UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☐ Soliciting

Material under §240.14a-12

electroCore,

Inc.

(Name of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No

fee required.

☐ Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On Tuesday, September 3, 2024

Dear Stockholder:

The Annual Meeting of Stockholders of electroCore, Inc., (the “Company”,

“we” or “us”), will be held virtually via the internet at www.virtualshareholdermeeting.com/ECOR2024, on Tuesday,

September 3, 2024 at 9:00 a.m. Eastern time for the following purposes:

| 1. | To elect two Class III directors to the Board for a three-year term of office expiring at the 2027 Annual Meeting of Stockholders; |

| 2. | To ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year ending December 31,

2024; |

| 3. | To approve, by non-binding advisory vote, the resolution approving named executive officer compensation; and |

| 4. | To approve, by non-binding advisory vote, the frequency of future non-binding advisory votes on resolutions approving future named

executive officer compensation. |

These items of business are more fully described in the Proxy Statement

that accompanies this Notice or which is available at the website listed in this Notice. All stockholders are invited to attend the meeting.

The record date for the Annual Meeting is July 5, 2024. Only stockholders of record at the close of business on that date are entitled

to notice of and to vote at the meeting.

The 2024 Annual Meeting will be a completely virtual meeting of stockholders,

which will be conducted exclusively by webcast on the internet. No physical meeting will be held.

Important Notice Regarding the Availability

of Proxy Materials for the Stockholders’

Meeting to Be Held on September 3, 2024 at 9:00 a.m. Eastern Time virtually via the internet at

www.virtualshareholdermeeting.com/ECOR2024

The Proxy Statement and Annual Report on Form

10-K

are available at www.proxyvote.com.

By Order of the Board of Directors,

Brian M. Posner

Chief Financial Officer and Corporate Secretary

Rockaway, New Jersey

July 17, 2024

You are cordially invited to attend the virtual annual meeting.

Whether or not you plan to attend the Annual Meeting online, we urge you to vote your shares by following the instructions for voting

on the notice and access card, as described in this proxy statement. If you received a copy of the proxy card by mail, you may sign, date

and mail the proxy card in the enclosed return envelope.

TABLE OF CONTENTS

Page

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

2 |

| |

|

| PROPOSAL 1 - ELECTION OF DIRECTORS |

9 |

| |

|

| BOARD DIVERSITY |

15 |

| |

|

| INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

16 |

| |

|

| PROPOSAL 2 - RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS |

22 |

| |

|

| PROPOSAL NUMBER 3 - NON-BINDING ADVISORY VOTE, ON THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION |

23 |

| |

|

| PROPOSAL NUMBER 4 - NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF FUTURE NON- BINDING ADVISORY VOTES ON FUTURE NAMED EXECUTIVE

OFFICER COMPENSATION |

24 |

| |

|

| EXECUTIVE OFFICERS |

25 |

| |

|

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

26 |

| |

|

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

29 |

| |

|

| EXECUTIVE COMPENSATION |

30 |

| |

|

| DIRECTOR COMPENSATION |

38 |

| |

|

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

40 |

| |

|

| TRANSACTIONS WITH RELATED PERSONS |

41 |

| |

|

| HOUSEHOLDING OF PROXY MATERIALS |

44 |

| |

|

| ADDITIONAL INFORMATION |

44 |

| |

|

| NEXT YEAR’S ANNUAL MEETING |

45 |

| |

|

| OTHER MATTERS |

46 |

Forward-Looking Statements

This Proxy Statement contains various forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

which represent our expectations or beliefs concerning future events. All statements other than statements of historical facts contained

in this Proxy Statement, including statements regarding our future results of operations and financial position, strategy and plans, and

our expectations for future operations, are forward-looking statements. Forward-looking statements include those containing such words

as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,”

“goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,”

“sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning.

These forward-looking statements rely on assumptions and involve risks and uncertainties, many of which are beyond our control, including,

but not limited to, factors detailed in this Proxy Statement and under Part I, “Item 1A. Risk Factors” and in other sections

of our most recent Annual Report on Form 10-K and in our other subsequent filings with the Securities and Exchange Commission (the “SEC”).

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may

vary materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or persons acting

on its behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance

on our forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and, except

as required by law, we undertake no duty to update or revise any forward-looking statement.

200 Forge Way, Suite 205

Rockaway, NJ 07866

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

Be Held on September 3, 2024

QUESTIONS AND ANSWERS ABOUT

THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

electroCore, Inc. (“electroCore”, the “Company”,

We” or “Us”) is sending you these proxy materials because the Board of Directors (the “Board") of electroCore

is soliciting your proxy to vote at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments

or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy

statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return

the related proxy card, or follow the instructions below to submit your proxy by phone or online.

The Annual Meeting will be a completely virtual meeting of stockholders,

which will be conducted exclusively online via the virtual meeting website at www.virtualshareholdermeeting.com/ECOR2024. Hosting a virtual

meeting enables increased stockholder attendance since stockholders can participate from any location around the world. Stockholders can

vote via the internet in advance or during the virtual Annual Meeting.

Will I receive a printed proxy statement and Annual Report on Form

10-K?

Under the “notice and access” rules adopted by the SEC,

we are furnishing proxy materials to our stockholders primarily via the internet, instead of mailing printed copies of those materials

to each stockholder. As a result, we intend to mail a notice of internet availability of proxy materials on or about July 22, 2024 to

all stockholders of record entitled to vote at the Annual Meeting. The notice contains instructions on how to access our proxy materials,

including our proxy statement and our Annual Report on Form 10-K. The notice also instructs you on how to access your proxy card to vote

through the internet or by telephone. The notice is not a proxy card and cannot be used to vote your shares.

This process is designed to expedite stockholders’ receipt of

proxy materials, lower the cost of the Annual Meeting, and help minimize the environmental impact of the Annual Meeting. However, if you

would prefer to receive printed proxy materials, please follow the instructions included in the notice. If you have previously elected

to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

How do I attend the virtual Annual Meeting?

This year the annual meeting will be a completely virtual meeting.

There will be no physical meeting. The meeting will only be conducted via live webcast.

To participate in the virtual meeting, visit www.virtualshareholdermeeting.com/ECOR2024

and enter the 16-digit control number included on your notice of internet availability of proxy materials or on your proxy card. You may

begin to log into the meeting platform beginning at 8:45 a.m. Eastern Time on Tuesday, September 3, 2024. The meeting will begin promptly

at 9:00 a.m., Eastern Time on Tuesday, September 3, 2024.

