UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_________________________________________

SCHEDULE 14A INFORMATION

_________________________________________

Consent Solicitation Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

|

|

☒

|

|

Filed by a Party other than the Registrant

|

|

☐

|

Check the appropriate box:

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material pursuant to § 240.14a-12

|

Cass Information Systems, Inc.

(Name of Registrant as Specified in its Charter)

___________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

Cass Information Systems, Inc.

12444 Powerscourt Drive, Suite 550

St. Louis, Missouri, 63131

|

Notice of Annual Meeting of Shareholders

|

To be held on April 15, 2025

The Annual Meeting of Shareholders of Cass Information Systems, Inc. will be held at the location specified below on Tuesday, April 15, 2025, at 8:30 a.m. local time, for the following purposes:

1. To elect four directors to serve, each for a one-year term;

2. To hold a non-binding advisory vote on executive compensation;

3. To ratify the appointment of KPMG LLP as the independent registered public accounting firm for 2025; and

4. To act upon such other matters as may properly come before the Annual Meeting or any adjournment thereof.

The close of business on February 28, 2025 has been fixed as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

This year’s Annual Meeting will be held at The Bogey Club, located at 9266 Clayton Road, Saint Louis, Missouri 63124.

All shareholders are cordially invited to attend the Annual Meeting.

This booklet includes the notice and proxy statement, which describes the business we will conduct at the meeting and provides information about the Company that you should consider when you vote your shares. The Company has not planned a communications segment or any presentations for the Annual Meeting.

Whether or not you intend to be present, it is important that your shares be represented and voted at the Annual Meeting. You can vote your shares by one of the following methods: vote over the internet or by telephone using the instructions on your proxy card, or mark, sign, date and promptly return your proxy card. The presence, in person or by properly executed proxy, of a majority of the common stock outstanding on the record date is necessary to constitute a quorum at the Annual Meeting.

Please note that you will be required to present an admission ticket to attend the Annual Meeting. Your admission ticket is attached to your proxy card. If your shares are held in the name of a broker, trust, bank or other nominee, you can request an admission ticket by contacting our Investor Relations department at (314) 506-5500 or ir@cassinfo.com.

By Order of the Board of Directors,

Matthew S. Schuckman

Secretary

St. Louis, Missouri

March 6, 2025

1

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on April 15, 2025 :

The Company’s Proxy Statement and annual report on Form 10-K for the 2024 fiscal year are available free of charge at www.investorvote.com/cass and on our Investor Relations site at www.cassinfo.com.

The Company makes available free of charge, through its website www.cassinfo.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed and furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the Exchange Act), as soon as reasonably practicable after such documents are electronically filed with, or furnished to, the Securities and Exchange Commission (the SEC).

|

2

|

CASS INFORMATION SYSTEMS, INC.

Proxy Statement

|

Table of Contents

3

Proxy Statement

Cass Information Systems, Inc.

12444 Powerscourt Drive, Suite 550

St. Louis, Missouri, 63131

Proxy Statement

Annual Meeting of Shareholders to be held April 15, 2025

This Proxy Statement is being furnished to the common shareholders of Cass Information Systems, Inc. (the Company) on or about March 6, 2025 in connection with the solicitation of proxies on behalf of the Board of Directors of the Company (the Board) for use at the annual meeting of shareholders (the Annual Meeting) to be held on April 15, 2025 at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting, and at any adjournment of that meeting.

Holders of common stock, par value $.50 per share, of the Company at its close of business on February 28, 2025 (the Record Date) are entitled to receive notice of and vote at the Annual Meeting. On the Record Date, there were 13,464,839 shares of common stock outstanding and entitled to vote at the Annual Meeting. Holders of record of common stock are entitled to one vote per share of common stock they held of record on the Record Date on each matter that may properly come before the Annual Meeting. Company management and members of the Board, in the aggregate, directly or indirectly controlled approximately 3.16% of the common stock outstanding on the Record Date.

Shareholders of record on the Record Date are entitled to cast their votes in person or by properly executed proxies at the Annual Meeting. The presence, in person or by properly executed proxy, of a majority of the shares of common stock outstanding on the Record Date is necessary to constitute a quorum at the Annual Meeting. If a quorum is not present at the time the Annual Meeting is convened, the Company may adjourn the Annual Meeting.

If a quorum is present, the affirmative vote of a majority of the shares entitled to vote which are present in person or represented by proxy at the Annual Meeting is required to elect directors; approve, by advisory vote, executive compensation; ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2025; and to act on any other matters properly brought before the Annual Meeting. This means that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” a director nominee for such nominee to be elected or “for” such other proposal for it to be approved. Shareholders may not cumulate their votes in the election of directors.

In tabulating the voting results, abstentions and shares represented by broker non-votes (explained below) will be counted as present and entitled to vote for purposes of determining a quorum. For purposes of determining whether the shareholders have elected a director nominee or approved a matter, abstentions are treated as shares represented and entitled to vote on each proposal and will thus have the same effect as a vote “against” a director nominee or such other proposal. Shares held by brokers that do not have discretionary authority to vote on a proposal and have not received voting instructions from their clients are considered “broker non-votes.” Broker non-votes will not be considered in determining the number of votes necessary for approval of a matter and will have no effect on the outcome of the vote for directors or other proposals. As such, for your vote to be counted, you must submit your voting instruction form to your broker.

Please note that brokers may not use discretionary authority to vote shares on the election of directors if they have not received instructions from their clients. Please vote your proxy so your vote can be counted. The inspector of elections appointed for the Annual Meeting will separately tabulate and certify affirmative and negative votes, abstentions and broker non-votes.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by (i) filing with the Secretary of the Company, at or before the Annual Meeting, a written notice of revocation bearing a date later than the date of the proxy, (ii) duly executing and dating a subsequent proxy relating to the common stock and delivering it to the Secretary of the Company at or before the vote is taken at the Annual Meeting, or (iii) attending the

4

Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice revoking a proxy, or any subsequent proxy, should be sent to Cass Information Systems, Inc., Attn: Matthew S. Schuckman, Secretary, 12444 Powerscourt Drive, Suite 550, St. Louis, Missouri 63131.

All common stock represented at the Annual Meeting by properly executed proxies received prior to or at the Annual Meeting and not properly revoked will be voted at the Annual Meeting in accordance with the instructions indicated in such proxies. If no instructions are indicated, such proxies will be voted FOR the election of the Board’s director nominees; FOR approval of executive compensation; FOR the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2025; and in the discretion of the proxies with respect to any other matter that is properly brought before the Annual Meeting or any adjournment thereof. The Board does not know of any matters other than the matters described in the Notice of Annual Meeting attached to the Proxy Statement that will come before the Annual Meeting.

The Board solicits the proxies. In addition to the use of the mails, proxies may be solicited personally or by telephone or electronic transmission by directors, officers or regular employees of the Company. It is contemplated that brokerage houses, custodians, nominees and fiduciaries will be requested to forward the soliciting material to the beneficial owners of common stock held of record by such persons, and will be reimbursed by the Company for expenses incurred therewith. The cost of solicitation of proxies will be borne by the Company.

5

Proposal No. 1

Election of Directors

Composition of the Board, Board Diversity and Director Qualifications

Proposal 1: Election of Directors

The Board recommends a vote FOR each director nominee.

|

Name and

Principal Occupation

|

Independent

|

Age

|

Director Since

|

|

Committee

Memberships

|

|

| |

ARC

|

CC

|

NGC

|

|

Ralph W. Clermont

Director

|

Yes

|

77

|

2015

|

|

ò

|

|

ò

|

|

Wendy J. Henry

Director

|

Yes

|

63

|

2022

|

|

ò

|

|

|

|

James J. Lindemann

Director

|

Yes

|

69

|

2007

|

|

|

ò

|

|

|

Sally H. Roth

Director

|

Yes

|

77

|

2019

|

|

|

|

ò

|

|

ARC

|

Audit and Risk Committee

|

CC

|

Compensation Committee

|

NGC

|

Nominating and Corporate Governance Committee

|

Composition of the Board

The size of the Company’s Board is set at 12 members. On January 21, 2025, the Board approved and adopted the Third Amended and Restated Bylaws of the Company (as so amended, the “Bylaws”). The amendments include the following change as it relates to the composition of the Board:

The current Board is divided into three classes. Prior to the adoption of the amended Bylaws, each director was elected for a three-year term, and the term of each class of directors expired in successive years. The amended Bylaws work to declassify the Board as directors’ terms expire as follows: each director elected at the 2025 annual meeting of shareholders will be elected for a one-year term expiring at the 2026 annual meeting of shareholders; each director elected at the 2026 annual meeting of shareholders will be elected for a one-year term expiring at the 2027 annual meeting of shareholders; and at the 2027 annual meeting of shareholders and at each annual meeting of shareholders thereafter, all directors will be elected for a one-year term expiring at the next annual meeting of shareholders.

6

Proposal No. 1 - Election of Directors

Nominees and Continuing Directors

The Nominating and Corporate Governance Committee has nominated incumbent directors Ralph W. Clermont, Wendy J. Henry, James J. Lindemann, and Sally H. Roth for re-election, each to serve a one-year term.

Each of the nominees has consented to serve if elected. If any of them become unavailable to serve as a director before the Annual Meeting, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board. Proxies cannot be voted for a greater number of nominees than those named in this Proxy Statement.

