Opinion by: Igor Zemtsov, chief technology officer

at TBCC

Following “Libragate,”

memecoin prices crashed, with their market cap falling nearly 60%

from 2025’s highs. But meme tokens,

dead? They’ve got more lives than a cat on caffeine.

Despite the chaos, memecoins were still holding a $47.9-billion

market cap as of March 10. It’s not exactly spare change.

Meanwhile, degens are still out here “buying the dip” like it’s a

Black Friday sale, convinced that absurdly named tokens like

Unicorn Fart Dust, Fartcoin and Buttcoin will print them a 100x

profit before year’s end.

Some call it irrational. Others call it degeneracy. But when has

that ever stopped anyone in crypto?

Down bad, but not dead yet

Sure, memecoins aren’t exactly outshining Bitcoin

(BTC), Ether (ETH) or Solana

(SOL) right now. They’ve been

getting absolutely obliterated. Prices have tanked, liquidity has

dried up, and traders who thought they’d be sipping cocktails on a

yacht by now are busy coping in Telegram groups.

Let’s not pretend this is the first time memecoins have been

pronounced dead. Every time the world writes them off, they somehow

claw their way back — sometimes with an even more absurd rally than

before.

After all, logic has never been crypto’s strong suit. If it

were, we wouldn’t have seen billion-dollar valuations for

fart-themed tokens in the first place. And if human nature tells us

anything, it’s that people will always chase the next big hype

cycle — especially when it comes wrapped in humor and the promise

of overnight riches.

Memecoins are down bad right now. But dead? Not a chance. The

moment another ridiculous trend takes hold, the money will come

flooding back. Because in crypto, what goes down eventually goes

way back up — often in the most unexpected, meme-fueled ways.

Better marketing than serious crypto startups

Forget white papers, roadmaps or security audits. Memecoins

don’t need any of that. All it takes is a viral meme on X, a

10-minute token launch, and within a few weeks, it could be sitting

at a $50-million market cap. Meanwhile, legitimate projects spend

years developing products, hiring developers and raising funds,

only to watch their tokens struggle to gain traction.

Recent:

Solana revenue slumps 93% from January high after

memecoin bubble bursts

For memecoins, community is everything. The bigger it is, the

better the pump. It’s not just the kind that retweets project

updates 10 times daily, but one that fully embraces the joke. These

communities don’t just speculate — they believe. And when enough

people buy the meme, the token pumps.

Shiba Inu (SHIB) built a cult

following as the so-called Dogecoin (DOGE) killer. It never

killed DOGE, but it evolved into a $9-billion token with its own

blockchain. Others took an even weirder approach. Fartcoin turned

flatulence into finance. Unicorn Fart Dust captured the magic of

completely nonsensical branding. And Buttcoin, a 2013 meme mocking

Bitcoin, made a comeback to troll the entire industry.

The formula is obvious: The more absurd the name, the bigger the

hype. Sometimes, “it’s funny” is the only investment thesis you

need.

Sure, the crash wiped out some gains, but let’s not act like

memecoins vanished. They didn’t go to zero, which, in crypto terms,

makes them survivors. A strong community, relentless memes and

top-tier shitposting can keep even the most ridiculous assets

alive.

Memecoins are a rebellion against traditional finance

People are investing money in Dogecoin instead of Apple stock,

and for good reason. Well, sort of. Crypto has become the go-to

escape hatch for those fed up with traditional finance. Banks

freeze accounts. Regulators add more red tape. Insider trading runs

rampant. Meanwhile, memecoins are a free-for-all, where anyone can

win big or lose everything. No middlemen. No rules. Just vibes.

The same Buttcoin proves that people will pump anything just for

fun. What started as a joke now has a dedicated community trying to

make it the next Bitcoin. It’s complete insanity, which is

precisely why it works.

If the world has gone mad, why not profit from the chaos? With

financial markets becoming more centralized, restrictive and

controlled, memecoins offer an anarchic alternative. They represent

the financial Wild West, where anything goes; even the most absurd

assets can see billion-dollar valuations.

Memecoins as internet culture

Memecoins have been around since 2013, when Dogecoin launched as

a joke about speculative trading. No one — not even its creators —

took it seriously until Elon Musk got involved and became its

unofficial CEO.

That same year, Buttcoin was born from a YouTube video. It

wasn’t a token back then, just a meme. But years later, the

community decided to turn the joke into an actual cryptocurrency.

It exploded because people love jokes — and some believe it could

be the next Bitcoin.

Each new wave of memecoins pushes the absurdity even further —

first DOGE, then Shiba, then Bonk (BONK). Now we have an

entire market of tokens inspired by farts, crap and butts. And

somehow, they keep outperforming serious projects.

As long as people love memes, memecoins will have a place in

crypto. It is internet culture that has turned into an asset

class.

Are memecoins here to stay?

Most memecoins start as a joke, but some have found actual use

cases. DOGE is already accepted for payments by Tesla, AMC and

GameStop. SHIB holders can shop at Gucci, Nordstrom and Whole

Foods. Even newer projects like Solcat are launching games to

expand their ecosystems.

Memecoins aren’t just memes anymore. They’re shaping a new

financial reality where virality, speculation and internet culture

define value. But let’s address the obvious: The recent crash has

slashed valuations, leaving many wondering what’s next.

Are they here to stay, or are we watching them fade into

irrelevance? If history tells us anything, it’s that memecoins are

like cockroaches — resilient, unpredictable and always resurfacing.

Investors should brace for more chaos because these tokens are as

volatile as ever.

Memecoins may not be running the show right now, but let’s be

honest: The next big meme token is probably already brewing in a

Telegram group, just waiting for its moment to explode (or

implode).

Opinion by: Igor Zemtsov, chief technology officer

at TBCC.

This article is for

general information purposes and is not intended to be and should

not be taken as legal or investment advice. The views, thoughts,

and opinions expressed here are the author’s alone and do not

necessarily reflect or represent the views and opinions of

Cointelegraph.

...

Continue reading Memecoins 2.0: The market crashed,

but the billion-dollar circus rolls on

The post

Memecoins 2.0: The market crashed, but the

billion-dollar circus rolls on appeared first on

CoinTelegraph.

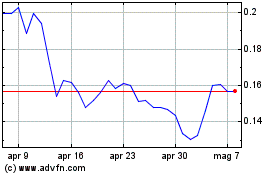

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Apr 2024 a Apr 2025