The virtual meeting platform is fully supported across browsers (Microsoft

Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable

software and plugins. Participants should ensure that they have a strong internet connection wherever they intend to participate in the

meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the

start of the meeting.

Technical assistance will be available for stockholders who experience

technical issues accessing the meeting. Contact information for technical support will appear on the virtual meeting website prior to

the start of the meeting.

However, even if you plan to attend the virtual Annual Meeting, we

recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Annual Meeting.

How do I gain admission to the virtual Annual Meeting?

You are entitled to attend the virtual Annual Meeting only if you were

a stockholder of record as of the record date for the Annual Meeting, which was July 5, 2024, or you hold a valid proxy for the Annual

Meeting. You may attend the Annual Meeting, and may vote and submit a question during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/ECOR2024

and using your 16-digit control number to enter the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on July 5, 2024

will be entitled to vote at the Annual Meeting. As of July 5, 2024, there were 6,446,866 shares of common stock outstanding and entitled

to vote.

Stockholder of Record: Shares Registered in Your Name

If on July 5, 2024 your shares were registered directly in your name

with our transfer agent, Broadridge Corporate Issuer Solutions, Inc. (“Broadridge”), then you are a stockholder of record.

As a stockholder of record, you may vote at the Annual Meeting by going to the virtual meeting website or vote by proxy. Whether or not

you plan to attend the Annual Meeting, we urge you to fill out and return the related proxy card or vote by proxy by phone or online as

instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on July 5, 2024 your shares were not held in your name, but rather

in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street

name” and a notice of internet availability of proxy materials should be forwarded to you by that organization, which notice will

contain instructions on how you may direct the voting of your shares and how to access and participate in the Annual Meeting. The organization

holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner,

you have the right to direct your broker or other agent regarding how to vote the shares in your account.

How do I ask questions?

If you would like to submit a question during the meeting, log into

the virtual meeting platform at www.virtualshareholdermeeting.com/ECOR2024 which provides functionality for you to submit a question during

the meeting. Please note that questions that are pertinent to meeting matters will be answered during the meeting, subject to time constraints,

and questions regarding personal matters or others that are not pertinent to meeting matters will not be answered.

On what matters am I voting?

There are four matters scheduled for a vote:

| · | Proposal 1. To elect two Class III directors to the Board for a three-year term of office expiring at the 2027 Annual Meeting

of Stockholders. |

| · | Proposal 2. To ratify the selection of Marcum LLP as our independent registered public accounting firm for the fiscal year

ending December 31, 2024. |

| · | Proposal 3. To approve, by non-binding advisory vote, the resolution approving named executive officer compensation (the “Say

on Pay Proposal”). |

| · | Proposal 4. To approve, by non-binding advisory vote, the frequency of future non-binding advisory votes on resolutions approving

future named executive officer compensation (the “Say When on Pay Proposal”). |

Our Board recommends that you vote your shares:

| · | “For” the nominees to the Board set forth in this proxy statement; |

| · | “For” the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year end

2024; |

| · | “For” the Say on Pay Proposal; and |

| · | “For” THREE YEARS as the preferred frequency of the Say When on Pay Proposal. |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration

at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in

the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

With respect to Proposal 1, you may vote for “For” or “Against”

or “Abstain” with respect to the nominees.

With respect to Proposal 2, you may vote for “For” or “Against”

or you may “Abstain” from voting.

With respect to Proposal 3, you may vote for “For” or “Against”

or you may “Abstain” from voting.

With respect to Proposal 4, you may vote for “ONE YEAR,”

“TWO YEARS,” “THREE YEARS,” or you may “Abstain” from voting.

The procedures for voting are:

Stockholder of Record: Shares Registered in Your Name

Stockholders of record may vote their shares (i) electronically at

the virtual Annual Meeting, or (ii) by proxy by mail, telephone or internet. Whether or not you plan to attend the virtual Annual Meeting,

we urge you to vote by proxy to ensure your vote is counted. You may choose one of the following voting methods to cast your vote.

| 1. | To vote electronically at the virtual Annual Meeting, see above in “How do I attend the virtual Annual Meeting?” |

| 2. | If you have received a printed copy of these proxy materials, you may vote by mail by simply marking your proxy, dating and signing

it, and return it to us in the postage-paid envelope provided. |

| 3. | To vote by telephone or internet, follow the instructions on the proxy card. |

The method by which you vote now will in no way limit your right to

vote electronically at the virtual Annual Meeting if you later decide to attend.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

Beneficial holders may access the virtual annual meeting with the 16-digit

control number provided with their notice of internet availability of proxy materials.

Internet proxy voting is provided to allow you to vote your shares

online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware

that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone

companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of

common stock you own as of July 5, 2024.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your

proxy card by mail, by phone, online or virtually at the Annual Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

The New York Stock Exchange (NYSE) rules on broker discretionary voting

prohibit banks, brokers, and other intermediaries from voting uninstructed shares on certain matters, including the election of directors.

Notwithstanding the NYSE rule, banks, brokers, and other intermediaries may choose not to exercise any permitted discretion, in which

case, if you hold your stock in street name and do not instruct your bank, broker, or other intermediary how to vote in the election of

directors, it is possible that no votes will be cast on your behalf with respect to any Proposal. It is important that you cast your vote

on all matters. Abstentions will, however, count towards the quorum requirement for the Annual Meeting.

Are abstentions and broker non-votes counted as votes cast?

No. Under the laws of the State of Delaware, our state of incorporation,

“votes cast” at a meeting of stockholders by the holders of shares entitled to vote are determinative of the outcome of the

matter subject to vote. Abstentions and broker non-votes will not be considered “votes cast” based on current Delaware law

requirements and our Certificate of Incorporation and by-laws.

What if I return a proxy card or otherwise vote but do not make

specific choices?

If you return a signed and dated proxy card or otherwise vote without

marking voting selections, your shares will be voted:

| · | “For” the individual director nominees; |

| · | “For” the ratification of Marcum LLP as our independent registered public accounting firm for the fiscal year end 2024; |

| · | “For” the Say on Pay Proposal; and |

| · | “For” THREE YEARS as the preferred frequency of the Say When on Pay Proposal. |

If any other matter is properly presented at the Annual Meeting, your

proxyholder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition

to these proxy materials, our directors and employees may also solicit proxies by telephone, or by other means of communication. Directors

and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other

agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one notice of internet

availability of proxy materials?

