BASF Sales, Earnings Miss Forecasts on Lower Margins, Write-Downs -- Update

19 Gennaio 2024 - 8:32AM

Dow Jones News

By Andrea Figueras

BASF said sales and earnings last year missed both the company's

guidance and consensus expectations, dragged by write-downs and

sales of lower-margin products.

Reporting preliminary figures, the German chemicals giant said

Friday that it expects to book a 1.1 billion-euro ($1.20 billion)

hit mainly related to noncash write-downs of its surface

technologies, agricultural and materials segments.

Sales were EUR68.90 billion, according to the preliminary

figures, down from EUR87.33 billion in 2022. The company had

previously guided for sales of between EUR73 billion and EUR76

billion, while analysts had forecast EUR70.58 billion.

Earnings before interest and taxes before special items fell to

EUR3.81 billion from EUR6.88 billion, the company said. This

compared with its forecast range of EUR4.0 billion and EUR4.4

billion and analysts' consensus estimate of EUR3.93 billion.

BASF said it swung to a net profit of EUR225 million from a loss

of EUR627 million a year earlier, when it was hit by impairments on

Russia-related assets of its oil-and-gas business Wintershall Dea,

but still missed analysts' expectations of EUR2.25 billion.

The company will publish its full 2023 report on Feb. 23.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

January 19, 2024 02:17 ET (07:17 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

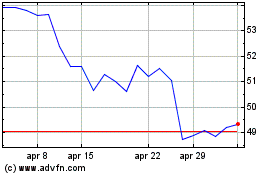

Grafico Azioni BASF (TG:BAS)

Storico

Da Dic 2024 a Dic 2024

Grafico Azioni BASF (TG:BAS)

Storico

Da Dic 2023 a Dic 2024