- Reported revenues up 2.7% at £5.469

billion in sterling, up 11.3% at $9.135 billion in dollars and up

6.5% at €6.663 billion in euros

- Constant currency revenues up 11.3%,

like-for-like revenues up 8.7%

- Constant currency net sales up 6.4%,

like-for-like net sales up 4.1%

- Reported billings down 3.0% at

£22.060 billion ravaged by sterling strength, but up 5.7% in

constant currency

- Reported net sales margin of 13.0%,

flat with last year, up 0.3 margin points on a constant currency

basis and up 0.3 margin points like-for-like in line with the full

year margin target

- Headline reported profit before

interest and tax £622 million, down 2.4%, but up 9.0% in constant

currency

- Headline profit before tax £532

million up 1.5%, up 15.6% in constant currency

- Profit before tax £491 million up

15.0%, up 33.7% in constant currency

- Reported profit after tax £396

million up 25.6%, up 47.9% in constant currency

- Headline diluted earnings per share

29.2p up 2.8%, up 17.1% in constant currency

- Reported diluted earnings per share

27.0p up 25.6%, up 47.7% in constant currency

- Dividends per share 11.62p up 10%, a

pay-out ratio of 40% versus 37% last year

- Share buy-backs upped significantly

in line with target to £390 million in the first half, up from £133

million last year, equivalent to 2.3% of the issued share capital

against 1.0% last year

- Targeted dividend pay-out ratio of

45% likely to be achieved this year well ahead of schedule

- Including all associates and

investments, revenues total over $24 billion annually and people

average over 179,000

WPP (NASDAQ:WPPGY) today reported its 2014 Interim Results.

Key figures

£ million

H1 2014

∆ reported1

∆ constant2

H1 2013 Billings

22,060 -3.0%

5.7% 22,736

Revenue

5,469 2.7%

11.3% 5,327

Net sales

4,792 -1.9%

6.4% 4,884

Headline EBITDA3

733 -2.7%

8.1% 753

Headline PBIT4

622 -2.4%

9.0% 637

Net sales margin5

13.0%

-

0.36

13.0%

Profit before tax

491 15.0%

33.7% 427

Profit after tax

396 25.6%

47.9% 315

Headline diluted EPS7

29.2p 2.8%

17.1% 28.4p

Diluted EPS8

27.0p 25.6%

47.7% 21.5p

Dividends per

share 11.62p

10.0% 10.0% 10.56p

First-half and Q2 highlights

- Reported billings decreased by

3.0% to £22.060bn, but up 5.7% in constant currency

- Reported revenue growth of 2.7%,

with like-for-like growth of 8.7%, 2.6% growth from acquisitions

and -8.6% from currency, reflecting the continuing strength of the

pound sterling against the US dollar, Euro and many currencies in

the faster growth markets, as seen in the final quarter of 2013 and

the first half of this year. Quarter two growth has seen

significant improvement over the first quarter of the year

- Reported net sales down 1.9% in

sterling (up 6.3% in dollars and 1.8% in euros), with like-for-like

growth of 4.1%, 2.3% growth from acquisitions and -8.3% from

currency

- Constant currency revenue growth in

all regions and business sectors, characterised by particularly

strong growth geographically in North America, the United Kingdom

and Asia Pacific, Latin America, Africa & the Middle East and

Central and Eastern Europe, and functionally in advertising and

media investment management and sub-sectors direct, digital and

interactive and specialist communications

- Like-for-like net sales growth of

4.1%, an improvement over the first quarter, with the gap

compared to revenue growth widening further in the second quarter,

as the scale of digital media purchases in media investment

management and data investment management revenues increased

- Reported headline EBITDA down

2.7%, with constant currency growth of 8.1%, delivered through

strong like-for-like organic net sales growth and by 0.3 margin

points improvement, with operating costs up 6.2%, rising less than

net sales

- Reported headline PBIT decreased

slightly by 2.4%, but up 9.0% in constant currency with both

constant currency and like-for-like net sales margin, a more

accurate competitive comparator, increasing by 0.3 margin points,

in line with the Group’s full year target

- Reported headline diluted EPS up

2.8%, up 17.1% in constant currency, enabling the payment of a

10% higher interim ordinary dividend of 11.62p, giving a pay-out

ratio of 40% compared with 37% last year. The Group’s targeted

pay-out ratio is 45% over the next two years, which is likely to be

achieved in 2014 well ahead of schedule

- Average net debt decreased by

£348m (+11%) to £2.765 billion compared to last year, at 2014

constant rates, reflecting improvements in working capital and also

the benefit of converting the £450 million Convertible Bond in

mid-2013

- Creative and effectiveness

excellence recognised again in 2014 with the award of the

Cannes Lion to WPP for the most creative Holding Company for the

fourth successive year since the award’s inception and another to

Ogilvy & Mather Worldwide for the third consecutive year as the

most creative agency network. In another rare occurrence in our

industry, Grey was named Global Agency of the Year 2013 by both US

trade magazines Ad Age and Ad Week. For the third consecutive year,

WPP was awarded the EFFIE as the most effective Holding

Company

- Clear number one position in all

net new business tables for the last two and a half years

- Strategy implementation

accelerated even in a dead POG world as sector targets for fast

growth markets and new media raised from 35-40% to 40-45% over next

five years

Current trading and outlook

- July 2014 | July net sales were

up 2.8% like-for-like, against a strong comparative growth rate in

2013 of 4.1%. All regions and sectors were positive, and showed a

similar pattern to the first half, albeit slightly lower overall.

