UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| United States Steel Corporation |

(Name of Registrant as Specified In Its Charter)

|

| |

ANCORA CATALYST INSTITUTIONAL, LP

ANCORA BELLATOR FUND, LP

ANCORA CATALYST, LP

ANCORA MERLIN INSTITUTIONAL, LP

ANCORA MERLIN, LP

ANCORA IMPACT FUND LP SERIES CC

ANCORA IMPACT FUND LP SERIES DD

ANCORA ALTERNATIVES LLC

ANCORA HOLDINGS GROUP, LLC

FREDRICK D. DISANTO

JAMIE BOYCHUK

ROBERT P. FISHER, JR.

DR. JAMES K. HAYES

ALAN KESTENBAUM

ROGER K. NEWPORT

SHELLEY Y. SIMMS

PETER T. THOMAS

DAVID J. URBAN

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Ancora Catalyst Institutional,

LP, together with the other participants named herein (collectively, “Ancora”), intend to file a preliminary proxy

statement and accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of Ancora’s slate of director nominees at the 2025 annual meeting of stockholders (the “Annual Meeting”)

of United States Steel Corporation, a Delaware corporation (the “Company”).

On March 14, 2025, James

Chadwick, President of Ancora Alterantives LLC, was quoted in the following article published by Bloomberg:

US Steel Activist Investor Boosts Holdings in Turnaround Push

Bloomberg

By Joe Deaux

March 14, 2025

Ancora Holdings Group has added to its holdings of

United States Steel Corp. as the activist investor continues to push its case to replace the board and install a new chief executive officer

to lead a turnaround of the American steelmaker.

Ancora’s position in the Pittsburgh-based steelmaker

is now worth more than $100 million, Jim Chadwick, portfolio manager and head of the firm’s Alternatives subsidiary, said in an

interview. Chadwick said he continues to buy as it becomes more likely that Nippon Steel Corp.’s offer to buy US Steel will fall

through.

Ancora and Alan Kestenbaum — its nominee to

replace David Burritt as CEO of US Steel — haven’t yet spelled out a detailed plan to investors on how they intend to turn

around the once-iconic steelmaker. Chadwick said they’ll be investing “significant” capital and resources to grow the

North American flat-rolled steel business.

“If we go to the finish line on this, I’d

like to be a top-10 shareholder in the company. That’s the goal,” Chadwick said in an interview. “If there’s a

situation of the deal not going to happen, which I think is where we’re headed, I wouldn’t want leadership to use that and

come back and keep themselves entrenched.”

The recent buying adds to the activist investor’s

initial holding of some 0.18% it revealed in January after former President Joe Biden blocked the deal, citing national security concerns.

The increased position, Chadwick said, puts Ancora at just about 1% of total shares outstanding, putting it barely inside the top 20 holders.

Kestenbaum has also began buying stock personally

— enough to make him a larger shareholder of US Steel than the steel producer’s current CEO, Chadwick said. A government filing

with further details could be available later Friday, he said.

The move comes as hope for the deal that drew massive

attention during the 2024 American presidential election has shown little progress. President Donald Trump last month made clear that

he didn’t want Nippon Steel to hold a majority stake in the US firm.

US Steel said in a late-January statement that it’s

board has a proven track record of acting in the best interests of the company and stockholders. The company said it remains “confident

that our partnership with Nippon Steel is the best deal for American steel, American jobs, American communities and American supply chains.”

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Ancora Catalyst Institutional, LP (“Ancora

Catalyst Institutional”), together with the other participants named herein, intend to file a preliminary proxy statement and

accompanying universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for

the election of Ancora Catalyst Institutional’s slate of highly-qualified director nominees at the 2025 annual meeting of stockholders

of United States Steel Corporation, a Delaware corporation (the “Company”).

ANCORA CATALYST INSTITUTIONAL STRONGLY ADVISES ALL

STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the anticipated proxy solicitation

are expected to be Ancora Catalyst Institutional, Ancora Bellator Fund, LP (“Ancora Bellator”), Ancora Catalyst, LP

(“Ancora Catalyst”), Ancora Merlin Institutional, LP (“Ancora Merlin Institutional”), Ancora Merlin,

LP (“Ancora Merlin”), Ancora Impact Fund LP Series CC (“Ancora Impact CC”), Ancora Impact Fund LP

Series DD (“Ancora Impact DD”), Ancora Alternatives LLC, (“Ancora Alternatives”), Ancora Holdings

Group, LLC (“Ancora Holdings”), Fredrick D. DiSanto, Jamie Boychuk, Robert P. Fisher, Jr., Dr. James K. Hayes, Alan

Kestenbaum, Roger K. Newport, Shelley Y. Simms, Peter T. Thomas, and David J. Urban.

