Stablecoins Signal Strong Bitcoin Demand: Could BTC Renew Its ATH Soon?

30 Ottobre 2024 - 5:30AM

NEWSBTC

The recent activity in Bitcoin price and demand metrics suggests a

potential resurgence in market interest, which could lead to a

renewed all-time high. So far, Bitcoin has recently achieved a

significant price rebound, reclaiming a trading level above $70,000

after a sustained period of resistance just below this price mark.

This uptrend follows a 5% increase over the past 24 hours,

positioning Bitcoin for $71,933 at the time of writing. One factor

influencing this rally is a heightened demand reflected in

stablecoin movements, a metric often used to gauge market sentiment

and potential buy-in for Bitcoin, CryptoQuant analyst BinhDang

highlighted this in a recent post on the CryptoQuant QuickTake

Platform. Related Reading: Bitcoin Hash Ribbons Flash ‘Buy’ Signal:

Analysts See New Highs On The Horizon Stablecoin Supply Ratio

Oscillator Reflects Demand Surge BinhDang highlighted that the

Stablecoin Supply Ratio Oscillator (SSRO) has reached levels

previously seen during Bitcoin’s lows, notably those observed in

November 2022. The analyst noted: Since Bitcoin bottomed in

November 2022, the 90-day and 200-day oscillators have seen lows

similar to that bottom during the 3 months of Q3 2024. Notably, the

SSRO tool, which gauges the ratio of Bitcoin’s market cap to that

of prominent stablecoins like USDT, USDC, BUSD, and others, is a

barometer for tracking Bitcoin’s demand relative to stablecoin

supply. The oscillator measures the extent to which stablecoins,

commonly used for Bitcoin purchases, flow into Bitcoin and thus

signal purchasing interest. When the oscillator shows low values,

as it did during Bitcoin’s November 2022 low, it implies that

stablecoins are more likely to be converted into Bitcoin,

increasing demand. This trend has resulted in Bitcoin crossing the

$70,000 threshold, encouraging investor sentiment and speculation

regarding potential future highs. New Bitcoin ATH On The Horizon?

According to BinhDang, BTC could continue its upward movement

if the demand holds steady and aligns with favorable macroeconomic

data or upcoming election insights. BinhDang wrote: SSRO indicates

high demands on the average quarterly data set (90d), breaking

above the positive 2-points. If demand continues to sustain and the

announcements and news in early November include some favorable

macro and election data, a move to and break above the positive

3-points is possible. The analyst notes that a rise above the

SSRO’s positive three-point level has coincided with strong bullish

cycles in previous periods, specifically in January 2023, October

2023, and February 2024. While BTC has consistently seen increases

in price over the past days touching nearly $72,000 today, the

asset’s daily trading volume has been on the same trend. Related

Reading: Bitcoin Triggers Golden Cross: What This Means For The

Crypto Trend Particularly, data from CoinGecko shows that in

the past 7 days, Bitcoin’s 24-hour trading volume has risen from

below $35 billion, as seen last Tuesday, to as high as $51.6

billion. Featured image created with DALL-E, Chart from TradingView

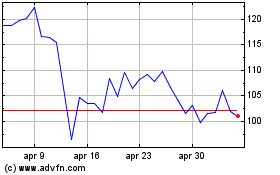

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

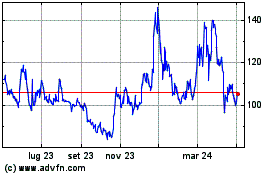

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024