WPP (NYSE:WPP) today reported its Third Quarter Trading Update

2018.

Mark Read, Chief Executive Officer, WPP, stated:

“Turning around WPP requires decisive action and radical

thinking, and our performance in the third quarter of 2018

reinforces our belief in that approach.

“The slowdown primarily reflects a further weakening of the

performance of our businesses in North America and in our creative

agencies, issues that we highlighted in our interim results.

“As previously stated, our industry is facing structural change,

not structural decline, but in the past we have been too slow to

adapt, become too complicated and have under-invested in core parts

of our business. There is much to do and we have taken a number of

critical actions to address these legacy issues and improve our

performance.

“In April, we started immediately to develop the strategy for

the new WPP that would simplify our organisation, better position

our companies, invest more in creative talent, establish a common

data and technology strategy and make it easier for our clients to

access the many great strengths that reside within our company. At

its heart is a new vision for WPP, supported by a strong culture

that binds us together and makes us the most attractive destination

for the best talent, allowing us to lead our industry in the

future.

“We have already begun implementing this strategy, identifying

the investments and restructuring actions that are needed to

simplify the company and putting teams in place in the key areas of

data and technology. We moved quickly to strengthen our balance

sheet, making 16 disposals to date, primarily of non-core

investments, raising £704 million. As a result of this, and a

renewed focus on working capital, our net debt is down £925 million

compared to the same period last year.

“Since my appointment as CEO in September, we have put more of

these plans into action with the creation of VMLY&R, a new

brand experience agency formed by the merger of VML and Y&R;

further simplification with the integration of our healthcare

agencies with Ogilvy, VMLY&R and Wunderman; and key

appointments in operations, clients and technology as we build an

even stronger executive team at the centre of WPP.

“There is a significant opportunity to develop Kantar into the

world’s leading data, insights and consulting company. We

believe in the potential for Kantar but given our many priorities,

we need to make tough choices and we believe that the best way to

unlock this potential is with a strategic or financial partner. The

Board has approved a formal process to review the strategic options

that will maximise share owner value. It is envisaged that WPP will

remain a share owner with strategic links to ensure that the

benefits to clients are realised. Preparations are underway,

involving Kantar management, and unsolicited expressions of

interest have been received.

“This move, together with the actions that we will continue to

take, should further improve our balance sheet. In future, we will

pay greater attention to capital discipline and focus our

acquisition spending only on the most strategic opportunities that

we can tightly integrate into our organisation.

“In April, independent analysts identified WPP as having the

most business at risk from publicly announced client reviews among

our peer group. The Ford review, which began nearly a year ago,

resulted in the loss of the creative business but the retention of

global activation and the majority of our work around the world.

While we have lost pitches (primarily media) in relation to

American Express, GSK, HSBC, Opel and United Airlines, we have

retained significant business with these clients. We have also won

and successfully defended business with Adidas, BP, Hilton, Mars,

Mondelez, Shell, T-Mobile and GSK’s Panadol. Our successes

highlight our strengths, but we need to make it simpler for clients

to get the best talent and expertise seamlessly from across

WPP.

“After 22 years as Group Finance Director,

Paul Richardson has decided to retire from the company.

He will leave during the course of 2019, and work with us to ensure

a smooth transition as we appoint his successor. Paul has

played a central role in building WPP, and on behalf of the Board

and the company as a whole I would like to thank him for his

contribution to our success over many years.

“WPP has grown into a large and complex organisation, with many

strengths, but also challenges. It will take time to improve

our performance and we are realistic about the short-term issues

that we face. Our top 150 leaders met in Brooklyn two weeks ago to

discuss our plans and came away excited by the future, united by a

new sense of common purpose, and committed to work together to

build a new WPP.

“We will provide a strategy update in December. We look forward

to updating our people, clients and share owners on the new vision

for WPP, the substantial growth opportunities that exist for us,

and how we will capture them through a simplified structure,

investments in technology and talent, and a new culture that draws

the best and brightest to WPP.”

Highlights

- Third quarter reported revenue down

0.8% at £3.758 billion, impacted by currency headwinds of 2.0%.