If you receive more than one notice of internet availability of proxy

materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions in the

notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at

the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| · | You may submit another properly completed proxy card with a later date. |

| · | You may grant a subsequent proxy by phone or online. |

| · | You may send a timely written notice that you are revoking your proxy to electroCore’s Corporate Secretary at 200 Forge Way,

Suite 205, Rockaway, NJ 07866. |

| · | You may attend the Annual Meeting and vote virtually. Simply attending the Annual Meeting without voting virtually will not, by itself,

revoke your proxy. |

Your most current proxy card or proxy submitted by phone or online

is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent,

you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the

Annual Meeting, who will separately count, for each of the proposals, votes “For,” “Against” and any broker non-votes

and abstentions. For each of the Proposals, broker non-votes will have no effect and will not be counted toward the vote total.

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street

name” does not give instructions to the broker, bank or other nominee holding the shares as to how to vote on matters deemed “non-routine.”

Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker,

bank or other nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker, bank or other nominee

can still vote the shares with respect to matters that are considered to be “routine,” but cannot vote the shares with respect

to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that

may substantially affect the rights or privileges of stockholders, such as mergers, reverse stock splits, stockholder proposals, elections

of directors (even if not contested) and, executive compensation, including advisory stockholder votes on executive compensation and on

the frequency of stockholder votes on executive compensation. The ratification of the selection of the independent registered public accounting

firm is generally considered to be “routine” and brokers, banks or other nominees generally have discretionary voting power

with respect to such proposals although not all brokers and nominees may choose to exercise that discretion. Broker non-votes will be

counted for the purpose of determining whether a quorum is present at the Annual Meeting.

How many votes are needed to approve each proposal?

Regarding Proposal 1, the election of directors, the Board’s

nominees will be elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the

election of directors, and which did not abstain. This means that if each of the nominees receives one or more votes, he will be elected

as a director. Only votes “For,” or “Against” will affect the outcome with respect to this proposal, and abstentions

will have no effect.

To be approved, Proposal 2, the ratification of Marcum as our independent

registered public accounting firm, must receive “For” votes from the holders of a majority of shares present in person or

represented by proxy and entitled to vote on the matter. Abstentions will count towards the quorum requirement for the annual meeting

but will not count as a vote for or against Proposal 2.

To be approved, Proposal 3, the Say on Pay Proposal must receive “For”

votes from holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. Abstentions will

count towards the quorum requirement for the annual meeting but will not count as a vote for or against Proposal 2.

Regarding Proposal 4, you have four choices for voting on this proposal.

You may indicate your preference, on an advisory basis, as to whether future advisory votes on named executive officer compensation should

be conducted every ONE YEAR, TWO YEARS, or THREE YEARS. You may also ABSTAIN from voting. Stockholders are not voting to approve or disapprove

the recommendation of the Board, and the outcome of the vote is not binding on us. Rather, the frequency that receives the greatest number

of votes cast by the voting power of the shares of our common stock present in person (including virtually) or represented by proxy at

the Annual Meeting and entitled to vote thereon will be considered the preferred frequency of our stockholders and reviewed by the Board

for its consideration in establishing the future frequency of such votes. Abstentions will count towards the quorum requirement for the

annual meeting but will not count as a vote for or against Proposal 4.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid Annual Meeting.

A quorum is present if stockholders holding at least 33.33% of the outstanding shares of common stock entitled to vote are present at

the Annual Meeting in person or represented by proxy. As of July 5, 2024, the record date for the Annual Meeting, there were 6,446,866

shares outstanding and entitled to vote. Thus, the holders of 2,148,956 shares must be present in person or represented by proxy at the

Annual Meeting to have a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted

on your behalf by your broker, bank or other nominee) by mail, by phone or online or if you vote in person at the Annual Meeting. Abstentions

and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the Annual Meeting

or the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting

to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting.

In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after

the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual

Meeting, it intends to file a Form 8-K to publish preliminary results and, within four business days after the final results are known,

file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement and Form 10-K are available at www.proxyvote.com.

PROPOSAL 1 - ELECTION OF

DIRECTORS

The Board is divided into three classes and currently has eight members.

Each class has a three-year term expiring at the annual meeting in the third year following election. Vacancies on the Board may be filled

only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including

vacancies created by an increase in the number of directors, will serve for the remainder of the full term of that class and until the

director’s successor is duly elected and qualified.

There are two continuing Class III directors in the class whose term

of office expires as of the Annual Meeting that have been nominated by the Board for election at the Annual Meeting: John P. Gandolfo

and Charles S. Theofilos, M.D. If elected at the Annual Meeting, each of these nominees will serve until the 2027 Annual Meeting of Stockholders.

On July 11, 2024, one of our Directors, F. Peter Cuneo, resigned as

a Class III director, and was immediately reappointed to the Board as a Class I director with a term expiring at the 2025 Annual Meeting

of Stockholders. Mr. Cuneo will continue to serve until the 2025 Annual Meeting where he will not stand for reelection.

It is our policy to invite and encourage directors and the director

nominee to attend the Annual Meeting. All of the then-incumbent directors attended the 2023 Annual Meeting.

Directors are elected by a plurality of the votes of the shares present

in person or represented by proxy and entitled to vote on the election of directors, and which did not abstain. Accordingly, for Proposal

1, the nominees have to receive the highest number of votes cast in order to be elected. Shares represented by executed copies of the

accompanying proxies will be voted, if authority to do so is not withheld, for the election of each of the two nominees named below.

If any of the nominees become unavailable for election as a result

of an unexpected occurrence, shares that would have been voted for such nominee will instead be voted for the election of a substitute

nominee that the Board will propose. Each person nominated for election has agreed to serve if elected. We have no reason to believe that

any of the nominees will be unable to serve.

NOMINEES FOR THE CLASS III DIRECTOR POSITION

Our nominating and governance committee seeks to assemble a Board that,

as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience

necessary to oversee and direct our business. To that end, the nominating and governance committee has identified and evaluated the nominees

in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the

skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the nominating

and governance committee views as critical to effective functioning of the Board. The brief biographies below include information, as

of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of the directors

nominees that led the nominating and governance committee to believe that nominee should continue to serve on the Board. However, each

of the members of the nominating and governance committee may have a variety of reasons why he believes a particular person would be an

appropriate nominee for the Board, and these views may differ from the views of other members.

The following is a brief biography of each nominee for director and

a discussion of the specific experience, qualifications, attributes or skills of such nominee that led the nominating and governance committee

to recommend that person as a nominee for director, as of the date of this proxy statement.

