Advertising company tries to address void left by sudden exit of

CEO Martin Sorrell

By Ben Dummett and Nick Kostov

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 17, 2018).

A little-known private-equity executive will steer WPP PLC

through one of its stormiest periods following the weekend

resignation of Martin Sorrell, the ad giant's high-profile founder

and chief executive.

Roberto Quarta, until Saturday WPP's chairman, has assumed the

role of executive chairman pending the appointment of a new CEO,

effectively putting him in charge of a global company struggling

with a fast-changing advertising market.

Along with two new joint-chief operating officers, he will try

to address the leadership void created by the departure of Mr.

Sorrell, who built the London-based company over 30 years and

closely managed the dozens of units that comprise the company.

Born in Italy, Mr. Quarta, 68 years old, moved with his family

as a teenager to the U.S. and helped pay to attend College of the

Holy Cross in Massachusetts by working as a security guard. Years

later, in the 1990s, his corporate cost-cutting skills would in

some circles help earn him the nickname "Bob the Knife" and "Spare

No Quarta."

WPP has said it is looking within and outside the company for a

permanent successor to Mr. Sorrell, who stepped down following an

investigation into allegations of personal misconduct.

WPP said it is treating the departure as a retirement, and the

investigation's findings are confidential. Mr. Sorrell, 73, has

denied any financial impropriety. WPP's board is scheduled to meet

Tuesday ahead of results for the first quarter. Shares were down

more than 6.5% in London on Monday.

The company named Mark Read, chief executive of WPP agency

Wunderman, and Andrew Scott, WPP's corporate development director

and chief operating officer for Europe, as the new joint-chief

operating officers for WPP. That provides Mr. Quarta with help

overseeing functions such as strategy, investments and retaining

clients.

While well-known in certain business circles in Europe, Mr.

Quarta's success as head of what is now called BBA Aviation PLC and

as an operating partner at U.S. buyout firm Clayton Dubilier &

Rice have shown him to be a no-nonsense executive focused on the

bottom line who can make tough decisions, according to people who

have worked with and for him over the years.

In the 1990s, as chief executive at BBA Group, he cut costs and

steered an effort that led to the industrial conglomerate selling

five of its seven regional divisions. The move created two global

players, including BBA Aviation, a leading operator of airport

facilities serving private aircraft. That effort won much

shareholder support as the stock surged during his tenure as CEO,

which ended in 2001.

Mr. Quarta then joined Clayton Dubilier & Rice, while

staying on at BBA as chairman until 2007. He focused on helping the

buyout firm identify industrial companies to acquire, then applying

his sector expertise to help boost revenue and profits, according

to a person familiar with the matter.

At Rexel SA, acquired by CD&R in 2005, Mr. Quarta and his

colleagues were central in helping the Paris-based distributor of

electrical products more than double its earnings during the buyout

firm's ownership, which ended in 2012, according to people familiar

with the matter.

Always immaculately turned out, Mr. Quarta pushed management to

expand faster into the growing markets of Latin America and Asia,

and pursue the next acquisition, according to former Rexel

employees.

"He's the only guy that scared the shit out of us," said one

former Rexel employee. "It was all about speed and financial

efficiency."

Mr. Quarta entered high school with limited English, and majored

in languages at college. His father worked as a tailor in

Worcester, Mass.

Today, Mr. Quarta remains CD&R's European chairman, but

isn't actively involved with any of the portfolio companies. That

provides him with more time for his responsibilities at both WPP

and British medical-device maker Smith & Nephew PLC, where he

is chairman.

Mr. Quarta is no stranger to adversity both at WPP and at Smith

& Nephew.

After joining WPP in the summer of 2015, Mr. Quarta helped to

persuade Mr. Sorrell to accept a steep pay cut, warding off a

shareholder revolt over his pay package.

Around the middle of last year, U.S. activist investor Elliot

Management Corp. took an undisclosed position in Smith &

Nephew, according to people familiar with the matter. Elliott met

with Mr. Quarta and argued for Smith & Nephew to sell assets to

boost the company's stock price. But Mr. Quarta rejected Elliott's

ideas, arguing in part that the sales would undercut Smith &

Nephew's value, according to the people familiar with the

matter.

That said, the company announced in October, a few months

earlier than planned, that CEO Olivier Bohuon would retire by the

end of the following year. Elliott declined to comment.

Now at WPP, Mr. Quarta could face a tough battle with

shareholders. Some analysts suggest that without Mr. Sorrell at the

helm, the company should be broken up.

"It's hard to see what can be done apart from some M&A

activity which monetizes some of the assets of the company," said

Alex DeGroote, a media analyst with Cenkos. "The problem isn't

replacing Martin, the problem is that the model doesn't work."

Write to Ben Dummett at ben.dummett@wsj.com and Nick Kostov at

Nick.Kostov@wsj.com

(END) Dow Jones Newswires

April 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

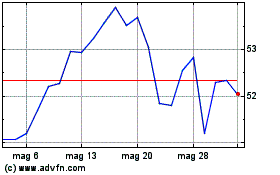

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024