Satoshi’s Record At Stake: Bitcoin ETFs Could Cross 1 Million BTC Today

31 Ottobre 2024 - 5:30AM

NEWSBTC

US Bitcoin ETFs recorded their highest daily inflow since

inception, amassing $870 million on Tuesday. This surge in

investment comes as the largest cryptocurrency inches closer to its

all-time high of $73,700, originally reached in March. This

comes as investor sentiment appears to be buoyed by speculation

surrounding a potential victory for Republican candidate Donald

Trump over VP Kamala Harris, which many believe could foster a more

positive environment for the digital asset ecosystem, ultimately

favoring crypto prices. Bitcoin ETFs Inflows And Price Rally

According to Bloomberg data, Tuesday’s subscriptions pushed the

year-to-date inflows for the group of 12 Bitcoin ETFs to over $23

billion. Analysts attribute the growing demand for Bitcoin exposure

to Trump’s elevated odds in election betting markets.

However, while Trump leads in prediction markets, polls show a

tight race against Vice President Harris, who has pledged to

support a regulatory framework for the cryptocurrency industry.

Still, Trump’s approach seems to have resonated more with the

community. Related Reading: Solana Memecoin Market Thrives: POPCAT

Reaches New Record Price Of $1.75 Adding to the speculation,

Bitcoin options markets reflect a one-third chance of a price swing

exceeding 10% on election day, November 5, as indicated by Nick

Forster, founder of the crypto trading platform Derive.xyz.

This surge would take the Bitcoin price to a new all-time high of

$72,900 in the potential scenario where BTC consolidates above

$72,000 for the next few days ahead of the election. Forster

believes such volatility often encourages traders to position

themselves for potential market movements, increasing demand for

Bitcoin ETFs and contributing to the current price rally since the

beginning of the week. Expert Warns Of Potential Selloff ETF

expert Eric Balchunas has also commented on the bullish sentiment

surrounding Bitcoin ETFs. He noted that these funds are on track to

reach 1 million BTC in holdings as early as today. In a

recent social media post, Balchunas reported that US spot ETFs

could surpass 1 million BTC by next Wednesday, potentially

surpassing the holdings of Bitcoin’s mysterious creator, Satoshi

Nakamoto, by mid-December, with the funds adding approximately

17,000 BTC each week. However, following Tuesday’s performance,

Balchunas remarked, “We’re going to need to move up our

predictions,” highlighting that Bitcoin ETFs had gobbled up over

12,000 coins in a single day, now holding 996,000 BTC. The

expert expressed optimism about the likelihood of breaching the 1

million mark today, stating that the “extraordinary” trading volume

from the previous day is likely to translate into significant

inflows. Related Reading: Cardano (ADA) NVT Ratio Now Highest Since

June: What Does It Mean? Balchunas also cautioned that market

conditions can be unpredictable. “Anything can happen,” he warned,

referencing the risk of a sudden selloff that could delay reaching

the 1 million BTC milestone. Conversely, if Bitcoin prices

continue to rise and a Trump victory boosts market enthusiasm, a

fear of missing out (FOMO) could drive even more rapid

accumulation, according to the expert’s analysis. When writing, the

largest cryptocurrency on the market was trading at $72,360, up

over 8% in the 7-day time frame. Featured image from DALL-E,

chart from TradingView.com

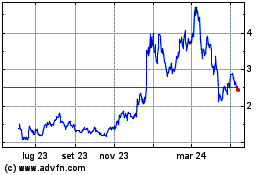

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Ott 2024 a Nov 2024

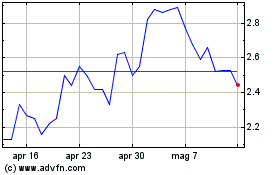

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Nov 2023 a Nov 2024