John P. Gandolfo

John P. Gandolfo, 63, has served as a member of the Board since April

2020. He brings to the Board more than 30 years of financial leadership at both public and private companies across multiple industry

sectors, including in expense control and cash flow optimization Since 2018, he has served as chief financial officer of Eyenovia,

Inc., a publicly held, late clinical stage biopharmaceutical company focusing on the development of ophthalmic drugs. Prior to Eyenovia,

he served as chief financial officer of Xtant Medical Holdings, Inc., a publicly held orthopedic and spine medical device company with

multiple operations throughout the United States from 2010 to 2017. He has served on the board of Oragenics, Inc, a development-stage

company dedicated to fighting infectious diseases including coronaviruses and multidrug-resistant organisms, since September 2023. His

prior healthcare-related experience includes roles as chief financial officer of Progenitor Cell Therapy LLC, Power Medical Interventions

and Bioject, Inc., among others. Mr. Gandolfo’s experience also includes serving on the audit committees of the boards of multiple

medical technology companies including Odyssey Health, Inc., a medical device company which he has served as a director since 2019. Mr.

Gandolfo holds a B.A. in business administration from Rutgers University. The Board believes that these experiences, and his ability to

serve as a financial expert on our audit committee, qualify him to serve on the Board.

Charles S. Theofilos, M.D.

Charles S. Theofilos, M.D., 62, has served as a member of the

Board since December 2023. Dr. Theofilos is a retired neurosurgeon who founded The Spine Center in Palm Beach Gardens, Florida in 1996.

He also founded and serves as president of Theo Concepts, LLC and founder of The Theo Group, a family office. Previously, he served as

co-director of the Neuroscience Center, chairman of Neurosurgery, and Chairman of Cranial and Spinal Surgery, at JFK Medical Center in

Atlantis, Florida, director of Spine Surgery at Jupiter Medical Center, and chairman of Neurosurgery at Palm Beach Gardens Medical Center.

Dr. Theofilos has been a founder, director and/or investor in a number of early-stage medical device and healthcare companies, including

K2Medical, SpineCore LLC and electroCore, LLC, our predecessor. Dr. Theofilos received an M.D. from Emory University School of Medicine,

a B.A. in biology from Emory University, and a GMP (General Management Program) from The Wharton School of The University of Pennsylvania.

The Board believes Dr. Theofilos is qualified to serve on the Board due to his long tenure as a practicing physician and neuro-surgeon,

as well as serving as a co-founder, director and investor in a number of successful early stage medical device and healthcare companies.

Required Vote

Regarding Proposal 1, the Board’s nominees will be elected by

a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the director election matter,

and which did not abstain. Only votes “For,” or “Against” will affect the outcome with respect to this proposal,

and abstentions will have no effect (although they will count towards the quorum requirements for the Annual Meeting).

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED IN THIS PROPOSAL NO. 1.

CONTINUING DIRECTORS

Class I Directors (Terms Expiring in 2025)

F. Peter Cuneo

F. Peter Cuneo, 80, has served as a member of the Board since April

2020 and been the Chairman of the Board since October 2021. He currently serves as a managing principal of Cuneo & Company LLC, a

private investment and management company that he founded. He previously served as executive chairman of CIIG Capital Partners II, a special

acquisition corporation listed on Nasdaq, from September 2022 until April 2023 following the completion of the business combination with

Zapp Electric Vehicles, Inc. He was the chairman of Arrival Ltd., a global electric vehicle company, from September 2021 until February

2023. Mr. Cuneo’s past experience includes serving as chief executive officer of Marvel Entertainment Inc. and as vice chairmen

until its sale to The Walt Disney Company in 2009, and served on the board of Iconix Brand Group from 2007 through 2021. Earlier in his

career, he successfully led three turnarounds, first as president of Clairol’s Personal Care Division, as president of Black and

Decker’s Security Hardware Group, and as chief executive officer of Remington Products. Previously, he also served as president

of Bristol-Meyers Squibb Co.’s pharmaceutical group in Canada. Mr. Cuneo’s board experience includes serving as chairman of

Valiant Entertainment from 2012 to 2018 following Cuneo & Company LLC’s investment in the company. He currently serves as chairman

emeritus of the Alfred University Board of Trustees and served on the board of the National Archives Foundation in Washington, D.C. until

2023. Mr. Cuneo holds an M.B.A. from Harvard Business School, a B.S. from Alfred University and was a Lieutenant in the United States

Navy, having served two deployments during the Vietnam War. The Board believes that Mr. Cuneo’s extensive business and financial

background, including his significant consumer-focused expertise, qualify him to serve on the Board.

Daniel S. Goldberger

Daniel S. Goldberger, 65, has served as our Chief Executive Officer

and a member of the Board since October 2019. Mr. Goldberger served as a director of Koru Medical Systems, a manufacturer of infusion

pump systems, from April 2017 until May 2022 and he served as its executive chairman from August 2017 until September 2019. From January

2018 to September 2019, Mr. Goldberger served as the chief executive officer of Synergy Disc Replacement Inc., a private company commercializing

a proprietary total disc implant for cervical spine therapy. From July 2017 to September 2017, Mr. Goldberger served as chief executive

officer of Milestone Medical, Inc. Prior to this he served as the chief executive officer of Xtant Medical Holdings, Inc. from August

2013 to January 2017. He also served on the board and as the chief executive officer of Sound Surgical Technologies LLC from April 2007

to February 2013. Mr. Goldberger has also served on the boards of Xtant Medical Holdings, Inc., Sound Surgical, Xcorporeal. Theragen,

Inc., and Glucon. Mr. Goldberger earned a B.S. in mechanical engineering from The Massachusetts Institute of Technology, and a M.S. in

mechanical engineering from Stanford University. The Board believes that Mr. Goldberger’s extensive senior management experience

in the medical device industry, including as our Chief Executive Officer, qualify him for service on the Board.

Julie A. Goldstein

Julie A. Goldstein, 66, has served as a member of the Board since March

2022. Ms. Goldstein has more than 30 years of leadership expertise in product, media and entertainment marketing, which spans a career

in radio, television, music and theater. Ms. Goldstein’s specific expertise includes operations, sales development, advertising,

and project management. She has also spearheaded many major national and international marketing campaigns. She was a producer for the

Broadway musical First Date from 2013 to 2014. At music labels JIVE Records, RCA Records, and Virgin Records, she served as vice president

of marketing and development. She also held the position of vice president of marketing and sales at NewsCorp / TV Guide Television Network

and began her career in radio marketing. Her expertise around spending and strategic marketing techniques contributed to RCA’s turnaround.

She received the Billboard Magazine’s Radio Promotion Director of the Year, Bertelsmann Key Management Award, and Virgin Records

Promotion Director of the Year. Ms. Goldstein holds a B.A. in communications and social welfare from California State University at Chico.

