0000731766false00007317662024-12-032024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————————————

FORM 8-K

—————————————

Current Report

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 3, 2024

—————————————

UNITEDHEALTH GROUP INCORPORATED

(Exact name of registrant as specified in its charter)

—————————————

| | | | | | | | | | | | | | |

| Delaware | | 1-10864 | | 41-1321939 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 9900 Bren Road East, | | | 655 New York Avenue NW | | |

| Minnetonka, | Minnesota | | 55343 | Washington, | | DC | | 20001 |

| (Address of principal executive offices) | | (Zip Code) | (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (800) 328-5979

N/A

(Former name or former address, if changed since last report.)

—————————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | UNH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On December 3, 2024, UnitedHealth Group Incorporated (the “Company”) issued a press release regarding its 2024 financial outlook and initial projections for 2025. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Company will stream the Investor Conference presentation and management question-and-answer portion of the meeting on Wednesday, December 4, 2024, beginning at 8:00 a.m. EST, and will make conference materials available on its Investor Relations page at www.unitedhealthgroup.com at 6:30 a.m. EST. A replay of the conference will be available on the Company web site.

The information in this Item 7.01, including the exhibit attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | | | | |

| Exhibit | Description | | | |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 3, 2024

| | | | | | | | | | | | | | |

| | | UNITEDHEALTH GROUP INCORPORATED |

| | | By: | /s/ Kuai H. Leong |

| | | | |

| | | | Kuai H. Leong |

| | | | Senior Deputy General Counsel and Deputy Corporate Secretary |

(For Immediate Release)

UnitedHealth Group Updates Business Outlook Ahead of Investor Conference

(December 3, 2024) – UnitedHealth Group (NYSE: UNH) issued financial guidance ahead of its annual Investor Conference which takes place on December 4, beginning at 8:00 a.m. ET.

UnitedHealth Group will introduce its 2025 outlook which includes revenues of $450 billion to $455 billion, net earnings of $28.15 to $28.65 per share and adjusted net earnings of $29.50 to $30.00 per share. Adjusted net earnings only excludes the after-tax non-cash amortization expense pertaining to acquisition-related intangible assets. Cash flows from operations are expected to range from $32 billion to $33 billion. As announced in the third quarter earnings release, UnitedHealth Group 2024 net earnings are expected to be $15.50 to $15.75 per share and adjusted net earnings $27.50 to $27.75 per share.

The company will stream the Investor Conference presentation and management question-and-answer portion of this meeting on its Investor Relations page at www.unitedhealthgroup.com. Meeting materials and a replay of the conference will be available on the Investor Relations page.

About UnitedHealth Group

UnitedHealth Group (NYSE: UNH) is a health care and well-being company with a mission to help people live healthier lives and help make the health system work better for everyone through two distinct and complementary businesses. Optum delivers care aided by technology and data, empowering people, partners and providers with the guidance and tools they need to achieve better health. UnitedHealthcare offers a full range of health benefits, enabling affordable coverage, simplifying the health care experience and delivering access to high-quality care. Visit UnitedHealth Group at www.unitedhealthgroup.com and follow UnitedHealth Group on LinkedIn.

Non-GAAP Financial Information

This news release presents non-GAAP financial information provided as a complement to the results provided in accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of the non-GAAP financial information to the most directly comparable GAAP financial measure is provided in the accompanying tables found at the end of this release.

Forward-Looking Statements

The statements, estimates, projections, guidance or outlook contained in this document include “forward-looking” statements which are intended to take advantage of the “safe harbor” provisions of the federal securities laws. The words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “forecast,” “outlook,” “plan,” “project,” “should” and similar expressions identify forward-looking statements. These statements may contain information about financial prospects, economic conditions and trends and involve risks and uncertainties. Actual results could differ materially from those that management expects, depending on the outcome of certain factors including: our ability to effectively estimate, price for and manage medical costs; new or changes in existing health care laws or regulations, or their enforcement or application; cyberattacks, other privacy/data security incidents, or our failure to comply with

related regulations; reductions in revenue or delays to cash flows received under government programs; changes in Medicare, the CMS star ratings program or the application of risk adjustment data validation audits; the DOJ’s legal action relating to the risk adjustment submission matter; our ability to maintain and achieve improvement in quality scores impacting revenue; failure to maintain effective and efficient information systems or if our technology products do not operate as intended; risks and uncertainties associated with our businesses providing pharmacy care services; competitive pressures, including our ability to maintain or increase our market share; changes in or challenges to our public sector contract awards; failure to achieve targeted operating cost productivity improvements; failure to develop and maintain satisfactory relationships with health care payers, physicians, hospitals and other service providers; the impact of potential changes in tax laws and regulations; increases in costs and other liabilities associated with litigation, government investigations, audits or reviews; failure to complete, manage or integrate strategic transactions; risk and uncertainties associated with the continuing sale of operations in South America; risks associated with public health crises arising from large-scale medical emergencies, pandemics, natural disasters and other extreme events; failure to attract, develop, retain, and manage the succession of key employees and executives; our investment portfolio performance; impairment of our goodwill and intangible assets; failure to protect proprietary rights to our databases, software and related products; downgrades in our credit ratings; and our ability to obtain sufficient funds from our regulated subsidiaries or from external financings to fund our obligations, reinvest in our business, maintain our debt to total capital ratio at targeted levels, maintain our quarterly dividend payment cycle, or continue repurchasing shares of our common stock.