Cumulative like-for-like net sales growth for the first seven

months of 2014 is now 4.0%

- FY 2014 quarter 2 revised

forecast | Increase in like-for-like revenue growth from the

quarter 1 revised forecast, as the scale of digital media purchases

increased, with net sales growth similar at over 3% and a stronger

first half and a similar second half. Headline net sales operating

margin target improvement, as previously, of 0.3 margin points in

constant currency

- Dual Focus in 2014 | 1. Stronger

than competitor revenue and net sales growth due to leading

position in both faster growing geographic markets and digital,

premier parent company creative position, new business,

horizontality and strategically targeted acquisitions; 2. Continued

emphasis on balancing net sales growth with headcount increases and

improvement in staff costs/net sales ratio to enhance operating

margins

- Long-term targets reaffirmed |

Above industry revenue and net sales growth due to geographically

superior position in new markets and functional strength in new

media and data investment management, including data analytics and

the application of new technology; improvement in staff cost/net

sales ratio of 0.2 or more depending on net sales growth; net sales

operating margin expansion of 0.3 margin points or more; and

headline diluted EPS growth of 10% to 15% p.a. from net sales

growth, margin expansion, strategically targeted small and

medium-sized acquisitions and share buy-backs

In this press release not all of the figures and ratios used are

readily available from the unaudited interim results included in

Appendix 1. Where required, details of how these have been arrived

at are shown in the Appendices.

Review of Group results

Revenues Revenue analysis £ million

2014 ∆

reported

∆ constant9

∆ LFL10

acquisitions

2013

First quarter 2,570

1.5% 9.6%

7.0% 2.6% 2,532

Second quarter 2,899

3.7% 12.8%

10.2% 2.6% 2,795

First half 5,469

2.7% 11.3%

8.7% 2.6% 5,327

Net sales analysis

£ million

2014

∆ reported ∆ constant

∆ LFL acquisitions

2013 First quarter

2,283 -1.8% 6.1%

3.8% 2.3%

2,326

Second quarter 2,509

-2.0% 6.8%

4.4% 2.4% 2,558

First half 4,792 -1.9% 6.4% 4.1% 2.3% 4,884

Reported billings were down 3.0% at £22.060 billion, but up 5.7%

in constant currency. Estimated net new business billings of £2.556

billion ($4.089 billion) were won in the first half of the year,

compared with a similar level of £2.613 billion in the first half

of last year, resulting in the Group leading all net new business

tables once again. The Group continues to benefit from

consolidation trends in the industry, winning assignments from

existing and new clients, including several very large

industry-leading advertising, digital and media assignments, the

full benefit of which will be seen in Group revenues later in 2014

and in 2015. Pitch results following recent pharmaceutical client

consolidations have benefited the Group’s healthcare communications

businesses significantly.

Reportable revenue was up 2.7% at £5.469 billion. Revenue on a

constant currency basis was up 11.3% compared with last year, the

difference to the reportable number reflecting the continuing

strength of the pound sterling against the US dollar, Euro and many

currencies in the faster growth markets, as seen in the final

quarter of 2013 and the first half of this year. As a number of our

current competitors report in US dollars and in euros, appendices 2

and 3 show WPP’s interim results in reportable US dollars and euros

respectively. This shows that US dollar reportable revenues were up

11.3% to $9.135 billion, which compares with the $7.373 billion of

our closest current competitor and euro reportable revenues were up

6.5% to €6.663 billion, which compares with €3.358 billion of our

nearest current European-based competitor.

On a like-for-like basis, which excludes the impact of

acquisitions and currency, revenues were up 8.7% in the first half,

with net sales up 4.1%, with the gap compared to revenue growth

widening further in the second quarter, as the scale of digital

media purchases in media investment management and data investment

management revenues increased. In the second quarter, like-for-like

revenues were up 10.2%, a significant strengthening over the first

quarter’s 7.0%, with net sales also further strengthening up 4.4%,

following 3.8% in the first quarter giving 4.1% for the first half.

Client data continues to reflect increased advertising and

promotional spending – with the former tending to grow faster than

the latter, which from our point of view is more positive – across

most of the Group’s major geographic and functional sectors.

Quarter two saw a continuation of the strength of advertising

spending in fast moving consumer goods, especially. Nonetheless,

clients understandably continue to demand increased effectiveness

and efficiency, i.e. better value for money. Although corporate

balance sheets are much stronger than pre-Lehman and confidence is

higher as a result, the Eurozone, Middle East, BRICs hard or soft

landing and US deficit uncertainties still demand caution. The now

over $7 trillion net cash lying virtually idle in those balance

sheets, still seems destined to remain so, with companies, even

after the recent upturn in merger activity, unwilling to attempt

excessive acquisition risk (except perhaps in our own industry) or

expand capacity, particularly in mature markets.

Operating profitability

Reported headline EBITDA was down 2.7% to £733 million, up 8.1%

in constant currency. Reported headline operating profit was down

2.4% to £622 million from £637 million, but up 9.0% in constant

currency. As has been noted before, our profitability tends to be

more skewed to the second half of the year compared with some of

our competitors, for reasons which we do not yet understand.

Reported headline net sales operating margins were flat with the

first half of last year at 13.0%, up 0.3 margin points in constant

currency, in line with the Group’s full year margin target of a 0.3

margin points improvement on a constant currency basis. On a

like-for-like basis, operating margins were also up 0.3 margin

points.

