FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of

Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of January 2016

Commission File Number: 0-16350

WPP PLC

(Translation of registrant’s name into English)

27 Farm Street, London W1J 5RJ, England

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted

solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is

not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Forward-Looking Statements

In connection with the provisions of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”), the Company may include

forward-looking statements (as defined in the Reform Act) in oral or written public statements issued by or on behalf of the Company. These forward-looking statements may include, among other things, plans, objectives, projections and anticipated

future economic performance based on assumptions and the like that are subject to risks and uncertainties. As such, actual results or outcomes may differ materially from those discussed in the forward-looking statements. Important factors that may

cause actual results to differ include but are not limited to: the unanticipated loss of a material client or key personnel, delays or reductions in client advertising budgets, shifts in industry rates of compensation, regulatory compliance costs or

litigation, natural disasters or acts of terrorism, the Company’s exposure to changes in the values of major currencies other than the UK pound sterling (because a substantial portion of its revenues are derived and costs incurred outside of

the United Kingdom) and the overall level of economic activity in the Company’s major markets (which varies depending on, among other things, regional, national and international political and economic conditions and government regulations in

the world’s advertising markets). In light of these and other uncertainties, the forward-looking statements included in the oral or written public statements should not be regarded as a representation by the Company that the Company’s

plans and objectives will be achieved. In addition, you should consider the risks described in Item 3D, captioned “Risk Factors” in the Company’s Form 20-F for the year ended 31 December 2014, which could also cause actual

results to differ from forward-looking information. In light of these and other uncertainties, the forward-looking statements included in this document should not be regarded as a representation by the Company that the Company’s plans and

objectives will be achieved.

The Company undertakes no obligation to update or revise any such forward-looking statements, whether as a result of new

information, future events or otherwise.

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 1 |

|

Press Release dated 8 January 2016, made by WPP plc. |

|

|

| 2 |

|

Press Release dated 11 January 2016, made by WPP plc. |

|

|

| 3 |

|

Press Release dated 11 January 2016, made by WPP plc. |

|

|

| 4 |

|

Press Release dated 13 January 2016, made by WPP plc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

WPP PLC |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: 14 January 2016. |

|

|

|

By: |

|

/s/ Paul W.G. Richardson |

|

|

|

|

|

|

Paul W.G. Richardson |

|

|

|

|

|

|

Group Finance Director |

Exhibit 1

|

|

|

| FOR IMMEDIATE RELEASE |

|

8 January 2016 |

WPP PLC (“WPP”)

Notification of Preliminary Results

WPP will announce its Preliminary Statement for the year ended 31 December 2015 on Friday, 4 March 2016.

|

|

|

|

|

| Contact: |

|

|

|

|

| Feona McEwan, WPP |

|

+ 44 (0)207 408 2204 |

|

|

Exhibit 2

|

|

|

| FOR IMMEDIATE RELEASE |

|

11 JANUARY 2016 |

WPP PLC (“WPP”)

WPP invests in Courtside Ventures

Bruin

Sports Capital, the media, sports, marketing and branded lifestyle venture launched in 2015 by George Pyne today announced a strategic partnership with Courtside Ventures, a venture capital fund investing across early stage technology and media

companies with a focus on sports. Backed by anchor investor Dan Gilbert, founder and chairman of Rock Ventures, Quicken Loans and majority owner of the NBA’s Cleveland Cavaliers, and WPP, the world’s leading communication services company,

Courtside Ventures will invest $35MM to support innovative technology disrupters across sports and media that have the potential for broader applicability across other markets.