The following information is submitted with respect to the nominees for election to the Board, together with the members of the Board whose terms will continue after the Annual Meeting or until their respective successors are duly elected and qualified:

Director Biographies

The following is a brief biographical summary of the experience of our directors and director nominees:

Director nominees to serve a one-year term until 2026:

|

Ralph W. Clermont

Ralph W. Clermont, 77, has been a director since 2015. Mr. Clermont enjoyed a 39-year career with KPMG LLP, retiring in 2008 as managing partner of its St. Louis office where he led the firm’s Midwest financial services practice and managed the audits of numerous banking organizations. He currently serves as Lead Director of National Bank Holdings Corporation, a publicly traded bank holding company, where he is also Chairman of the Audit and Risk Committee as well as a member of its Compensation Committee and Nominating and Corporate Governance Committee. Mr. Clermont is a certified public accountant and member of both the American Institute of Certified Public Accountants and the Missouri Society of Certified Public Accountants. He earned his bachelor’s degree in accounting from Saint Louis University.

The Board selected Mr. Clermont for his clear understanding of the complex financial and accounting issues that face multi-faceted organizations such as Cass.

|

| |

|

Wendy J. Henry

Wendy J. Henry, 63, has been a director since 2022. Ms. Henry served as Managing Partner of the BKD, LLP (BKD), now Forvis Mazars, LLP, St. Louis office until her retirement in 2021. Prior to becoming Managing Partner, Ms. Henry served as an Audit Partner in BKD’s Colorado office, where she held various positions and managed the audits of numerous organizations. Her career at BKD began in 1993 when her prior firm merged into BKD. Ms. Henry is a retired certified public accountant and member of the American Institute of Certified Public Accountants and has previously served on the board of directors at United Way of Greater St. Louis, St. Louis Zoo, Mercy Health East Communities, and Regional Business Council. She earned her bachelor’s degree in business with a concentration in accounting from Illinois College.

The Board selected Ms. Henry for her financial and risk management expertise, including understanding the complex risk management, financial and accounting issues that face multi-faceted organizations such as Cass.

|

| |

|

James J. Lindemann

James J. Lindemann, 69, has been a director since 2007. Until his retirement in 2018, he was Executive Vice President of Emerson Electric Co. (Emerson), a publicly traded manufacturing company based in St. Louis, Missouri. Mr. Lindemann joined Emerson in 1977, where he held a number of increasingly responsible engineering and marketing positions with its Specialty Motor business unit. In 1992, he was named President of Commercial Cam, and in 1995, he was named President of the Emerson Appliance Motor business unit. In 1996, Mr. Lindemann was promoted to Chairman and CEO of the Emerson Motor Co. He was named Senior Vice President of Emerson in 1999 and Executive Vice President in 2000.

The Board selected Mr. Lindemann to serve as a director based on his experiences with Emerson, where he has served as a senior manager of a publicly traded manufacturing company, obtained international expertise and worked successfully with large corporate enterprises.

|

7

Proposal No. 1 - Election of Directors

|

Sally H. Roth

Sally H. Roth, 77, has been a director since 2019. Ms. Roth served as Area President-Upper Midwest for Regions Bank from 2007 until her retirement in 2014. Prior to her appointment as Area President, Ms. Roth served as Regions Bank’s Commercial Banking Executive for the Saint Louis metropolitan market. Her banking career began at Mercantile Bank (now U.S. Bank) in 1985 where she held various positions including Group Manager – Large Corporate Banking and Community Bank President until 1997. Ms. Roth served in various roles at Bank of America from 1997 to 2002. She holds a Master of Business Administration degree from Washington University in Saint Louis.

The Board selected Ms. Roth to serve as a director because of her extensive commercial banking experience and expertise and her unique knowledge of the banking markets in which the Company does business.

|

|

The Company’s Board recommends a vote “FOR” the four nominees for election to the Board of Directors.

|

Directors to serve until 2027:

|

Robert A. Ebel

Robert A. Ebel, 69, has been a director since 2006. He was CEO of Universal Printing Company, a privately-held printing company headquartered in St. Louis, Missouri, until the sale of the company in 2017. Mr. Ebel began his tenure with Universal Printing Company as CFO and Board member in 1986. In 1996, he was appointed to the position of CEO. Mr. Ebel currently serves on the Board of the St. Louis Graphic Arts Joint Health and Welfare Fund and is active in various civic and charitable organizations in the St. Louis metropolitan area.

The Board selected Mr. Ebel to serve as a director because it believes he brings valuable business management and finance expertise to the Board. His duties as CEO of a privately-held business based in St. Louis provided him with a strong knowledge of the local commercial marketplace served by the Company’s subsidiary bank.

|

| |

|

Randall L. Schilling

Randall L. Schilling, 62, has been a director since 2009. He is the founder and owner of OPO Startups, a co-working center for digital startups providing space and access to mentors, investors, programming, educational resources, and a community of local entrepreneurs. He was the President and CEO of BoardPaq LLC, a privately-held software company based in St. Charles, Missouri, from 2010 until the sale of the company in 2019. From 1992 to 2010, he was the CEO of Quilogy, Inc., a nationally recognized, privately-held information technology professional services company. Mr. Schilling is currently the President & CEO of Munibit, a privately held software company based in St. Charles, Missouri. Additionally, Mr. Schilling has been active in various other civic and charitable organizations in the St. Louis metropolitan area, including Partners for Progress – Education Chairman.

The Board selected Mr. Schilling to serve as a director because he possesses information technology expertise to help address the challenges the Company faces in the rapidly changing information technology arena.

|

| |

|

Franklin D. Wicks, Jr.

Franklin D. Wicks, Jr., 71, has been a director since 2006. He was Executive Vice President and President of Applied Markets of Sigma-Aldrich Corporation (Sigma-Aldrich), which was a publicly-traded life science and high technology company located in St. Louis, Missouri, until his retirement in 2015. Dr. Wicks worked for Sigma-Aldrich for 33 years, beginning as a research chemist and subsequently working in marketing, then as President of Sigma Chemical and Vice President of Worldwide Operations, Sigma-Aldrich. He served as President, Scientific Research Division, Sigma-Aldrich from 1999 to 2002 and was responsible for operations in 34 countries. Prior to his appointment as Executive Vice President and President of Applied Markets of Sigma-Aldrich, Dr. Wicks served as President-SAFC. After receiving his Ph. D., Dr. Wicks served for four years on the staff of the Navigators at the Air Force Academy and at the University of Colorado at Boulder before joining Sigma-Aldrich. He currently serves on the advisory Board of Covenant Theological Seminary.

The Board selected Dr. Wicks to serve as a director because of his public company senior management experience, familiarity with corporate governance, and knowledge of local and global marketplace issues.

|

8

Proposal No. 1 - Election of Directors

Directors to serve until 2026:

|

Eric H. Brunngraber

Eric H. Brunngraber, 68, has been a director since 2003. Mr. Brunngraber currently serves as Executive Chairman of the Company, a position he has held since his retirement as CEO effective April 18, 2023 and as Chairman of the Board of Directors, a position he has held since 2015. Mr. Brunngraber has served in several executive and numerous other positions with the Company since his employment with Cass began in 1979, including as CEO from 2008 until April 2023, President from 2006 to 2022, Chief Operating Officer (COO) from 2006 to 2008, Chief Financial Officer (CFO) from 1997 to 2006, and Executive Vice President of Cass Commercial Bank, the Company’s bank subsidiary. Mr. Brunngraber is and has been active in numerous civic, charitable, and professional organizations in the St. Louis metropolitan area, including the Regional Business Council, CEOs Against Cancer, and Concordance, a St. Louis based nonprofit established to reduce reincarceration rates.

The Board selected Mr. Brunngraber to serve as a director because of his long tenure with the Company that has provided him with a deep understanding of its strategy, business lines, operations, finance, regulatory environment, and culture.

|

| |

|

Benjamin F. Edwards, IV

Benjamin F. Edwards, IV, 69, has been a director since 2005. He is Chairman, CEO and President of Benjamin F. Edwards & Company, a St. Louis-based investment firm. Previously, Mr. Edwards was branch manager of the Town & Country, Missouri office of A.G. Edwards/Wachovia Securities LLC, a national investment firm. Mr. Edwards’ career with A.G. Edwards began in 1977, where he held numerous positions including Employment Manager, Financial Advisor, Associate Branch Manager, Regional Officer, Director of Sales and Marketing and President, as well as a member of the Board of Directors of A.G. Edwards from 1994 to 2007. He currently is a member of the Board of The Bogey Club in St. Louis and a member of the CEO Forum.

The Board selected Mr. Edwards to serve as a director because of his management expertise in investment banking, including experience with capital markets transactions and investments in both public and private companies.

|

| |

|

Ann W. Marr

Ann W. Marr, 67, has been a director since August 2022. She joined World Wide Technology, Inc. (WWT), a St. Louis based systems integrations, value added reseller and software development company, in 1997 as Executive Vice President of Global Human Resources, a position she served in until her retirement in January 2024. Ms. Marr has over 30 years of experience in human resources and has previously held positions with Enterprise Rent-A-Car and Anheuser Busch Companies. Ms. Marr also managed WWT’s Corporate Development Program, which includes diversity and inclusion, supplier diversity and small business enterprise and was President of the WWT Charitable Foundation. She is very active in the St. Louis community, having served on the Board of Trustees for Maryville University, the St. Louis Regional Chamber Association, the United Way of Greater St. Louis, Charmaine Chapman Society, The St. Louis Police Foundation, and the Gateway Arch Park Foundation. Ms. Marr also is on the Advisory Board of the National Association of African Americans in Human Resources and a member of the Society for Human Resource Management.