Given the significance of data investment management revenues to

the Group, with none of our direct parent company competitors

significantly present in that sector, net sales are a more

meaningful measure of competitive comparative top line and margin

performance. This is because data investment management revenues

include pass-through costs, principally for data collection, on

which no margin is charged and with the growth of the internet, the

process of data collection becomes more efficient. In addition, the

Group’s media investment management sub-sector is increasingly

buying digital media on its own account and, as a result, the

subsequent billings to clients have to be accounted for as revenue,

as well as billings. Thus, revenues and the rate of growth of

revenues will increase, although net sales and the growth rate of

net sales will remain unaffected and the latter will present a

clearer picture of underlying performance. Because of these two

significant factors, the Group, whilst continuing to report revenue

and revenue growth, will focus even more on net sales and the net

sales operating margin in the future. In the first half, as noted

above, the constant currency and like-for-like headline net sales

margin was up 0.3 margin points.

On a reported basis, net sales operating margins, before all

incentives11, were 15.3%, down 0.4 margin points, compared with

15.7% last year. The Group’s staff cost to net sales ratio,

including incentives, increased by 0.1 margin points to 66.6%

compared with 66.5% in the first half of 2013. On a constant

currency basis, however, net sales margins, before all incentives,

were 15.4%, flat with the first half of 2013, and the staff cost to

net sales ratio, including incentives, was down 0.2 margin points

to 66.5% compared with 66.7% in the first half of 2013. This

reflected better staff cost to net sales ratio management, through

better control of the growth of staff numbers and salary and

related costs, as compared to net sales, than in the first half of

2013.

Operating costs

In the first half of 2014, reported operating costs12 fell by

1.8% and were up by 6.2% in constant currency, compared with

reported net sales down 1.9% and constant currency growth of 6.4%.

Reported staff costs excluding all incentives were up 0.5 margin

points at 64.3% of net sales and up 0.3 margin points in constant

currency. Incentive costs amounted to £113.0 million or 16.0% of

headline operating profits before incentives and income from

associates, compared to £127.9 million last year, or 17.4%, a

decrease of £14.9 million or 11.6%. Target incentive funding is set

at 15% of operating profit before bonus and taxes, maximum at 20%

and in some instances super-maximum at 25%. Severances were £27.5

million in the first half, up £9.4 million on last year. Variable

staff costs were 6.5% of revenues and 7.4% of net sales, at the

higher end of historical ranges and, again, reflecting good staff

cost management and flexibility in the cost structure.

On a like-for-like basis, the average number of people in the

Group, excluding associates, was 120,102 in the first half of the

year, compared to 118,315 in the same period last year, an increase

of 1.5%. On the same basis, the total number of people in the

Group, excluding associates, at 30 June 2014 was 121,883, up only

1.7% compared to 119,801 at 30 June 2013, and up only 808, or 0.7%,

on 121,075 at 1 January 2014, reflecting careful control of

headcount increases. On the same basis revenues increased 8.7%,

with net sales up 4.1%.

Interest and taxes

Net finance costs (excluding the revaluation of financial

instruments) were £90.4 million compared to £113.3 million in the

first half of 2013, a decrease of £22.9 million, reflecting lower

levels of average net debt and higher income from investments.

The headline tax rate was 20.0% (2013 21.8%). The tax rate on

reported profit before tax was 19.3% (2013 26.2%).

Earnings and dividend

Reported headline profit before tax was up 1.5% to £532 million

from £524 million and up 15.6% in constant currency.

Reported profit before tax rose by 15.0% to £491 million from

£427 million, or up 33.7% in constant currency. Reported profits

attributable to share owners rose by 29.9% to £365 million from

£281 million. In constant currency, profits attributable to share

owners rose by 53.3%.

Reported diluted headline earnings per share rose by 2.8% to

29.2p from 28.4p. In constant currency, diluted headline earnings

per share on the same basis rose by 17.1%. Diluted reported

earnings per share rose by 25.6% to 27.0p from 21.5p and by 47.7%

in constant currency.

As outlined in the June 2013 AGM statement, the Board gave

consideration to the merits of increasing the dividend pay-out

ratio from the then current level of approximately 40% to between

45% and 50%. Following that review, the Board decided to target a

further increase in the pay-out ratio to 45% over the next two

years and, as a result, declared an increase of 20% in the 2013

final dividend to 23.65p per share, which together with the interim

dividend of 10.56p per share, made a total of 34.21p per share for

2013, an overall increase of 20%. This represented a dividend

pay-out ratio of 42%, compared to a pay-out ratio of 39% in 2012.

Given your Company’s better than expected progress, your Board

believes it is likely we will reach the targeted dividend pay-out

ratio of 45% in 2014, one year ahead of the anticipated date and,

as a result, declares an increase of 10% in the interim dividend to

11.62p per share, compared with the 2.8% growth in reported diluted

headline earnings per share and reported earnings per share up

24.2%. The dividend pay-out ratio for the first half is, therefore,

40%, reflecting the stronger weighting of the final dividend,

against 37% last year. The record date for the interim dividend is

10 October 2014, payable on 10 November 2014. Further details of

WPP’s financial performance are provided in Appendices 1, 2 and

3.

Regional review

The pattern of revenue and net sales growth differed regionally.

