WPP Shares Plunge on Worst Results in Years -- Update

01 Marzo 2018 - 10:32AM

Dow Jones News

By Nick Kostov

WPP PLC shares tumbled 12% Thursday after the company logged its

worst year since the financial crisis and forecast no growth for

2018, a further sign of the heavy toll of advertising's digital

revolution.

The world's largest ad company said it is setting budgets this

year on the assumption that both revenue and net sales will be

flat. For 2017, net sales were down 0.9% on a like-for-like basis,

against a forecast they would be "broadly flat."

The company said it is simplifying its unwieldy structure,

accelerating its development from a group of individual companies

to a "cohesive global team."

Like other big ad firms, WPP is grappling with the slowest

revenue growth since the financial crisis as previously big

spending consumer-good companies keep a tight lid on marketing

budgets. That slowdown in growth has pressured agency holding

companies to revamp an organizational structure that has gone out

of style.

"There are two things going on: technological change, and the

second is short term pressures, whether it be zero-based budgeting,

activists or private equity," Mr. Sorrell said in an interview with

The Wall Street Journal.

"We're clear on the destination," Mr. Sorrell said. "The changes

that are taking place are pushing us to do it faster."

Big ad firms built their businesses over the years by acquiring

different specialists with their own ways of working and separate

finances. Now there has been a move across the industry to align

the different agencies closer together to allow clients to better

access resources across their groups and cut costs. WPP executives

often refer to its approach as "horizontality."

The company, which owns creative and media agencies such as J.

Walter Thompson and Ogilvy & Mather, reported a 1.3% decline in

fourth-quarter organic net sales, a closely watched metric in the

industry that excludes currency effects and acquisitions. That

growth rate was below analysts' expectations of a roughly 0.7%

rise.

In the fourth quarter, organic net sales were down 3.4% in North

America, declined 2.6% in Western Continental Europe and dropped 3%

in Asia Pacific. The bright spot was the U.K., which rose 9.1%.

WPP's closest competitors have been facing similar headwinds.

France's Publicis Groupe SA posted organic growth of just 0.8% last

year, while Omnicom Group Inc. posted lackluster fourth-quarter

revenue, blaming a pullback by marketers on project work, losses at

some independent-branded agencies and softness in its programmatic

business.

Omnicom's longtime CEO, John Wren, said he expects the company

to post softer organic growth this year compared with 2017 because

of challenges in the marketplace like changes in technology,

shareholder activism and new competitors.

The overall outlook for Madison Avenue remains cloudy. Ad

companies are dealing with major slowdowns in industries that they

have long relied upon for growth, such as consumers-goods giants

and retailers. Those sectors are putting additional pressure on ad

firms to reduce the fees they pay for services.

The slowdown in advertising spend has affected agency sector

organic growth, which has slowed from 4.5% in 2015 to 1.9% in 2016

and to an expected 1.1% in 2017, UBS analysts wrote in a note this

week.

In their note, the analysts cited a long list of challenges that

the sector is facing, including marketers experiencing slower

growth, companies continuing to cut the fees they pay agencies, and

growing competition from consulting firms. Another challenge has

been brands cracking down on nontransparent practices in the

ad-buying sector, which industry observers say has squeezed holding

company margins.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

March 01, 2018 04:17 ET (09:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

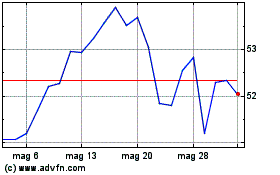

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024