The Board believes Ms. Goldstein’s extensive media and marketing expertise qualifies her to serve on the Board.

Patricia Wilber

Patricia Wilber, 63, has served as a member of the Board since March

2022. Ms. Wilber has been a chief marketing officer, global business strategist, and board member who delivers organizational and cultural

transformation for branding. She is a pioneer in new franchise models and branded partnerships. Ms. Wilber last served as the executive

vice president, chief marketing officer, and managing director of partnerships, EMEA, the highest position in the marketing department

at The Walt Disney Company from 2015 to 2018, where she drove growth for Disney’s marquee brands by leading marketing and communications

for Disney, Pixar, Star Wars, and Marvel. Additionally, she established and led EMEA’s 40-country integrated marketing, franchise

and partnership functions, including a major reorganization of the EMEA channels to boost growth and profitability by significantly reducing

expenses. Ms. Wilber has also served as a member of the board of Zapp Electric Vehicles, Group, Ltd., since October 2022. She also currently

serves on the board of the medical nonprofit organizations, Vibrant Emotional Health and Yale New Haven Hospital. She served on the board

of Euro Disney SCA from 2015 to 2018, and Magical Cruise Company, more commonly known as the Disney Cruise Line from 2013 to 2018. Ms.

Wilber holds a B.A. in history from Brown University. The Board believes Ms. Wilber’s strategic marketing expertise and public company

board experience qualify her to serve on the Board.

Class II (Terms Expiring in 2026)

Thomas J. Errico, M.D.

Thomas J. Errico, M.D., 72, is a founder of our

company and has served as a member of the Board since 2005. Dr. Errico has been a board-certified orthopedic surgeon since 1986, and currently

serves as a pediatric orthopedic spine surgeon at Nicklaus Children’s Hospital. He also is an Associate Professor of Orthopedic

Surgery at the University of Miami School of Medicine. He previously served as the chief, Division of Spine Surgery in Orthopedics, at

NYU Langone Health from 1997 until 2018. He currently serves on the board of Setting Scoliosis Straight, a nonprofit organization focused

on advancing medical techniques in the treatment of spinal deformities and was an adjunct professor of the Department of Orthopaedic Surgery

at NYU Grossman School of Medicine. In addition, Dr. Errico is a member of the International Society for the Advancement of Spine Surgery,

and served as its president from 2010 to 2011. He is also an original member of the North American Spine Society, and served as its president

from 2003 to 2004. Dr. Errico has founded multiple companies in the healthcare industry, including Spinecore, Inc. in 2001, where he served

as a director until it was sold to Stryker, Inc. in 2004. Dr. Errico was also a founding member of K2M Group Holdings, Inc. in January

2004. Dr. Errico holds a B.S. in zoology from Rutgers University and an M.D. from Rutgers Medical School, formerly the University of Medicine

and Dentistry of New Jersey. The Board believes Dr. Errico is qualified to serve on the Board due to his long tenure as a practicing spine-surgeon

and his leadership role with world-class medical institutions, as well as serving as a co-founder, director and investor in a number of

successful early-stage healthcare companies.

Thomas M. Patton

Thomas M. Patton, 60, has served as a member of the Board since April

2020. He is a seasoned healthcare executive and board member with operational, strategic, financial, legal, compliance and transactional

experience, from start-ups to growth companies, both public and private. He currently is an advisor to the private equity firm SV Health

Investors and serves on the board of the Connecticut Port Authority and is co-chair of its audit committee. He also serves on the private

company boards’ of directors of each of Packing Compliance Labs, Robling Medical, LLC and Miach Orthopaedics, Inc. He was the chief

executive officer and member of the board of directors of Ximedica, LLC, a private medical products outsource design and development company

from August 2020 to May 2021. From 2015 to 2021, he also served on the board of Misonix, Inc., a publicly traded ultrasonic surgical tools

and wound care company, and chaired that company’s audit committee, from October 2015 to November 2021 and served as president and

chief executive officer of CAS Medical Systems, a publicly traded developer and distributor of patient monitoring equipment, from 2010-2019.

His prior experience includes roles as co-founder, president and chief executive officer of QDx, Inc., a developer of unique micro-fluidic

diagnostic technology utilizing digital imaging techniques for hematologic analysis, as president and chief operating officer of Novametrix

Medical Systems, Inc., and as chief executive officer of Wright Medical Technology, Inc. Mr. Patton has served on more than a dozen boards

of directors for both public and private medical products and services companies. Mr. Patton holds a B.A. in economics from Holy Cross

University and J.D. from Georgetown University Law Center. The Board believes that Mr. Patton’s business and financial experience,

as well as his medical device industry expertise and ability to serve as an “audit committee financial expert,” qualify him

to serve on the Board.

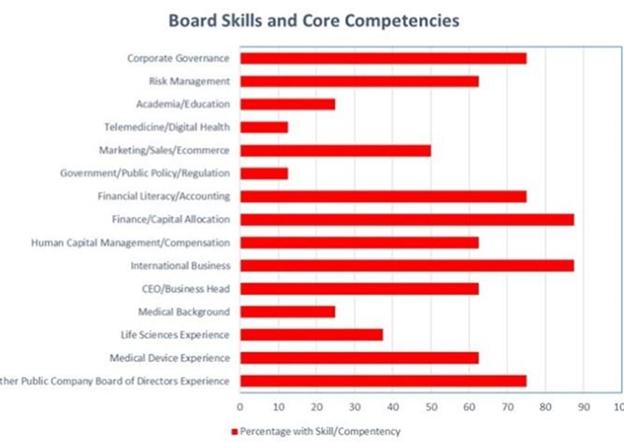

Skills Matrix

Each director brings relevant experience to the Board. The matrix below

shows the Board’s mix of key skills and experience in areas that are important to our business. The skills and experience matrix

is also used to identify the skills which we consider when nominating directors. The matrix is a summary; it does not include all the

skills, experiences and qualifications that each director nominee offers, and if a particular skill, experience or qualification is not

listed it should not signal that a director does not possess that skill, experience or qualification.

Demographic Background

The Board is committed to having diverse individuals from different

backgrounds with varying perspectives, professional experience, education and skills serving as members of the Board. The Board believes

that a diverse membership with a variety of perspectives and experiences is an important feature of a well-functioning board.