The Board selected Ms. Marr to serve as a director because of her extensive background in human capital management, bringing perspective to the dramatic changes in the work environment and her leadership and oversight experience with respect human resources and other executive compensation related matters.

|

| |

|

Martin H. Resch

Martin H. Resch, 59, was elected to serve as a director on the Board in 2023. Mr. Resch is President and CEO of the Company, positions he has held since 2022 and April 2023, respectively. Prior to joining the Company in November 2020, Resch was senior executive at Bank of the West in San Francisco, California. As executive vice president, Resch functioned as the commercial banking group’s chief administrative officer/chief operating officer with responsibility for strategy, operations, finance, technology and human resources, as well as collaborating with a B2B FinTech incubator. His other roles at Bank of the West included serving as corporate treasurer and leading the regulatory response to the Dodd-Frank and Volcker legislation. Resch earned his bachelor’s degree in computer science from Oregon State University and master’s degree in business administration from Cornell University.

The Board selected Mr. Resch to serve as a director because of his role as the Company’s CEO in which he is responsible for the strategic direction and day-to-day leadership of the Company. Furthermore, Mr. Resch has highly relevant technology experience and valuable insights running banks.

|

9

Proposal No. 1 - Election of Directors

|

Joseph D. Rupp

Joseph D. Rupp, 74, has been a director since 2016. He currently serves as Lead Director of the Board, a position he has held since 2019. He retired from a 45-year tenure with Olin Corporation (Olin), a publicly traded global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition located in Clayton, Missouri. During his time at Olin, Mr. Rupp served as Chairman of the Board from 2016 until his retirement in 2017, as Chairman and CEO from 2015 to 2016, as Chairman, President and CEO from 2005 to 2014, and as President and CEO from 2002 to 2005. Mr. Rupp previously served on the board of directors of Nucor Corporation, a publicly traded producer of steel and related products, Dot Foods, Inc., a privately held foodservice redistribution company, and O-I Glass, Inc., a publicly traded glass bottle manufacturer. He earned his bachelor’s degree in metallurgical engineering from Missouri University of Science and Technology.

The Board selected Mr. Rupp to serve as Lead Director because it believes he has valuable experience understanding the day-to-day and more complex issues that face multi-faceted, publicly traded organizations.

|

Director Independence

Based on the independence standards as defined by the Nasdaq marketplace rules, the Board has determined in its business judgment that all of the directors and director-nominees are independent as such term is defined in the Nasdaq listing standards, except for Mr. Brunngraber and Mr. Resch. In addition, each of the members of the Audit and Risk Committee and Compensation Committee meets the heightened independence standards set forth in the SEC rules and the Nasdaq listing standards. In making these determinations, the Board has reviewed all transactions and relationships between each director (or any member of his or her immediate family) and the Company, including transactions and relationships described in the directors’ responses to questions regarding employment, business, family, and other relationships with the Company and its management. These included transactions relating to non-audit accounting services provided to the Company by Forvis, LLP, Ms. Henry’s former employer, and commissions paid in connection with the Company’s share repurchase program to Benjamin F. Edwards & Company, of which Mr. Edwards serves as Chairman, CEO and President. The Board has concluded that these transactions did not impair director independence for a variety of reasons, including that (i) the amounts in question were considerably under the thresholds set forth in applicable independence standards, in each case less than 1% of the recipient’s consolidated gross revenues, (ii) Ms. Henry and Mr. Edwards did not have a direct or indirect interest in the transactions, and (iii) the relationships overall were deemed immaterial. As a result of this review, the Board concluded, as to each independent director, that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

10

Corporate Governance

Corporate Governance Guidelines

The Board oversees and guides the Company’s management and its business affairs. Committees support the role of the Board on issues that benefit from consideration by a smaller, more focused subset of directors. All committee members are elected by and serve at the pleasure of the Board. In its oversight of the Company, the Board sets the tone for the ethical standards and performance of management, staff, and the Company as a whole. The Board has adopted Corporate Governance Guidelines that capture the long-standing practices of the Company as well as current corporate governance best practices. The guidelines are available on our Investor Relations site at www.cassinfo.com.

The Company has adopted a Code of Conduct and Business Ethics policy, applicable to all Company directors, executive officers and employees. This policy is publicly available and can be viewed on the Company’s Investor Relations site at www.cassinfo.com.

Board Evaluation

The Board conducts a self-assessment annually to review its performance over the past year and determine whether it and its committees are functioning effectively. The Chairman of the Nominating and Corporate Governance Committee is responsible for leading the review of the Board and summarizing the overall findings. Each member of the Board conducts a thorough evaluation of the Board as a whole and each member of the Board individually. This assessment seeks to review areas in which the Board and/or management believes a better contribution could be made. The Chairman of the Nominating and Corporate Governance Committee reviews the evaluations and presents a summary of findings to the Board. The Board uses this information to create a set of action items for any areas in which members feel could improve the Board’s effectiveness.

Each individual Board committee also conducts its own self-assessment annually and presents a summary to the Board. The Board then determines if there are steps that should be taken to improve the efficiency and effectiveness of each committee.

The purpose of these annual evaluations is not to focus on individual Board members, but the Board and each committee as a whole. A separate assessment of each individual director is made by the Nominating and Corporate Governance Committee when deciding whether to nominate such director for reelection to the Board.

The Nominating and Corporate Governance Committee periodically reviews the self-assessment process and makes changes it deems necessary to improve the process and its effectiveness.

Board Leadership Structure

The Company’s Corporate Governance Guidelines provide guidance and flexibility that allows the Board to determine the best leadership structure to promote Board effectiveness and ensure that authority and responsibility are effectively allocated between the Board and management. The Board recognizes that no single leadership model is right for all companies and at all times, and depending on the circumstances and personnel, different leadership structures may be appropriate. Accordingly, the Board formally reviews its leadership structure not less than annually as part of its self-evaluation process to ensure that the proper balance is present in the Company’s current model.

In April 2023, as part of a planned succession process, Mr. Brunngraber transitioned roles from Chairman and CEO to Executive Chairman of the Board. Mr. Resch succeeded Mr. Brunngraber as CEO and was appointed to the Board. The Board thoroughly evaluated its leadership structure in the period leading up to this transition. The Board believes that

11

Mr. Brunngraber, as the former CEO and extensive experience with the Company, continues to be best situated to serve as Chairman at this time because his deep understanding of the Company’s operations and strategic plan make him uniquely qualified to provide the continuity needed to continue to ensure a smooth transition of the CEO role.

The Board believes that Mr. Rupp, as Lead Independent Director, brings to the Board experience, oversight, and expertise from outside the Company that allows him to provide strong independent oversight of management. The Company’s Corporate Governance Guidelines provide that the Lead Director must qualify as independent in accordance with the Guidelines. It is the Lead Director’s role to promote the appropriate involvement of the independent directors in governance matters and ensure the effectiveness of the independent directors in their role on behalf of the shareholders. In particular, the Lead Director is responsible for (a) staying regularly informed about the strategy of the Company and about critical issues and performance of the Company; (b) working with both the Chairman and CEO to set the agendas for Board meetings; (c) calling meetings of the independent directors when needed; (d) providing Board leadership in times of crisis; (e) setting the agenda for and chairing executive sessions of the independent directors; (f) acting as liaison between the independent directors and the Chairman for matters raised in executive sessions; (g) chairing meetings of the Board or shareholders when the Chairman is not in attendance; (h) attending meetings of the committees of the Board when necessary or at his/her discretion and communicating regularly with the chairs of the Board committees; (i) working with the Chairman to ensure the conduct of Board meetings provides adequate time for serious discussion of important issues and that appropriate information is made available to Board members on a timely basis; (j) being available on request for consultation and direct communication with major shareholders; and (k) performing such other duties as may be requested from time to time by the Board or by a majority of the independent directors.

For these reasons, and after considering the perspectives of the independent directors and benchmarking and performance data, the Board determined that this leadership structure continues to be in the best interests of shareholders at this time. With a former CEO serving as Chairman, there is unified leadership and continuity, while the Lead Independent Director holds management accountable for the Company’s continued success. While the Board has determined that this leadership structure is best for the Company and its shareholders at this time, the Board will continue to monitor its effectiveness and appropriateness.

In accordance with the Company’s Corporate Governance Guidelines, non-management directors convene quarterly without the presence of management directors or executive officers of the Company.

