UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2024

Commission File No. 001-37596

_______________________________

FERRARI N.V.

(Translation of Registrant’s Name Into English)

_______________________________

Via Abetone Inferiore n.4

I-41053 Maranello (MO)

Italy

Tel. No.: +39 0536 949111

(Address of Principal Executive Offices)

_______________________________

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x Form 40-F o

The following exhibit is furnished herewith:

Exhibit 99.1 Press release issued by Ferrari N.V. dated December 5, 2024.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| Date: December 5, 2024 | FERRARI N.V. |

| | | |

| | | |

| By: | /s/ Antonio Picca Piccon |

| | Name: | Antonio Picca Piccon |

| | Title: | Chief Financial Officer |

Index of Exhibits

Exhibit

Number Description of Exhibit

99.1 Press release issued by Ferrari N.V. dated December 5, 2024.

Exhibit 99.1

FERRARI N.V.: COMPLETION OF THE FIFTH TRANCHE AND ANNOUNCEMENT OF THE SIXTH TRANCHE OF THE MULTI-YEAR SHARE REPURCHASE PROGRAM

Maranello (Italy), December 5, 2024 – Ferrari N.V. (NYSE/EXM: RACE) (“Ferrari” or the “Company”) informs that the Company has purchased, under the Euro 250 million share buyback program announced on June 28, 2024, as the fifth tranche of the multi-year share buyback program of approximately Euro 2 billion expected to be executed by 2026 in line with the disclosure made during the 2022 Capital Markets Day (the “Fifth Tranche”), the additional common shares - reported in aggregate form, on a daily basis - on the New York Stock Exchange (NYSE) as follows:

| | | | | | | | | | | | | | | | | |

Trading

Date

(dd/mm/yyyy)

|

Stock

Exchange

|

Number of common shares purchased

|

Average price per share excluding fees

($)

|

Consideration excluding fees

($)

|

Consideration excluding fees

(€)

|

| 26/11/2024 | NYSE | 3,240 | 432.0253 | 1,399,761.97 | 1,330,319.30 |

| Total | — | 3,240 | 432.0253 | 1,399,761.97 | 1,330,319.30 |

(*) translated at the European Central Bank EUR/USD exchange reference rate as of the date of each purchase

With the purchases described above the Company has completed the Fifth Tranche.

The total consideration for such Fifth Tranche of the Program was:

•Euro 199,999,033.02 for No. 484,498 common shares purchased on the EXM.

•USD 54,951,659.71 (Euro 49,993,350.32*) for No. 119,584 common shares purchased on the NYSE.

As of December 4, 2024, the Company held in treasury No. 14,768,408 common shares equal to 5.75% of the total issued share capital including the common shares and the special voting shares, net of shares assigned under the Company’s equity incentive plan.

Since the start of the multi-year share buyback program of approximately Euro 2 billion announced during the 2022 Capital Markets Day, on July 1, 2022, until December 4, 2024, the Company has

| | | | | | | | | | | |

Ferrari N.V. Amsterdam, The Netherlands |

Registered Office: Via Abetone Inferiore N. 4, I – 41053 Maranello (MO) Italy |

Dutch trade registration number: 64060977 | |

purchased a total of 3,945,644 own common shares on EXM and NYSE, including transactions for Sell to Cover, for a total consideration of Euro 1,172,736,456.04.

A comprehensive overview of the transactions carried out under the buyback program, as well as the details of the above transactions, are available on Ferrari’s corporate website under the Buyback Programs section (https://www.ferrari.com/en-EN/corporate/buyback-programs).

The Company intends to continue its multi-year share buyback program with a sixth tranche of up to Euro 150 million (“Sixth Tranche”) to start on December 6, 2024 and to end no later than February 20, 2025 with two components:

•Firstly, Ferrari has entered into a non-discretionary buyback agreement for an amount up to Euro 130 million to be executed on the EXM market through a primary financial institution (the “Bank”). The Bank will make its trading decisions concerning the timing of the purchases of Ferrari’s common shares independently of and uninfluenced by Ferrari and it will act in compliance with applicable rules and regulations, including the provisions of the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052 (the “Regulations”). Under this agreement, once executed, purchases may continue during any closed periods of Ferrari in accordance with the Regulations.

•Secondly, Ferrari has entered into an additional mandate with a primary financial institution for up to Euro 20 million to be executed on the NYSE. Pursuant to such mandate Ferrari would provide the financial institution with purchase instructions from time to time in compliance with applicable rules, regulations and legal requirements. The actual timing, number and value of common shares repurchased on the NYSE will depend on a number of factors, including market and general business conditions.

The Sixth Tranche implements the resolution adopted by the Shareholders’ Meeting (held on April 17, 2024) and duly communicated to the market, which authorized the purchase of up to 10% of the Company’s common shares during the eighteen-month period following such Shareholders’ Meeting. The repurchase authority will expire on October 16, 2025 or until such authority is extended or renewed before such date.

Details of the repurchase transactions carried out under the Sixth Tranche shall be disclosed to the market as required by applicable regulation.

About Ferrari

Ferrari is among the world’s leading luxury brands focused on the design, engineering, production and sale of the world’s most recognizable luxury performance sports cars. Ferrari brand symbolizes exclusivity, innovation, state-of-the-art sporting performance and Italian design. Its history and the image enjoyed by its cars are closely associated with its Formula 1 racing team, Scuderia Ferrari, the most successful team in Formula 1 history. From the inaugural year of Formula 1 World Championship in 1950 through the present, Scuderia Ferrari has won 248 Grand Prix races, 16 Constructors’ World titles and 15 Drivers’ World titles. Ferrari designs, engineers and produces its cars in Maranello, Italy, and sells them in over 60 markets worldwide.

Forward Looking Statements

This document contains forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “continue”, “on track”, “successful”, “grow”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, “guidance” and similar expressions. Forward-looking statements are not guarantees of future performance. Rather, they are based on the Ferrari Group’s (hereinafter, the “Group”) current expectations and projections about future events and, by their nature, are subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in such statements as a result of a variety of factors described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Group” in the Company’s annual and quarterly reports filed with the U.S. Securities and Exchange Commission, which are available on Ferrari’s website (https://www.ferrari.com/en-EN/corporate). Any forward-looking statements contained in this document speak only as of the date of this document and the Company does not undertake any obligation to update or revise publicly forward-looking statements. Further information concerning the Group and its businesses, including factors that could materially affect the Company’s financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission, the AFM and CONSOB.

For further information:

Media Relations

tel.: +39 0536 949337

Email: media@ferrari.com

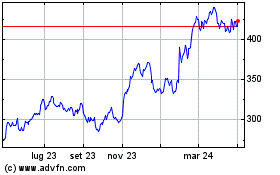

Grafico Azioni Ferrari NV (NYSE:RACE)

Storico

Da Nov 2024 a Dic 2024

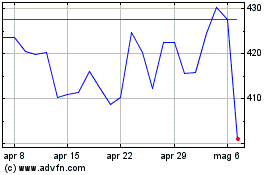

Grafico Azioni Ferrari NV (NYSE:RACE)

Storico

Da Dic 2023 a Dic 2024