Bitcoin Nears ATH As Miners Hold Back On Selling—Bullish Signals Flashing

09 Novembre 2024 - 12:00PM

NEWSBTC

Bitcoin has managed to maintain its footing above the $75,000 price

mark following a new all-time high (ATH) of $76,872 recorded

yesterday. At present, the cryptocurrency is trading at $76,587,

reflecting a modest 0.9% dip from its peak while still marking a

1.7% daily increase. This stability signals resilience and has

fuelled speculation regarding Bitcoin’s next price move. Related

Reading: Bitcoin’s Current Price Action Sets Stage For 30% Rally,

Says Crypto Analyst Bitcoin Miners Hold Back On Selling, Why? As

Bitcoin currently trades above $76,000, a CryptoQuant analyst

identified as theKriptolik has pointed out a notable trend among

Bitcoin miners. According to theKriptolik, miners are refraining

from selling their BTC holdings, even with the asset trading near

its ATH, as they believe the current valuation remains undervalued.

The analyst highlighted that miners typically transfer BTC to

exchanges and sell it when prices approach an ATH, partly to cover

their operational expenses. However, this behaviour has not been

observed recently, signifying a potential belief in further price

gains. TheKriptolik elaborated on this behaviour by referencing

miner activity on October 29, when a substantial inflow of BTC to

exchanges occurred, resulting in a sale of the holdings with no

corresponding outflows. This lack of recent exchange-bound

transfers indicates miners’ confidence in Bitcoin’s ongoing upward

momentum. Historically, miner behaviour has served as a key

indicator of market sentiment, with sales often coinciding with

market tops. Optimism Among Analysts And Technical Signals The

positive sentiment among miners is mirrored by other market

analysts, who have offered bullish forecasts for Bitcoin’s price

trajectory. Javon Marks, a prominent crypto analyst, noted that

Bitcoin’s ability to maintain a stronghold above a critical $67,559

level sets the stage for further upward movement. According to

Marks, Bitcoin could experience a rally of over 51%, potentially

pushing the price to $116,652. Marks emphasized that this movement

could unfold at a faster pace than many market participants

currently anticipate, driven by strong underlying market dynamics.

Similarly, another CryptoQuant analyst, Mignolet, has provided an

outlook that suggests the conditions for Bitcoin entering the

second phase of its bull rally are falling into place. Mignolet

explained that this transition involves changes in market

participant behaviour, particularly among long-term holders (LTHs)

and short-term holders (STHs). As LTH supply begins to be

distributed, an influx of new liquidity and capital is critical to

sustaining the rally’s momentum. According to Mignolet, the current

market environment, characterized by increased liquidity and echoes

of the 2017 bull cycle, supports the completion of Phase 2 of

Bitcoin’s price surge. Conditions for entering Phase 2 are being

completed “A key condition for moving into Phase 2 is an increase

in STH supply, specifically through a surge in new capital.

Currently, the market is experiencing abundant new liquidity.” – By

@mignoletkr Link 👇… pic.twitter.com/gszfQFcn13 — CryptoQuant.com

(@cryptoquant_com) November 8, 2024 Featured image created with

DALL-E, Chart from TradingView

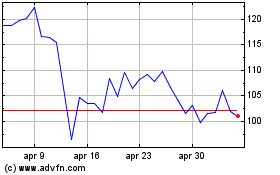

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

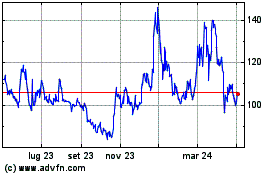

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025