00009276538-K08/26/2024false00009276532024-08-262024-08-260000927653us-gaap:CommonStockMember2024-08-262024-08-260000927653mck:A1.500NotesDue2025Member2024-08-262024-08-260000927653mck:A1.625NotesDue2026Member2024-08-262024-08-260000927653mck:A3.125NotesDue2029Member2024-08-262024-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 26, 2024

McKESSON CORPORATION

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-13252 | | 94-3207296 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

6555 State Hwy 161

Irving, TX 75039

(Address of Principal Executive Offices, and Zip Code)

(972) 446-4800

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common stock, $0.01 par value | | MCK | | New York Stock Exchange |

| 1.500% Notes due 2025 | | MCK25 | | New York Stock Exchange |

| 1.625% Notes due 2026 | | MCK26 | | New York Stock Exchange |

| 3.125% Notes due 2029 | | MCK29 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01 | Regulation FD Disclosure |

On August 26, 2024, McKesson Corporation (“Company”) issued and posted on its website (https://www.mckesson.com/About-McKesson/Newsroom/Press-Releases/ and https://investor.mckesson.com/news/default.aspx) a news release announcing that it signed a definitive agreement to acquire a controlling interest in Community Oncology Revitalization Enterprise Ventures, LLC (“Core Ventures”). A copy of that news release is attached hereto as Exhibit 99.1.

On August 25, 2024, the Company entered into a unit purchase agreement (“Purchase Agreement”) with Florida Cancer Specialists & Research Institute, LLC (“Florida Cancer Specialists”) and Core Ventures to acquire a controlling interest in Core Ventures. The Company has committed to purchase an approximately 70% controlling equity interest for approximately $2.49 billion in cash, subject to certain customary adjustments.

The closing of the transactions contemplated by the Purchase Agreement are subject to the satisfaction of customary closing conditions, including regulatory review.

Florida Cancer Specialists owns and operates a medical practice that offers and provides, at various locations in Florida, professional medical services in oncology and ancillary activities related thereto. Core Ventures is engaged by Florida Cancer Specialists as its exclusive provider of non-clinical business and other administrative services.

Cautionary Statements:

Except for historical information, statements in this report regarding the Company’s proposed acquisition and related arrangements constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks and uncertainties that could cause actual results to differ materially from those in those statements. It is not possible to identify all such risks and uncertainties. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are first made. Except to the extent required by law, the company undertakes no obligation to publicly update forward-looking statements. We encourage investors to read the important risk factors described in the Company’s most recent Form 10-K filed with the Securities and Exchange Commission. These risk factors include, but are not limited to: we may be unable to obtain necessary regulatory approvals; we may not achieve expected outcomes from the transaction; we might be adversely impacted by delays or other difficulties, including related to the transactions described in this press release; we from time to time record significant charges from impairment to goodwill, intangibles and other assets or investments; we might be adversely impacted by events outside of our control, such as widespread public health issues, natural disasters, political events, economic events and other catastrophic events.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 26, 2024

| | | | | | | | |

| | |

| McKesson Corporation |

| |

| By: | /s/ Britt J. Vitalone |

| | Britt J. Vitalone |

| | Executive Vice President and |

| | Chief Financial Officer |

McKesson Signs Agreement to Acquire Controlling Interest in Florida Cancer Specialists & Research Institute’s Core Ventures

Acquisition enhances McKesson’s integrated oncology platform; Florida Cancer Specialists & Research Institute to join The US Oncology Network

IRVING, Texas, August 26, 2024—McKesson Corporation (NYSE: MCK) announced today that it signed a definitive agreement to acquire a controlling interest in Community Oncology Revitalization Enterprise Ventures, LLC (Core Ventures). Core Ventures, a business and administrative services organization, was established by Florida Cancer Specialists & Research Institute, LLC (FCS), a leading physician-owned community oncology practice. FCS physicians will continue to retain a minority interest in Core Ventures.

McKesson will purchase its controlling interest for approximately $2.49 billion in cash, which will represent approximately 70% ownership. Following completion of the transaction, Core Ventures will be part of the Oncology platform, and financial results will be reported within McKesson’s US Pharmaceutical segment. The transaction is subject to customary closing conditions, including necessary regulatory clearances. Following the close of the transaction, FCS, a practice with more than 250 physicians and 280 advanced practice providers, across nearly 100 locations in Florida, will remain independently owned and FCS will join McKesson’s The US Oncology Network (The Network), a leading oncology organization, dedicated to advancing local and affordable cancer care and better patient outcomes.

“This milestone marks an important step forward in our efforts to advance community-based oncology care,” said Brian Tyler, chief executive officer, McKesson. “By growing our Oncology platform, we will bring advanced treatments and improved care experiences to patients, while also reducing the overall cost of care. FCS and Core Ventures’ expertise and patient-first approach align with our commitment to accelerating clinical development, improving patient outcomes, and expanding access to quality cancer care in the community. We are also pleased to welcome Florida Cancer Specialists & Research Institute to The US Oncology Network, reinforcing our dedication to empowering community-based providers to independently thrive in today’s rapidly evolving healthcare landscape.”

