FalsePROGRESSIVE CORP/OH/000008066100000806612025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 29, 2025

THE PROGRESSIVE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | 001-09518 | 34-0963169 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | | | |

| 300 North Commons Blvd., | Mayfield Village, | Ohio | | 44143 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (440) 461-5000

| | | | | | | | | | | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 Par Value | PGR | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 29, 2025, The Progressive Corporation (the “Company”) issued a news release containing financial results for the Company and its consolidated subsidiaries for the month and year ended December 31, 2024, and selected quarterly financial results. A copy of the news release is attached hereto as Exhibit 99.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

See exhibit index on page 3.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: | January 29, 2025 | | | |

| | | THE PROGRESSIVE CORPORATION |

| | | | |

| | | | |

| | | By: | /s/ Mariann Wojtkun Marshall |

| | | Name: | Mariann Wojtkun Marshall |

| | | Title: | Vice President and Chief Accounting Officer |

| | | | |

EXHIBIT INDEX

| | | | | | | | | | | | | | |

| Exhibit No. Under Reg. S-K Item 601 | | Form 8-K Exhibit No. | |

Description |

| 99 | | 99 | | |

| | | | |

| 104 | | 104 | | Cover Page Interactive Data File (the cover page tags are

embedded within the Inline XBRL document). |

| | | | | | | | | | | |

| | | |

| The Progressive Corporation | | | Company Contact: |

| 300 North Commons Blvd. | | | Douglas S. Constantine |

| Mayfield Village, Ohio 44143 | | | (440) 395-3707 |

| | | |

| | | |

PROGRESSIVE REPORTS DECEMBER RESULTS

MAYFIELD VILLAGE, OHIO -- January 29, 2025 -- The Progressive Corporation (NYSE:PGR) today reported the following results for the month and quarter ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December | | | Quarter | | |

| (millions, except per share amounts and ratios; unaudited) | 2024 | | 2023 | | Change | 2024 | | 2023 | | Change |

| Net premiums written | $ | 5,964 | | | $ | 4,876 | | | 22 | | % | $ | 18,105 | | | $ | 15,130 | | | 20 | % |

| Net premiums earned | $ | 6,717 | | | $ | 5,310 | | | 26 | | % | $ | 19,144 | | | $ | 15,773 | | | 21 | % |

| Net income | $ | 942 | | | $ | 901 | | | 5 | | % | $ | 2,356 | | | $ | 1,988 | | | 19 | % |

| Per share available to common shareholders | $ | 1.60 | | | $ | 1.53 | | | 5 | | % | $ | 4.01 | | | $ | 3.37 | | | 19 | % |

| Total pretax net realized gains (losses) on securities | $ | (140) | | | $ | 144 | | | (197) | | % | $ | (53) | | | $ | 303 | | | (117) | % |

| Combined ratio | 84.1 | | 83.4 | | 0.7 | | pts. | 87.9 | | 88.7 | | (0.8) pts. |

| Average diluted equivalent common shares | 587.7 | | 587.4 | | 0 | % | 587.7 | | 587.5 | | 0 | % |

|

| | | | | | | | | | | | | | | | | |

| December 31, |

| (thousands; unaudited) | 2024 | | 2023 | | % Change |

| Policies in Force | | | | | |

| Personal Lines | | | | | |

| Agency – auto | 9,778 | | 8,336 | | 17 |

| Direct – auto | 13,996 | | 11,190 | | 25 |

| Special lines | 6,520 | | 5,969 | | 9 |

| Property | 3,517 | | 3,096 | | 14 |

| Total Personal Lines | 33,811 | | 28,591 | | 18 |

| Commercial Lines | 1,141 | | 1,099 | | 4 |

| Companywide | 34,952 | | 29,690 | | 18 |

| | | | | |

Progressive offers personal and commercial insurance throughout the United States. Our Personal Lines business writes insurance for personal vehicles (auto and special lines products) and personal property insurance for homeowners, other property owners, and renters. Our Commercial Lines business writes auto-related liability and physical damage insurance, business-related general liability and commercial property insurance predominantly for small businesses, and workers’ compensation insurance primarily for the transportation industry.

