PyroGenesis Canada Inc. (http://pyrogenesis.com) (TSX: PYR) (OTCQX:

PYRGF) (FRA: 8PY), a high-tech company (the “Company” or

“PyroGenesis”) that designs, develops, manufactures and

commercializes advanced plasma processes and sustainable solutions

which are geared to reduce greenhouse gases (GHG) and address

environmental pollutants, is pleased to announce its financial and

operational results for the fourth quarter and the fiscal year

ended December 31st, 2023.

“2023 was an interesting year for PyroGenesis,

as we dealt with many of the issues associated with the growth and

adoption of clean technology in a cautious economic environment,”

said P. Peter Pascali, President and CEO of PyroGenesis. “We

navigated cash management challenges brought about by higher costs

associated with commercializing our technologies, continued

inflationary pressures on material and labour costs, longer sales

cycles for system sales caused by the uncertain economic

environment we are all facing, and multiple requests from potential

customers to help them in their investigation of using plasma as a

solution to their many problems. As much of this type of work is

new-use proof-of-concept, profit margins are negligible, and

timelines imprecise.”

“While many of these efforts did not yield large

contracts or system sales during the year, we cannot underestimate

the impact these engagements have had and are having,” said Mr.

Pascali. “In a few short years we have moved front-of-mind to many

current and potential heavy industry customers who sought us out as

they made their initial steps on their decarbonization journey.

Since late 2019, when our work on the first tests of plasma in iron

ore pelletization heralded our entry into the field of heavy

industry decarbonization, the opportunities have expanded far

beyond the one-furnace/one-industry concept, to numerous process

heating steps in virtually every heavy industry. The array of

opportunities possible within the aluminum industry alone has

surpassed that of any one specific technology solution we offered

in the past. This is a fundamental change that has taken hold in

2023 which I would suggest significantly de-risks PyroGenesis

overall.”

Mr. Pascali added, “As the decarbonization trend

continues to mature, we are well-positioned as a company with deep

experience in the field – a key factor to customers as the scale of

projects amplifies. This, along with our continued focus on cost

optimization, our strong backlog of almost $29 million, negligible

debt, the recent commercialization of our titanium metal powder

production system, and a very robust sales pipeline, feeds my

optimism for the future. As I have mentioned in the past, our

revenue will fluctuate quarter to quarter, but our commitment will

not. We are positioning ourselves to become a leader in heavy

industry decarbonization technology solutions for many years to

come.”

The information below represents important

highlights from the past year, followed by an outline of the

Company’s strategy and outlook for 2024.

2023 Q4 Production

Highlights

The information below represents highlights from

the past quarter for each of the Company’s main business verticals,

followed by an outline of the Company’s strategy, and key

developments that will impact the subsequent quarters.

In Q4 2023, PyroGenesis continued its focus on

advancing its updated business strategy that was first outlined in

the Company’s 2022 fourth quarter and year-end results.

As noted, as the variety of uses for the

Company’s core technologies has expanded, and industry interest has

increased, the Company is concentrating its activities under a

three tiered solution ecosystem that aligns with economic drivers

that are key to global heavy industry:

Energy Transition & Emission Reduction:

- fuel switching, utilizing the

Company’s electric-powered plasma torches and biogas upgrading

technology to help heavy industry reduce fossil fuel use and

greenhouse gas emissions,

Commodity Security & Optimization:

- recovery of viable metals, and

optimization of production methods/processes geared to increase

output, maximize raw materials and improve availability of critical

minerals,

Waste Remediation:

- safe destruction of hazardous

materials, and the recovery and valorization of underlying

substances such as chemicals and minerals.

Within each vertical the Company offers several solutions at

different stages of commercialization.

Commodity Security & Optimization

In October, the Company

provided an update (Press Release dated October 3, 2023) on two

projects: (i) the PUREVAP™ Quartz Reduction Reaction (“QRR”) pilot

plant and (ii) the Fumed Silica Reactor (“FSR”) project.

For the QRR project – an initiative to create

high purity silicon from quartz in a single step using a plasma

reactor – the noteworthy progress and confirmations included:

- Completion of the scaling up of the

QRR process by 2,500x from the previous laboratory scale,

validating the original proof of concept.

- Demonstration of operation in a

semi-continuous batch cycle.

- Production of silicon from quartz

using a one-step direct carbothermal reduction process.

- 25% reduction in raw material use

compared with conventional methods.

- Achievement of 3N+ (or 99.9+%)

silicon purity, a crucial purity level for battery-grade silicon

applications.

- Optimized QRR design for high

performance during the tapping process, minimizing silicon

contamination.

For the FSR project – an initiative to convert

quartz into fumed silica in a single step using a plasma reactor –

the Company announced that in a major step towards commercial-scale

production, PyroGenesis had successfully deployed the FSR on a

laboratory scale, resulting in the milestone production of fumed

silica. Preliminary tests and analysis also confirmed that the

material produced has chemical and physical characteristics

compatible with those of commercially available fumed silica.

In October, the Company

announced (Press Release dated October 11, 2023) a successful

“pour” of silicon from the PUREVAP™ Quartz Reduction Reaction

(QRR), successfully validated 100% of the project's critical

milestones.

In November, the Company

announced (Press Release dated November 9, 2023) a successful

third-party validation of fumed silica, from the FSR project, from

lab-scale production. Separately, the Company announced that

production of the fumed silica pilot plant was underway, which was

announced as intended to be in operation in Q2 of 2024.

In December, the Company

announced (Press Release dated December 18, 2023) the successful

receipt of a U.S. patent for its innovative NEXGEN Plasma

Atomization metal powder production technology for use in additive

manufacturing and 3D printing.

