Emmerson PLC /

Ticker: EML / Index: AIM / Sector: Mining

1

February 2024

Emmerson PLC ("Emmerson" or

the "Company")

Scoping Study Completed on

Breakthrough New Processing Route and Updated

Financials

Emmerson PLC, the Moroccan focused potash development

company, is delighted to announce the

results of an in-depth scoping study on a new, innovative

processing route (the "Scoping Study") at its 100% owned Khemisset

Potash Project ("Khemisset" or the

"Project"), which significantly reduces the Project's environmental

impact and enhances its economic returns.

Highlights

Khemisset Multi-mineral

Process

· The Scoping Study

sets out a ground-breaking proprietary processing method named the

Khemisset Multi-mineral Process ("KMP")

· KMP involves the

treatment of brine to remove magnesium and iron chlorides through

the addition of phosphate and ammonia, allowing the residual brine

to be recycled in the plant

· KMP offers

significant environmental benefits by eliminating the need for deep

well injection ("DWI") and reducing water consumption by

approximately 50%

· KMP creates two

new slow-release fertiliser products, struvite and vivianite, while

also increasing the recovery rate of Muriate of Potash ("MOP") from

85% to approximately 91%

· Struvite and

vivianite command a price premium as multi-nutrient, slow-release

fertiliser products, which reduce phosphate run-off and enable less

frequent application by farmers

· KMP delivers a

further substantial boost to the Project's economics, increasing

the post-tax NPV8 by 120% to US$2.2 billion and

delivering an exceptional post-tax IRR of 40%

· KMP has

significant value as intellectual property with additional

potential licencing revenues. The Company currently has a patent

pending

Financial

Updates

· Financial

estimates for the Project updated from the feasibility study

announced in June 2020 (the "2020 Feasibility Study"), both for the

production process as originally designed ("Original Design"), and

incorporating the KMP (the Project, including the KMP, being the

"KMP Process Solution")

· KMP substantially

improves the Project economics:

o Post-tax NPV8 of

US$2.2 billion (Original Design without KMP updated to

NPV8 US$1.0 billion)

o Post-tax IRR of 40% (Original

Design IRR updated to 26%)

o Annual EBITDA US$440 million

per annum (Original Design US$258 million)

· Total Project

capex (incorporating KMP) now estimated to be US$525 million

(Original Design capex US$539 million), reflecting industry-wide

cost inflation since 2020

· All-in sustaining

cost of US$163 per tonne ("/t") positions the Project at the lower

end of the cost curve and delivers robust returns across a range of

potash price assumptions

Environmental

Approval

· The Company is

still awaiting notification from the Commission Ministérielle de

Pilotage (''Ministerial Committee''

or the ''Committee''), to whom the Khemisset environmental approval

was referred in July 2023

Chief Executive Officer, Graham Clarke, said:

"The Khemisset Multi-mineral Process is an

exciting, innovative development that represents a major

improvement both environmentally and economically.

"The KMP arose from our team continuously exploring ways to

minimise impact on the environment, particularly when it comes to

water; we are always striving to protect this critical resource. It

also forms part of the optimisation work that we had committed to

do in discussions with water authorities in H1 2023. The KMP

addresses these issues, while also delivering significant economic

upside through the production of new fertiliser products to

complement Khemisset's potash.

"The KMP transforms the environmental credentials of the

Project by eliminating the requirement for the disposal of brines

through DWI and significantly reducing process water consumption,

both important points for the Moroccan authorities and local

communities. We believe it further strengthens the case for

approving our Environmental and Social Impact Assessment

("ESIA").

"Struvite and vivianite are multi-nutrient fertilisers

containing phosphate, nitrogen, magnesium, and iron respectively.

Their lower solubility means the nutrients are released over a

longer period, and are less prone to being washed away by rain.

This means that application rates can be less frequent, and

phosphate run-offs that cause eutrophication of streams and lakes

are significantly reduced.

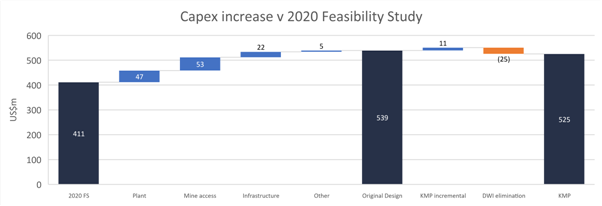

"As part of our Scoping Study, we have updated our economic

estimates for the Project, both based on the Original Design and

the new KMP. Cost inflation since 2020 has inevitably resulted in

an increase in capex of approximately 31% for the Original Design.