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

COMPREHENSIVE INCOME STATEMENT

For the month ended December 31, 2024

(millions)

(unaudited)

| | | | | | | | | | | | | |

| December 2024 | | | | Comments on Monthly Results1 |

Net premiums written | $ | 5,964 | | | | | |

| | | | | |

Revenues: | | | | | |

Net premiums earned | $ | 6,717 | | | | | |

Investment income | 269 | | | | | |

Net realized gains (losses) on securities: | | | | | |

Net realized gains (losses) on security sales | (31) | | | | | |

Net holding period gains (losses) on securities | (108) | | | | | |

| Net impairment losses | (1) | | | | | Represents write down of securities in an unrealized loss position that we do not intend to hold until recovery. |

Total net realized gains (losses) on securities | (140) | | | | | |

Fees and other revenues | 94 | | | | | |

Service revenues | 34 | | | | | |

Total revenues | 6,974 | | | | | |

| | | | | |

Expenses: | | | | | |

Losses and loss adjustment expenses | 4,326 | | | | | |

Policy acquisition costs | 511 | | | | | |

Other underwriting expenses | 904 | | | | | |

Investment expenses | 3 | | | | | |

Service expenses | 37 | | | | | |

Interest expense | 23 | | | | | |

Total expenses | 5,804 | | | | | |

| | | | | |

Income before income taxes | 1,170 | | | | | |

Provision for income taxes | 228 | | | | | Includes $17 million of tax benefits primarily related to dividends that were declared in December on shares held in our ESOP that are deductible for income tax purposes. |

Net income | 942 | | | | | |

| | | | | |

Other comprehensive income (loss): | | | | | |

| | | | | |

Change in total net unrealized gains (losses) on fixed-maturity securities | (456) | | | | | |

| | | | | |

| | | | | |

| | | | | |

Total comprehensive income (loss) | $ | 486 | | | | | |

| | | | | |

1 For a description of our financial reporting and accounting policies as it applies to information contained throughout this release, see Note 1 to our 2023 audited consolidated financial statements included in our 2023 Shareholders’ Report, which can be found at www.progressive.com/annualreport.

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

COMPREHENSIVE INCOME STATEMENTS

For the year ended December 31,

(millions)

(unaudited)

| | | | | | | | | | | |

| Full Year |

| 2024 | | 2023 |

| Net premiums written | $ | 74,424 | | | $ | 61,550 | |

| | | |

| Revenues: | | | |

| Net premiums earned | $ | 70,799 | | | $ | 58,665 | |

| Investment income | 2,832 | | | 1,892 | |

| Net realized gains (losses) on securities: | | | |

| Net realized gains (losses) on security sales | (414) | | | 14 | |

| Net holding period gains (losses) on securities | 679 | | | 348 | |

| Net impairment losses | (1) | | | (9) | |

| Total net realized gains (losses) on securities | 264 | | | 353 | |

| Fees and other revenues | 1,064 | | | 889 | |

| Service revenues | 413 | | | 310 | |

| Total revenues | 75,372 | | | 62,109 | |

| | | |

| Expenses: | | | |

| Losses and loss adjustment expenses | 49,060 | | | 45,655 | |

| Policy acquisition costs | 5,383 | | | 4,665 | |

| Other underwriting expenses | 9,462 | | | 6,242 | |

| Investment expenses | 29 | | | 26 | |

| Service expenses | 446 | | | 349 | |

| Interest expense | 279 | | | 268 | |

| Total expenses | 64,659 | | | 57,205 | |

| | | |

| Income before income taxes | 10,713 | | | 4,904 | |

| Provision for income taxes | 2,233 | | | 1,001 | |

| Net income | 8,480 | | | 3,903 | |

| | | |

| Other comprehensive income (loss): | | | |

| | | |

Change in total net unrealized gains (losses) on fixed-maturity securities | 193 | | | 1,186 | |

| | | |

| | | |

| | | |

| Total comprehensive income (loss) | $ | 8,673 | | | $ | 5,089 | |

| | | |

| | | |

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

COMPUTATION OF NET INCOME AND COMPREHENSIVE INCOME PER SHARE

&

INVESTMENT RESULTS

For the month and year ended December 31,

(millions – except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | |

| The following table sets forth the computation of per share results: | | | | | | |

| December | | Full Year | |

| 2024 | | 2024 | | 2023 | |

| | | | | | |

Net income | $ | 942 | | | $ | 8,480 | | | $ | 3,903 | | |

Less: Preferred share dividends and other1 | 0 | | | 17 | | | 38 | | |

Net income available to common shareholders | $ | 942 | | | $ | 8,463 | | | $ | 3,865 | | |

