Corporation shall be held at such date and time and in such manner as may be fixed by resolution

of the Board of Directors.

Section 2.2 Special Meeting.

(A) Subject

to the rights of the holders of any series of stock having a preference over the Common Stock of the Corporation as to dividends, voting

or upon liquidation (the “Preferred Stock”) with respect to such series of Preferred Stock, special meetings of the

stockholders may be called only by or at the direction of (1) the Chairman of the Board of Directors or the Chief Executive Officer, or

(2) the Board of Directors pursuant to a resolution adopted by a majority of the total number of directors which the Corporation would

have if there were no vacancies (the “Whole Board”), or (3) the Secretary of the Corporation at the written request

of a stockholder of record who owns and has owned, or is acting on behalf of one or more beneficial owners who own and have owned, continuously

for at least one year as of the record date fixed in accordance with these Bylaws to determine who may deliver a written request to call

such special meeting, capital stock representing at least twenty-five percent (25%) of the outstanding shares of capital stock of the

Corporation entitled to vote generally in the election of directors (the “Special Meeting Request

Required Shares”), and who continue to own

the Special Meeting Request Required Shares at all times between such record date and the date of the applicable meeting of stockholders.

For purposes of this Section 2.2, a record or beneficial owner shall be deemed to “own” shares of capital stock of

the Corporation that such record or beneficial owner would be deemed to own in accordance with clause (3) of the first paragraph of Section

9.1 (without giving effect to any reference to Constituent Holder or any stockholder fund comprising a Qualifying Fund contained therein).

(B) Any

record stockholder (whether acting for him, her or itself, or at the direction of a beneficial owner) may, by written notice to the Secretary,

demand that the Board of Directors fix a record date to determine the record stockholders who are entitled to deliver a written request

to call a special meeting (such record date, the “Ownership Record Date”). A written demand to fix an Ownership Record

Date shall include all of the information that must be included in a written request to call a special meeting, as set forth in paragraph

(D) of this Section 2.2. The Board of Directors may fix the Ownership Record Date within ten (10) days of the Secretary’s

receipt of a valid demand to fix the Ownership Record Date. The Ownership Record Date shall not precede, and shall not be more than ten

(10) days after, the date upon which the resolution fixing the Ownership Record Date is adopted by the Board of Directors. If an Ownership

Record Date is not fixed by the Board of Directors within the period set forth above, the Ownership Record Date shall be the date that

the first written request is received by the Secretary pursuant to this paragraph (B).

(C) A

beneficial owner who wishes to deliver a written request to call a special meeting must cause the nominee or other person who serves as

the record stockholder of such beneficial owner’s stock to sign the written request to call a special meeting. If a record stockholder

is the nominee for more than one beneficial owner of stock, the record stockholder may deliver a written request to call a special meeting

solely with respect to the capital stock of the Corporation beneficially owned by the beneficial owner who is directing the record stockholder

to sign such written request to call a special meeting.

(D) Each

written request to call a special meeting shall include the following and shall be delivered to the Secretary of the Corporation: (i)

the signature of the record stockholder submitting such request and the date such request was signed, (ii) the complete text of each business

proposal desired to be submitted for stockholder approval at the special meeting, and (iii) as to the beneficial owner, if any, directing

such record stockholder to sign the written request to call a special meeting and as to such record stockholder (unless such record stockholder

is acting solely as a nominee for a beneficial owner) (each such beneficial owner and each record stockholder who is not acting solely

as a nominee, a “Disclosing Party”):

(1) all

of the information required to be disclosed pursuant to Section 2.9(C)(1) of these Bylaws by each Disclosing Party, (i) not later

than ten (10) days after the record date for determining the record stockholders entitled to notice of the special meeting (such record

date, the “Meeting Record Date”), to disclose the foregoing information as of the Meeting Record Date and (ii) not

later than the 5th day before the special meeting, to disclose the foregoing information as of the date that is ten (10) days prior to

the special meeting or any adjournment or postponement thereof;

(2) with

respect to each business proposal to be submitted for stockholder approval at the special meeting, a statement whether or not any Disclosing

Party will deliver a proxy statement and form of proxy to holders of at least the percentage of voting power of all of the outstanding

shares of capital stock of the Corporation generally entitled to vote in the election of directors (“Voting Stock”)

required under applicable law to carry such proposal (such statement, a “Solicitation Statement”); and

(3) any

additional information reasonably requested by the Board of Directors to verify the Voting Stock ownership position of such Disclosing

Party.