Courtside Ventures will leverage the expertise of its experienced team of sports, digital and marketing executives: George Pyne, who will serve as

Non-Executive chairman, is founder and CEO of Bruin Sports Capital, whose firm’s operational experience and 25 year track record of building successful platform businesses across multiple industries will provide Courtside Ventures with unique

knowledge and connections in the sports industry. Dan Gilbert will lend his insight as an internationally recognized entrepreneur and investor in today’s leading digital and technology start-up companies. These experiences, combined

with WPP’s collective worldwide network and global reach across industries will allow Courtside Ventures to establish steady access to innovative deals and a long term source of capital from a diversified and experienced group of investors to

accelerate, expand and amplify Courtside’s investments. Its partners will include Deepen Parikh, venture partner at Interplay Ventures and co-founder of NYVC Sports, Vasu Kulkarni, founder and CEO of sports analytics company Krossover and

an experienced entrepreneur and investor, and Brian Hermelin, Managing Partner and co-founder of Rockbridge Growth Equity and Detroit Venture Partners, two investment arms within Gilbert’s portfolio of companies. Courtside Ventures’

Advisory Board will include long-time sports media entrepreneur Brian Bedol, founder and CEO of Bedrocket Media Ventures, and founder of Classic Sports Network (now ESPN Classic) and College Sports Network (now CBS Sports Network), and veteran

sports media executive Doug Perlman, founder and CEO of Sports Media Advisors, and former head of the media divisions at IMG and the National Hockey League. The company will have operations in Detroit and New York City.

“This powerful partnership’s unparalleled pedigree in sports, marketing, and technology enables Bruin Sports Capital to be at the forefront of

digital innovation,” said George Pyne, Founder and CEO of Bruin Sports Capital. “Courtside Ventures is well positioned to recognize and take advantage of the important role sports plays within the changing dynamics of today’s

media landscape.”

“The fact that yet another venture capital firm will be operating in Detroit is more evidence that the city is becoming one

of the most innovative and exciting entrepreneurial places in the country. The intersection of sports and technology will be located in downtown Detroit,” said Dan Gilbert. “Courtside Ventures will enable entrepreneurs to harness the power

and appeal of sports while creating significant value for fans and investors.”

“Sports remains a fundamental interest for our clients, the media and our people. So, we are delighted to

participate in Courtside, particularly with Dan Gilbert and George Pyne. “The icing on the cake is the Detroit location, home of our largest client, Ford,” said WPP founder and CEO Sir Martin Sorrell.

The investment continues WPP’s commitment to digital and content, with sport critical to this strategy. Last year GroupM, the world’s leading media

investment management group that is wholly owned by WPP, launched ESP Properties, a commercial and creative advisor to sports and entertainment rights holders. ESP Properties is dedicated to helping properties take full advantage of digital and

data-driven changes in the media landscape to better understand their audiences, develop more relevant ways to engage with them, and provide potential brand partners more valuable ways to connect with their communities of fans. Iconic organizations

such as the All Blacks (New Zealand Rugby Union) and the Cleveland Cavaliers are among a growing list of major clients.

WPP already works with a large

number of premium sports organizations and properties across its operating companies, including the IOC, FIFA, UEFA, Premier League, La Liga, F1, Manchester United, City Football Group, NASCAR, NBA, PAC-12, the NFL and retired Brazilian football

legends Ronaldo, via a partnership in 9ineSports & Entertainment and Pelé, via a partnership between GroupM and Legends 10, the exclusive global agent to Pelé. This new investment in Courtside Ventures will allow WPP to widen

and deepen those relationships on behalf of its clients.

With Courtside, Bruin Sports Capital participated in a second successful fund raise since last

year, and this latest major deal allows Bruin to continue diversifying and expanding its portfolio of platform businesses. In 2015, Bruin acquired experiential marketing agency Engine Shop, and On Location Experiences, which recently acquired

Jon Bon Jovi’s Runaway Tours, launching Bruin’s presence into the global sports and entertainment hospitality industry.

Contact:

|

|

|

|

|

| Feona McEwan, WPP |

|

+ 44(0) 207 408 2204 |

|

|

| Kevin McCormack, WPP |

|

+1 (212) 632 2239 |

|

|

Exhibit 3

|

|

|

| For Immediate Release |

|

11 January 2016 |

WPP PLC (“WPP”)

Kantar acquires a majority stake in market research firm in the Nordics

WPP announces that its data investment management division Kantar has acquired a majority stake in its partner in Denmark and Sweden, Millward Brown Denmark

ApS.