Per common share: | | | | | | |

Basic | $ | 1.61 | | | $ | 14.45 | | | $ | 6.61 | | |

Diluted | $ | 1.60 | | | $ | 14.40 | | | $ | 6.58 | | |

| | | | | | |

Comprehensive income (loss) | $ | 486 | | | $ | 8,673 | | | $ | 5,089 | | |

Less: Preferred share dividends and other1 | 0 | | | 17 | | | 38 | | |

Comprehensive income (loss) attributable to common shareholders | $ | 486 | | | $ | 8,656 | | | $ | 5,051 | | |

Per common share: | | | | | | |

Diluted | $ | 0.83 | | | $ | 14.73 | | | $ | 8.60 | | |

| | | | | | |

Average common shares outstanding - Basic | 585.7 | | 585.5 | | 584.9 | |

Net effect of dilutive stock-based compensation | 2.0 | | 2.2 | | 2.6 | |

Total average equivalent common shares - Diluted | 587.7 | | 587.7 | | 587.5 | |

| | | | | | |

1 Includes the underwriting discounts and commissions on issuance, initial issuance costs, and excise tax related to the preferred share redemption in February 2024.

| | | | | | | | | | | | | | | | | | | | |

The following table sets forth the investment results for the period: | | | |

| December | | Full Year | |

| 2024 | | 2024 | | 2023 | |

Fully taxable equivalent (FTE) total return: | | | | | | |

Fixed-income securities | (0.4)% | | 3.8% | | 5.4% | |

Common stocks | (3.0)% | | 22.9% | | 26.7% | |

Total portfolio | (0.5)% | | 4.6% | | 6.3% | |

| | | | | | |

Pretax annualized investment income book yield | 4.1% | | 3.9% | | 3.1% | |

| | | | | | |

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

For the month ended December 31, 2024

($ in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 2024 |

| Personal Lines Business1 | | Commercial | | |

| Vehicles | | | | | | Lines | | Companywide |

| Agency | | Direct | | Property | | Total | | Business | | Total |

| Net Premiums Written | $ | 2,284 | | | $ | 2,831 | | | $ | 222 | | | $ | 5,337 | | | $ | 626 | | | $ | 5,964 | |

% Growth in NPW2 | 22% | | 32% | | (8)% | | 25% | | 0% | | 22% |

| Net Premiums Earned | $ | 2,445 | | | $ | 3,063 | | | $ | 256 | | | $ | 5,764 | | | $ | 952 | | | $ | 6,717 | |

| % Growth in NPE | 27% | | 34% | | 10% | | 30% | | 10% | | 26% |

| | | | | | | | | | | |

| GAAP Ratios | | | | | | | | | | | |

| Loss/LAE ratio | 64.9 | | | 67.9 | | | 10.8 | | | 64.2 | | | 65.0 | | | 64.3 | |

| Expense ratio | 18.1 | | | 20.6 | | | 30.0 | | | 19.9 | | | 19.1 | | | 19.8 | |

| Combined ratio | 83.0 | | | 88.5 | | | 40.8 | | | 84.1 | | | 84.1 | | | 84.1 | |

Net catastrophe loss ratio3 | (0.3) | | (19.9) | | | (1.2) | | | 0.2 | | | (1.0) | |

| | | | | | | | | | | |

Actuarial Adjustments4 | | | | | | | | | | | |

| Reserve Decrease/(Increase) | | | | | | | | | | | |

| Prior accident years | | | | | | | | | | | $ | 22 | |

| Current accident year | | | | | | | | | | | 81 | |

| Calendar year actuarial adjustment | $ | 28 | | | $ | 39 | | | $ | 55 | | | $ | 122 | | | $ | (19) | | | $ | 103 | |

| | | | | | | | | | | |

| Prior Accident Years Development | | | | | | | | | | | |

| Favorable/(Unfavorable) | | | | | | | | | | | |

| Actuarial adjustment | | | | | | | | | | | $ | 22 | |

| All other development | | | | | | | | | | | 34 | |

| Total development | | | | | | | | | | | $ | 56 | |

| | | | | | | | | | | |

| Calendar year loss/LAE ratio | | | | | | | | | | | 64.3 | |

| Accident year loss/LAE ratio | | | | | | | | | | | 65.1 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1 Starting in December 2024, our personal property products will be reported along with our personal vehicle products as part of our Personal Lines operating segment, based on our regular analysis of reportable operating segments.