This above list is not exhaustive. We discuss these matters, and certain risks that may affect our business operations, financial condition and results of operations, more fully in our filings with the SEC, including our reports on Forms 10-K, 10-Q and 8-K. By their nature, forward-looking statements are not guarantees of future performance or results and are subject to risks, uncertainties and assumptions that are difficult to predict or quantify. Actual results may vary materially from expectations expressed or implied in the Investor Conference materials, related presentations or any of our prior communications. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake to update or revise any forward-looking statements, except as required by law.

# # #

| | | | | | | | | | | | | | |

| Investors: | Zack Sopcak | | | |

| Zack.Sopcak@uhg.com | | | |

| 952-936-7215 | | | |

| | | | |

| Media: | Eric Hausman | | | |

| Eric.Hausman@uhg.com | | | |

| 952-936-3963 | | | |

| | | | |

| | | | |

UNITEDHEALTH GROUP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURE

ADJUSTED EARNINGS PER SHARE

| | |

| Use of Non-GAAP Financial Measure |

Adjusted net earnings per share is a non-GAAP financial measure. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, or superior to, financial measures prepared in accordance with GAAP. Management believes the use of adjusted net earnings per share provides investors and management useful information about the earnings impact of the following items: Intangible Amortization: As amortization fluctuates based on the size and timing of the Company’s acquisition activity, management believes this exclusion presents a more useful comparison of the Company's underlying business performance and trends from period to period. While intangible assets contribute to the Company’s revenue generation, the intangible amortization is not directly related. Therefore, the related revenues are included in adjusted earnings per share. South American Impacts: Represents the effects of various international transactions, including the loss on sale of our Brazilian operations that was completed on February 6, 2024, the loss on our remaining South American operations being classified as held for sale and certain other non-recurring matters impacting our South American operations. As these matters are related to the Company's strategy to exit South America, the impact is not representative of the Company's underlying business performance and therefore management believes the exclusion presents a more useful comparison of the Company's underlying business performance and trends from period to period. Direct Response Costs - Cyberattack: Management believes the exclusion of costs incurred to investigate and remediate the attack, other direct and incremental costs incurred as a result of the cyberattack and incremental costs for accommodations to support care providers presents a more useful comparison of the Company's and its reportable segments' underlying business performance and trends from period to period. |

| | | | | | | | | | | | | | |

| | Projected Year Ended

December 31, |

| | 2024 | | 2025 |

| Net earnings attributable to UnitedHealth Group common shareholders | | $14,375 - $14,650 | | $25,850 - $26,450 |

| Intangible amortization | | ~1,665 | | ~1,625 |

| Tax effect of intangible amortization | | ~(410) | | ~(400) |

| South American impacts | | ~8,515 | | — |

| Tax effect of South American impacts | | ~(175) | | — |

| Direct response costs - cyberattack | | ~2,000 | | — |

| Tax effect of direct response costs - cyberattack | | ~(470) | | — |

| Adjusted net earnings attributable to UnitedHealth Group common shareholders | | $25,500 - $25,775 | | $27,075 - $27,675 |

| | | | |

| Diluted earnings per share | | $15.50 - $15.75 | | $28.15 - $28.65 |

| Intangible amortization per share | | ~1.80 | | ~1.75 |

| Tax effect of intangible amortization per share | | ~(0.45) | | ~(0.40) |

| South American impacts per share | | ~9.15 | | — |

| Tax effect of South American impacts per share | | ~(0.15) | | — |

| Direct response costs - cyberattack per share | | ~2.15 | | — |

| Tax effects of direct response costs - cyberattack per share | | ~(0.50) | | — |

| Adjusted diluted earnings per share | | $27.50 - $27.75 | | $29.50 - $30.00 |

Cover

|

Dec. 03, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 03, 2024

|

| Entity Registrant Name |

UNITEDHEALTH GROUP INCORPORATED

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-10864

|

| Entity Tax Identification Number |

41-1321939

|

| Entity Address, Address Line One |

9900 Bren Road East,

|

| Entity Address, City or Town |

Minnetonka,

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55343

|

| Other Address, Address line one |

655 New York Avenue NW

|

| Other Entity Address, City or Town |

Washington,

|

| Other Entity Address, State or Province |

DC

|

| Other Entity Address, Postal Zip code |

20001

|

| City Area Code |

800

|

| Local Phone Number |

328-5979

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

UNH

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000731766

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionOther Address, Address line one

| Name: |

unh_OtherAddressAddressLineOne |

| Namespace Prefix: |

unh_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionOther Entity Address, City or Town

| Name: |

unh_OtherEntityAddressCityOrTown |

| Namespace Prefix: |

unh_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionOther Entity Address, Postal Zip code

| Name: |

unh_OtherEntityAddressPostalZipCode |

| Namespace Prefix: |

unh_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionOther Entity Address, State or Province

| Name: |

unh_OtherEntityAddressStateOrProvince |

| Namespace Prefix: |

unh_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

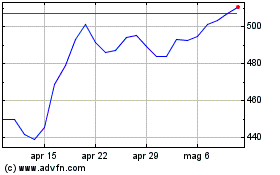

Grafico Azioni UnitedHealth (NYSE:UNH)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni UnitedHealth (NYSE:UNH)

Storico

Da Dic 2023 a Dic 2024