In the case of the KMP, the elimination of DWI reduces this

increase to 28%.

"More significantly, the addition of new revenue sources

delivers considerable economic benefits, with the IRR of 40% for

the Project including the KMP considerably higher than most potash

projects in development.

"The KMP process sets a new benchmark for the industry. The

Company is excited by the results of the study and is eager to

progress the findings.

"With regards to the ESIA approval, we believe that the

Moroccan authorities are continuing to assess the Company's

application. We will provide further updates on all matters,

including any formal notifications regarding the ESIA, in due

course."

KMP

Presentation

A presentation, outlining the KMP, is

available on the Company's website, on the following

page:

www.emmersonplc.com/investors/corporate-documents

Khemisset Multi-mineral Potash Process

Scoping Study

The Scoping Study describes a new

process, the Khemisset Multi-mineral Process which was developed by

Emmerson for use in the Khemisset potash project in

Morocco.

The Scoping Study was compiled by

Emmerson's in-house technical team, but incorporated sales and

marketing reports from S&P Global and Mordor Intelligence,

process plant design work from Barr Engineering, and testwork by

the Saskatchewan Research Council, and Wardell Armstrong

International.

The KMP process, in simple terms,

involves the separation of magnesium and iron chlorides from the

brines through the addition of phosphates and ammonia, creating in

the process magnesium phosphate (struvite) and iron phosphate

(vivianite) fertiliser products in addition to ammonium chloride,

while allowing the brine to then be recycled back through the

process plant for a better recovery rate of potassium. These

products are thus in addition to the MOP product originally

designed to be produced at Khemisset.

The KMP represents a

transformational improvement to the Project both environmentally

and economically.

The conversion of a waste stream

(the brine containing magnesium and iron chloride) into further

fertiliser products, struvite and vivianite, adds significantly to

the sustainability of the Project. Any outcome that reduces waste

is a positive but, in this case, an additional benefit is that the

two products produced in its place are slow-release fertilisers,

which allow farmers to reduce application rates and mitigate the

negative impacts of fertiliser production, transportation, and

usage from a carbon footprint and water run-off

perspective.

Struvite and vivianite are likely to

be suitable for use in climates susceptible to heavy rainfall

events, where less soluble slow-release fertilisers reduce the risk

of newly applied nutrients being washed away, which also causes

problematic run off issues. In addition, slow-release products

provide the nutrients when the plant requires them, allowing

farmers to use less fertiliser and to apply less

frequently.

Morocco is already a global

fertiliser hub, so the ability to add not only potash but also

these additional magnesium and iron phosphate products to its

nutrient portfolio will enhance its position as a global

agriculture and fertiliser lead, in particular on the African

continent. The KMP requires a supply of both phosphate and ammonia,

both of which will be available in Morocco, further reducing the

negative impacts of transporting raw materials over longer

distances.

The KMP involves relatively modest

changes to the process plant, primarily through a reduction in

crushing, and the addition of a separation stage and the creation

of two separate decomposition stages (one magnesium and one

iron).

As part of the Scoping Study, the

economics of the Project have been refreshed and updated to reflect

capex/opex and pricing movements since 2020. These are described in

more detail below.

Process

Basics

The KMP process involves the

treatment of brine to extract magnesium and iron chlorides,

producing magnesium phosphate (struvite) and iron phosphate

(vivianite) fertilisers.

The ore that is processed at

Khemisset is a mix of three potash-bearing minerals: sylvite,

carnallite and rinneite. The original process was designed to

handle this mix to produce the potash (MOP), and a brine waste

containing magnesium chloride and iron chloride requiring disposal

by DWI.

While sylvite contains only

potassium chloride, carnallite ore also contains magnesium

chloride, and rinneite contains iron chloride. The MOP production

process requires that these impurities are removed, and the

Original Design envisaged their disposal through injection into

identified deep geological formations in a process known as

DWI.

The KMP separates the rinneite-rich

ores from the sylvite/carnallite ores once the Run of Mine ("RoM")

ore has been presented to the front end of the treatment plant.

This is a two-step process that generates separate brines with

differing chemical profiles, one being a high magnesium chloride

(low iron chloride) brine whilst the second is a high iron chloride

(low magnesium chloride) brine.

The high magnesium chloride brine is

further processed to produce a magnesium ammonium phosphate

(Mg(NH4)PO4) fertiliser by-product (struvite)

through the addition of phosphate and ammonia, whilst the high iron

chloride brine is converted into a phosphate-based by-product in

the form of hydrated ferrous phosphate (vivianite)

(Fe3(PO4)2.8H2O).