BOARD DIVERSITY

Each of the categories listed in the below table has the meaning as

it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix |

| Board Size: |

|

|

|

|

|

|

|

|

| Total Number of Directors |

|

8 |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Male |

|

Female |

|

Non-Binary |

|

Gender Undisclosed |

| Gender: |

|

6 |

|

2 |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

| Number of directors who identify in any of the categories below: |

|

|

|

|

|

|

|

|

| African American or Black |

|

— |

|

— |

|

— |

|

— |

| Alaskan Native or American Indian |

|

— |

|

— |

|

— |

|

— |

| Asian |

|

— |

|

— |

|

— |

|

— |

| Hispanic or Latinx |

|

— |

|

— |

|

— |

|

— |

| Native Hawaiian or Pacific Islander |

|

— |

|

— |

|

— |

|

— |

| White |

|

6 |

|

2 |

|

— |

|

— |

| Two or more races or ethnicities |

|

— |

|

— |

|

— |

|

— |

| LGBTQ+ |

|

— |

|

— |

|

— |

|

— |

| Persons with Disabilities |

|

1 |

|

— |

|

— |

|

— |

| Undisclosed |

|

— |

|

— |

|

— |

|

— |

Of our eight current directors, three (37.5%) identify as having at

least one diversity characteristic (i.e., female, non-binary, LGBTQ+, disabled, and/or race or ethnicity other than white).

During 2021 and early 2022, the Nomination and Governance Committee

made a concerted effort to recruit new diverse directors to the Board culminating in the appointment of Ms. Goldstein and Ms. Wilber in

March 2022.

INFORMATION REGARDING THE

BOARD OF DIRECTORS AND CORPORATE

GOVERNANCE

INDEPENDENCE OF THE BOARD OF DIRECTORS

Our common stock is listed on the Nasdaq Capital Market. Under Nasdaq

rules, independent directors must comprise a majority of our Board. Under Nasdaq rules, a director will only qualify as an “independent

director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere

with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board has undertaken a review of the independence of each director

and considered whether each director has a material relationship with us that could compromise his or her ability to exercise independent

judgment in carrying out his responsibilities. As a result of this review, the Board has determined that each of our current directors

other than Daniel S. Goldberger, our CEO, are “independent directors” as defined under the applicable rules and regulations

of the SEC and the listing requirements and rules of Nasdaq. In making these determinations, the Board has reviewed and discussed information

provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate

to us and our management, including the beneficial ownership of our capital stock by each non-employee director, any relevant family relationships,

and the transactions involving directors described in the section entitled “Certain Related Party Transactions.”

BOARD LEADERSHIP STRUCTURE

The Board has an independent chairman, Mr. Cuneo, who has authority,

among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and

to determine materials to be distributed to the Board. Accordingly, the Board Chairman has substantial ability to shape the work of the

Board. We believe that separation of the positions of Board Chairman and Chief Executive Officer reinforces the independence of the Board

in its oversight of the business and affairs of us. In addition, we believe that having an independent Board Chairman creates an environment

that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and

improving the ability of the Board to monitor whether management’s actions are in the best interests of our company and our stockholders.

As a result, we believe that having an independent Board Chairman enhances the effectiveness of the Board as a whole.

There are no family relationships among any of our directors and executive

officers nor have any of our executive officers or key employees been involved in a legal proceeding that would be required to be disclosed

pursuant to Item 401(f) of Regulation S-K of the Exchange Act.

ROLE OF THE BOARD IN RISK OVERSIGHT

One of the key functions of the Board is informed oversight of our

risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function

directly through the Board as a whole, as well as through various standing committees of the Board that address risks inherent in their

respective areas of oversight. In particular, the Board is responsible for monitoring and assessing strategic risk exposure and our audit

committee is responsible for considering and discussing our major financial risk exposures and our risk assessment and risk management

policies (including those related to data privacy, data security and cybersecurity). Our audit committee also periodically reviews the

general process for the oversight of risk management by the Board.

The nominating and governance committee monitors compliance with legal

and regulatory requirements and the effectiveness of our corporate governance practices, including whether they are successful in preventing

illegal or improper liability-creating conduct. Our nominating and governance committee is responsible for overseeing key aspects of our

general risk management efforts, including the allocation of risk management functions among the Board and its committees. Our compensation

committee is responsible for assessing and monitoring whether any of the our compensation policies and programs has the potential to encourage

excessive risk-taking.

MEETINGS OF THE BOARD OF DIRECTORS

The Board met 11 times during 2023. Each Board member attended 75%

or more of the aggregate number of meetings of the Board and of the committee(s) on which he or she served that were held during the portion

of 2023 for which he or she was a director or committee member.

Nasdaq rules require that the non-management directors of the board

meet at regularly scheduled executive sessions, without management present, in order to empower the non-management directors to serve

as a more effective check on management. During 2023, our non-management directors met in executive session, without management present,

at the end of regularly scheduled board meetings or during scheduled executive session calls. Mr. Cuneo, our Board Chairman, presided

over the executive sessions.

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS

The Board has three committees: an audit committee, a compensation

committee and a nominating and governance committee. The following table provides membership and meeting information for 2023 for each

of the Board committees.

| Name |

|

Audit Committee |

|

Compensation Committee(1) |

|

Nominating & Governance Committee(1) |

| F. Peter Cuneo (2) |

|

|

|

|

|

|

|

X |

|

| Thomas J. Errico, M.D. |

|

|

|

|

X |

|

|

X |

* |

| John P. Gandolfo |

|

X |

|

|

X |

* |

|

|

|

| Julie A. Goldstein |

|

|

|

|

X |

|

|

X |

|

| Trevor J. Moody (3) |

|

|

|

|

X |

* |

|

|

|

| Thomas M. Patton |

|

X |

* |

|

|

|

|

|

|

| Patricia Wilber |

|

X |

|

|

|

|

|

X |

|

| Number of meetings in 2023 |

|

6 |

|

|

5 |

|

|

5 |

|

*Committee Chair

| (1) | Charles S. Theofilos, M.D., was appointed to Board in December 2023 and to the Compensation Committee and the Nominating & Governance

Committee on March 8, 2024. |

| (2) | Mr. Cuneo, our Chairman of the Board, resigned from the Nominating and Governance Committee effective August 4, 2023. |

| (3) | Mr. Moody resigned from the Board and its committees effective August 4, 2023, at which time Mr. Gandolfo become the Chairman of the

Compensation Committee. |

Below is a description of each committee of the Board. Each of the

committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities.

The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence,”

and each member is free of any relationship that would impair his individual exercise of independent judgment with regard to us.

Audit Committee

Our audit committee reviews our internal accounting procedures and

consults with and reviews the services provided by our independent registered public accountants. Our audit committee currently consists

of three directors, Mr. Gandolfo, Mr. Patton and Ms. Wilber. Mr. Patton is the chairman of the audit committee, and it is the opinion

of the Board that Mr. Gandolfo and Mr. Patton are each an “audit committee financial expert” as defined by SEC rules and regulations.

