Bitcoin Bullish: Trader Profit-Taking Stays Low Despite $71,000 Break

30 Ottobre 2024 - 3:00PM

NEWSBTC

On-chain data shows the Bitcoin short-term holders have only been

taking minimal profits recently despite the asset’s latest rally.

Bitcoin Short-Term Holder SOPR Is Currently At Relatively Low

Levels As pointed out by an analyst in a CryptoQuant Quicktake

post, the short-term holder SOPR is still under the range that has

signaled overheated conditions for the asset during the past year.

The “Spent Output Profit Ratio” (SOPR) here refers to an indicator

that tells us about whether the Bitcoin investors as a whole are

selling their coins at a profit or loss. Related Reading: Ethereum

Bullish Signal: Whales Withdraw $750 Million In ETH From Exchanges

When the value of this metric is greater than 1, it means the

average holder on the network is transferring their coins at a net

profit. On the other hand, it being under this mark implies

loss-taking is dominant. In the context of the current discussion,

the SOPR of a specific segment of the BTC userbase is of interest:

the short-term holders (STHs). This cohort includes the BTC

investors who bought their coins within the past 155 days.

Statistically, the longer an investor holds onto their coins, the

less likely they become to sell them at any point. As the STHs are

relatively young holders, they don’t carry much resilience, and

thus, can be prone to panic selling whenever a major change occurs

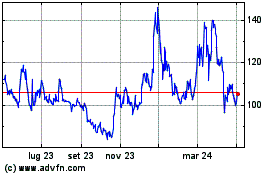

in the market, like a rally or crash. Now, here is a chart that

shows the trend in the Bitcoin STH SOPR over the past year or so:

As displayed in the above graph, the Bitcoin STH SOPR has been

above the 1 level recently, suggesting that this group has been

realizing a net amount of profit with their transactions. With the

latest bullish push that BTC has seen beyond the $71,000 level, the

metric has seen some uplift, as the STHs have ramped up their

profit-taking. The indicator is now sitting at 1.017. It’s apparent

from the chat, however, that this is not actually that high a

value. According to the quant, the indicator has shown to be

overheated whenever it has broken 1.03 during the recent phase of

consolidation. The latest value has clearly been under this mark.

As such, the rally could have more room to grow, before the

profit-taking from the STHs becomes a threat. This is only assuming

that the same 1.03 boundary would apply to the current market as

well, since the STH SOPR had been able to visit much higher levels

before Bitcoin had encountered a top in March of this year. Related

Reading: “Time To Get Ready For Another Bull Run,” Bitcoin Analyst

Says— Here’s Why The indicator could be to monitor in the coming

days, as where it goes next could provide hints about where the

cryptocurrency’s price might also be going. BTC Price Sitting at

the $71,200 level, Bitcoin is now not far from surpassing the high

witnessed back in June. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

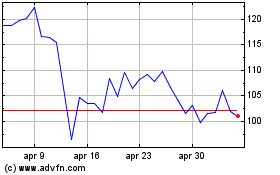

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025