BASF Sales, Earnings Miss Forecasts on Lower Margins, Write-Downs -- 2nd Update

19 Gennaio 2024 - 10:23AM

Dow Jones News

By Andrea Figueras

BASF said Friday that its 2023 results missed expectations,

dragged by impairments and lower margins that weren't offset by

cost cuts.

The European chemicals giant's key profit figure--earnings

before interest, taxes and special items--fell to 3.81 billion

euros ($4.14 billion) from EUR6.88 billion, compared with a EUR4

billion-EUR4.4 billion forecast range and an analyst consensus

estimate of EUR3.93 billion.

Net profit was EUR225 million, far below analysts' expectations

of EUR2.25 billion, in part due to impairments of EUR1.1 billion

related to its surface technologies, agricultural and materials

segments. In 2022 BASF had a loss of EUR627 million.

BASF's update illustrates the challenges that incoming Chief

Executive Markus Kamieth faces. He is set to succeed Martin

Brudermueller from April.

Like many of its peers, BASF had to navigate a tough environment

last year, with weaker demand amid slowing global economic growth

and high energy prices.

In December, BASF announced an overhaul aimed at lifting

profitability at its battery-materials and agricultural units. It

has also agreed to sell assets of its shareholding in oil-and-gas

producer Wintershall Dea, to the London-based energy company

Harbour Energy. However, the German government is reviewing the

deal to ensure it doesn't compromise national security.

The company also said its sales dropped 21% to EUR68.90 billion,

below guidance for EUR73 billion-EUR76 billion. Analysts expected

EUR70.58 billion. Free cash flow is expected to amount to EUR2.7

billion, down from EUR3.33 billion.

BASF will publish its full 2023 report on Feb. 23.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

January 19, 2024 04:08 ET (09:08 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

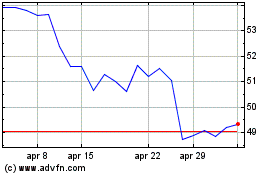

Grafico Azioni BASF (TG:BAS)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni BASF (TG:BAS)

Storico

Da Dic 2023 a Dic 2024