The Board has determined that each of the members of our audit committee is independent under Nasdaq listing rules and under Rule 10A-3

under the Exchange Act. We intend to continue to evaluate and comply with the requirements applicable to the audit committee. The principal

duties and responsibilities of our audit committee include:

| |

• |

appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm; |

| |

• |

discussing with our independent registered public accounting firm their independence from management and us; |

| |

• |

reviewing with our independent registered public accounting firm the scope and results of their audit; |

| |

• |

approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm and related fees; |

| |

• |

overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC; |

| |

• |

reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; |

| |

• |

establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal control or auditing matters; |

| |

• |

reviewing our code of business conduct and ethics and recommending any changes to the Board; |

| |

• |

reviewing and approving certain related party transactions; and |

| |

• |

discussing our major financial risk exposures (including those related to data privacy, cybersecurity data security and network security) and management's program to monitor, assess and control such exposures, including our risk assessment and risk management policies. |

Report of the Audit Committee of the Board of Directors

The audit committee reviewed, and discussed with management and Marcum

LLP, our independent registered public accounting firm, our audited consolidated financial statements for the fiscal year ended December

31, 2023. The audit committee received, reviewed and discussed (i) the written disclosures and communications from Marcum LLP regarding

relationships, if any, which might impair Marcum LLP’s independence from management and us, and (ii) all required communications

pertaining to the conduct of the audit, including any difficulties encountered in the course of the audit work, any restrictions on the

scope of activities or access to requested information, and any significant disagreements with management. Based on the foregoing, the

audit committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K

for the fiscal year ended December 31, 2023 and filed with the Securities and Exchange Commission.

/s/ Thomas M. Patton, Chair

/s/ John P. Gandolfo

/s/ Patricia Wilber

The material in this audit committee report is not “soliciting

material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any of our filings

under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation

language in any such filing.

Compensation Committee

Our compensation committee reviews and determines the compensation

of our executive officers. Our compensation committee currently consists of four directors, Dr. Errico, Mr. Gandolfo, Ms. Goldstein and

Dr. Theofilos, each of whom is a non-employee member of the Board as defined in Rule 16b-3 under the Exchange Act. Mr. Gandolfo is the

chairman of the compensation committee. The Board is of the opinion that the composition and functioning of our compensation committee

satisfies the applicable independence and other applicable requirements of Nasdaq and SEC rules and regulations. We intend to continue

to evaluate and comply with the requirements applicable to our compensation committee. The principal duties and responsibilities of our

compensation committee include:

| |

• |

establishing, approving, and making recommendations to the Board regarding performance goals and objectives relevant to the compensation of our Chief Executive Officer, evaluating the performance of our Chief Executive Officer in light of those goals and objectives and recommending to the full Board for approval, the chief executive officer’s compensation, including incentive-based and equity-based compensation, based on that evaluation; |

| |

• |

setting the compensation of our other executive officers, based in part on recommendations of the chief executive officer; |

| |

• |

reviewing, approving, and making recommendations to the Board regarding employment agreements, severance arrangements and change of control agreements for the Chief Executive Officer and other executive officers, as appropriate; |

| |

• |

exercising administrative authority under our stock plans and employee benefit plans; |

| |

• |

establishing policies and making recommendations to the Board regarding director compensation; |

| |

• |

review, approve and oversee the policies and procedures in connection with any compensation clawback policy; |

| |

• |

reviewing compensation plans, programs and policies; and |

| |

• |

handling such other matters that are specifically delegated to the compensation committee by the Board from time to time. |

The compensation committee meets regularly in executive session without

management present. However, from time to time, various members of management and other employees as well as outside advisors or consultants

may be invited by the compensation committee to make presentations, to provide financial or other background information or advice or

to otherwise participate in compensation committee meetings. The Chief Executive Officer may not participate in, or be present during,

any deliberations or determinations of the compensation committee regarding his compensation or individual performance objectives. The

charter of the compensation committee grants the compensation committee the authority to conduct or authorize investigations into any

matters within the scope of its responsibilities as it will deem appropriate. In addition, under its charter, the compensation committee

has the authority to select, retain and terminate, at our expense, advice and assistance from any consultants, independent legal counsel

or other advisors.

The compensation committee also considers matters related to individual

compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the efficacy of our compensation

strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at various meetings throughout

the year. For executives other than the Chief Executive Officer, the compensation committee solicits and considers evaluations and recommendations

submitted to the compensation committee by the Chief Executive Officer with respect to individual employee performance. In the case of

the Chief Executive Officer, the evaluation of his performance is conducted by the compensation committee with input from other independent

Board members, which recommends to the Board any adjustments to his compensation as well as awards to be granted as part of its deliberations,

the compensation committee may review and consider, as appropriate, materials such as financial reports and projections, operational data,

tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical

scenarios, executive and director share ownership information, stock performance data, analyses of historical executive compensation levels

and current Company-wide compensation levels and recommendations of a compensation consultant, including analyses of executive and director

compensation paid at other companies identified by the consultant, or otherwise considered by the Committee, to be comparable to us. During

the year ended December 31, 2023 and 2022, the compensation committee in its discretion did not engage a compensation consultant.

Nominating and Governance Committee

Our nominating and governance committee currently consists of four

directors, Dr. Errico, Ms. Goldstein, Dr. Theofilos and Ms. Wilber. Dr. Errico is the chairman of the nominating and governance committee.

The Board has determined that the composition of our nominating and

governance committee satisfies the applicable independence requirements under, and the functioning of our nominating and governance committee

complies with, the applicable requirements of Nasdaq. The Board also believes that each member of our nominating and governance committee

satisfies the applicable independence requirements of the Nasdaq. We will continue to evaluate and will comply with all future requirements

applicable to our nominating and governance committee. The nominating and governance committee’s responsibilities include:

| |

• |

annually reviewing the list of director selection criteria contained in our corporate governance guidelines, and making recommendations to the Board regarding necessary or appropriate changes thereto; |

| |

• |

identifying, reviewing and evaluating candidates, including candidates submitted by stockholders, for election to the Board and recommending to the Board (i) nominees to fill vacancies or new positions on the Board and (ii) the slate of nominees to stand for election by our stockholders at each annual meeting of stockholders; and |

| |

• |

annually recommending to the Board (i) the assignment of directors to serve on each committee; (ii) the chairman of each committee and (iii) the chairman of the Board or lead independent director, as appropriate; developing, recommending, overseeing the implementation of and monitoring compliance with, our corporate governance guidelines, and periodically reviewing and recommending any necessary or appropriate changes thereto; reviewing the adequacy of our certificate of incorporation and bylaws and recommending to the Board, as conditions dictate, amendments for consideration by the stockholders; and such other matters as directed by the Board. |