Risk Management Oversight

The Board believes that risk is inherent in innovation and the pursuit of long-term growth opportunities. The Company’s management is responsible for day-to-day risk management activities. The Board, acting directly and through its committees, is responsible for the oversight of the Company’s risk management practices. The Board’s role in the Company’s risk oversight process includes regular reviews of information from senior management (generally through Board committee presentation) regarding the areas of material risk to the Company. A description of certain material risks affecting the Company can be found in the Annual Report on Form 10-K for the year ended December 31, 2024. The Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Audit and Risk Committee oversees management of financial reporting, legal and regulatory compliance, and information technology risks, including cybersecurity risks. The Nominating and Corporate Governance Committee manages risks associated with the independence of the Board, potential conflicts of interest, and environmental, social, and governance (ESG) matters. Each committee reports regularly to the full Board on its activities. In addition, the Board participates in regular discussions with the Company’s senior management on many core subjects, including strategy, operations, finance, legal compliance, and public policy matters, in which risk oversight is an inherent element. The members of the Board also receive regular training from outside counsel on key risk topics, including legal and regulatory compliance, public company reporting requirements, ESG matters, information technology, cybersecurity and data privacy, as well as other topics of importance to public company governance, in order to remain current on best practices in managing risk.

12

Communications with the Board of Directors

The Board has established a process by which shareholders can communicate with the Board. Shareholders may communicate with any and all members of the Board by transmitting correspondence to the following address: Cass Information Systems, Inc., Name of Director(s), Attn: Matthew S. Schuckman, Secretary, 12444 Powerscourt Drive, Suite 550, St. Louis, Missouri 63131.

The Secretary will forward all correspondence to the Chairman or the identified director as soon as practicable. Correspondence addressed to the full Board will be forwarded to the Chairman, who will present the correspondence to the full Board or a committee thereof.

Board Meetings and Committees of the Board

The Board holds regularly scheduled meetings in January, April, July, and October. During the fiscal year ended December 31, 2024, the Board held its four regular meetings, and one additional offsite planning meeting was held in November to discuss the Company’s strategic plan. All directors attended at least 75% of the aggregate number of meetings of the Board and committees on which they served in 2024. The Company’s directors are encouraged, but not required, to attend the Company’s Annual Meeting. Each director who was serving on the Board at the time of the 2024 Annual Meeting of Shareholders attended the 2024 Annual Meeting of Shareholders.

The Company has three standing committees: the Audit and Risk Committee, the Nominating and Corporate Governance Committee, and the Compensation Committee. Each of these committees has a written charter approved by the Board annually. A copy of each charter can be found in the Investor Relations section of the Company’s website at www.cassinfo.com.

The following table represents the current membership of each of the Board committees and number of meetings held by each committee in 2024 (in parentheses). Each of the committees is comprised entirely of independent directors, as defined by Nasdaq and SEC rules.

|

Audit and Risk (5)

|

Nominating and Corporate Governance (4)

|

Compensation (4)

|

|

Ralph W. Clermont *

|

Ralph W. Clermont

|

James J. Lindemann *

|

|

Robert A. Ebel

|

Benjamin F. Edwards, IV

|

Ann W. Marr

|

|

Wendy J. Henry

|

Sally H. Roth

|

Joseph D. Rupp

|

|

Randall L. Schilling

|

Franklin D. Wicks, Jr. *

|

Franklin D. Wicks, Jr.

|

|

*Committee Chairman

|

|

|

13

The Audit and Risk Committee operates pursuant to the written charter approved by the Board. The charter is reviewed annually by the Committee and the Board and amended as appropriate to reflect the changing needs of the Company for risk oversight and the role of the Audit and Risk Committee in providing sound oversight in accordance with current best practices.

The Audit and Risk Committee oversees the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements. The Audit and Risk Committee is responsible for appointing, determining funding for and overseeing the independent registered public accountants for the Company, and meeting with and communicating between the independent registered public accountants and other corporate officers to review and participate in matters relating to corporate financial reporting and accounting procedures and policies. Among other responsibilities, the Audit and Risk Committee reviews financial information provided to shareholders and others, assesses the adequacy of financial and accounting controls, oversees implementation of new accounting standards and evaluates the scope of the audits of the independent registered public accountants and reports on the results of such reviews to the Board. In addition, the Audit and Risk Committee assists the Board in its oversight of the performance of the Company’s internal auditors. The Audit and Risk Committee meets with the internal auditors on a quarterly basis to review the scope and results of their work.

The Audit and Risk Committee also has primary responsibility for overseeing risks related to legal and regulatory compliance, information technology, data protection and cybersecurity, including the implementation of artificial intelligence, although the full Board also exercises oversight over these risks. This oversight includes receiving reports from the Company’s CIO on data protection and cybersecurity matters and strategies on a quarterly basis, with more frequent consultation should the need arise due to a specifically identified threat event or risk. Changes to the Company’s information security policies and programs are approved by the Audit and Risk Committee.

The Audit and Risk Committee is composed entirely of independent directors, each of whom meets the SEC’s independence and experience requirements. Further, the Board has determined that each of Mr. Clermont and Ms. Henry qualifies as an “audit committee financial expert,” as defined by the SEC and in accordance with the Nasdaq listing rules. In accordance with the charter, the Audit and Risk Committee meets as often as it determines necessary to fulfill its responsibilities, but not less than quarterly. The Committee met five times in 2024.

The Compensation Committee fulfills the Board’s responsibilities relating to compensation of the Company’s directors, CEO, and other executives. The Compensation Committee also has responsibility for approving, evaluating, and administering the compensation plans, policies, and overall programs of the Company. The Compensation Committee is able to delegate any of its responsibilities to one or more subcommittees as it deems appropriate in its discretion.

Compensation Processes and Procedures

As specified in its charter, the Compensation Committee recommends annual retainer fees, Board and committee meeting fees, and terms and awards of stock compensation for non-management directors, subject to appropriate approval by the Board or shareholders.

The Compensation Committee also establishes and administers the Company’s executive compensation program and related benefits. While the Compensation Committee may seek input and recommendations from the CEO, CFO, or the Senior Vice President of Human Resources concerning the elements of executive and director compensation, and confer with them on compensation philosophies, all significant matters regarding compensation for executives are ultimately the responsibility of the Compensation Committee. The Compensation Committee annually reviews corporate goals and objectives relative to the CEO’s compensation and determines the CEO’s compensation level based on this evaluation, subject to Board approval. The Compensation Committee is responsible for recommending to the Board salary levels and incentive stock compensation for executive officers of the Company, and approving incentive stock compensation for other members of management as recommended by the CEO. The responsibility for allocating cash bonuses for executive officers other than himself is delegated to the CEO, in accordance with provisions of the profit-sharing program approved by the Board.

14

Periodically, the Company uses compensation specialists to assist in designing or modifying some components of its overall compensation program and to provide comparison data of compensation at other organizations with which the Company competes for executive management talent. In such circumstances, the Compensation Committee does not rely solely on survey data or the consultant’s judgment or recommendation, but considers such data when exercising its judgment in evaluating the Company’s compensation program.

Compensation Committee Interlocks and Insider Participation

Ms. Marr and Messrs. Lindemann, Rupp and Wicks served on the Compensation Committee during the entire fiscal year ended December 31, 2024. None of the members of the Compensation Committee during the last fiscal year is or has been an officer or employee of the Company. None of the Company’s executive officers currently serves, or in the past fiscal year has served, as a member of the Board of Directors or compensation committee (or other Board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on the Board or the Compensation Committee.

None of the members of the Company’s Compensation Committee or other members of the Board is a person having a relationship requiring disclosure by the Company pursuant to Item 404 of Regulation S-K.

|

Nominating and Corporate Governance Committee

|

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become members of the Board, recommending director-nominees, and developing and addressing corporate governance principles and issues applicable to the Company and its subsidiaries. The Nominating and Corporate Governance Committee also oversees the Company’s progress on ESG matters, working with the Company’s management and ESG Committee.

In recommending director-nominees to the Board, the Nominating and Corporate Governance Committee solicits candidate recommendations from its own members, other directors, and management. In evaluating candidates, the Nominating and Corporate Governance Committee takes into consideration such factors as it deems appropriate, including any legal requirements or listing standards requirements. The Nominating and Corporate Governance Committee considers a candidate’s judgment, skills, integrity and moral character, experience with organizations of comparable size and complexity, the interplay of the candidate’s experience with the experience of other Board members, and the extent to which the candidate would be a desirable and valuable addition to the Board and any committees of the Board. Furthermore, the Nominating and Corporate Governance Committee also evaluates candidates’ relevant experience in business generally and within the financial industry, as well as a candidate’s education and other matters, and seeks candidates with skills and acumen relating to audit and finance functions, corporate governance, culture, human capital management, operations and technology, cybersecurity, risk management, and specific industries strategically important to the Company. With respect to incumbent candidates, the Committee also considers meeting attendance, meeting participation and the Board evaluation. The criteria and selection process are not standardized and could vary from time to time.

In general, no person who will have reached the age of 75 prior to election date may be nominated for election or re-election to the Board. However, the Board will review individual circumstances and the best interests of the Company and its shareholders when considering the nomination of directors and may from time to time choose to nominate a director who is 75 years old or older, particularly where such a director possesses unique skills, experience, or leadership traits, or would otherwise continue to be a valuable contributor to the mission of the Board. It is also the Board’s practice to limit new directors to no more than two per year in order to maintain Board continuity. Ms. Roth, 77 and Mr. Clermont, 77, have been nominated to serve as directors for a one-year term in order to help with board succession.

