Record-Breaking Day: Spot Bitcoin ETF Trading Exceeds $3 Billion As BTC Eyes Record Peak

30 Ottobre 2024 - 12:00AM

NEWSBTC

As Bitcoin (BTC), the largest cryptocurrency by market

capitalization, inches closer to its all-time high of $73,700

reached in March, the US spot Bitcoin ETF market has re-emerged as

a key driver of the cryptocurrency’s recent price surge. On

Tuesday, total trading volume for spot Bitcoin ETFs surpassed $3

billion, coinciding with Bitcoin’s price briefly above the pivotal

$73,000 mark for the first time in over 7 months. Bitcoin ETF

Market Set To Surpass 1 Million BTC Holdings Soon Notably, crypto

investor BigRig observed a remarkable uptick in Bitcoin ETF

purchases over the past two weeks, reporting $2.673 billion in

inflows since October 16. This accounts for a substantial

11.8% of total ETF inflows during this period, suggesting a robust

interest from institutional and retail investors. BigRig also

pointed out that, prior to Tuesday’s trading volume, this period

represented the best day for ETF inflows. Related Reading: Dogecoin

Price Is About To Complete This Breakout To A Descending Megaphone

Pattern, Is $1 Next? Bloomberg ETF analyst Eric Balchunas added to

the optimistic narrative by stating that US spot ETFs are on track

to hold 1 million Bitcoin by next Wednesday, surpassing the

holdings of Satoshi Nakamoto, the enigmatic creator of Bitcoin, by

mid-December with an average addition of about 17,000 BTC per week.

However, Balchunas also cautioned that market volatility could

impact these projections. “Anything can happen,” he noted,

referencing the possibility of a sudden selloff that could delay

the timeline. Conversely, if prices continue to rise and

political factors, such as a potential Trump victory in the

upcoming election, contribute to increased market enthusiasm, the

expert believes that this influx of new investors could accelerate

the pace of Bitcoin’s ascent to new highs. Whale Accumulation Spurs

Optimism Despite heightened activity in the Bitcoin ETF market, the

price of the largest cryptocurrency recently fell short of its

all-time high, retracing to approximately $72,250 at the time of

writing. However, there are positive indicators for Bitcoin

bulls. The cryptocurrency has been consolidating above key support

levels, with strong backing around the $66,000 mark. This

support has effectively prevented any significant decline over the

past week and has contributed to the ongoing rally. However, what

would be a notable bullish indicator would be a sustained

consolidation above the $70,000 level for the bulls, which could

further demonstrate the strength of the current move. Related

Reading: Analyst Says XRP Price Is Ready For A Breakout As Metrics

Turn Bullish, What To Expect Market expert Miles Deutscher has been

vocal about his bullish outlook for Bitcoin, particularly in the

latter months of the year. He recently pointed out a significant

trend: whales—large holders of Bitcoin—are accumulating the

cryptocurrency at an “unprecedented pace.” This observation

suggests that institutional demand for Bitcoin is currently

outpacing retail interest, a shift that could have implications for

massive price movements to the upside in the near future. Deutscher

further highlighted that Bitcoin exchange reserves have reached

all-time lows. This means that the amount of Bitcoin available on

exchanges for trading has dwindled, signaling a supply squeeze.

Featured image from DALL-E, chart from TradingView.com

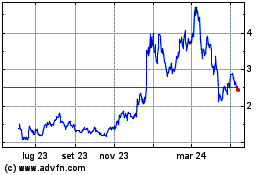

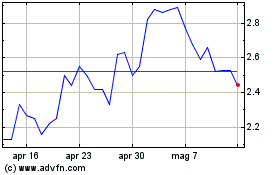

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Nov 2023 a Nov 2024