BOE's Carney to Extend Term by One Year to June 2019

31 Ottobre 2016 - 7:50PM

Dow Jones News

LONDON—Bank of England Gov. Mark Carney is to serve an extra

year as head of the U.K. central bank to see the U.K. beyond its

exit from the European Union, the BOE said Monday.

Mr. Carney said in a letter to Treasury chief Philip Hammond

that he would be "honored" to serve as governor until June

2019.

Mr. Carney took the job in 2013 on the understanding he would

serve five years of the standard eight-year term for a BOE

governor. He opened the door to serving the full term—until

2021—late last year, but recent clashes with Brexit-supporting

lawmakers fueled speculation he might leave in mid-2018.

The decision raises the prospect he will stay through the

completion of negotiations to exit the European Union. Prime

Minister Theresa May has said she will formally trigger Article 50

of the Lisbon Treaty by the end of March, opening a two-year window

for negotiations.

"By taking my term in office beyond the expected period of the

Article 50 process, this should help contribute to securing an

orderly transition to the U.K.'s new relationship with Europe," he

said.

Speculation over his future had reached fever-pitch in the U.K.

He has faced criticism from some euroskeptics for what they

consider his scaremongering about the potential costs of leaving

the EU. But the central banker's supporters say his strong response

to the June referendum result avoided market panic that could have

endangered the world economy.

Mrs. May earlier affirmed her support for him to remain at the

job for a full-term, in a rebuke to the hard-liners who want him

out sooner.

"It is clearly a decision for him, but the PM would certainly be

supportive of him going on beyond his five years," Mrs. May's

spokeswoman said. "She recognizes the work that he has been doing

for the country and supports that."

Asked if the prime minister thought Mr. Carney was the best man

for the job, Mrs. May's spokeswoman said: "Absolutely."

The spokeswoman said Mrs. May has regular discussions with Mr.

Carney. Downing Street said the two spoke Monday in a meeting that

had been scheduled for some time.

Signs of possible tensions with Mrs. May surfaced after her

speech at the Conservatives' party conference in early October, in

which she criticized the BOE's easy-money policies. Treasury chief

Philip Hammond later clarified that the government had no plans to

change the BOE's inflation-fighting remit or dilute its cherished

independence.

Mr. Carney, a Canadian, had told British lawmakers last week

that he was still reflecting on his decision, which he called

"entirely personal" because of the potential disruption to his

family of serving a longer term.

Prior to the referendum, his spell in office garnered mixed

reviews. One lawmaker memorably described him as "an unreliable

boyfriend" following apparent pledges on interest rates that he

later backed away from. But he won plaudits for his efforts to

modernize the BOE and especially for his sure-footed response to

the Brexit vote.

Mr. Carney and his colleagues will decide whether they need to

ease policy further on Thursday, after cutting the benchmark

interest rate to a new low of 0.25% and reviving a crisis-era

bond-buying program in August to cushion the economy from a

potential Brexit shock.

Martin Sorrell, chief executive of WPP PLC, which owns such

advertising agencies as Ogilvy & Mather and Grey, said he hoped

Mr. Carney would stay. "He stabilized things at a very difficult

time," Mr. Sorrell said in an interview. "They were worried and

concerned, but they moved very quickly to deal with it."

Write to Jason Douglas at jason.douglas@wsj.com and Nicholas

Winning at nick.winning@wsj.com

(END) Dow Jones Newswires

October 31, 2016 14:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

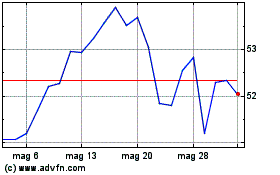

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024