German Private Sector Downturn Deepens In September

23 Settembre 2024 - 8:34AM

RTTF2

German private sector activity fell deeper into contraction in

September with accelerated reduction in manufacturing output, flash

survey results from S&P Global showed on Monday.

At 47.2, the headline HCOB composite output index fell to a

seven-month low in September from 48.4 in August. The score was

forecast to fall moderately to 48.2.

The drag from the manufacturing sector increased as goods output

posted its steepest rate of contraction for 12 months. At the same

time, support to the economy from growth in the service sector

continued to wane.

The services Purchasing Managers' Index fell to a six-month low

of 50.6 compared to 51.2 in the previous month. The reading was

seen at 51.1.

The manufacturing PMI hit a 12-month low of 40.3, down from 42.4

in August. The reading was forecast to remain unchanged at

42.4.

Total inflows of business dropped the most in nearly a year, as

a renewed fall in new work received by services firms coincided

with a deepening downturn in manufacturing new orders. New export

business also decreased on a broad-based basis.

A fall in backlogs of work hinted at decreasing capacity

utilization across the private sector. Job losses were reported for

the fourth straight month.

Increased willingness to trim workforce numbers coincided with a

substantial deterioration in their expectations towards activity in

the coming year. For the first time in twelve months, companies

anticipating a decrease in output over the next year outnumbered

those forecasting a rise.

Turning to prices, the survey showed a notable softening of cost

pressures in September. Input price inflation in the service sector

was the weakest in over three-and-a-half years. Manufacturing

purchasing costs fell at the quickest pace in six months.

There was a slower increase in service sector output prices and

factory gate charges posted an accelerated and solid reduction.

"A technical recession seems to be baked in," Hamburg Commercial

Bank Chief Economist Cyrus de la Rubia said. "Our GDP nowcast for

the current quarter, which considers the HCOB PMI among other

indicators, now points to a 0.2% decrease compared to the quarter

before."

The economy already shrank at a rate of 0.1 percent in the

second quarter. There is still some hope that the fourth quarter

will be better as higher wages combined with lower inflation should

boost not only real income but also consumption, supporting

domestic demand, said de la Rubia.

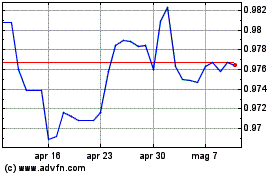

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Feb 2025 a Mar 2025

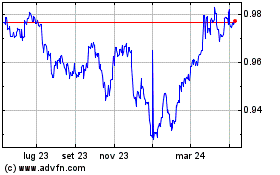

Grafico Cross Euro vs CHF (FX:EURCHF)

Da Mar 2024 a Mar 2025