Since joining the Millward Brown network as a licensee in 1997, the company, with offices in Copenhagen and Stockholm, has grown to become one of

the most prominent market research agencies in Denmark and Sweden, with a well-balanced client portfolio combining large international clients and local brands.

With this acquisition, Kantar strengthens its presence and broadens its offer in all Nordic markets.

Millward Brown Denmark ApS’ consolidated revenues for the year ended 30 June 2014 were DKK 52.3 million, with gross assets of DKK

23.8 million as at the same date.

Kantar is the data investment management arm of WPP and one of the world’s largest insight, information and

consultancy groups. By connecting the diverse talents of its 12 specialist companies, the group aims to become the pre-eminent provider of compelling and inspirational insights for the global business community. Its 30,000 employees work across 100

countries and across the whole spectrum of research and consultancy disciplines, enabling the group to offer clients business insights at each and every point of the consumer cycle. The group’s services are employed by over half of the Fortune

Top 500 companies.

Worldwide, WPP’s data investment management companies (including associates and investments) collectively generate revenues of

almost US$5 billion and employ over 36,000 people. In the Nordics (Denmark, Finland, Norway, Sweden), WPP companies (including associates) generate revenues of nearly US$500 million and employ over 2,500 people.

Contact:

|

|

|

|

|

| Feona McEwan, WPP |

|

+44(0) 20 7408 2204 |

|

|

| Chris Wade, WPP |

|

|

|

|

Exhibit 4

|

|

|

| FOR IMMEDIATE RELEASE |

|

13 JANUARY 2016 |

WPP PLC (“WPP”)

WPP Digital acquires minority stake in Mitú

WPP Digital, the investment arm of WPP, has acquired a minority interest in Mitú, Inc. (“Mitú”), a leading online Hispanic-focused digital

content creator and media company catering to young Latino audiences in the US and Latin America.

Mitú’s clients include America Movil, Kia,

MillerCoors, NBCUniversal and Procter & Gamble. Mitú was founded in 2012 and is based in Santa Monica with offices in Mexico and Colombia. It employs around 120 people.

Mitú creates and distributes original content as well as producing branded entertainment on behalf of its clients. Mitú’s technology enables it

to efficiently analyze its Latino audience’s consumption of content across social media, thus providing it with a feedback loop for the company to continually create viral content. Mitú has over two billion global monthly views across all

platforms in the US, as well as Mexico, Brazil and other Latin American countries.

This investment continues WPP’s strategy of investing in regions

and sectors such as digital. In North America, Group companies (including associates and investments) collectively generate revenues of over US$7 billion and employ over 27,000 people. In Latin America, WPP companies (including associates and

investments) collectively generate revenues of over US$1.6 billion and employ over 21,000 people. WPP’s digital revenues were US$6.9 billion in 2014, representing 36% of the Group’s total revenues of US$19 billion. WPP has set a target of

40-45% of revenue to be derived from digital in the next five years.

Within WPP, its operating company WPP Digital develops new digital services,

provides common data and technology platforms for WPP clients and agencies and coordinates relationships with leading digital media and technology companies. WPP Digital comprises the agencies Blue State Digital, POSSIBLE, Rockfish, and F.biz in

Brazil; the technology companies Acceleration, Hogarth and Salmon; as well as investments in technology companies such as Percolate and Fullscreen, among others.

Contact:

|

|

|

|

|

| Feona McEwan, WPP |

|

+ 44(0) 207 408 2204 |

|

|

| Kevin McCormack, WPP |

|

+1 (212) 632 2239 |

|

|

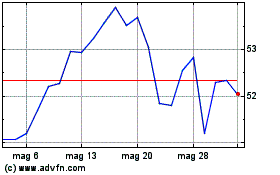

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024