Bitcoin Holder Profits Now 121%: How Much Higher Can BTC Go?

09 Novembre 2024 - 1:30PM

NEWSBTC

On-chain data shows the Bitcoin investors are now carrying 121%

profits on average. Here’s whether this has been enough for a top

in the past. Bitcoin Profitability Index Is Currently Sitting

Around 221% In a new post on X, CryptoQuant author Axel Adler Jr

has discussed about the latest trend in the Bitcoin Average

Profitability Index. The “Average Profitability Index” is an

indicator for BTC that compares the asset’s spot value with its

realized price. The “realized price” here refers to a measure of

the cost basis or acquisition value of the average investor in the

Bitcoin market. This metric’s value is determined using on-chain

data, with the last price at which each coin in circulation was

transacted on the blockchain being taken as its current cost basis.

Related Reading: Bitcoin Sentiment Enters Danger Zone: Investors

Now Extremely Greedy When the Average Profitability Index is

greater than 100%, it means the spot price of the cryptocurrency is

currently higher than its realized price. Such a trend suggests the

average investor is holding a net amount of profit. On the other

hand, the indicator being under this threshold implies the BTC

market as a whole is carrying coins at a net unrealized loss.

Naturally, the index being exactly equal to 100% indicates the

holders as a whole are just breaking-even on their investment. Now,

here is a chart that shows the trend in the Bitcoin Average

Profitability Index over the past decade: As is visible in the

above graph, the Bitcoin Average Profitability Index has registered

a notable increase recently as the cryptocurrency’s run to the new

all-time high (ATH) price has occurred. The indicator has now

reached a value of around 221%, which suggests the investors are in

a significant amount of gains. More particularly, the BTC addresses

as a whole are in a net profit of 121%. Generally, the higher the

profits of the holders get, the more likely they become to fall to

the allure of profit-taking. The current Average Profitability

Index level is high, but it’s uncertain if it’s high enough for a

mass selloff to become a risk. Related Reading: Bitcoin Could Be

Ready For ‘Phase 2’ Of This Historical Bull Pattern In the chart,

the analyst has marked how high the metric went at the time of the

tops of the previous bull runs. It would appear that 2017 peaked at

460%, while 2021 at 395%. So far in the current cycle, the highest

that the index has gone was 272%, which happened during the top

back in March of this year. Given the fact that the indicator is

yet to hit this level, let alone the peaks from the last cycles,

it’s possible that Bitcoin still has sufficient room to run, before

a top becomes probable. BTC Price At the time of writing, Bitcoin

is trading around $76,200, up more than 9% over the past week.

Featured image from Dall-E, CryptoQuant.com, chart from

TradingView.com

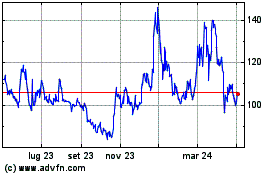

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Ott 2024 a Nov 2024

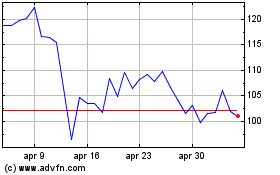

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Nov 2023 a Nov 2024