Finally, the excess ammonia is

removed from the two brine solutions as ammonium chloride

(NH4Cl). The brines, now stripped of their contained

magnesium chloride and iron chloride, are recycled back into the

processing circuit and re-used, significantly reducing water

consumption and improving the recovery of potash, as some of the

potassium chloride and a considerable volume of water would

otherwise be lost in the brine disposed of by DWI.

Process testwork validating the KMP

design has been carried out by two internationally renowned

metallurgical testing laboratories: the Saskatchewan Research

Council (SRC), Canada, and Wardell Armstrong International (WAI),

Cornwall, UK. Testing has included mineral liberation analysis,

separation tests, mineral decomposition tests, brine processing and

product agglomeration trials. Excellent results have demonstrated

that the magnesium contained within carnallite, and the iron

contained within rinneite, can be recovered from magnesium-rich and

iron-rich decomposition brines and converted to struvite/vivianite

and associated products respectively, at both very high grades and

recovery levels.

Further testwork will be undertaken

to optimise KMP and provide additional information in support of

engineering design.

Struvite production

Struvite is magnesium ammonium

phosphate (Mg(NH4)PO4). It is formed from the

reaction between magnesium chloride brine with ammonium phosphate

(diammonium phosphate ("DAP")), plus ammonia

("NH3").

Struvite is a known slow-release

fertiliser that offers both nitrogen and phosphorous plus the

benefit of magnesium which is an essential plant

nutrient.

Vivianite production

Vivianite is hydrated ferrous

phosphate

(Fe3(PO4)2.8H2O).

Ferrous phosphate formation is based on the reaction between

ferrous chloride (brine) with DAP, plus ammonia.

Vivianite is a slow-release

fertiliser that provides phosphorous, plus the benefit of iron,

which is also an essential plant nutrient, although it is not

currently marketed as such.

Ammonium Chloride

Ammonium chloride (NH4Cl)

is a by-product in both of the DAP/brine reactions presented

above.

Solid ammonium chloride is primarily

used as a fertiliser, particularly in southeast Asia, but is also

used to make dry batteries and ammonia compounds, as a soldering

flux, and as a pickling agent in zinc coating and

tinning.

The possibility of retaining the

ammonium chloride in solution in order to reduce the quantity of

ammonia required as a reagent is under consideration as potential

further upside of the KMP.

Geology and

Mining

The principal potash minerals in the

Khemisset Basin are carnallite, sylvite, and rinneite. These are

distributed in three sub-basins within the main basin.

Rinneite is rarely described in

potash deposits, unlike sylvite and carnallite, which are more

traditional targets for exploration and exploitation. However, the

high content of potassium oxide ("K2O") (34.56%) in

rinneite has been proven to be extractable through hot leaching and

crystallisation by metallurgical testing previously carried out by

Emmerson, and was therefore incorporated into the original potash

processing route.

The KMP process means that different

ore blends can be treated more efficiently, which offers the

opportunity to improve the mine plan, and increase reserves. As

well as the recovery of additional minerals from the ore, the

recycling of brines will result in augmented MOP recoveries through

the KMP, which will in turn allow lower cut-off grades and a

further expansion of reserves and resource.

The KMP process is designed to

handle carnallite, sylvite, and rinneite as planned to be extracted

from the Khemisset resource in any reasonable ratio as determined

by the mine plan. On this basis, no changes are necessary to the

mining plan or mine access requirements as set out in the 2020

Feasibility Study.

However, the combined benefits of

improved recovery of potash by eliminating the losses to DWI, as

well as the recovery of magnesium chloride and iron chloride from

the ore, means that the target mining horizon cut-off grades and

mining height can be increased, allowing the use of larger

machines, with increased cutting rates that means fewer machines

are needed, reducing capex, opex and ventilation requirements. This

assumption has been reflected in the economic evaluation of the

KMP.

The KMP process will also enable a

more detailed review of the mining plan, with the opportunity for

an enhanced and flexible extraction strategy which is less reliant

on a consistent ratio of ore.

A revised mining plan is a more

detailed exercise that will be undertaken in due course.

Environment

The Company remains committed to

developing the Project with minimal risk to the environment, and

over more than three years has introduced a number of optimisations

designed to mitigate potential environmental impacts.

The development of the KMP arose out

of the general objective of the Company to minimise potential

environmental impacts wherever possible, but also, importantly,

reflects the interactions with the authorities whose particular

focus is on water management, a precious resource in

Morocco.