The tables below give details of revenue and net sales and revenue

and net sales growth by region for the second quarter and first

half of 2014, as well as the proportion of Group revenues and net

sales and operating profit and operating margin by region;

Revenue analysis

£ million

Q2 2014

∆ reported

∆ constant13

∆ LFL14

% group

Q2 2013

% group N. America

963 0.9% 10.9%

11.4% 33.2%

954 34.2% United Kingdom

426 21.7% 21.7%

19.2% 14.7%

350 12.5% W. Cont. Europe

653 -2.1%

3.1% 1.7% 22.5%

667 23.8%

AP, LA, AME, CEE15

857 4.0%

19.4% 11.9%

29.6% 824 29.5%

Total

Group 2,899 3.7% 12.8% 10.2%

100.0% 2,795 100.0%

£ million

H1 2014 ∆ reported

∆ constant ∆ LFL

% group

H1 2013

% group N. America 1,878

2.1% 11.1%

10.4% 34.4% 1,840

34.5% United Kingdom

784 17.2%

17.2% 15.2% 14.3%

669 12.6% W. Cont. Europe

1,244 -1.1%

3.6% 2.6%

22.7% 1,258 23.6% AP, LA,

AME, CEE 1,563

0.2% 15.4% 8.7%

28.6% 1,560

29.3%

Total Group 5,469 2.7%

11.3% 8.7% 100.0% 5,327 100.0%

Net sales analysis

£ million

Q2 2014 ∆ reported

∆ constant ∆ LFL

% group

Q2 2013

% group N. America 851

-5.8% 3.6%

4.1% 33.9% 903

35.3% United Kingdom

349 8.2% 8.2%

6.5% 13.9%

322 12.6% W. Cont. Europe

548 -4.3%

0.8% -0.3% 21.9%

573 22.4% AP, LA, AME, CEE

761 0.1%

15.0% 7.5%

30.3% 760 29.7%

Total

Group 2,509 -2.0% 6.8% 4.4%

100.0% 2,558 100.0%

£ million

H1 2014 ∆ reported

∆ constant ∆ LFL

% group

H1 2013

% group N. America 1,678

-3.7% 4.8%

4.3% 35.0% 1,743

35.7% United Kingdom

665 8.4%

8.4% 6.9% 13.9%

613 12.5% W. Cont. Europe

1,052 -3.3%

1.3% 0.6%

22.0% 1,089 22.3% AP, LA,

AME, CEE 1,397

-3.0% 11.9% 5.5%

29.1% 1,439

29.5%

Total Group 4,792 -1.9%

6.4% 4.1% 100.0% 4,884 100.0%

Operating profit analysis (Headline

PBIT)

£ million

H1 2014 % margin

H1 2013 % margin N.

America 250 14.9%

255 14.6% United Kingdom

91 13.7%

85 13.9% W. Cont. Europe

98 9.3%

100 9.2% AP, LA, AME, CEE

183 13.1%

197 13.7%

Total Group 622

13.0% 637 13.0%

North America like-for-like net sales growth increased

4.1% in the second quarter, slightly down on the first quarter

growth of 4.4%, with a slight decline in the rate of growth in the

Group’s advertising and media investment management and healthcare

communications businesses, largely offset by stronger growth in the

Group’s data investment management, public affairs and public

relations and specialist communications businesses, which include

direct, digital and interactive.

United Kingdom net sales were up 6.5% like-for-like in

the second quarter, similar to the first quarter, with YTD growth

of 6.9%. There was continuing strong growth in the Group’s media

investment management businesses, with growth accelerating in the

Group’s direct, digital and interactive, public relations and

public affairs and specialist communications agencies, offset by

some softening in data investment management, healthcare

communications and branding & identity.

Western Continental Europe, which although very

challenged from a macro-economic point of view, maintained positive

growth in the second quarter, albeit at a slower rate, as it did in

the first quarter, with like-for-like revenue growth of 1.7%. The

Netherlands, Portugal, Spain and Turkey showed strong growth in the

second quarter but Austria, Belgium, Greece, Ireland, Italy and

Switzerland remain difficult. Net sales slipped back slightly in

the second quarter, down 0.3% compared with 1.7% growth in the

first quarter. France, Greece, Portugal, Spain and Turkey improved

over the first quarter, but Germany, the Netherlands, Denmark,

Norway, Belgium, Switzerland and Italy were slower. By sector,

advertising and media investment management improved over the first

quarter, offset by a slower rate of growth in the Group’s data

investment management, public relations and public affairs and

direct, digital and interactive businesses.

Asia Pacific, Latin America, Africa & the Middle East and

Central and Eastern Europe, improved significantly in the

second quarter, with like-for-like revenue growth of 11.9%, more

than double that of the first quarter growth of 5.2%, driven by

strong growth in Asia Pacific and Central and Eastern Europe. The

BRICs16 and Next 1117 parts of Asia

Pacific and the MIST18 showed strong growth. Net

sales growth also improved in the second quarter, with

like-for-like growth of 7.5% compared with 3.2% in the first

quarter, and the improvement in Asia Pacific driven largely by

gains in the Group’s media investment management, data investment

management and direct, digital and interactive businesses in

Greater China, India and Pakistan.

In Central and Eastern Europe, like-for-like net sales

were up almost 14% compared with 1% in the first quarter, with

double digit growth across several markets including Poland and the

Czech Republic. Russia also performed strongly despite the current

political tensions, but the Ukraine, understandably, saw continued

softness.

Due to the first half of 2014 being seasonally lower, as usual,

than the second half and also due to sterling’s strength, 29.1% of

the Group’s net sales came from Asia Pacific, Latin America, Africa

and the Middle East and Central and Eastern Europe, slightly down

on the same period last year, but up over 1.0 margin point compared

with the first quarter. This is against the Group’s revised

strengthened strategic objective of 40-45% over the next five

years.

