Toncoin Stabilizes Above $5: Is Now The Time To Buy TON?

17 Gennaio 2025 - 3:00AM

NEWSBTC

Toncoin (TON) has shown signs of recovery, trading above $5.5 after

experiencing price declines in recent weeks. This rebound has not

only boosted TON’s market capitalization by some millions but also

brought investors to ponder on Toncoin’s potential for a sustained

rally. Particularly, as the TON market stabilizes so far, questions

about investor sentiment and market risk are coming to the

forefront. Related Reading: Toncoin Could See A 65% Surge In The

Next 43 Days—Here’s Why Is Now The Time To Buy TON A CryptoQuant

Quicktake Platform contributor Darkfost recently analyzed Toncoin’s

market behavior, focusing on the annualized realized volatility

over a one-week period. This metric as shared by the analyst has

dropped below the 0.25 threshold, offering insights into the

prevailing investor sentiment and perceived market risk. While low

volatility is often associated with reduced risk, it may also

indicate waning market interest or growing investor caution.

Notably, the decline in realized volatility is a significant

development, as periods of low volatility have historically been

followed by market reversals. Darkfost emphasized that reduced

volatility often signals diminished investor interest, which can

present both opportunities and challenges for traders. On the one

hand, such periods may highlight reduced market risks, offering

potential entry points for long-term investors. On the other hand,

they require careful analysis, as low volatility alone cannot

guarantee future price movements. Darkfost suggested that

monitoring these low-volatility periods closely, alongside other

indicators, is essential for making informed decisions. Additional

evaluation of broader trends and corroborating signals is necessary

to identify whether these zones represent genuine buying

opportunities. Toncoin Market Performance And Outlook In recent

weeks, TON’s price has shown little movement in either a bullish or

bearish direction. Despite the broader crypto market experiencing a

recent downturn, TON has managed to hold steady above the $5 mark,

avoiding any significant drops below this level. Related Reading:

Toncoin Signals Accumulation Phase as Open Interest Hits Nine-Month

Low – What’s Next? Even as the broader crypto market now begins to

recover, TON has struggled to break past the $5 threshold,

indicating that it may be encountering resistance at this price

point. At the time of writing, TON is trading at $5.22, reflecting

a modest 0.5% increase over the past day. Interestingly, despite

this encountered resistance above $5, TON appears to still be

seeing significant movement behind the scenes. Just yesterday, the

network registered over 100% in large transaction volume reaching

nearly $8.5 billion Toncoin $TON surged 104% in large transaction

volume over the past 24 hours, reaching $8.13 billion, driven by

significant whale activity and $127 million in market-wide shorts

liquidations. Currently trading at $5.39, TON’s spike aligns with a

broader crypto market recovery… pic.twitter.com/7uLTLhz3h6 — ᵇᵉᵃᵗ

(@beatbroker) January 15, 2025 Featured image created with DALL-E,

Chart from TradingView

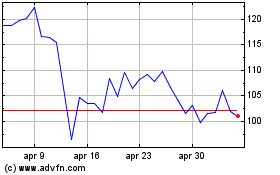

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

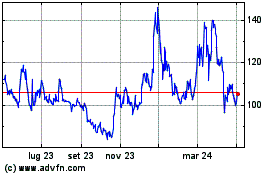

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025