The KMP process represents a

material improvement to the environmental footprint of the Project,

most significantly in the elimination of DWI entirely, but also in

the reduction in process plant water consumption by up to 60% (50%

of the total water). In the context of concerns around water

availability in Morocco, the importance of these benefits is

difficult to overstate.

Disposing of brines through DWI, as

envisaged in the original design, is still considered to be a good

solution, but injectivity testing would still need to be performed

to confirm the best location.

The KMP plant would also produce new

fertiliser products that would enhance Morocco's credentials as a

fertiliser hub and help address food security issues.

Sales and

Marketing

Struvite

Struvite is currently mainly

manufactured as a by-product of water treatment plants, where the

natural phosphates recovered from wastewater are reacted with

magnesium to produce small quantities of struvite, which is

currently sold as a premium slow-release fertiliser in North

America.

Struvite sales are therefore

currently relatively small, with estimated production in 2022 of

approximately 250 thousand tonnes, although a new facility has been

announced to bring a further 200 thousand tonnes per annum ("ktpa")

to the market in the US.

The KMP would produce around 750ktpa

of struvite, which is considerably higher than the current market

supply. However, in reality the struvite market is currently

limited by production with demand potentially much higher as

confirmed by marketing studies commissioned by Emmerson.

Furthermore, agronomic tests support

struvite as being a premium slow-release source of phosphates as

well as nitrogen and magnesium, able to attract a premium price,

particularly as KMP-produced struvite will contain no deleterious

heavy metal elements that exist in struvite from water treatment

plants.

A S&P Global report,

commissioned by Emmerson, estimated a value based on the nutrient

content of struvite as US$424/t. However, Mordor Intelligence

reported that actual struvite prices in North America are in excess

of US$1,000/t. Emmerson has taken a more conservative position

between these extremes, particularly in view of the size of the

current market and has assumed US$500/t in its economic model,

which nonetheless delivers considerable value.

Vivianite

Vivianite is not currently sold in

significant quantities as a fertiliser but shares similarities with

struvite in that both are slow-release phosphate fertilisers

containing an additional micronutrient. Struvite contains magnesium

and vivianite contains iron, with both micro-nutrients seen in

existing fertiliser blends depending on crop

requirements.

As with struvite, it is realistic

that a premium price is achievable, although the base case

financials assume a sales price derived from nutrient content of

US$299/t, as estimated by S&P Global.

Ammonium chloride

Ammonium chloride is an inorganic

compound used to make dry batteries and ammonia compounds, as a

soldering flux, as a pickling agent in zinc coating and tinning,

and as a fertiliser. Ammonium chloride has a relatively established

market.

Costs and Financials

As part of understanding the

economic impact of KMP, it was necessary to update the financial

model for the Project both based on its Original Design, and after

incorporating the changes from integrating the KMP

process.

The starting point for this process

was the financial model included in the 2020 Feasibility Study,

which was prepared in detail by Golders, and which was originally

announced in June 2020.

The revised figures, used in

updating the 2020 Feasibility Study, take into account revised

pricing expectations for specific items of plant and mining

equipment, as well as input costs such as electricity, LPG, and

diesel. Where relevant, the estimations also include updates

arising from optimisations (such as the switch to dry-stack

tailings, the incorporation of four declines rather than two, and

the sourcing of water from Khemisset waste-water treatment plant),

and the basic engineering work completed on the process plant by

Barr Engineering and on mine access and other infrastructure by

Reminex SA.

Key Performance

Indicators

A summary of the key financials of

the KMP compared with the Original Design and the 2020 Feasibility

Study is as follows:

It should be noted that the project

offers considerable upside in the event of higher prices being

achievable (notably struvite), while also being resilient to a

lower price environment, including for potash. The following tables

illustrate the NPV8 and IRR of the project incorporating

the KMP enhancement at various MOP and struvite prices.

Capex

Updated financials for the Original

Design reflect cost inflation, as well as the impact of

optimisations and improvements since the 2020 Feasibility Study.

Overall, this resulted in capex increasing by 30% from US$411

million to US$539 million, which is broadly in line with process

plant equipment price index movements over that period, as well as

cost increases experienced by other mining projects.

The KMP capex is slightly lower at

US$525 million, with US$25 million saved from eliminating DWI

mitigated by US$11 million of additional equipment in the process

plant.

Potash

Costs

Cash costs (excluding the KMP

additional products) for both KMP and Original Design have also

increased since 2020, with inflation impacting energy, equipment,

and other operating costs, mitigated by operating efficiencies

(particularly in mining).