2 In Commercial Lines, our transportation network company (TNC) business experienced a decrease in the monthly adjustment for projected mileage, which is the basis for computing premiums. Excluding the TNC business, our total Commercial Lines net premiums written growth rate would have been 5% for the month.

3 Represents catastrophe losses incurred during the period, including development on prior events and the impact of reinsurance, as a percent of net premiums earned. The negative Personal Lines catastrophe loss ratio was primarily due to favorable development attributable to Hurricanes Helene and Milton, in excess of current month storm losses, in both our vehicle and property products.

4 Represents adjustments solely based on our normally scheduled actuarial reviews. For our Personal Lines property business, the actuarial reserving methodology includes changes to catastrophe losses, while the reviews in our personal and commercial vehicle businesses do not include catastrophes.

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

For the year ended December 31, 2024

($ in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Full Year |

| Personal Lines Business | | Commercial | | |

| Vehicles | | | | | | Lines | | Companywide |

| Agency | | Direct | | Property | | Total | | Business | | Total |

| Net Premiums Written | $ | 26,967 | | | $ | 33,432 | | | $ | 3,071 | | | $ | 63,470 | | | $ | 10,953 | | | $ | 74,424 | |

| % Growth in NPW | 21% | | 27% | | 8% | | 23% | | 8% | | 21% |

| Net Premiums Earned | $ | 25,640 | | | $ | 31,458 | | | $ | 2,993 | | | $ | 60,091 | | | $ | 10,707 | | | $ | 70,799 | |

| % Growth in NPE | 21% | | 26% | | 17% | | 23% | | 8% | | 21% |

| | | | | | | | | | | |

| GAAP Ratios | | | | | | | | | | | |

| Loss/LAE ratio | 67.7 | | | 69.8 | | | 69.3 | | | 68.9 | | | 70.1 | | | 69.1 | |

| Expense ratio | 18.4 | | | 19.9 | | | 29.0 | | | 19.7 | | | 19.3 | | | 19.7 | |

| Combined ratio | 86.1 | | | 89.7 | | | 98.3 | | | 88.6 | | | 89.4 | | | 88.8 | |

Net catastrophe loss ratio1 | 3.0 | | 24.8 | | | 4.1 | | | 0.7 | | | 3.6 | |

| | | | | | | | | | | |

Actuarial Adjustments2 | | | | | | | | | | | |

| Reserve Decrease/(Increase) | | | | | | | | | | | |

| Prior accident years | | | | | | | | | | | $ | (123) | |

| Current accident year | | | | | | | | | | | 530 | |

| Calendar year actuarial adjustment | $ | 97 | | | $ | 72 | | | $ | 450 | | | $ | 619 | | | $ | (212) | | | $ | 407 | |

| | | | | | | | | | | |

| Prior Accident Years Development | | | | | | | | | | | |

| Favorable/(Unfavorable) | | | | | | | | | | | |

| Actuarial adjustment | | | | | | | | | | | $ | (123) | |

| All other development | | | | | | | | | | | 539 | |

| Total development | | | | | | | | | | | $ | 416 | |

| | | | | | | | | | | |

| Calendar year loss/LAE ratio | | | | | | | | | | | 69.1 | |

| Accident year loss/LAE ratio | | | | | | | | | | | 69.7 | |

| | | | | | | | | | | |

1 Represents catastrophe losses incurred during the year, including the impact of reinsurance, as a percent of net premiums earned.

2 Represents adjustments solely based on our normally scheduled actuarial reviews. For our Personal Lines property business, the actuarial reserving methodology includes changes to catastrophe losses, while the reviews in our personal and commercial vehicle businesses do not include catastrophes.