Business sector review

The pattern of revenue and net sales growth also varied by

communications services sector and operating brand. The tables

below give details of revenue and net sales, revenue and net sales

growth by communications services sector, as well as the proportion

of Group revenues and net sales for the second quarter and first

half of 2014 and operating profit and operating margin by

communications services sector;

Revenue analysis

£ million

Q2 2014

∆ reported ∆ constant

∆ LFL

% group

Q2 2013

% group

AMIM19

1,302 12.2%

22.7% 19.4%

44.9% 1,161 41.5%

Data Inv. Mgt.20

611 -6.0%

1.7% 2.6%

21.1% 651 23.3%

PR & PA21

223 -5.6%

2.6% 2.8%

7.7% 236 8.5%

BI, HC & SC 22

763 2.0%

10.6% 4.9%

26.3% 747 26.7%

Total

Group 2,899 3.7% 12.8% 10.2%

100.0% 2,795 100.0%

£ million

H1 2014 ∆ reported

∆ constant ∆ LFL % group

H1 2013 % group

AMIM 2,391 9.0%

18.9% 16.4%

43.7% 2,193 41.2%

Data Inv. Mgt. 1,177

-5.0% 2.6% 1.8%

21.5% 1,238

23.2% PR & PA 435

-4.9% 2.7%

2.3% 8.0% 458

8.6% BI, HC & SC

1,466 1.9% 9.9%

5.0% 26.8%

1,438 27.0%

Total Group 5,469

2.7% 11.3% 8.7% 100.0% 5,327

100.0%

Net sales analysis

£ million

Q2 2014

∆ reported ∆ constant

∆ LFL % group

Q2 2013 % group AMIM

1,120 -0.9%

8.6% 6.1% 44.6%

1,129 44.1% Data Inv. Mgt.

436 -8.0%

-0.4% 1.7% 17.4%

474 18.5% PR & PA

221 -4.9% 3.4%

3.5% 8.8%

232 9.1% BI, HC & SC

732 1.2% 9.9%

3.8% 29.2%

723 28.3%

Total Group 2,509

-2.0% 6.8% 4.4% 100.0% 2,558

100.0%

£

million

H1 2014

∆ reported ∆ constant

∆ LFL % group

H1 2013 % group AMIM

2,118 -1.2%

7.8% 5.9% 44.2%

2,144 43.9% Data Inv. Mgt.

843 -6.3%

1.1% 1.2%

17.6% 899 18.4% PR &

PA 430 -4.5%

3.2% 2.7%

9.0% 451 9.2% BI,

HC & SC 1,401

0.8% 8.9% 3.8%

29.2% 1,390

28.5%

Total Group 4,792 -1.9% 6.4%

4.1% 100.0% 4,884 100.0%

Operating profit analysis

(PBIT)

£ million

H1 2014 % margin

H1 2013 % margin AMIM

312 14.7%

315 14.7% Data Inv. Mgt.

88 10.5%

93 10.4% PR & PA

65 15.0% 60

13.2% BI, HC & SC

157 11.2% 169

12.2%

Total Group 622

13.0% 637 13.0%

Advertising and Media Investment Management

As in the first quarter, advertising and media investment

management remains the strongest performing sector. Constant

currency net sales grew by 8.6% in the second quarter, an

acceleration over the 7.0% growth seen in the first quarter.

Like-for-like growth was 6.1%, a slight increase over the first

quarter growth of 5.7%. The rate of growth in the Group’s

advertising businesses was slower than the first quarter,

principally in North America and the United Kingdom, more than

offset by the increased rate of growth in the Group’s media

investment management businesses, principally in Asia Pacific as

noted above. Of the Group’s advertising networks, as in the first

quarter, Grey in particular, continued their strong performance,

especially in North America. Growth in the Group’s media investment

management businesses has been consistently strong over the last

three years and this has continued into the first half of 2014,

with constant currency net sales growth almost 12% for the first

half and like-for-like growth up over 10%.

The Group gained a total of £2.556 billion ($4.089 billion) in

net new business wins (including all losses and excluding

retentions) in the first half, compared to £2.613 billion ($4.180

billion) in the same period last year. Of this, J. Walter Thompson

Company (celebrating its 150th Anniversary year with a return to

its original name), Ogilvy & Mather Worldwide, Y&R, Grey

and United generated net new business billings of £431 million

($690 million). Also, out of the Group total, GroupM, the Group’s

media investment management company (which includes Mindshare, MEC,

MediaCom, Maxus, GroupM Search and Xaxis), together with

tenthavenue, generated net new business billings of £1.759 billion

($2.815 billion). This new business performance ranks top of the

class in all new business surveys in the first half, as in the last

two years.

On a reportable basis, net sales margins were flat at 14.7%,

reflecting the impact of the strength of sterling on high margin

markets, but up 0.3 margin points on a constant currency basis.

Data Investment Management

On a constant currency basis, data investment management net

sales decreased 0.4% in the second quarter, as a result of the sale

of the call centre business in the United States in April.

Like-for-like net sales were up 1.7% compared with 0.6% in the

first quarter. In the second quarter, all regions except the United

Kingdom and Western Continental Europe grew, with a significant

improvement in North America, Asia Pacific, Africa and Central

& Eastern Europe. The faster growing markets of Asia Pacific,

Latin America, Africa and the Middle East maintained the strong

growth seen in the first quarter, with like-for-like net sales up

over 6% in the first half. Constant currency net sales margins

improved strongly by 0.8 margin points, partly reflecting the

improved performance in North America and in the faster growing

markets and a minor benefit from restructuring.

Public Relations and Public Affairs

In constant currency, public relations and public affairs net

sales increased 3.4% in the second quarter, compared with 2.9% in

the first quarter. Like-for-like net sales were up 3.5%, a

significant improvement over the first quarter growth of 1.9%,

reflecting stronger growth in North America and the United Kingdom.

Burson-Marsteller, Cohn & Wolfe and the specialist public

relations and public affairs businesses performed particularly

well. Constant currency net sales margins improved by 1.9 margin

points and by 1.8 margin points on a reportable basis, with

Burson-Marsteller, Cohn & Wolfe and the specialist businesses

showing improved margins in the first half.