Constant currency revenue up 1.2%, like-for-like revenue up

0.2%

- Third quarter constant currency revenue

less pass-through costs down 0.9%, like-for-like revenue less

pass-through costs down 1.5%

- Nine months reported revenue down 1.6%

at £11.251 billion

- Nine months constant currency revenue

up 2.3%, like-for-like revenue up 1.1%

- Nine months constant currency revenue

less pass-through costs up 0.7%, like-for-like revenue less

pass-through costs down 0.3%

- Net debt at 30 September down £925

million compared with same period last year, following disposal of

certain non-core assets and an improvement in net working

capital

- Net new business of $4.0 billion in

first nine months

Revenue analysis

£ million

2018 ∆

reported

∆ constant1

∆ LFL2

Acquisitions

20173

First quarter 3,555 -4.0%

2.0% 0.8% 1.2%

3,704

Second quarter 3,938

-0.2% 3.7% 2.4%

1.3% 3,946

First half

7,493 -2.1% 2.9%

1.6% 1.3% 7,650

Third quarter

3,758 -0.8% 1.2%

0.2% 1.0% 3,788

First

nine months 11,251 -1.6% 2.3% 1.1%

1.2% 11,438

Revenue less pass-through costs

£ million

2018 ∆ reported ∆ constant

∆ LFL Acquisitions

20173 First quarter 2,948

-5.1% 1.0% -0.1%

1.1% 3,107

Second quarter

3,201 -2.1% 1.8%

0.7% 1.1% 3,269

First half

6,149 -3.6% 1.4%

0.3% 1.1% 6,376

Third

quarter 3,103 -2.9%

-0.9% -1.5% 0.6%

3,195

First nine months 9,252 -3.3%

0.7% -0.3% 1.0% 9,571

Review of quarter three and first nine months

Revenue

As shown in the tables above, in the third quarter of 2018,

reported revenue was down 0.8% at £3.758 billion. Revenue in

constant currency was up 1.2% compared with last year, the

difference to the reported number reflecting the strengthening of

the pound sterling in the first half, primarily against the US

dollar, and other currencies in the third quarter. On a

like-for-like basis, excluding the impact of acquisitions and

currency fluctuations, revenue was up 0.2%, compared with 1.6% in

the first half. Geographically, like-for-like revenue growth in the

third quarter was stronger in Asia Pacific, Latin America, Africa

& the Middle East and Central & Eastern Europe, with all

other regions, particularly North America and the United Kingdom,

slipping back. South East Asia and Latin America were particularly

strong with Africa & the Middle East more difficult.

Functionally, all sectors, except data investment management,

performed less well compared with the first half.

In the third quarter, there was a slowdown in revenue less

pass-through costs, with -0.9% constant currency growth and -1.5%

like-for-like. All regions, except Asia Pacific, Latin America,

Africa & the Middle East and Central & Eastern Europe

showed a deteriorating trend in the third quarter, with all

sectors, except data investment management, slipping back.

Regional review

Revenue analysis – Third

Quarter

£ million

2018 ∆ reported

∆ constant4

∆ LFL5

% group

2017 %

group N. America 1,331 -1.5%

-1.6% -3.5% 35.5%

1,351 35.7% United Kingdom

517 0.6% 0.6%

-0.9% 13.7% 514 13.6% W.

Cont Europe 763 0.5%

2.3% 1.0% 20.3%

759 20.0%

AP, LA, AME, CEE6

1,147 -1.5% 4.2%

4.4% 30.5% 1,164

30.7%

Total Group 3,758 -0.8%

1.2% 0.2% 100.0% 3,788 100.0%

Revenue analysis – First Nine

Months

£ million

2018 ∆ reported ∆

constant ∆ LFL % group

2017 % group N. America

3,930 -5.8% -0.3% -1.6%

34.9% 4,169 36.5% United

Kingdom 1,608 3.0%

3.0% 1.8% 14.3% 1,561

13.6% W. Cont Europe 2,373

3.9% 3.7% 1.5%

21.1% 2,285 20.0% AP, LA, AME,

CEE 3,340 -2.4%

4.1% 3.9% 29.7% 3,423

29.9%

Total Group 11,251 -1.6%

2.3% 1.1% 100.0% 11,438 100.0%

Revenue less pass-through costs

analysis – Third Quarter

£ million

2018 ∆ reported

∆ constant ∆ LFL % group

2017 % group N. America

1,106 -4.3% -4.5%

-5.3% 35.6% 1,156

36.2% United Kingdom 402

-1.0% -1.0% -2.0%

13.0% 406 12.7% W. Cont Europe

630 -0.4% 1.3%

-0.4% 20.3% 632

19.8% AP, LA, AME, CEE 965

-3.6% 2.0% 2.4%

31.1% 1,001 31.3%

Total

Group 3,103 -2.9% -0.9% -1.5%

100.0% 3,195 100.0%

Revenue less pass-through costs

analysis – First Nine Months

£ million

2018 ∆ reported ∆

constant ∆ LFL % group

2017 % group N. America

3,261 -8.5% -3.1% -3.7%

35.3% 3,563 37.2% United

Kingdom 1,235 1.2%

1.2% 0.3% 13.3% 1,221

12.8% W. Cont Europe 1,949

4.3% 4.1% 1.1%

21.1% 1,869 19.5% AP, LA, AME,

CEE 2,807 -3.8%

2.7% 2.5% 30.3% 2,918

30.5%

Total Group 9,252 -3.3%

0.7% -0.3% 100.0% 9,571 100.0%

North America showed further continued pressure in the

third quarter, with like-for-like revenue less pass-through costs

down 5.3%, compared with -3.3% in the second quarter and -2.9% in

the first half, as parts of the Group’s media investment

management, data investment management, health & wellness,

direct, digital & interactive and specialist communications

businesses slipped back, driven partly by client losses, but

largely by spending reductions among the Group’s larger clients.