Although the Nominating and Corporate Governance Committee does not specifically solicit suggestions for possible candidates from shareholders, the Nominating and Corporate Governance Committee will consider candidates recommended by shareholders who meet the criteria discussed above and set by the Nominating and Corporate Governance Committee, with the concurrence of the full Board. The criteria will be re-evaluated periodically and will include those criteria set out in the Corporate Governance Guidelines and the Nominating and Corporate Governance Committee’s charter. The Company’s bylaws require that shareholders send timely notice of director nominations to our Secretary and that any such notice include the information set forth in the Company’s bylaws, as further discussed in the section “Shareholder Proposals for the 2026 Annual Meeting” elsewhere in this Proxy Statement.

15

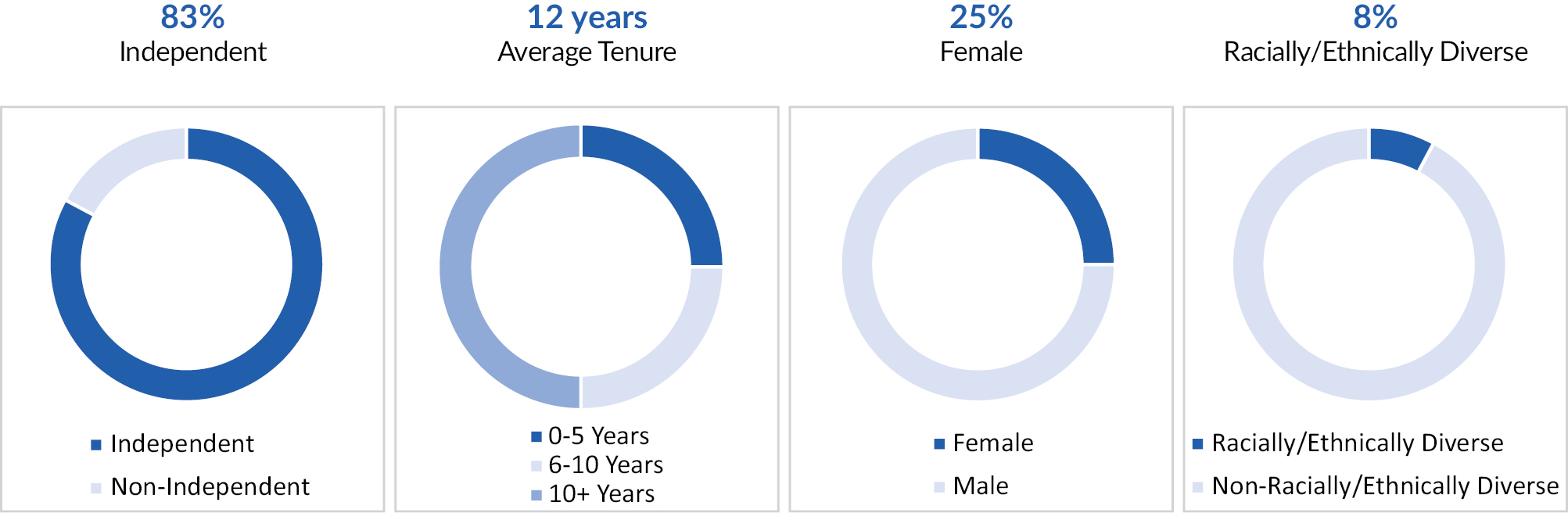

Board Diversity

Director Snapshot

While the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Company and the Board strongly believe diversity is critical to the Company’s success and creating long-term value for shareholders. The Company believes that a Board consisting of individual directors with diverse backgrounds ensures broader representation and inspires deeper commitment to management, employees, and the community. Diversity in gender, ethnic background, professional experience, and other experiences are prioritized when considering candidates for director. As of December 31, 2024, the Board consists of nine men and three women, with one person of color. The Company enhanced its Board diversity in recent years and is committed to continue its focus and efforts on Board diversity in the future.

Director Compensation

Each director of the Company who is not an officer or employee of the Company receives compensation for his or her services as follows:

|

|

Annual Retainer

($) Prior to April 15, 2025

|

Annual Retainer

($) on and After April 15,

2025

|

|

Lead Director

|

27,500

|

27,500

|

|

Board Member

|

52,000

|

52,000

|

|

Audit and Risk Committee Chair

|

15,000

|

15,000

|

|

Audit and Risk Committee Member

|

7,500

|

7,500

|

|

Compensation Committee Chair

|

12,000

|

12,000

|

|

Compensation Committee Member

|

5,000

|

5,000

|

|

Nominating and Corporate Governance Committee Chair

|

10,000

|

10,000

|

|

Nominating and Corporate Governance Committee Member

|

5,000

|

5,000

|

|

Restricted Stock Award *

|

70,000

|

80,000

|

16

Restricted stock awards to directors are issued under the Company’s 2023 Omnibus Stock and Performance Compensation Plan (the Omnibus Plan), which was approved by shareholders in 2023. Because they are time-based awards, shares of restricted stock and restricted stock unit (RSU) awards accrue dividends and dividend equivalents, which will be paid upon vesting of the awards. Restricted stock carries voting rights from the date of grant, and RSU awards provide voting rights upon settlement in shares. Shares vest in full on the first anniversary date of the awards or, if elected by the director, vest at retirement from the Board, as disclosed below. The grant date of restricted stock and RSU awards to non-employee directors is typically two days following the Annual Meeting, when the full Board approves the awards. In accordance with the Company’s stock ownership guidelines, directors are expected to retain all shares granted to them during their service as Board members and are encouraged to acquire stock in amounts consistent with their financial resources.

The Company maintains a non-employee director compensation election program to allow non-employee directors to receive their annual board member retainer fees in the form of restricted stock or RSUs and provide for a separate election to defer the vesting of awards and any underlying dividends or dividend equivalents until the date of termination of service as a director. Elections must be made prior to the calendar year for which the election will apply and made annually, with the exception of the first year in which a director becomes eligible to participate, after which the election must be made within 30 days.

Summary Compensation - Directors

The table below sets forth the following compensation for each director who is not a named executive officer or employee for the fiscal year ended December 31, 2024: (i) dollar value of fees earned or paid; (ii) aggregate grant date fair value of restricted stock awards; (iii) all other compensation; and (iv) dollar value of total compensation.

|

Name (1)

|

Fees Earned or Paid

in Cash ($) (2)

|

Stock Awards ($) (3)

|

All Other

Compensation ($) (4)

|

Total ($)

|

|

Ralph W. Clermont

|

94,500

|

69,975

|

23,300

|

187,775

|

|

Robert A. Ebel

|

74,500

|

69,975

|

16,945

|

161,420

|

|

Benjamin F. Edwards, IV

|

57,000

|

69,975

|

1,936

|

128,911

|

|

Wendy J. Henry

|

59,500

|

69,975

|

5,152

|

134,627

|

|

James J. Lindemann

|

69,000

|

69,975

|

27,940

|

166,915

|

|

Ann W. Marr

|

57,000

|

69,975

|

5,243

|

132,218

|

|

Sally H. Roth

|

72,000

|

69,975

|

10,892

|

152,867

|

|

Joseph D. Rupp

|

84,500

|

69,975

|

20,970

|

175,445

|

|

Randall L. Schilling

|

59,500

|

69,975

|

27,940

|

157,415

|

|

Franklin D. Wicks, Jr.

|

72,000

|

69,975

|

25,344

|

167,319

|

(1) Compensation for Mr. Resch is set forth in Executive Officers – Summary Compensation Table and related tables. Because Mr. Resch is an employee of the Company, he did not receive any additional compensation for services as director in 2024. Mr. Brunngraber served as a non-executive employee of the Company during the year ended December 31, 2024 and did not receive separate compensation for his services as a director. Mr. Brunngraber was compensated in 2024 pursuant to his Executive Chairman compensation arrangement, which is described below.

(2) Represents fees paid during 2024 for services as a director. For Mr. Rupp, the amount also includes fees received as the Lead Director. Amounts include the following fees for service on the Executive Loan Committee of Cass Commercial Bank, the Company’s bank subsidiary: Mr. Clermont, $15,000; Ms. Roth $15,000; and Mr. Ebel, $15,000. Messrs. Clermont, Lindemann, Rupp, Schilling, and Wicks elected to receive their Board retainer fees in the form of restricted stock and each received 1,202 shares of restricted stock in lieu of $52,000 of cash payments. The restricted stock vests in full on the first anniversary of the grant date of the awards or, if elected by the director, vests at retirement from the Board.