Branding and Identity, Healthcare and Specialist

Communications

At the Group’s branding and identity, healthcare and specialist

communications businesses (including direct, digital and

interactive) constant currency net sales grew strongly at 9.9% in

the second quarter, with like-for-like growth of 3.8%, similar to

the first quarter growth of 3.7%. On a like-for-like basis the

Group’s direct, digital and interactive and specialist

communications businesses performed strongly in the second quarter

with the Group’s branding and identity and healthcare agencies

slower. Like-for-like, digital revenues now account for almost 36%

of Group revenues and grew by 12.7% in the first half and net sales

by 7.7%. Constant currency net sales margins for this sector as a

whole were down 0.6 margin points, reflecting pressure in branding

and identity and higher severances.

Associates, Investments, People, Countries, Clients,

Horizontality

Including 100% of associates and investments, the Group has

annual revenues of over $24 billion and over 179,000 full-time

people in over 3,000 offices in 110 countries. The Group,

therefore, has access to an unparalleled breadth and depth of

marketing communications resources. It services 342 of the Fortune

Global 500 companies, all 30 of the Dow Jones 30, 68 of the NASDAQ

100 and 716 national or multi-national clients in three or more

disciplines. 451 clients are served in four disciplines and these

clients account for almost 53% of Group revenues. This reflects the

increasing opportunities for co-ordination between activities, both

nationally and internationally. The Group also works with 371

clients in 6 or more countries. The Group estimates that well over

a third of new assignments in the first half of the year were

generated through the joint development of opportunities by two or

more Group companies. Horizontality, or making sure our people in

different disciplines work together, is clearly becoming an

increasingly important part of client strategies, particularly as

they continue to invest in brand in slower-growth markets and both

capacity and brand in faster-growth markets.

Cash flow highlights

In the first half of 2014, operating profit was £531 million,

depreciation, amortisation and impairment £185 million, non-cash

share-based incentive charges £54 million, net interest paid £125

million, tax paid £134 million, capital expenditure £95 million and

other net cash outflows £3 million. Free cash flow available for

working capital requirements, debt repayment, acquisitions, share

re-purchases and dividends was, therefore, £413 million.

This free cash flow was absorbed by £222 million in net cash

acquisition payments and investments (of which £15 million was for

earnout payments with the balance of £207 million for investments

and new acquisitions payments) and £390 million in share

re-purchases, a total outflow of £612 million. This resulted in a

net cash outflow of £199 million, before any changes in working

capital and also reflects our strategic objectives of investing

£300-£400 million annually in acquisitions and investments and

increasing share buy-backs from 1-2% of the issued share capital to

2-3%.

A summary of the Group’s unaudited cash flow statement and notes

as at 30 June 2014 is provided in Appendix 1.

Acquisitions

In line with the Group’s strategic focus on new markets, new

media and data investment management, the Group completed 36

transactions in the first half; 20 acquisitions and investments

were in new markets and 29 in quantitative and digital. Of these,

13 were in both new markets and quantitative and digital.

Specifically, in the first six months of 2014, acquisitions and

increased equity stakes have been completed in advertising and

media investment management in Canada, the United Kingdom,

France, the Netherlands, Poland, Russia, Turkey, the Middle East,

South Africa, Peru, Australia, China, India and Vietnam; in data

investment management in Italy, the Netherlands, Romania,

Spain, the Kingdom of Saudi Arabia and the United Arab Emirates;

in public relations and public affairs in China; in

direct, digital and interactive in the United States, the

United Kingdom, China and Vietnam.

A further five acquisitions and investments were made in July

and so far in August, with two in advertising and media

investment management in Africa and India; two in data

investment management in the United Kingdom; and one in

direct, digital and interactive in the United States. Two

further acquisitions will be announced today, the first in media

investment management in France and the second in the United States

in data investment management.

Balance sheet highlights

Average net debt in the first six months of 2014 was £2.765

billion, compared to £3.113 billion in 2013, at 2014 exchange

rates. This represents a decrease of £348 million, continuing to

reflect improvements in the levels of working capital in the second

half of 2013 and also the benefit of converting the £450 million

Convertible Bond in mid-2013. On 30 June 2014 net debt was £2.957

billion, against £2.717 billion on 30 June 2013, an increase of

£240 million. The increased net debt figure reflects significant

incremental net acquisition spend of £116 million and incremental

share re-purchases of £257 million, more than offsetting the

relative improvement in working capital.

In July, the Group increased the size and extended the maturity

of its Revolving Credit Facilities from $1.2 billion and £475

million due November 2016 to $2.5 billion due July 2019.

Your Board continues to examine the allocation of its EBITDA of

£1.9 billion or over $3.0 billion, for the preceding twelve months

and substantial free cash flow of over £1.2 billion, or

approximately $2.0 billion per annum, also for the previous twelve

months, to enhance share owner value. The Group’s current market

value of £16.4 billion implies an EBITDA multiple of 8.7 times, on

the basis of the trailing 12 months EBITDA to 30 June 2014.

Including net debt at 30 June of £2.957 billion, the Group’s

enterprise value to EBITDA multiple is 10.3 times. The Group’s free

cash flow multiple is 13.2 times for the same period.

A summary of the Group’s unaudited balance sheet and notes as at

30 June 2014 is provided in Appendix 1.

Return of funds to share owners

Following the decision in June 2013 to increase the dividend

pay-out ratio of approximately 40% to 45% over the next two years

and this year’s strong first-half results, your Board raised the

interim dividend by 10%, a pay-out ratio in the first half of 40%.