KMP unit costs are lower than the

Original Design primarily due to the improved recoveries of potash

as a result of recycling brines back into the circuit.

KMP Unit

Costs

The KMP products are, like salt,

by-products of the potash process, but their expected unit margins

are sufficiently large that it is not meaningful to show their

value as a net credit to potash costs.

Instead, the table below shows their

estimated production costs per tonne. It should be noted that

ammonium chloride is considered a secondary by-product, and KMP

costs have been allocated to struvite/vivianite only.

Pricing

Assumptions

The following price assumptions were

used in the economic assessment:

MOP prices were kept in line with

2020 assumptions. Although prices rose dramatically in 2021 and

2022, fertiliser prices have now normalised.

Struvite prices were estimated to be

US$500/t. S&P Global estimated the value of the contained

nutrients to be US$424/t, to which a conservative premium was

applied to reflect the incremental benefit of being a

multi-nutrient, slow-release product.

Vivianite price assumptions were

based on S&P Global's estimates of nutrient content. Vivianite

has similar qualities to struvite, and it is therefore reasonable

to expect a premium, however, a more conservative assumption was

adopted to reflect the lack of an established market.

Other pricing assumptions were based

on current pricing levels.

Opportunities and Next Steps

The KMP Scoping Study and updated

financials underlines the robust financials of the Original Design

but outlines that the new process will deliver significant

improvements both in terms of environmental impact (particularly

relating to water management), and economically.

Further enhancements can also be

anticipated that are not, as yet, incorporated into the economic

analysis. These include the following:

· Redesigning the

mine plan to take into account the improved potash recoveries and a

wider range of economically extractable minerals made possible by

the KMP

· Exploring more

cost-efficient sources of phosphate (e.g. monoammonium phosphate

(MAP)) to lower production costs

· Drying of struvite

to reduce water content and create a higher value product

(dittmarite)

· Recycling ammonium

chloride to reduce requirement of ammonia

· Negotiating

sources of key reagents, notably phosphates and ammonia

· Developing

marketing plans for struvite and vivianite and signing offtake

agreements

· Option to develop

on-site blending with MOP for production of a variety of

multi-mineral fertilisers

· Processing IP

could be transferrable to other operations in Morocco and

beyond

The Company will then move forward

with discussions with key suppliers, offtakers and other

stakeholders regarding this new optimisation. Further testwork,

crop studies, and design amendments will then be fed back into the

overall project design, before ultimately being incorporated into a

revised bankable feasibility study (including an updated mine

plan), ahead of completing financing and commencing

construction.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside

information for the purposes of the UK Market Abuse

Regulation and the Directors of the Company are responsible for the

release of this announcement.

Competent Persons' Statement

The technical information in this

report is based on information reviewed by Mr. Graham Clarke, a

Competent Person who is a BEng Mining Engineering and a

Fellow of the Institute of Materials, Minerals and Mining.

Mr. Clarke is employed by Emmerson PLC and has

sufficient experience which is relevant to the information reported

here. Mr Clarke consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

**ENDS**

For further information, please

visit www.emmersonplc.com,

follow us on Twitter (@emmerson_plc), or contact:

|

Emmerson PLC

Graham Clarke / Jim Wynn / Charles

Vaughan

|

+44 (0) 207 138 3204

|

|

Liberum Capital Limited (Nominated Advisor and Joint

Broker)

Scott Mathieson / Matthew Hogg / Kane

Collings

|

+44 (0)20 3100 2000

|

|

Shard Capital (Joint Broker)

Damon Heath / Isabella

Pierre

|

+44 (0)20 7186 9927

|

|

BlytheRay (Financial PR and IR)

Tim Blythe / Megan Ray / Said

Izagaren

|

+44 (0) 207 138 3204

|

Notes to Editors

Emmerson is focused on advancing the

Khemisset project ("Khemisset" or the "Project") in Morocco into a

low cost, high margin supplier of potash, and the first primary

producer on the African continent. With an initial 19-year life of

mine, the development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation, and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one

of the leading phosphate producers globally, ranking third in the

world in terms of tonnes produced annually, and the development of

this mine is set to consolidate its position as the most important

fertiliser producer in Africa. The Project has a large JORC

Resource Estimate (2012) of 537Mt @ 9.24% K2O, with significant

exploration potential, and is perfectly located to support the

expected growth of African fertiliser consumption whilst also being

located on the doorstep of European markets. The need to feed the

world's rapidly increasing population is driving demand for potash

and Khemisset is well placed to benefit from the opportunities this

presents.