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

BALANCE SHEET AND OTHER INFORMATION

(millions - except per share amounts and common shares repurchased)

(unaudited)

| | | | | |

| December 31, 2024 |

| CONDENSED GAAP BALANCE SHEET: | |

| Investments, at fair value: | |

| Available-for-sale securities: | |

Fixed maturities1 (amortized cost: $77,126) | $ | 75,332 | |

Short-term investments (amortized cost: $615) | 615 | |

| Total available-for-sale securities | 75,947 | |

| Equity securities: | |

Nonredeemable preferred stocks (cost: $756) | 728 | |

Common equities (cost: $745) | 3,575 | |

| Total equity securities | 4,303 | |

Total investments2, 3 | 80,250 | |

| Net premiums receivable | 14,369 | |

Reinsurance recoverables (including $4,487 on unpaid loss and LAE reserves) | 4,765 | |

| Deferred acquisition costs | 1,961 | |

| Other assets | 4,400 | |

| Total assets | $ | 105,745 | |

| |

| Unearned premiums | $ | 23,858 | |

| Loss and loss adjustment expense reserves | 39,057 | |

Other liabilities2 | 10,346 | |

| Debt | 6,893 | |

| Total liabilities | 80,154 | |

Shareholders’ equity | 25,591 | |

Total liabilities and shareholders’ equity | $ | 105,745 | |

| |

| |

| Common shares outstanding | 586 | |

| Common shares repurchased - actual | 79 | |

| Average cost per common share | $ | 266.98 | |

| Book value per common share | $ | 43.67 | |

Trailing 12-month return on average common shareholders’ equity | |

| Net income | 35.5 | % |

| Comprehensive income | 36.4 | % |

| Net unrealized pretax gains (losses) on fixed-maturity securities | $ | (1,790) | |

| Increase (decrease) from November 2024 | $ | (577) | |

| Increase (decrease) from December 2023 | $ | 245 | |

| Debt-to-total capital ratio | 21.2 | % |

| Fixed-income portfolio duration | 3.3 | |

| Weighted average credit quality | AA- . |

1 As of December 31, 2024, we held certain hybrid securities and recognized a change in fair value of $4 million as a realized loss during the period we held these securities.

2 Includes $2,695 million of dividends payable on common shares and $125 million of net unsettled security transactions; the common share dividends were paid on January 16, 2025.

3 Includes $6 billion, net of unsettled transactions, of investments in a consolidated, non-insurance subsidiary of the holding company.

Monthly Commentary

•The Company has no additional commentary regarding December’s results.

Events

Our fourth quarter Investor Relations conference call is currently scheduled to be held on Tuesday, March 4, 2025, at 9:30 a.m. eastern time. This conference call, which will consist of both a conference call and webcast, is scheduled to last 90 minutes and will begin with an approximate 45-minute presentation on our claims process and technology, followed by a question and answer session with Tricia Griffith, our CEO, and John Sauerland, our CFO. We plan to post our 2024 Shareholders’ Report online and file our Annual Report on Form 10-K with the SEC on Monday, March 3, 2025. If the dates of our events, which are always subject to change, are rescheduled, we will announce the change in a press release as soon as practical and publish it on our investor website. Details regarding access to the conference call, or any event changes, will be available at: https://investors.progressive.com/events.

We plan to release January results on Wednesday, February 19, 2025, before the market opens.

About Progressive

Progressive Insurance® makes it easy to understand, buy and use car insurance, home insurance, and other protection needs. Progressive offers choices so consumers can reach us however it’s most convenient for them — online at progressive.com, by phone at 1-800-PROGRESSIVE, via the Progressive mobile app, or in-person with a local agent.

Progressive provides insurance for personal and commercial autos and trucks, motorcycles, boats, recreational vehicles, and homes; it is the second largest personal auto insurer in the country, a leading seller of commercial auto, motorcycle, and boat insurance, and one of the top 15 homeowners insurance carriers.

Founded in 1937, Progressive continues its long history of offering shopping tools and services that save customers time and money, like Name Your Price®, Snapshot®, and HomeQuote Explorer®.

The Common Shares of The Progressive Corporation, the Mayfield Village, Ohio-based holding company, trade publicly at NYSE: PGR.

