U.S. Dollar Falls Amid Fed Rate Cut Speculation

25 Settembre 2024 - 6:10AM

RTTF2

The U.S. dollar weakened against other major currencies in the

Asian session on Wednesday, as traders speculate for another

half-point rate cut in November.

Investors await Fed Chair Jerome Powell's remarks on Thursday

and U.S. inflation data on Friday for further policy cues.

Asian stock markets traded higher, boosted by markets in China,

Hong Kong and Taiwan after China's central bank unveiled its

biggest stimulus since the pandemic to support the nation's

economy, primarily the property sector. Spike in commodity prices

also supported the markets.

Fed Governor Michelle Bowman said Tuesday that inflationary

risks remain, and the Fed should lower interest rates at a

"measured" pace.

She noted that lowering rates too quickly risks unleashing

pent-up demand and cash, which would send inflation upward

again.

Her comments stand in contrast to commentary from a handful of

other policymakers who saw scope for further easing.

The currency started falling by a weak consumer confidence

report on Tuesday.

Data from the Conference Board showed that the consumer

confidence index fell to 98.7 in September from an upwardly revised

105.6 in August. Economists had expected the index to edge down to

103.8 from the 103.3 originally reported for the previous

month.

In the Asian trading today, the U.S. dollar fell to a 1-month

low of 1.1199 against the euro and a 2-1/2-year low of 1.3430

against the pound, from yesterday's closing quotes of 1.1180 and

1.3412, respectively. The greenback may test support near 1.13

against the euro and 1.36 against the pound.

Against the yen and the Swiss franc, the greenback slipped to a

5-day low of 142.91 and a 1-week low of 0.8415 from Tuesday's

closing quotes of 143.21 and 0.8433, respectively. The next

possible downside target for the greenback is seen around 138.00

against the yen and 0.82 against the franc.

Against Australia, the New Zealand and the Canadian dollars, the

greenback slipped to more than a 1-1/2-year low of 0.6909, a

9-month low of 0.6356 and nearly a 7-month low of 1.3420 from

Tuesday's closing quotes of 0.6891, 0.6338 and 1.3430,

respectively. If the greenback extends its downtrend, it is likely

to find support around 0.70 against the aussie, 0.65 against the

kiwi and 1.32 against the loonie.

Looking ahead, U.S. MBA mortgage approvals data, U.S. new home

sales data for August and U.S. EIA crude oil data are slated for

release in the New York session.

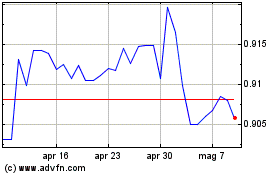

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Feb 2025 a Mar 2025

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Mar 2024 a Mar 2025