Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

16 Maggio 2023 - 12:58PM

Edgar (US Regulatory)

Filed Pursuant to

Rule 433

Registration Statement

No. 333-255698

Relating to Preliminary

Prospectus

Supplement dated

May 15, 2023 to

Prospectus dated

April 30, 2021

NEWS

FOR IMMEDIATE RELEASE

| Contacts: |

Al Scott |

Brent Vandermause |

| |

Media Relations |

Investor Relations |

| |

(847) 402-5600 |

(847) 402-2800 |

Allstate Prices

Series J Preferred Shares

NORTHBROOK, Ill., May 16, 2023 –

The Allstate Corporation (NYSE: ALL) announced that on May 15, 2023 it priced a $600 million public offering of 7.375% Fixed Rate Noncumulative

Perpetual Preferred Stock, Series J (Series J Preferred Stock). The company intends to use the net proceeds for general corporate purposes,

due to the redemption of all outstanding shares of Series G Preferred Stock on April 17, 2023, at par for a total redemption payment

of $575 million. Loop Capital Markets is a bookrunner on the transaction, making this the first time a minority-, women- or veteran-owned

business enterprise has acted as a joint bookrunner on a preferred stock issuance.

The

Series J Preferred Stock, with a liquidation preference of $25,000 per share (equivalent to $25 per Depositary Share, the security to

be issued to investors) will pay dividends, as and if declared, quarterly in arrears on Jan. 15, April 15, July 15 and Oct. 15, beginning

in October 2023, at a rate of 7.375% per year. The Series J Preferred Stock is perpetual and has no maturity date. Application will be

made to list the Depositary Shares on the New York Stock Exchange under the symbol “ALL PR J” (CUSIP No. 020002788). The

offering is expected to close on May 18, 2023, subject to customary closing conditions.

The

Depositary Shares are being offered for sale pursuant to a prospectus and related prospectus supplement that constitute a part of The

Allstate Corporation’s shelf registration statement filed with the Securities and Exchange Commission (SEC) on Form S-3 on April

30, 2021. Before making an investment, potential investors should first read the prospectus supplement and accompanying prospectus, the

registration statement and the other documents that The Allstate Corporation filed or will file with the SEC in connection with the offering.

Alternatively, copies may be obtained by calling Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, BofA Securities Inc. toll-free

at 1-800-294-1322, J.P. Morgan Securities LLC collect at 1-212-834-4533, Loop Capital Markets LLC at 1-312-913-4900, or Wells Fargo Securities

LLC toll-free at 1-800-645-3751.

Financial information, including material

announcements about The Allstate Corporation, is routinely posted on www.allstateinvestors.com.

# # #

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Nov 2024 a Dic 2024

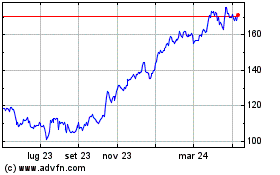

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Dic 2023 a Dic 2024