Bitcoin Short-Term Holders Now Capitulating: Bottom Here?

14 Gennaio 2025 - 3:00AM

NEWSBTC

On-chain data shows the Bitcoin short-term holders have started

selling at a loss. Here’s what this could mean for the

cryptocurrency’s price. Bitcoin Short-Term Holder SOPR Has Just

Dipped Under 1 As pointed out by CryptoQuant author Axel Adler Jr

in a new post on X, the Bitcoin Spent Output Profit Ratio (SOPR) of

the short-term holders has declined into the red zone recently.

Related Reading: Bitcoin Sentiment Plummets To Neutral: Reversal

Signal? The “SOPR” here refers to an on-chain indicator that tells

us whether the BTC investors are selling their coins at a profit or

loss. The metric works by going through the transaction history of

each coin being sold/transferred on the network to see what price

it was transacted at prior to this. If the last transfer price of

the coin was less than the current spot value it’s being sold at

now, then its sale could be assumed to be leading to profit

realization. Similarly, transactions of the tokens of the opposite

type correspond to loss-taking. The SOPR adds up the profits and

losses being realized across the network in this manner and

calculates what their ratio stands at. In the context of the

current topic, the SOPR of only a particular segment of the sector

is of interest: the short-term holders (STHs). This cohort is made

up of the investors who bought their coins within the past 155

days. When the indicator has a value greater than 1, it means the

STHs as a whole are selling their coins at a profit. On the other

hand, it is under the threshold implies loss realization is

dominant among these holders. Now, here is a chart that shows the

trend in the 7-day simple moving average (SMA) of the Bitcoin STH

SOPR over the past decade: As is visible in the above graph, the

7-day SMA of the Bitcoin STH SOPR shot up to high levels above the

1 mark during the last couple of months of 2024, implying the group

was participating in significant profit-taking during the asset’s

run to new all-time highs. This wasn’t anything unusual, as STHs

have historically proven themselves to represent the fickle-minded

side of the market, who sell at first sight of any major change in

the market, like a rally or crash. Predictably, with the market

downturn that has followed in the last few weeks, the STHs have

shown another shift, as their profit-taking has calmed down and

loss-taking has started taking over. The 7-day SMA of the indicator

has declined to 0.99, which suggests the loss realization is now

just ahead of the profit realization. Related Reading: Crypto

Analyst Explains What Could Trigger Ethereum Rally To $6,000 From

the chart, it’s apparent that past capitulation events have

generally coincided with tops for Bitcoin. So far, though, the

level of loss-taking isn’t anything too notable, which may suggest

the indicator could have to decline a bit more before BTC finds a

bullish reversal. BTC Price Bitcoin has erased the recent recovery

as its price has seen another 3% plunge during the past day, which

has taken it to $91,600. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

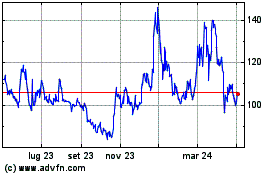

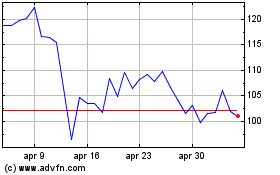

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025