(3) These amounts represent the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for restricted stock and RSU awards granted to directors in fiscal 2024. Shares vest in full on the first anniversary of the grant date or, if elected by the director, upon the director’s retirement from the Board. These amounts were computed in accordance with the Financial Accounting Standard Board’s Accounting Standard Codification Topic 718 (FASB ASC Topic 718). These amounts do not represent the actual amounts paid to or realized by the directors during fiscal year 2024. The value as of the grant date for restricted stock is recognized over the number of days of service required for the grant to become vested. See Note 11 to the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 for a complete description of the material assumptions

17

applied in determining grant date fair value. The aggregate number of shares of restricted stock and RSU awards issued and outstanding at December 31, 2024 for each director was as follows and for Mr. Brunngraber includes prior stock-based awards received in his role as CEO and Executive Chairman with performance-based shares of 36,326 assumed to vest at the target level of performance:

|

|

Name

|

Shares *

|

RSUs *

|

|

| |

Eric H. Brunngraber

|

36,326

|

24,218

|

|

|

Ralph W. Clermont

|

20,410

|

—

|

|

Robert A. Ebel

|

14,401

|

—

|

|

Benjamin F. Edwards, IV

|

1,602

|

—

|

|

Wendy J. Henry

|

4,655

|

—

|

|

James J. Lindemann

|

24,245

|

—

|

|

Ann W. Marr

|

4,730

|

—

|

|

Sally H. Roth

|

9,399

|

—

|

|

Joseph D. Rupp

|

18,485

|

—

|

|

Randall L. Schilling

|

24,245

|

—

|

|

Franklin D. Wicks, Jr.

|

22,100

|

—

|

| |

* If elected, included shares received in lieu of cash retainer fees and/or shares deferred until retirement

|

|

(4) Represents dividends paid or accrued on unvested time-based restricted stock and RSU awards for all directors other than Mr. Brunngraber. For Mr. Brunngraber, the amount reported represents dividends paid or accrued on unvested time-based restricted stock and RSUs of $29,304 and the additional compensation received by Mr. Brunngraber for his services in fiscal 2024 as an employee Executive Chairman, as more fully discussed in the narrative below.

Effective April 2023, Mr. Brunngraber retired as CEO of the Company and has remained an employee of the Company in the Executive Chairman role for which he receives the following compensation: (i) a base salary of $562,000; (ii) eligibility to receive an annual target profit-sharing bonus of 40% of his base salary; (iii) a long-term incentive compensation (LTIC) opportunity at target based on 100*% of his base salary (for 2024, comprised of 40% time-based RSUs and 60% performance-based restricted stock); and (iv) continuation of certain employee benefits and perquisites.

For fiscal 2024, Mr. Brunngraber received the following compensation as Executive Chairman: (i) salary payments of $562,000; (ii) a 2024 profit-sharing bonus of $80,900; (iii) a grant date fair value of $561,996 based on a 2024 LTIC award of 5,076 time-based RSUs and 7,613 shares of performance-based restricted stock that may be earned at the target achievement level; (iv) matching 401(k) contributions of $20,700; and (v) other benefits and perquisites totaling $30,000. In January 2025, Mr. Brunngraber received a grant date fair value of $561,990 based on a 2025 LTIC award of 5,422 time-based RSUs and 8,133 performance-based RSUs that may be earned at the target achievement level. The number of 2024 and 2025 performance-based LTIC awards that will ultimately be earned and vest, if any, will vary in an amount from 0% to 150% of the target amount awarded based on the achievement of pre-established financial performance goals over the prospective three-year performance period from the date of grant. The terms and conditions of the Company’s profit-sharing program and LTIC program, including as they relate to Mr. Brunngraber’s 2024 awards, are fully described in “Executive Compensation and Related Information – Compensation Discussion and Analysis” section of this Proxy Statement. The grant date fair value of Mr. Brunngraber’s LTIC awards is computed in accordance with FASB ASC Topic 718, is based on the target number of performance-based restricted stock or RSUs, as applicable, and is calculated using the fair market value of the Company’s common stock on the date of grant of $44.29 for grants made on January 25, 2024 and of $41.46 for grants made on January 23, 2025. These amounts do not represent the actual amounts paid to or realized by Mr. Brunngraber. The value as of the grant date for restricted stock is recognized over the number of days of service required for the grant to become vested. See Note 11 to the Company’s audited financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 for a complete description of the material assumptions applied in determining grant date fair value.

Certain Relationships and Related Party Transactions

Some of the directors and executive officers of the Company, and members of their immediate families and firms and corporations with which they are associated, have had transactions with the Company’s subsidiary bank, including borrowings and investments in depository accounts. All such loans and investments have been made in the ordinary course of business, on substantially the same terms, including interest rates charged or paid and collateral required, as those prevailing at the same time for comparable transactions with unaffiliated persons, and did not involve more than the normal risk of collectability or present other unfavorable features.

18

During the year ended December 31, 2024, Mr. Brunngraber, a director of the Company, also served as an employee of the Company as Executive Chairman. Compensation paid to Mr. Brunngraber for his services as Executive Chairman during fiscal 2024 are included in “Summary Compensation – Directors” above. Mr. Brunngraber will continue to be compensated pursuant to his existing compensation arrangement, as disclosed in “Summary Compensation – Directors.”

As provided by the Audit and Risk Committee’s charter, the Audit and Risk Committee must review and approve all transactions between the Company and any related person that are required to be disclosed pursuant to Item 404 of Regulation S-K. “Related person” and “transaction” shall have the meanings given to such terms in Item 404 of Regulation S-K, as amended from time to time. In determining whether to approve or ratify a particular transaction, the Audit and Risk Committee will take into account any factors it deems relevant.

Report of the Audit and Risk Committee

The Audit and Risk Committee assists the Board in providing oversight of the systems and procedures relating to the integrity of the Company’s financial statements, the Company’s financial reporting process, its systems of internal accounting and financial controls, the internal audit process, risk management, the annual independent audit process of the Company’s annual financial statements, the Company’s compliance with legal and regulatory requirements, and the qualification and independence of the Company’s independent registered public accounting firm. These responsibilities are laid out in the Audit and Risk Committee’s charter, which is available on the Investor Relations section of the Company’s website at www.cassinfo.com.

The Audit and Risk Committee reviews with management the Company’s major financial risk exposures and the steps management has taken to monitor, mitigate, and control such exposures. Management has the responsibility for the implementation of these activities. In fulfilling its oversight responsibilities, the Committee reviewed and discussed with management the audited financial statements in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, including a discussion of the quality and the acceptability of the Company’s financial reporting and controls.

The Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited financial statements with U.S. generally accepted accounting principles and on the effectiveness of the Company’s internal control over financial reporting. The Committee reviewed with the independent registered public accounting firm the firm’s judgments as to the quality and the acceptability of the Company’s financial reporting and such other matters as are required to be discussed with the Committee under auditing standards of the Public Company Accounting Oversight Board (PCAOB) (United States), including the matters required to be discussed by the Statement on Auditing Standards No. 1301 (Communications with Audit Committees), and the rules and regulations of the SEC. In addition, the Committee has discussed with the independent registered public accounting firm the firm’s independence, including the impact of non-audit-related services provided to the Company, and has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accounting firm’s communications with the Audit and Risk Committee concerning independence.

The Committee also discussed with the Company’s internal auditors and the independent registered public accounting firm in advance the overall scope and plans for their respective audits. The Committee meets regularly with the internal auditor and the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 for filing with the SEC.

|

|

|

Ralph W. Clermont, Chairman

Robert A. Ebel

Wendy J. Henry

Randall L. Schilling

|

19

Information Security and Data Privacy

The Company has a comprehensive Information Security Policy and ensures data privacy policies adhere to the requirements of the General Data Protection Regulation, California Consumer Privacy Act, and other state and local data privacy regulations to the extent they impact the Company’s operations and handling of personal data. All employees are required to take regular training on information security requirements and must acknowledge policies and standards annually. In addition, the Company conducts ongoing phishing campaigns to test and educate all employees on how to spot phishing attacks and to measure the effectiveness of our training program. The Cass Global Data Privacy Policy, which addresses the privacy of our clients’ information, is available on our Investor Relations site at www.cassinfo.com. The Cass Commercial Bank Legal Disclaimers, Privacy Statement and Cookie Policy is also available on our Investor Relations site at www.cassinfo.com.

Insider Trading Policy and Procedures

The Company has adopted insider trading policies and procedures applicable to our directors, officers, and employees, and has implemented processes for the Company that it believes is reasonably designed to promote compliance with insider trading laws, rules, and regulations, and the Nasdaq listing standards. The Company’s insider trading policy, among other things, (i) prohibits directors, officers, and employees from trading in securities of the Company and certain other companies while in possession of material, non-public information; (ii) prohibits our directors, officers, and employees from disclosing material, non-public information of the Company and certain other companies to others; and (iii) requires that directors and certain designated officers obtain pre-clearance before trading in Company securities and only transact in Company securities during an open window period, subject to limited exceptions. A copy of the Company’s insider trading policy can be found as an exhibit to the Annual Report on Form 10-K for the year ended December 31, 2024.

Environmental, Social, and Governance

Acting with the highest degree of honesty, integrity, and compassion for all of the Company’s stakeholders, from clients and employees to the communities and the world around us, has been a hallmark of the Company’s culture for over 100 years. The Company is increasingly focused on and committed to strong ESG practices and believes ESG standards and business practices are aligned with the Company’s corporate purpose and values. The Company recognizes the importance for stakeholders to know and understand ESG initiatives and encourages stakeholders to read the Company’s annual ESG Report available on our Investor Relations site at www.cassinfo.com.

The Nominating and Corporate Governance Committee of the Board of Directors oversees the Company’s position and practices on ESG matters and other significant public policy issues, including but not limited to the protection of the environment, corporate social responsibility, and sustainability.

Environmental

The Company monitors its energy consumption and is committed to improving metrics such as emissions per transaction and as a percent of revenue. The Company also supports its clients with many sustainable products and services as more fully described in the Company’s ESG Report available on our Investor Relations site at www.cassinfo.com.