This reflects the relative absolute size and weighting of the final

dividend.

During the first six months of 2014, 31.3 million shares, or

2.3% of the issued share capital, were purchased at a cost of £390

million and an average price of £12.49 per share.

Current trading

July net sales were up 2.8% like-for-like, against a strong

comparative growth rate in July 2013 of 4.1%. All regions and

sectors were positive, and showed a similar pattern to the first

half, albeit slightly slower. Cumulative like-for-like net sales

growth for the first seven months of 2014 is now 4.0%. The Group's

quarter 2 revised forecasts, having been reviewed at the parent

company level in the first half of August, indicate full year

like-for-like net sales growth of over 3%, similar to the quarter 1

revised forecast and with a stronger first half and similar second

half.

Outlook

Macroeconomic and industry context

Following the Group’s record year in 2013, 2014 has started

stronger with a similar pattern to the final quarter of 2013, and

with all geographies and sectors growing revenues and net sales on

both a constant currency and like-for-like basis. Like-for-like net

sales were up 4.1% in the first half compared with 3.8% in the

first quarter of 2014 and 4.3% in the fourth quarter of last year,

which together with quarter three were the strongest quarters of

last year. Our operating companies are still hiring cautiously and

responding to any geographic, functional and client changes in

revenues and net sales – positive or negative. On a constant

currency basis, operating profit is above budget and well ahead of

last year and the increase in the net sales margin is in line with

the Group’s full year target of a 0.3 margin point improvement.

Concerns still remain globally over the four, largely

geo-political, “grey swans” (known unknowns), with perhaps even six

now in the case of the United Kingdom. They include the continuing

fragility of the Eurozone, for example, with the recently

disappointing GDP growth, or lack of growth from Italy and France;

the prospects for the Middle East, now considerably worse than a

year ago; a Chinese or BRICs hard or soft landing, with most, if

not all suffering a slowdown in 2013, and which continued into the

first half of 2014; and, probably still most importantly, dealing

with the US deficit and a record $16 trillion of debt, together

with tapering, in the most effective way. In addition, although

more parochially, the political decisions in the United Kingdom on

Scottish devolution and Britain’s membership of the European Union,

add further uncertainty to the United Kingdom economy. Very

recently, all these concerns have been heightened by the emergence

of three, again largely geo-political, “black swans” (unknown

unknowns). First, during the World Economic Forum last January, the

re-emergence of Sino/Japanese tensions over the Diaoyu/Senkaku

Islands; secondly, the crisis in the Ukraine and the consequential

Russian sanctions; and, thirdly, the most recent terrible conflicts

in Iraq and Gaza. All in all, whilst clients may be more confident

than they were in September 2008, they broadly remain unwilling to

take further risks, particularly given so many political flash

points. They remain focussed on a strategy of adding capacity and

brand building in both fast growth geographic and functional

markets, like digital and containing or reducing capacity, perhaps

with brand building to maintain or increase market share, in the

mature, slow growth markets. In addition, in a sub-pre-Lehman trend

world, they understandably, but perhaps inadvisedly, remain

focussed, on achieving their profitability objectives by cutting

costs, rather than by growing the top-line. The recent surge of

merger and acquisition activity, although to some extent driven by

tax considerations, may reflect a concern that cost reduction

opportunities may be close to being exhausted and that growth by

acquisition may need to be tapped.

The pattern for 2014 looks very similar to 2013, perhaps with

slightly increased client confidence, enhanced by slightly stronger

global GDP growth forecasts. These forecasts reflect the

mini-quadrennial events of the Winter Olympics at Sochi, the FIFA

World Cup in Brazil (which did position perceptions of Brazil and

Latin America, overall positively, just as the Beijing Olympics did

for China, the World Cup did for South Africa and London 2012 did

for the United Kingdom) and the mid-term Congressional elections in

the United States. Forecasts of worldwide real GDP growth still

hover around 2.7%, with inflation of 2.3% giving nominal GDP growth

of around 5.0% for 2014, a percent or so increase on 2013, although

they have been reduced recently and may be reduced further in due

course. Advertising as a proportion of GDP should at least remain

constant overall, although it is still at relatively depressed

historical levels, particularly in mature markets, post-Lehman and

advertising should grow at least at a similar rate as GDP, buoyed

by incremental branding investments in the under-branded faster

growing markets. Although both consumers and corporates seem to be

increasingly cautious and risk averse, they should continue to

purchase or invest in brands in both fast and slow growth markets

to stimulate top line sales growth. Merger and acquisition activity

may be regarded as an alternative way of doing this, particularly

funded by cheap long-term debt and for tax inversion reasons, but

we believe clients may ultimately regard this as a more risky way

than investing in marketing and brand and hence growing market

share, particularly given the variability or flexibility of

marketing spend.

All in all, however, on a reportable basis, 2014 looks likely to

be another demanding year, as a strong United Kingdom pound and

weak faster growth market currencies continue to take their toll on

our reported results. But, if budgets and quarter two revised

forecasts are met, 2014 will be another strong year, as the first

half results demonstrate. Current nominal worldwide GDP forecasts

for 2015 indicate a similar growth rate at around 5.4%. This

suggests that 2015 should be another good year for our industry,

despite the absence of any mini- or maxi-quadrennial events.

In addition, it is particularly pleasing to report continuing

progress for the Group’s creative and effectiveness excellence with

the award of the Cannes Lion to WPP for the most creative Holding

Company for the fourth successive year since the award’s inception

and another to Ogilvy & Mather Worldwide for the third

consecutive year as the most creative agency network. In another

rare occurrence in our industry, Grey was named Global Agency of

the Year 2013 by both US trade magazines Ad Age and Adweek. For the

third consecutive year, WPP was also awarded the EFFIE as the most

effective Holding Company.