The nominating and governance committee believes that candidates for

director should have certain minimum qualifications, which are described in our Corporate Governance Guidelines. The nominating and governance

committee also takes these minimum qualifications into account in identifying and evaluating director nominees, including nominees validly

recommended by stockholders. In identifying director nominees, the nominating and governance committee strives for a diverse mix of backgrounds

and expertise that enhances the ability of the directors collectively to understand the issues facing us and to fulfill the responsibilities

of the Board and its committees. For example, during 2021 and early 2022, the Board and the Committee made a concerted effort to recruit

diverse directors to the Board culminating in the appointment of Ms. Goldstein and Ms. Wilber in March 2022.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of our compensation committee was, during the year

ended December 31, 2023, an officer or employee of ours, was formerly an officer of ours or had any relationship requiring disclosure

by us under Item 404 of Regulation S-K. No interlocking relationship as described in Item 407(e)(4) of Regulation

S-K exists between any of our executive officers or Compensation Committee members, on the one hand, and the executive officers or

compensation committee members of any other entity, on the other hand, nor has any such interlocking relationship existed in the past.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Any interested party may communicate in writing with any particular

director, including our chairman, any committee of the Board, or the directors as a group, by sending such written communication to our

Corporate Secretary at our principal executive offices at 200 Forge Way, Suite 205, Rockaway, NJ 07866. Copies of written communications

received at such address will be provided to the Board or the relevant director unless such communications are considered, in the reasonable

judgment of our Corporate Secretary, to be of a purely marketing nature or inappropriate for submission to the intended recipient(s).

The Corporate Secretary or his designee may analyze and prepare a response to the information contained in communications received and

may deliver a copy of the communication to other Company staff members or agents who are responsible for analyzing or responding to complaints

or requests. Communications concerning potential director nominees submitted by any of our stockholders will be forwarded to the chairman

of the nominating and governance committee.

CODE OF BUSINESS CONDUCT AND ETHICS FOR EMPLOYEES, EXECUTIVE OFFICERS

AND DIRECTORS

We have adopted a Code of Business Conduct and Ethics (the “Code

of Conduct”), applicable to all of our employees, executive officers and directors. The Code of Conduct is available on our website

at www.electrocore.com, under the “Corporate Governance” tab of the “Investors” section. The audit committee

of the Board is responsible for overseeing the Code of Conduct and must approve any waivers of the Code of Conduct for executive officers

and directors. We expect that any amendments to the Code of Conduct, or any waivers of its requirements, will be disclosed on our website.

A copy of the Code of Conduct may be provided to any person without charge upon written request to: electroCore, Inc., Attn: Corporate

Secretary, 200 Forge Way, Suite 205, Rockaway, NJ 07866.

CORPORATE GOVERNANCE GUIDELINES

We have adopted Corporate Governance Guidelines to assure that the

Board has the necessary authority and practices in place to review and evaluate our business operations as needed and can make decisions

that are independent of our management. The guidelines are also intended to align the interests of directors and management with those

of the Company’s stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect

to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation

and succession planning, and board committees and compensation. The Corporate Governance Guidelines, as well as the charters for each

committee of the Board, are available on our website at www.electrocore.com.

PROPOSAL 2 - RATIFICATION

OF SELECTION OF INDEPENDENT AUDITORS

The audit committee of the Board has selected Marcum LLP as our independent

registered public accounting firm for the fiscal year ending December 31, 2024 and has further directed that management submit the selection

of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Marcum LLP has audited

our financial statements since 2020. Representatives of Marcum LLP are expected to be present at the virtual Annual Meeting. They will

have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder

ratification of the selection of Marcum LLP as our independent registered public accounting firm. However, the audit committee is submitting

the selection of Marcum LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify

the selection, the audit committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the audit committee

in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such

a change would be in the best interests of us and our stockholders.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table represents aggregate fees billed to us for the

fiscal years ended December 31, 2023 and December 31, 2022 by Marcum LLP, our principal accountants for these each of these two fiscal

years.

| | |

Year Ended December 31 |

| | |

2023 | |

2022 |

| Audit Fees | |

$ | 332,040 | | |

| 278,000 | |

| Audit-Related Fees | |

| — | | |

| — | |

| Tax Fees | |

| — | | |

| — | |

| Other Fees | |

| — | | |

| — | |

| Total Fees | |

$ | 332,040 | | |

| 278,000 | |

All fees described above were pre-approved by the audit committee.

Audit Fees include fees billed for the fiscal year shown for professional

services for the audit of our annual financial statements, quarterly reviews, and review of our registration statements and other SEC

filings.

PRE-APPROVAL POLICIES AND PROCEDURES

The audit committee has adopted a policy and procedures for the pre-approval

of audit and non-audit services rendered by our independent registered public accounting firm, Marcum LLP. The audit committee generally

pre-approves specified services in the defined categories of audit services, audit-related, tax and other services up to specified amounts.

The terms and fees of the annual engagement of the independent auditor are also subject to the specific pre-approval of the audit committee.

The pre-approval of services may be delegated to subcommittees consisting of one or more of the audit committee’s members, but the

decision must be reported to the full audit committee at its next scheduled meeting.

Required Vote

To be approved, Proposal 2, the ratification of Marcum as independent

auditors, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and

entitled to vote on the matter, and which did not abstain. Abstentions will count towards the quorum requirement for the Annual Meeting

and will not count as a vote for or against the proposal.

THE BOARD UNANIMOUSLY RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 2.

PROPOSAL NUMBER 3 -

NON-BINDING ADVISORY VOTE ON THE COMPANY’S NAMED EXECUTIVE OFFICER COMPENSATION

In accordance with Section 14A of the Exchange Act and the related

rules of the SEC, we are asking our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named

executive officers as disclosed in this proxy statement. This proposal, commonly known as a “Say-on-Pay” proposal, gives our

stockholders the opportunity to express their views on the compensation of our named executive officers. This vote is not intended to

address any specific item of compensation, but rather the overall compensation of our named executive officers and the principles, policies

and practices described in this proxy statement. Accordingly, the following advisory resolution is submitted for stockholder vote at the

Annual Meeting:

RESOLVED, that the stockholders of electroCore, Inc. approve,

on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement pursuant to the compensation