Social

The Company is focused on engaging its employees. The Company offers many attractive benefits to help support its employees, including profit sharing and an employee assistance program. The Company also has robust policies on equal opportunities, anti-harassment and non-discrimination. The health and safety of employees and work-life balance are actively promoted as more fully described in the Company’s ESG Report.

20

Governance

The Company strongly supports adherence to the Company’s Code of Conduct and Business Ethics and anonymous reporting of unethical or questionable practices without retaliation. The Company believes in a conservative and long-term view of risk management by various specialized committees, including strict focus on information and data privacy risk management. The Company has developed strong governance practices, including Board oversight as described above and in the Company’s ESG Report.

Shareholder Engagement

The Company greatly values feedback from its shareholders and relies on such feedback to help tailor its business policies and practices. Accordingly, in addition to soliciting feedback through proxy voting, the Company frequently interacts with shareholders throughout the year by participating in investor conferences and presentations and holding other meetings with current and prospective shareholders to provide transparency around emerging issues, discuss milestones, and inform decision-making.

During fiscal 2024, incorporating input from discussions and meetings with shareholders, the Company continued to devote time and resources to a number of ESG-driven policies and programs as discussed in the Company’s ESG Report.

21

Proposal No. 2

Advisory Vote on Executive Compensation

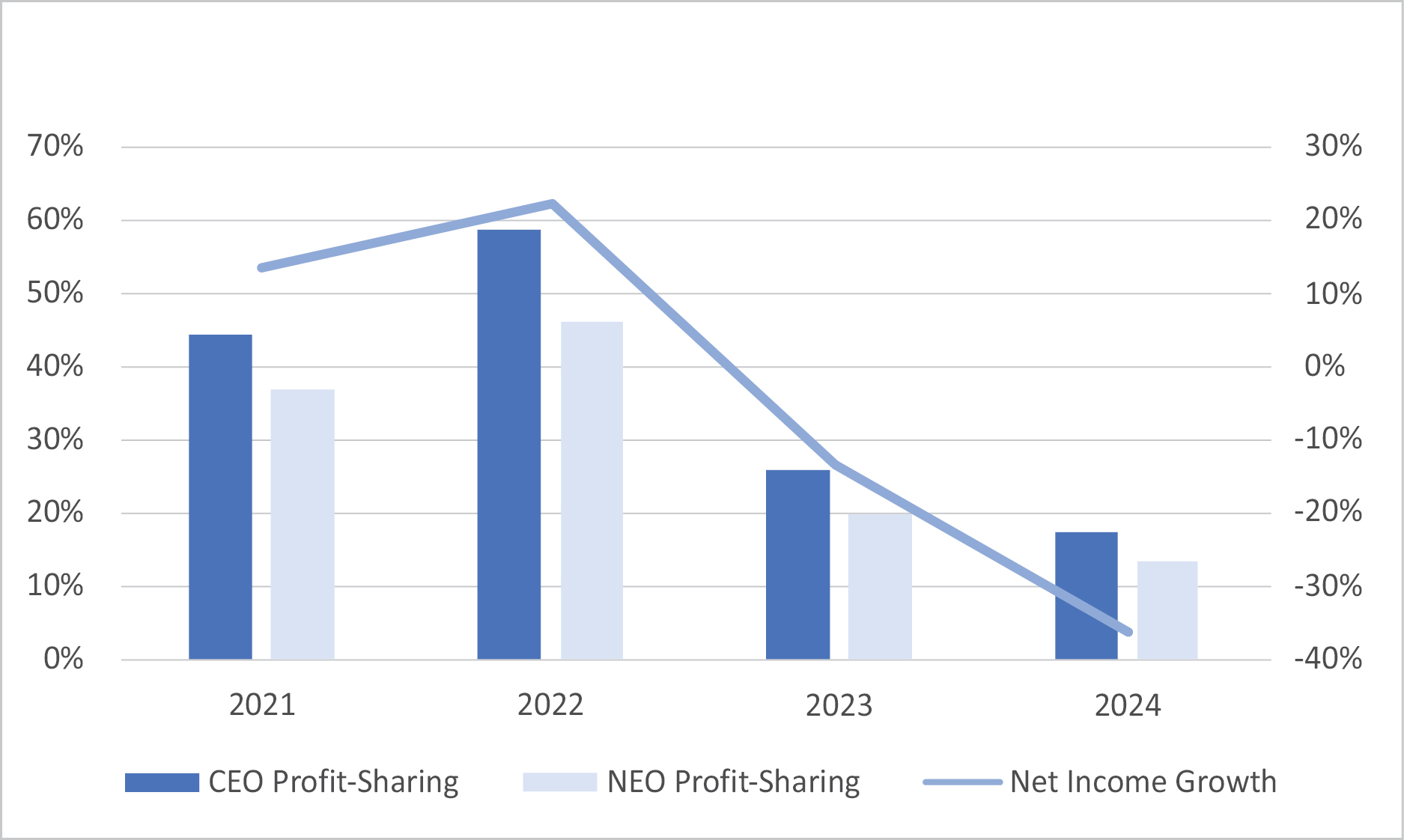

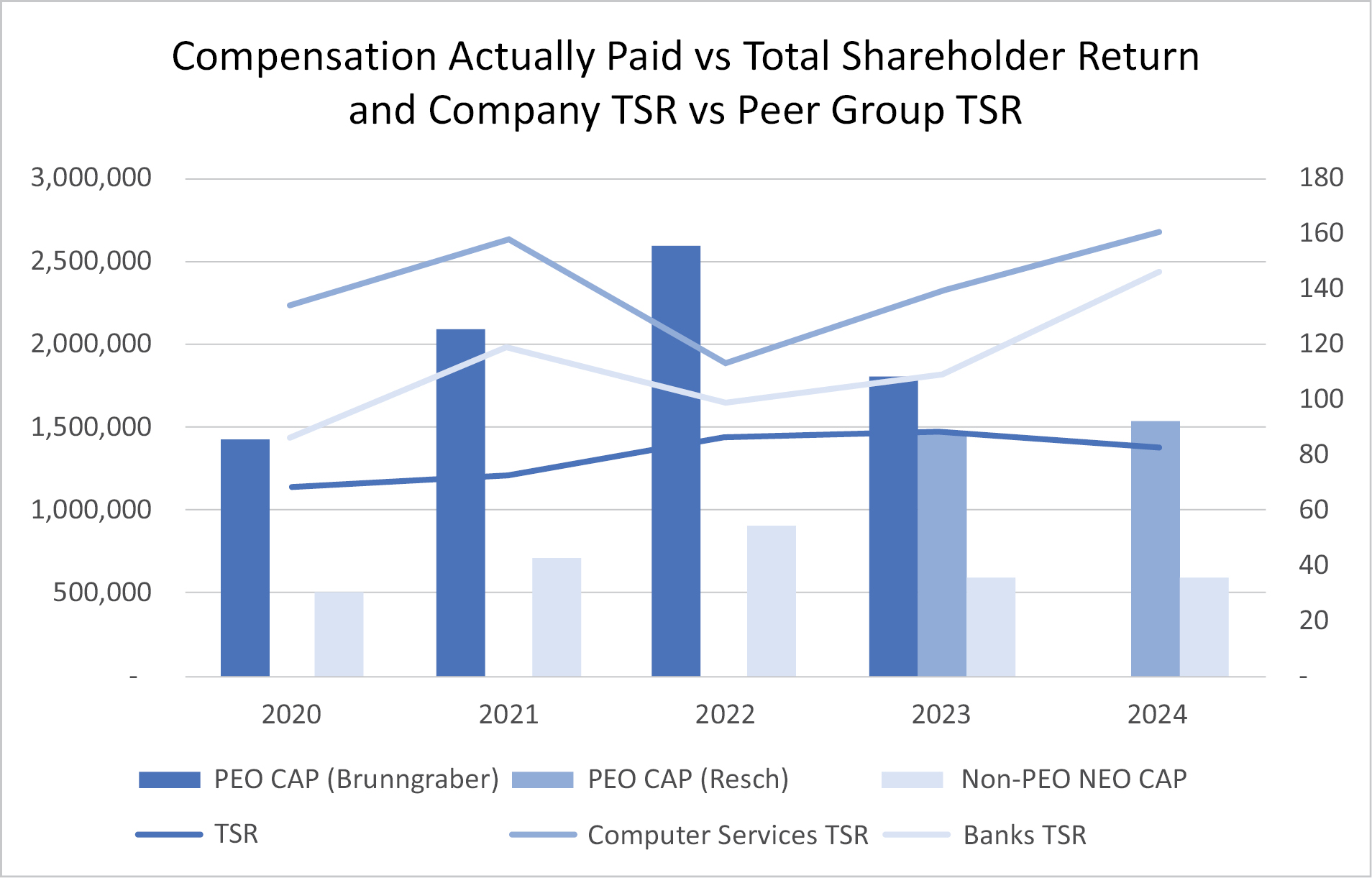

The Board is committed to excellence in governance and recognizes that executive compensation is an important matter for the Company’s shareholders. At the Company’s Annual Meeting of Shareholders on April 16, 2024, the shareholders were given the opportunity to endorse or not endorse, on a non-binding advisory basis, the Company’s compensation program for named executive officers by voting for or against a resolution calling for the approval of such program for the 2024 fiscal year. Shareholders approved the compensation program with approximately 96% of the votes cast by the holders of common stock.