As of the date hereof, Ancora Catalyst Institutional

directly beneficially owns 440,932 shares of Common Stock, 100 shares of which are held in record name. As of the date hereof, Ancora

Bellator directly beneficially owns 239,599 shares of Common Stock. As of the date hereof, Ancora Catalyst directly beneficially owns

47,919 shares of Common Stock. As of the date hereof, Ancora Merlin Institutional directly beneficially owns 444,898 shares of Common

Stock. As of the date hereof, Ancora Merlin directly beneficially owns 45,415 shares of Common Stock. As of the date hereof, Ancora Impact

CC directly beneficially owns 518,909 shares of Common Stock. As of the date hereof, Ancora Impact DD directly beneficially owns 286,169

shares of Common Stock. As of the date hereof, Mr. DiSanto directly beneficially owns 10,000 shares of Common Stock. As of the date hereof,

Mr. Kestenbaum directly beneficially owns 500,000 shares of Common Stock. As the investment advisor and general partner to each of Ancora

Catalyst Institutional, Ancora Bellator, Ancora Catalyst, Ancora Merlin Institutional, Ancora Merlin, Ancora Impact CC, Ancora Impact

DD and the Ancora Alternatives SMAs, Ancora Alternatives may be deemed to beneficially own the 440,932 shares of Common Stock beneficially

owned directly by Ancora Catalyst Institutional, 47,919 shares of Common Stock beneficially owned directly by Ancora Catalyst, 239,599

shares of Common Stock beneficially owned directly by Ancora Bellator, 444,898 shares of Common Stock beneficially owned directly by Ancora

Merlin Institutional, 45,415 shares of Common Stock beneficially owned directly by Ancora Merlin, 518,909 shares of Common Stock beneficially

owned directly by Ancora Impact CC, 286,169 shares of Common Stock beneficially owned directly by Ancora Impact DD and 137,453 shares

of Common Stock held in the Ancora Alternatives SMAs. As the sole member of Ancora Alternatives, Ancora Holdings may be deemed to beneficially

own the 440,932 shares of Common Stock beneficially owned directly by Ancora Catalyst Institutional, 47,919 shares of Common Stock beneficially

owned directly by Ancora Catalyst, 239,599 shares of Common Stock beneficially owned directly by Ancora Bellator, 444,898 shares of Common

Stock beneficially owned directly by Ancora Merlin Institutional, 45,415 shares of Common Stock beneficially owned directly by Ancora

Merlin, 518,909 shares of Common Stock beneficially owned directly by Ancora Impact CC, 286,169 shares of Common Stock beneficially owned

directly by Ancora Impact DD and 137,453 shares of Common Stock held in the Ancora Alternatives SMAs. As the Chairman and Chief Executive

Officer of Ancora Holdings, Mr. DiSanto may be deemed to beneficially own the 440,932 shares of Common Stock beneficially owned directly

by Ancora Catalyst Institutional, 47,919 shares of Common Stock beneficially owned directly by Ancora Catalyst, 239,599 shares of Common

Stock beneficially owned directly by Ancora Bellator, 444,898 shares of Common Stock beneficially owned directly by Ancora Merlin Institutional,

45,415 shares of Common Stock beneficially owned directly by Ancora Merlin, 518,909 shares of Common Stock beneficially owned directly

by Ancora Impact CC, 286,169 shares of Common Stock beneficially owned directly by Ancora Impact DD and 137,453 shares of Common Stock

held in the Ancora Alternatives SMAs. As of the date hereof, Messrs. Boychuk, Fisher, Newport, Thomas, and Urban, Dr. Hayes and Ms. Simms

do not beneficially own any shares of Common Stock.

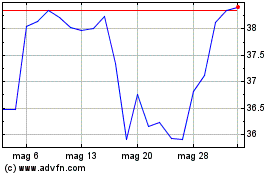

Grafico Azioni US Steel (NYSE:X)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni US Steel (NYSE:X)

Storico

Da Apr 2024 a Apr 2025