These reductions were partly offset by improving performance in the

Group’s public relations and public affairs businesses.

The United Kingdom, with like-for-like revenue less

pass-through costs down 2.0% in the third quarter, compared with

+1.4% in the second quarter and +1.5% for the first half, as most

sectors were impacted by the spending cuts and the impact of net

client losses in the quarter, particularly media investment

management, data investment management and direct, digital and

interactive. The Group’s advertising businesses showed a small

relative improvement compared with the first half.

Western Continental Europe, which showed particularly

strong growth in the second quarter, fell back with revenue less

pass-through costs down 0.4% compared with +3.9% in the second

quarter and -0.2% in the first quarter. Austria, Germany, Norway,

Spain, Sweden and Turkey performed less well, partly offset by an

improving trend compared with the first half in Belgium, Ireland,

Greece and Switzerland.

Asia Pacific, Latin America, Africa & the Middle East and

Central & Eastern Europe remained relatively stable with

like-for-like revenue less pass-through costs up 2.4% in the third

quarter, compared with 2.9% growth in the second quarter and 2.6%

for the first half. In Asia Pacific, India showed particularly

strong growth, with China and Singapore continuing to perform well.

Australia & New Zealand were down over 5% in the third quarter,

driven largely by the creative agencies and production businesses.

Latin America and Central & Eastern Europe continued their

strong growth in the third quarter, with the Middle East showing a

relative improvement but Africa slipped back compared with the

first half.

Business sector review

Revenue analysis – Third

Quarter

£ million

2018 ∆ reported

∆ constant7

∆ LFL8

% group

2017 %

group

AMIM9

1,669 -3.9% -1.8%

-0.5% 44.4% 1,737

45.9% Data Inv. Mgt. 634

-2.0% 0.5% 0.1% 16.9%

647 17.1%

PR & PA10

298 0.5% 1.7%

2.6% 7.9% 296

7.8%

BC, HW & SC11

1,157 4.5% 6.3%

0.6% 30.8% 1,108

29.2%

Total Group 3,758 -0.8%

1.2% 0.2% 100.0% 3,788 100.0%

Revenue analysis – First Nine

Months

£ million

2018 ∆ reported ∆

constant ∆ LFL % group

2017 % group AMIM 5,110

-3.7% 0.1% 1.3%

45.5% 5,307 46.4% Data Inv. Mgt.

1,870 -4.6% -1.1%

-1.4% 16.6% 1,960

17.1% PR & PA 879

-1.7% 2.6% 3.3% 7.8%

894 7.8% BC, HW & SC

3,392 3.5% 7.9%

1.8% 30.1% 3,277 28.7%

Total Group 11,251 -1.6% 2.3%

1.1% 100.0% 11,438 100.0%

Revenue less pass-through costs

analysis – Third Quarter

£ million

2018 ∆ reported ∆

constant ∆ LFL % group

2017 % group AMIM 1,297

-8.7% -6.5% -4.0%

41.8% 1,420 44.4% Data Inv. Mgt.

477 -3.5% -0.7%

-1.2% 15.4% 494

15.5% PR & PA 282

0.1% 1.4% 2.5% 9.1%

282 8.8% BC, HW & SC

1,047 4.8% 6.5%

0.4% 33.7% 999 31.3%

Total Group 3,103 -2.9% -0.9%

-1.5% 100.0% 3,195 100.0%

Revenue less pass-through costs

analysis – First Nine Months

£ million

2018 ∆ reported ∆

constant ∆ LFL % group

2017 % group AMIM 3,936

-7.8% -4.0% -1.8%

42.5% 4,268 44.6% Data Inv. Mgt.

1,423 -4.6% -0.8%

-1.4% 15.4% 1,491

15.6% PR & PA 833

-2.0% 2.2% 3.1% 9.0%

850 8.9% BC, HW & SC

3,060 3.3% 7.7%

1.4% 33.1% 2,962 30.9%

Total Group 9,252 -3.3% 0.7%

-0.3% 100.0% 9,571 100.0%

In the third quarter of 2018, like-for-like revenue less

pass-through costs in the Group’s advertising and media investment

management businesses showed a significant deterioration compared

with the first half, particularly in North America, the United

Kingdom and Continental Europe, partly offset by double

digit-growth in Asia Pacific and Latin America. The Group’s

advertising businesses remain difficult, particularly in

Continental Europe and Asia Pacific, with all regions, except the

United Kingdom and Latin America, slower.