Regulation FD Disclosure Outlets

The Company disseminates information to the public about the Company, its products, services and other matters through various outlets in order to achieve broad, non-exclusionary distribution of information to the public. These outlets include the Company’s website (progressive.com) and its investor relations website (investors.progressive.com). We encourage investors and others to review the information the Company makes public through these outlets, as such information distributed through these outlets may be considered to be material information.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Investors are cautioned that certain statements in this report not based upon historical fact are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These statements often use words such as “estimate,” “expect,” “intend,” “plan,” “believe,” “goal,” “target,” “anticipate,” “will,” “could,” “likely,” “may,” “should,” and other words and terms of similar meaning, or are tied to future periods, in connection with a discussion of future operating or financial performance. Forward-looking statements are not guarantees of future performance, are based on current expectations and projections about future events, and are subject to certain risks, assumptions and uncertainties that could cause actual events and results to differ materially from those discussed herein. These risks and uncertainties include, without limitation, uncertainties related to:

•our ability to underwrite and price risks accurately and to charge adequate rates to policyholders;

•our ability to establish accurate loss reserves;

•the impact of severe weather, other catastrophe events, and climate change;

•the effectiveness of our reinsurance programs and the continued availability of reinsurance and performance by reinsurers;

•the secure and uninterrupted operation of the systems, facilities, and business functions and the operation of various third-party systems that are critical to our business;

•the impacts of a security breach or other attack involving our technology systems or the systems of one or more of our vendors;

•our ability to maintain a recognized and trusted brand and reputation;

•whether we innovate effectively and respond to our competitors’ initiatives;

•whether we effectively manage complexity as we develop and deliver products and customer experiences;

•our ability to attract, develop, and retain talent and maintain appropriate staffing levels;

•the impact of misconduct or fraudulent acts by employees, agents, and third parties to our business and/or exposure to regulatory assessments;

•the highly competitive nature of property-casualty insurance markets;

•whether we adjust claims accurately;

•compliance with complex and changing laws and regulations;

•litigation challenging our business practices, and those of our competitors and other companies;

•the success of our business strategy and efforts to acquire or develop new products or enter into new areas of business and our ability to navigate the related risks;

•how intellectual property rights affect our competitiveness and our business operations;

•the success of our development and use of new technology and our ability to navigate the related risks;

•the performance of our fixed-income and equity investment portfolios;

•the impact on our investment returns and strategies from regulations and societal pressures relating to environmental, social, governance and other public policy matters;

•our continued ability to access our cash accounts and/or convert investments into cash on favorable terms;

•the impact if one or more parties with which we enter into significant contracts or transact business fail to perform;

•legal restrictions on our insurance subsidiaries’ ability to pay dividends to The Progressive Corporation;

•our ability to obtain capital when necessary to support our business and potential growth;

•evaluations and ratings by credit rating and other rating agencies;

•the variable nature of our common share dividend policy;

•whether our investments in certain tax-advantaged projects generate the anticipated returns;

•the impact from not managing to short-term earnings expectations in light of our goal to maximize the long-term value of the enterprise;

•the impacts of epidemics, pandemics, or other widespread health risks; and

•other matters described from time to time in our releases and publications, and in our periodic reports and other documents filed with the United States Securities and Exchange Commission, including, without limitation, the Risk Factors section of our Annual Report on Form 10-K for the year ending December 31, 2023.

Any forward-looking statements are made only as of the date presented. Except as required by applicable law, we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or developments or otherwise.

In addition, investors should be aware that accounting principles generally accepted in the United States prescribe when a company may reserve for particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when we establish reserves for one or more contingencies. Also, our regular reserve reviews may result in adjustments of varying magnitude as additional information regarding claims activity becomes known. Reported results, therefore, may be volatile in certain accounting periods.

v3.24.4

Cover Page

|

Jan. 29, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

PROGRESSIVE CORP/OH/

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

001-09518

|

| Entity Tax Identification Number |

34-0963169

|

| Entity Address, Address Line One |

300 North Commons Blvd.,

|

| Entity Address, City or Town |

Mayfield Village,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44143

|

| City Area Code |

440

|

| Local Phone Number |

461-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $1.00 Par Value

|

| Trading Symbol |

PGR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000080661

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

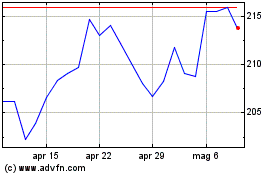

Grafico Azioni Progressive (NYSE:PGR)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Progressive (NYSE:PGR)

Storico

Da Gen 2024 a Gen 2025