The core of the Company’s executive compensation philosophy and practice continues to be to pay for performance. The Company’s executive officers are compensated in a manner consistent with the Company’s strategy, competitive practice, sound corporate governance principles, and shareholder interests and concerns. The Company believes its compensation program is strongly aligned with the long-term interests of shareholders, as exhibited in the Compensation Discussion and Analysis section of this Proxy Statement, which provides additional details on executive compensation, compensation philosophy and objectives, and the compensation of the named executive officers for the prior fiscal year. Shareholders are asked to vote on the following resolution:

“RESOLVED, that the shareholders approve the compensation paid to the Company’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the Compensation Discussion and Analysis, compensation tables and any related material contained in this Proxy Statement.”

The above-referenced disclosures are included in this Proxy Statement under the Executive Compensation and Related Information section.

The Board urges shareholders to endorse the compensation program for our executive officers by voting FOR the above resolution. As discussed in the Compensation Discussion and Analysis contained in this Proxy Statement, the Compensation Committee of the Board believes that the Company’s executive compensation is reasonable and appropriate, is justified by the performance of the Company, and is the result of a carefully considered approach.

As an advisory vote, this proposal is non-binding and will not overrule any decision by the Board or require the Board to take any action. However, the Board and the Compensation Committee value the opinions of the Company’s shareholders and will consider the outcome of the vote when making future compensation decisions for the named executive officers. It is expected that the next say-on-pay vote will occur at the 2026 Annual Meeting of Shareholders. The Company currently holds the say-on-pay vote every year.

|

The Company’s Board recommends a vote “FOR” the Company’s executive compensation program as described in the Compensation Discussion and Analysis, the compensation tables and otherwise in this Proxy Statement.

|

22

Executive Compensation and Related Information

Compensation Discussion and Analysis

Overview of Compensation Philosophy and Objectives

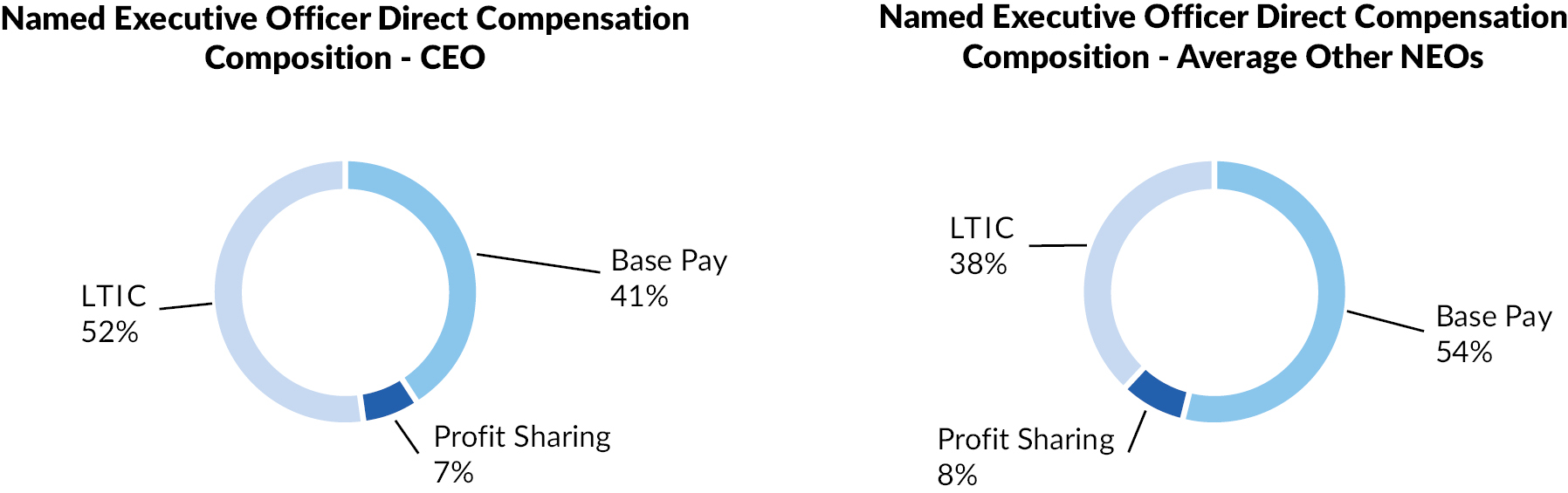

The Compensation Committee believes that the skill and dedication of executive officers and other management personnel are critical factors affecting the Company’s long-term success in meeting its objectives and fostering growth and profitability. In support of this, compensation programs have been designed to attract and retain a high level of talented leadership, reward performance in accordance with results, provide an incentive for future performance and align Company executives’ long-term interests with those of the shareholders.

The Compensation Discussion and Analysis (CD&A) describes, in detail, the Company’s executive compensation philosophy and programs provided to named executive officers as they are determined under SEC rules. For 2024, named executive officers, as determined and designated by the Company, included the following individuals:

|

Name

|

Title in Fiscal 2024

|

|

|

Martin H. Resch

|

President and Chief Executive Officer (CEO)

|

|

Michael J. Normile

|

Executive Vice President and Chief Financial Officer (CFO)

|

|

James M. Cavellier

|

Executive Vice President, Chief Information Officer (CIO)

|

|

Matthew S. Schuckman

|

Executive Vice President, General Counsel, and Corporate Secretary

|

|

Dwight D. Erdbruegger

|

President, Cass Commercial Bank

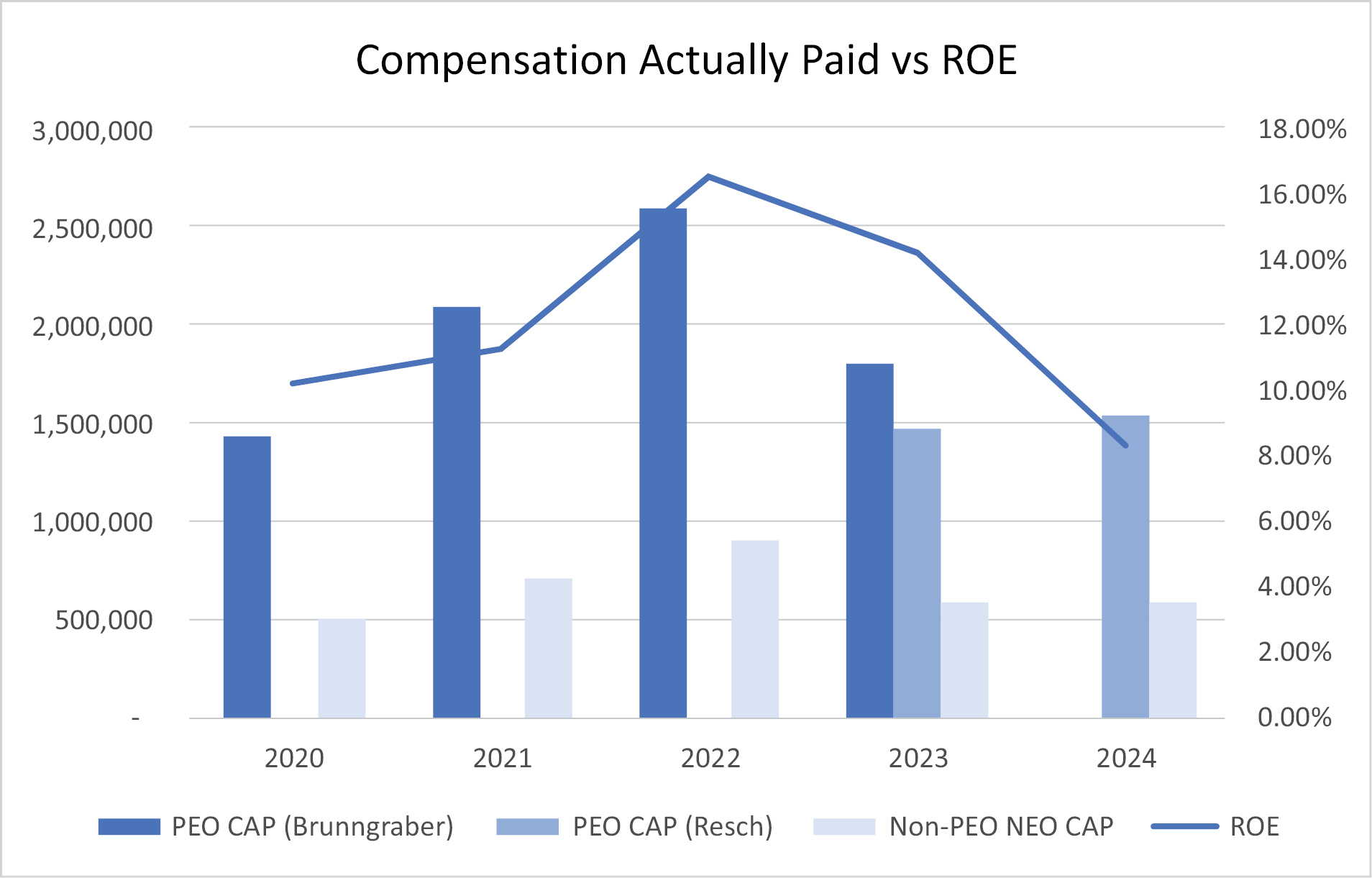

|