Financial guidance

For 2014, reflecting the first half net sales growth and quarter

2 revised forecasts:

- Like-for-like net sales growth of over

3.0%

- Target operating margin to net sales

improvement of 0.3 margin points on a constant currency basis in

line with full year margin target

In 2014, our prime focus will remain on growing revenues and net

sales faster than the industry average, driven by our leading

position in the new markets, in new media, in data investment

management, including data analytics and the application of

technology, creativity and horizontality. At the same time, we will

concentrate on meeting our operating margin objectives by managing

absolute levels of costs and increasing cost flexibility, in order

to adapt our cost structure in case of significant market changes.

The initiatives taken by the parent company in the areas of human

resources, property, procurement, information technology and

practice development continue to improve the flexibility of the

Group’s cost base. Flexible staff costs (including incentives,

freelance and consultants) remain close to historical highs of

around 6.5% of revenues or 7.4% of net sales and continue to

position the Group extremely well should current market conditions

deteriorate.

The Group continues to improve co-operation and co-ordination

among its operating companies in order to add value to our clients’

businesses and our people’s careers, an objective which has been

specifically built into short-term incentive plans. We have, in

addition, decided that a significant proportion of operating

company incentive pools will be funded and allocated on the basis

of Group-wide performance this year and over the coming years. This

will stimulate co-operative behaviour even more. Horizontality has

been accelerated through the appointment of 40 global client

leaders for our major clients, accounting for over one third of

total revenues in 2013 of $17 billion and of 16 country and

sub-regional managers already covering 50 of 110 countries in a

growing number of test markets and sub-regions. Emphasis has been

laid on the areas of media investment management, healthcare,

sustainability, government, new technologies, new markets,

retailing, sport, shopper marketing, internal communications,

financial services and media and entertainment. The Group continues

to lead the industry, in co-ordinating investment geographically

and functionally through parent company initiatives and winning

Group pitches. For example, the Group has been very successful in

the recent wave of consolidation in the pharmaceutical and shopper

marketing industries and the resulting "team" pitches and a number

of others, which combined creative and media assignments.

Our business remains geographically and functionally well

positioned to compete successfully and to deliver on our long-term

targets:

- Revenue and net sales growth greater

than the industry average

- Improvement in net sales margin of 0.3

margin points or more, excluding the impact of currency, depending

on net sales growth and staff cost to net sales ratio improvement

of 0.2 margin points or more

- Annual headline diluted EPS growth of

10% to 15% per annum delivered through revenue growth, margin

expansion, acquisitions and share buy-backs

To access WPP's 2014 interim results financial tables, please

visit: http://www.wpp.com/investor

This announcement has been filed at the Company Announcements

Office of the London Stock Exchange and is being distributed to all

owners of Ordinary shares and American Depository Receipts. Copies

are available to the public at the Company’s registered office.

The following cautionary statement is included for safe harbour

purposes in connection with the Private Securities Litigation

Reform Act of 1995 introduced in the United States of America. This

announcement may contain forward-looking statements within the

meaning of the US federal securities laws. These statements are

subject to risks and uncertainties that could cause actual results

to differ materially including adjustments arising from the annual

audit by management and the Company’s independent auditors. For

further information on factors which could impact the Company and

the statements contained herein, please refer to public filings by

the Company with the Securities and Exchange Commission. The

statements in this announcement should be considered in light of

these risks and uncertainties.

1 Percentage change in reported sterling 2 Percentage change

at constant currency rates 3 Headline earnings before interest,

tax, depreciation and amortisation 4 Headline profit before

interest and tax 5 Headline profit before interest and tax, as a

percentage of net sales 6 Margin points 7 Diluted earnings per

share based on headline earnings 8 Diluted earnings per share based

on reported earnings 9 Percentage change at constant currency

exchange rates 10 Like-for-like growth at constant currency

exchange rates and excluding the effects of acquisitions and

disposals 11 Short and long-term incentives and the cost of

share-based incentives 12 Excludes direct costs, goodwill

impairment, amortisation and impairment of acquired intangibles,

investment gains and write-downs, gains on re-measurement of equity

interests on acquisition of controlling interest and restructuring

cost s 13 Percentage change at constant currency rates 14

Like-for-like growth at constant currency exchange rates and

excluding the effects of acquisitions and disposals 15 Asia

Pacific, Latin America, Africa & Middle East and Central &

Eastern Europe 16 Brazil, Russia, India and China (accounting for

over $1.3 billion revenues, including associates, in the first

half) 17 Bangladesh, Egypt, Indonesia, South Korea, Mexico,

Nigeria, Pakistan, Philippines, Vietnam and Turkey - the Group has

no operations in Iran (accounting for over $430 million revenues,

including associates, in the first half) 18 Mexico, Indonesia,

South Korea and Turkey (accounting for over $325 million revenues,

including associates, in the first half) 19 Advertising, Media

Investment Management 20 Data Investment Management 21 Public

Relations & Public Affairs 22 Branding and Identity, Healthcare

and Specialist Communications

WPPSir Martin Sorrell, Paul Richardson, Chris Sweetland, Feona

McEwan, Chris Wade+44 20 7408 2204orKevin McCormack, Fran

Butera+1-212-632-2235orBelinda Rabano, +86 1360 1078

488www.wppinvestor.com

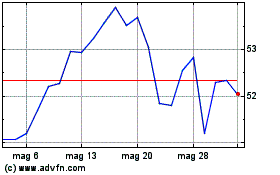

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024