FCS has provided exceptional care to cancer patients for over 40 years. During that time, services have grown to include clinical trials, diagnostic imaging, medical oncology and chemotherapy infusion, integrative therapy, molecular and pathology lab services, radiation oncology, next-generation sequencing, medically integrated dispensing, and data services. FCS currently conducts clinical trials through Sarah Cannon Research Institute (SCRI), one of the world’s leading oncology research organizations conducting community-based clinical trials. By joining The Network, FCS will have access to McKesson’s differentiated Oncology platform, including best-in-class oncology care products and services.

“Above all else, our patients are the true beneficiaries of this transaction, as we seek to drive meaningful outcomes and deliver sustained value with every interaction. Through the power of our combined operational expertise, we can bolster community oncology's role in increasing access to high-quality, affordable care,” said Lucio N. Gordan, MD, president and managing physician, FCS.

“This is a historic moment for FCS and reflects the evolution of our practice and the forward-thinking of physician leadership, our board, and the entire organization at large,” said Nathan H. Walcker, chief executive officer of FCS. “The US Oncology Network and FCS share a mission and we both aim to strengthen patient-centered cancer care in the community to improve outcomes. We are thrilled to partner with McKesson and join The Network, which furthers the joint commitment to bringing the best medicine and innovation for patients into communities across Florida.”

###

Cautionary Statements

Except for historical information, statements in this press release regarding McKesson’s proposed acquisition and related arrangements constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks and uncertainties that could cause actual results to differ materially from those in those statements. It is not possible to identify all such risks and uncertainties. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are first made. Except to the extent required by law, the company undertakes no obligation to publicly update forward-looking statements. We encourage investors to read the important risk factors described in the company’s most recent Form 10-K filed with the Securities and Exchange Commission. These risk factors include, but are not limited to: we may be unable to obtain necessary regulatory approvals; we may not achieve expected outcomes from the transaction; we might be adversely impacted by delays or other difficulties, including related to the transactions described in this press release; we from time to time record significant charges from impairment to goodwill, intangibles and other assets or investments; we might be adversely impacted by events outside of our control, such as widespread public health issues, natural disasters, political events, economic events and other catastrophic events.

About McKesson

McKesson Corporation is a diversified healthcare services leader dedicated to advancing health outcomes for patients everywhere. Our teams partner with biopharma companies, care providers, pharmacies, manufacturers, governments, and others to deliver insights, products, and services to help make quality care more accessible and affordable. Learn more about how McKesson is impacting virtually every aspect of healthcare at McKesson.com and read Our Stories.

About McKesson Oncology and Specialty Solutions

It’s an unprecedented time for patients living with cancer as life sciences companies race to create new, cutting-edge therapies. With cancer care becoming more targeted, providers, life sciences companies, and payers face a multitude of challenges and complexity in the development of new treatments and making them accessible to patients in need. At McKesson, our unmatched portfolio of oncology businesses and partners provide research, insights, technologies, and services that are helping to address these hurdles and improve cancer and specialty care.

•McKesson is fueling discovery by helping patients participate in cutting-edge clinical trials closer to home through its joint venture with Sarah Cannon Research Institute.

•The US Oncology Network and McKesson Provider Solutions are advancing specialty care and high-quality cancer care in the communities where patients live by supporting the practices of thousands of independent, community-based providers.

•Ontada®, a McKesson business dedicated to oncology, generates real-world data (RWD) and real-world evidence (RWE), and provides clinical education and provider technology to inform and improve cancer care.

•As one of the largest distributors of oncology and specialty medicines, we are ensuring medicines make their way to those who are counting on them.

•And through CoverMyMeds, Biologics by McKesson, and GPO services, our work continues to help patients access, afford, and adhere to their medicines.

Contacts

Rachel Rodriguez

Investors

469.260.0556 rachel.rodriguez@mckesson.com

Claire Crye

Media

281.825.9927 claire.crye@mckesson.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A1.500NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A1.625NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mck_A3.125NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

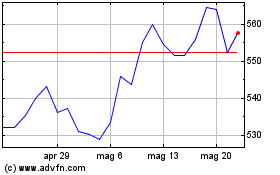

Grafico Azioni McKesson (NYSE:MCK)

Storico

Da Feb 2025 a Mar 2025

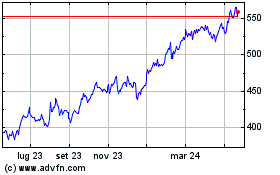

Grafico Azioni McKesson (NYSE:MCK)

Storico

Da Mar 2024 a Mar 2025