Fantom (FTM) Bull Run: 8% Price Surge And Robust Double-Digit Growth In Key Metrics

08 Maggio 2024 - 2:00AM

NEWSBTC

Fantom (FTM), a Layer-1 (L1) protocol, and its native token, FTM,

have experienced significant gains and notable achievements in the

first quarter (Q1) of 2024. According to a comprehensive

performance analysis conducted by Messari, amid the emerging crypto

bull market, Fantom has emerged as one of the major beneficiaries,

showing significant growth in key metrics and market

capitalization. FTM Market Cap Soars 101% QoQ By the numbers,

FTM’s circulating market capitalization saw a substantial 101%

quarter-over-quarter (QoQ) increase, jumping from $1.3 billion to

$2.6 billion, vaulting it up ten spots to 48th among all tokens

(currently 58th). The token’s rally extended for two consecutive

quarters, resulting in a fourfold increase since the end of Q3

2023. Related Reading: Here’s How This Ethereum Whale Made $16

Million From A Single Trade Although Fantom experienced a decrease

of 53% QoQ in revenue measured in FTM, amounting to 1.8 million

FTM, revenue denominated in USD exhibited a 4% QoQ increase,

reaching $1.2 million. According to Messari, the revenue

decline was primarily due to reduced inscription activity across

all smart contract platforms in Q1. Despite this, Fantom

maintained an upward trend in average daily transactions, excluding

inscription-related activity, surpassing the Q3 average and

reaching 247,000 daily transactions. Daily active addresses also

rebounded, rising by 24% QoQ to 40,500. In Q1, the staking

requirement for Fantom validators was significantly reduced from

500,000 FTM to 50,000 FTM, aiming to increase accessibility.

However, the number of active validators remained unchanged at

55. Notably, the total amount of FTM staked increased by 17%

QoQ, from 1.1 billion to 1.3 billion FTM, resulting in a 135% QoQ

surge in the total dollar value of staked FTM, reaching $1.2

billion. Among proof-of-stake (PoS) networks, Fantom ranked 22nd in

the dollar value of funds staked by the end of Q1. Memecoin Mania

Boosts Fantom On-Chain Activity During the year’s first quarter,

Total Value Locked (TVL) denominated in USD experienced a

substantial 59% QoQ increase, rising from $810.8 million in Q4 to

$1.28 billion. Conversely, TVL-denominated in FTM decreased

by 21% QoQ, indicating that the surge in USD-denominated TVL was

partly attributed to FTM’s price appreciation. Fantom’s average

daily decentralized exchange (DEX) volume surged by 64% QoQ, from

$10.2 million to nearly $176.8 million. In Q1, the “Memecoin Mania”

trend contributed to elevated on-chain activity across various

networks, including Fantom. Fantom’s monthly DEX volume surpassed

$1 billion in March, marking the first time since March 2023. The

number of DEXs on Fantom increased to 31 by the end of Q1, with no

single DEX dominating more than 30% of the market share. Related

Reading: Bloomberg’s Mike McGlone Reveals Why A $150,000 Bitcoin

Price Target Is Far Off Lastly, following an exploit in the

Multichain: Fantom Bridge, which affected stablecoins on Fantom in

Q3 2023, the Fantom Foundation took steps to increase the liquidity

of stablecoins. As of Q1 2024, two independent third-party

bridging solutions, Axelar (axlUSDC and axlUSDT) and LayerZero

(lzUSDC and lzUSDT), have emerged. USDC remains the predominant

stablecoin on Fantom, accounting for 98% of the stablecoin market

cap. USDT also experienced considerable growth, with an 86% QoQ

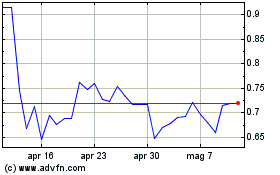

increase. The FTM token is currently trading at $0.7037, reflecting

an 8.7% increase in price over the past seven days. However, it has

experienced a decline of nearly 20% in the monthly time frame.

Featured image from Shutterstock, chart from TradingView.com

Grafico Azioni Fantom Token (COIN:FTMUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Fantom Token (COIN:FTMUSD)

Storico

Da Mar 2024 a Mar 2025