Each time the Disclosing Party’s Voting

Stock ownership position decreases following the delivery of the foregoing information to the Secretary, such Disclosing Party shall notify

the Corporation of his, her or its decreased Voting Stock ownership position, together with any information reasonably requested by the

Board of Directors to verify such position, within ten (10) days of such decrease or as of the 5th day before the special meeting, whichever

is earlier.

(E) The

Secretary shall not accept, and shall consider ineffective, a written request to call a special meeting pursuant to clause (A)(3) of this

Section 2.2:

(1) that

does not comply with the provisions of this Section 2.2;

(2) that

relates to an item of business that (i) is not a proper subject for stockholder action under the Corporation’s Amended and Restated

Certificate of Incorporation (the “Certificate of Incorporation”), these Bylaws or applicable law; or (ii) is expressly

reserved for action by the Board of Directors under the Certificate of Incorporation, these Bylaws or applicable law;

(3) if

such written request to call a special meeting is delivered between the time beginning on the 61st day after the earliest date of signature

on a written request to call a special meeting, that has been delivered to the Secretary, relating to an identical or substantially similar

item (as determined by the Board of Directors, a “Similar Item”), other than the election or removal of directors,

and ending on the one (1)-year anniversary of such earliest date;

(4) if

a Similar Item will be submitted for stockholder approval at any stockholder meeting to be held on or before the 120th day after the Secretary

receives such written request to call a special meeting (and, for purposes of this clause (4), the election of directors shall be deemed

to be a Similar Item with respect to all items of business involving the election or removal of directors, changing the size of the Board

of Directors and the filling of vacancies or newly created directorships resulting from any increase in the authorized number of directors);

or

(5) if

a Similar Item has been presented at any meeting of stockholders held within 180 days prior to receipt by the Secretary of such written

request to call a special meeting (and, for purposes of this clause (5), the election of directors shall be deemed to be a Similar Item

with respect to all items of business involving the election or removal of directors, changing the size of the Board of Directors and

the filling of vacancies or newly created directorships resulting from any increase in the authorized number of directors).

(F) Revocations:

(1) A

record stockholder may revoke a request to call a special meeting at any time before the special meeting by sending written notice of

such revocation to the Secretary of the Corporation.

(2) All

written requests for a special meeting shall be deemed revoked:

(a) upon

the first date that, after giving effect to revocation(s) and notices of ownership position decreases (pursuant to Section 2.2 (D)(3)

and the last sentence of Section 2.2(D), respectively), the aggregate Voting Stock ownership position of all the Disclosing Parties

who are listed on the unrevoked written requests to call a special meeting with respect to a Similar Item decreases to a number of shares

of Voting Stock less than the Special Meeting Request Required Shares;

(b) if

any Disclosing Party who has provided a Solicitation Statement with respect to any business proposal to be submitted for stockholder approval

at such special meeting does not act in accordance with the representations set forth therein; or

(c) if

any Disclosing Party does not provide the supplemental information required by Section 2.2(D)(3) or by the final sentence of Section

2.2(D), in accordance with such provisions.

(3) If

a deemed revocation of all written requests to call a special meeting has occurred after the special meeting has been called by the Secretary,

the Board of Directors shall have the discretion to determine whether or not to proceed with the special meeting.

(G) The

Board of Directors may submit its own proposal or proposals for consideration at a special meeting called at the request of one or more

stockholders. The Meeting Record Date for, and the place, date and time of, any special meeting shall be fixed by the Board of Directors;