Data investment management showed a slight improvement in the

third quarter, with like-for-like revenue less pass-through costs

down 1.2% compared with -1.3% in the second quarter and -1.5% for

the first half. There was significant improvement in Asia Pacific,

up over 7%, with Western Continental Europe also showing

improvement. North America remains difficult and the United

Kingdom, following an improvement in the second quarter, slipped

back, as Kantar Insights and Kantar Media came under pressure.

Kantar Public and Kantar Health remain challenged, but both showed

an improvement in the third quarter compared with the first

half.

Public relations and public affairs was the strongest performing

sector in the third quarter as it was in the second quarter, with

like-for-like revenue less pass-through costs up 2.5%. This was

driven by strong growth in both the United Kingdom and Germany

through the Group’s financial public relations businesses and

continued strong growth in Asia Pacific and the Middle East.

In the Group’s specialist communications businesses, direct,

digital & interactive together with health & wellness were

up strongly, but brand consulting remains challenging, particularly

in the United States following some client losses towards the end

of 2017.

Balance sheet highlights

Average net debt in the first nine months of 2018 was £4.991

billion, compared to £4.981 billion in 2017, at 2018 exchange

rates, an increase of £10 million. The small increase in the

average net debt figure, reflects the increase in capital

expenditure and dividends in the 12 months to 30 September,

together with a worsening net working capital position in the

second half of 2017, offset by the impact of the sale proceeds in

relation to the disposal of the Group’s interests in certain

associates and investments as outlined in the Group’s 2018 Interim

Results.

Net debt at 30 September 2018 was £4.884 billion, compared to

£5.809 billion on 30 September 2017, at 2018 exchange rates, a

decrease of £925 million. The decrease in the net debt figure at 30

September 2018 reflects £704 million proceeds in relation to the

disposal of non-core investments, principally Globant S.A. and

AppNexus, with an improvement in net working capital in the third

quarter.

There were no additional share repurchases in the third quarter,

and in the first half of 2018, 15.9 million shares, or 1.3% of the

issued share capital, were purchased at a cost of £201 million and

an average price of £12.63 per share.

Financial guidance

For 2018, reflecting the slowdown in the third quarter and a

more cautious outlook for the rest of the year:

- Like-for-like revenue less pass-through

costs growth is likely to be down 0.5% – 1.0%

- Forecast operating margin to revenue

less pass-through costs is likely to be down in the range of 1.0 –

1.5 margin points

Strategy update

We will update share owners on the Group’s strategy in December.

This update will address the actions that have already been taken

and those we will be taking to better position the business for

growth and to address under-performing units and detail the

restructuring costs that will be necessary, as well as the

associated benefits.

This announcement has been filed at the Company Announcements

Office of the London Stock Exchange and is being distributed to all

owners of Ordinary shares and American Depository Receipts. Copies

are available to the public at the Company’s registered office.

The following cautionary statement is included for safe harbour

purposes in connection with the Private Securities Litigation

Reform Act of 1995 introduced in the United States of America. This

announcement may contain forward-looking statements within the

meaning of the US federal securities laws. These statements are

subject to risks and uncertainties that could cause actual results

to differ materially including adjustments arising from the annual

audit by management and the Company’s independent auditors. For

further information on factors which could impact the Company and

the statements contained herein, please refer to public filings by

the Company with the Securities and Exchange Commission. The

statements in this announcement should be considered in light of

these risks and uncertainties.

1 Percentage change at constant currency exchange rates2

Like-for-like growth at constant currency exchange rates and

excluding the effects of acquisitions and disposals3 Prior year

figures have been restated for the impact of the adoption of IFRS

15: Revenue from Contracts with Customers4 Percentage change at

constant currency exchange rates5 Like-for-like growth at constant

currency exchange rates and excluding the effects of acquisitions

and disposals6 Asia Pacific, Latin America, Africa & Middle

East and Central & Eastern Europe7 Percentage change at

constant currency exchange rates8 Like-for-like growth at constant

currency exchange rates and excluding the effects of acquisitions

and disposals9 Advertising, Media Investment Management10 Public

Relations & Public Affairs11 Brand Consulting, Health &

Wellness and Specialist Communications (including direct, digital

and interactive)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181025005354/en/

WPP+44 20 7408 2204Mark ReadAndrew ScottPaul RichardsonLisa

HauChris WadeorKevin McCormack / Fran Butera, +1

212-632-2235orJuliana Yeh, +852 2280 3790orBuchanan

CommunicationsRichard Oldworth, +44 20 7466 5000 / +44 7710 130

634wpp.com/investors

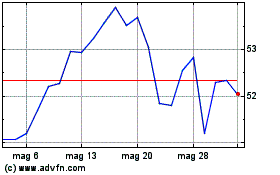

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni WPP (NYSE:WPP)

Storico

Da Lug 2023 a Lug 2024