Bitcoin Boom: Is BTC Preparing For Another 6X To $462,000?

31 Ottobre 2024 - 1:00AM

NEWSBTC

Bitcoin is marching higher, easing past $70,000 and $72,000 in the

past two days, sparking a wave of demand. Although prices are

moving within a tight range at spot rates, the uptrend remains.

While there are pockets of weakness, at least seen earlier today,

candlestick formation in the daily and weekly charts point to

strength. Is Bitcoin Preparing For A 6X Surge To $462,000? In a

post on X, one analyst thinks Bitcoin will not only break above its

all-time high at $74,000 but can easily 6X to over $462,000 in the

coming sessions. To support this outlook, the analyst said the coin

is breaking out above key resistance levels, and Fibonacci

extension levels mirror this shift in trend after the Q3 2024

plunge. Related Reading: Bitcoin Needs Daily Close Above $76,000 To

Confirm True Breakout: Analyst Based on the analyst’s assessment,

historical price action shows that BTC peaks between the 1.618 and

2.272 Fibonacci extension levels. Technical analysts use this tool

to project how fast prices will rally or drop based on a given

range. If history guides and the Fibonacci extension levels remain

valid, applying the same pattern to the current cycle could easily

see Bitcoin soar to between $174,000 and $462,000. These two levels

mark the extension levels’ lower and upper limits that define

past cycles’ peak zone. As bullish as this forecast is, it should

be known that the range anchoring any Fibonacci extension is

subjective. For this reason, it will change depending on the

analyst, meaning potential peaks will shift accordingly. Despite

everything, the consensus is that Bitcoin could break and reach new

all-time highs in Q4 2024. Taking to X, another analyst said

Bitcoin is already within a bullish breakout formation, easing

above a descending channel or bull flag. At the same time, prices

are breaking above the resistance of a “cup and handle” pattern.

Institutions Buying As BTC Recovers If bulls take over, pushing

prices higher, the evolution would confirm gains of Q1 2024.

Subsequently, it would mark the resumption of bulls, an encouraging

development following the 30% drop from March highs.

Related Reading: Dogecoin Metrics Reveal Increasing Network

Activity – Is DOGE Ready To Break Yearly Highs? Amid this wave of

optimism, institutions are also pouring in, getting exposure via

spot Bitcoin ETFs. According to SosoValue, there are massive

inflows as institutions buy more shares on behalf of their clients.

On October 29, spot Bitcoin ETF issuers in the United States bought

$870 million worth of shares backed by BTC for their clients.

BlackRock’s IBIT received $642 million, pushing their BTC under

management to over $24.9 billion. Feature image from DALLE, chart

from TradingView

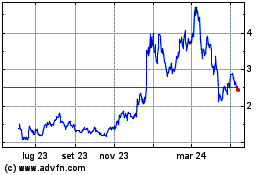

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Ott 2024 a Nov 2024

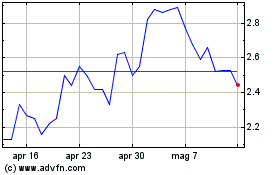

Grafico Azioni Optimism (COIN:OPUSD)

Storico

Da Nov 2023 a Nov 2024