By Nick Kostov and Stacy Meichtry

Advertising's digital upheaval took a heavy toll on WPP PLC as

the world's largest ad company Thursday logged its worst

performance since the financial crisis, triggering jitters among

investors across the sector.

On Thursday, WPP said net sales fell 0.9% on a like-for-like

basis last year, spooking investors who were expecting signs of

recovery after the company cut its forecast three times, predicting

a "broadly flat" 2017. The firm also said it is setting budgets for

2018 on the assumption of no growth in revenue and net sales.

WPP shares tumbled 14%, and the fallout quickly spread to rival

ad giants like Publicis Groupe SA, which fell 6%.

Digital disruption is leading Unilever PLC, Procter & Gamble

Co. and other consumer-goods giants that once splurged on ad

campaigns to rein in their spending. That is saddling ad firms with

their slowest revenue growth in a decade and pressuring agency

holding companies to revamp organizational structures that are out

of step with the digital age. Advertisers are demanding agencies

provide services that target consumers relentlessly over the

internet as well as coming up with traditional campaigns for print

and TV.

"We have to alter our model," WPP Chairman and Chief Executive

Martin Sorrell said in an interview.

Executives like Mr. Sorrell, 73, built the business model that

is now being tested. He corralled different Madison Avenue

agencies, such as J. Walter Thompson and Ogilvy & Mather, into

one large holding company while allowing those firms to run

independently. Agencies kept their own finances and creative

directors called the shots, instructing big clients on how to

revamp their brands.

Technological advances, however, have made it easier for clients

to cut out the agency middleman, purchasing online advertising

directly from platforms like Facebook Inc. and Google's parent

company, Alphabet Inc. Digital technology also eases automation in

some areas of the production process, allowing brands to reuse and

repurpose their advertising across different media. At the same

time, WPP's biggest clients are grappling with upstart rivals,

changing consumer tastes and the rise of e-commerce, putting

pressure on their marketing budgets.

Ad giants have responded by moving to align the different

agencies, cut costs and allow clients to work with advertising

staff that was previously siloed. WPP executives often refer to

this approach as "horizontality," while rival Publicis is trying to

unite its operations in a restructuring dubbed "The Power of One."

Omnicom has also been pushing to simplify areas like customer

relationship management, national brand advertising and public

relations.

This year alone, WPP has announced the merger of its public

relations firms Burson-Marsteller and Cohn & Wolfe and said

that it would consolidate five of its branding agencies into one.

In 2017, it combined its media agencies Maxus and MEC to form

Wavemaker; moved its digital agency Possible into its

customer-relationship marketing business Wunderman; and created WPP

Health & Wellness out of its four large health-care

agencies.

"We're clear on the destination. The changes that are taking

place are pushing us to do it faster," Mr. Sorrell said. "We have

to simplify and focus much more on a client and country level."

The question is whether the big ad companies can evolve fast

enough. P&G, long the biggest advertiser in the world, has said

that it is looking to cut an additional $400 million in agency and

production costs by 2021, having already saved around a combined

$750 million in recent year. Unilever, meanwhile, has also been

slashing agency fees and production costs, in part by reducing the

number of traditional ads it makes and bringing more of its

marketing work in-house.

Change has been particularly slow in the senior ranks of large

ad holding companies. There has been no talk at WPP of Mr. Sorrell

stepping down from the company he founded in 1986. His closest

rival, Omnicom, is run by 65-year-old Chief Executive John Wren,

who has been at the helm for more than two decades. Last year,

76-year-old Maurice Levy stepped aside as chief executive of

Publicis, the third-biggest ad company, after a drawn-out process

to choose Arthur Sadoun as his successor. Mr. Levy, however,

remains chairman of the firm.

Succession questions have dogged WPP for several years as

investors have demanded more clarity on the company's plans for

life beyond Mr. Sorrell, the only chief executive the company has

ever known.

Last June, Deborah Gilshan of Standard Life Investments called

on the WPP board to formally set a timetable for "an orderly

management succession."

"This remains the key governance risk to our long-term

investment in WPP, " she said.

As ad giants overhaul their operations -- investing in

artificial intelligence and engineering talent -- they also face

pressure to cut more costs to protect margins. WPP reported a 1.3%

decline in fourth-quarter organic net sales, a closely watched

metric in the industry that excludes currency effects and

acquisitions. Analysts expected a 0.7% rise.

In the fourth quarter, organic net sales were down 3.4% in North

America, 2.6% in Western Continental Europe and 3% in Asia Pacific.

The bright spot was the U.K., which rose 9.1%.

"2017 for us was not a pretty year," Mr. Sorrell said.

WPP's closest competitors have been facing similar headwinds.

Publicis posted organic growth of just 0.8% last year, while

Omnicom reported lackluster fourth-quarter revenue, blaming a

pullback by marketers on one-off projects and losses at some

independent-branded agencies. Mr. Wren, Omnicom's CEO, said he

expects the company to post softer organic growth this year

compared with 2017 due to technological change, shareholder

activism and new competitors.

WPP, Publicis and Omnicom have spent the past decade acquiring

assets to help them adapt to the online ad business. But many of

those investments ended up overlapping with their existing roster

of agencies, which had begun developing their own digital skills.

The duplication created confusion for clients seeking clarity about

how to operate in the digital ad world.

Mr. Sorrell said during WPP's earning presentation in London on

Thursday that the company is navigating the disruption by

partnering with Google, Facebook and Alibaba Group Holding Ltd.

Similarly, WPP has also been appointed by clients such like Nestlé

SA and HSBC Holdings PLC to work on digital transformation

projects, according to the company's investor presentation.

--Lara O'Reilly contributed to this article.

Write to Nick Kostov at Nick.Kostov@wsj.com and Stacy Meichtry

at stacy.meichtry@wsj.com

(END) Dow Jones Newswires

March 01, 2018 08:29 ET (13:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

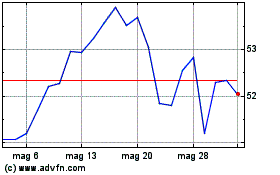

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024