Waste Remediation

In October, the Company

announced (Press Release dated October 24, 2023) receipt of a

$360,000 initial contract from a European engineering services firm

undertaking the discovery and safe destruction of chemical warfare

agents within the European Union. Under this agreement, as part of

a potential three-phase project, PyroGenesis will first provide a

lab-scale size plasma arc chemical warfare agent destruction system

(the “PACWADS”) as part of a multi-partner project aimed at

identifying, extracting, and disposing of chemical munitions and

chemical warfare agents residing in active marine passageways and

corridors. The second phase will consist of testing the system to

validate efficiency, performance and capacity. The eventual goal is

to develop a full-scale system once results from the lab-scale

system are reviewed.

Q4 Financial Highlights

In November, the Company

confirmed receipt (Press Release dated November 20, 2023) of a

production milestone payment of $520,000 associated with the plasma

torch contract with a U.S. corporation for Perfluoroalkyl and

Polyfluoroalkyl Substances (PFAS) destruction (Press Release dated

September 12, 2023).

In December, the Company

announced (Press Release dated December 20, 2023) closing of a

$1,250,000 non-brokered private placement of a convertible loan in

the amount of $1.25 million with Fiducie de Crédit Mellon Trust, a

related party.

Status as a Dual-Listed Publicly Traded

Company

As part of the Company’s proactive risk

management strategy, the Company announced in its Q2 news release

(Press Release dated August 10, 2023) that it was evaluating the

costs and benefits of maintaining a dual listing on both Nasdaq and

the TSX. That evaluation entailed an analysis of several key

factors, including (i) the financial costs associated with being on

each exchange, such as insurance costs, regulatory compliance

costs, legal fees, and accounting fees, (ii) the volume of trading

on both exchanges, and (iii) the regulatory and compliance

requirements of each exchange.

On October 27, 2023, after careful consideration

by the Board of Director, the Company announced it would be

voluntarily delisting from the Nasdaq exchange.

The Company’s shares were subsequently delisted

from Nasdaq and shares ceased trading on November 16, 2023. On the

same day, the Company’s shares began trading on the OTCQX Best

Market, under the symbol “PYRGF”.

None of these activities had any bearing on the

Company’s main listing on the TSX, where the Company’s stock

continued to trade uninterrupted under the symbol “PYR”. The

Company also trades on the Frankfurt Exchange, under the symbol

"8PY”.

Financial Summary

Revenues

PyroGenesis recorded revenue of $3.0 million in

the fourth quarter of 2023 (“Q4, 2023”), representing a decrease of

$0.3 million compared with $3.3 million recorded in the fourth

quarter of 2022 (“Q4, 2022”). Revenue for fiscal 2023 was $12.3

million, a decrease of $6.7 million over revenue of $19 million

compared to fiscal 2022.

Revenues recorded in fiscal 2023 were generated

primarily from:

- PUREVAP™ related sales of

$1,660,928 (2022 - $6,272,697)

- DROSRITE™ related sales of $535,868

(2022 - $1,912,807)

- support services related to systems

supplied to the US Navy $3,245,618 (2022 - $1,288,356)

- torch related sales of $3,396,458

(2022 - $5,558,210)

- Refrigerant destruction sales of

$605,962 (2022 - $Nil)

- biogas upgrading & pollution

controls of $1,713,810 (2022 - $3,347,443)

- other sales and services $1,186,437

(2022 - $633,990)

Q4, 2023 revenues decreased by $0.3 million,

mainly as a result of:

- PUREVAP™ related sales decreased by

$0.6 million due to the completion of the project and the Company

announcing the successful silicon “pour” validating all critical

milestones and with this achievement, the stage is set for

discussions in transitioning to commercial production,

- DROSRITE™ related sales decreased

by $0.3 million due to customer delays in funding for the

construction of the onsite facility,

- Support services related to systems

supplied for the US Navy increased by $1.5 million due to the

completion of several milestones and the increase in awarded

contracts. In addition, in 2022 a revision in the cost budget

affected the revenue recognized by percentage completion. At that

time, the customer had yet to provide us with a firm purchase order

for the change of scope,

- Torch-related products and services

decreased by $1.4 million, due to the completion of the project,

with the Company currently providing continuous onsite

support,

- SPARC™ related sales increased by

$0.2 million due to the advancement of the project, and,

- Biogas upgrading and pollution

controls related sales increased by $0.2 million specifically due

to the project advancement of our regenerative thermal oxidizer

system.

Fiscal 2023 revenues decreased by $6.7 million,

mainly as a result of:

- PUREVAP™ related sales decreased by

$4.6 million due to the completion of the project and initial phase

of testing and one-time $3.6 million sale of IP, in 2022, which was

not repeated in the current fiscal year,

- DROSRITE™ related sales decreased

by $1.4 million due to the impact of the continued customer delays

in funding for the construction of the onsite facility,

- Support services related to systems

supplied for the US Navy increased by $2.0 million due to the

completion of several milestones and the increase in awarded

contracts,

- Torch-related products and services

decreased by $2.2 million, due to the completion of the project,

with the Company currently providing continuous onsite

support,

- SPARC™ related sales increased by

$0.6 million due to the advancement of the project, and,

- Biogas upgrading and pollution

controls related sales decreased by $1.6 million due to the

delivery of and agreed completion of projects during the comparable

period of the previous year.

As of April 1, 2024, revenue expected to be

recognized in the future related to backlog of signed and/or

awarded contracts is $28.8 million. Revenue will be recognized as

the Company satisfies its performance obligations under long-term

contracts, which are expected to occur over a maximum period of

approximately 3 years.

Cost of Sales

and Services and

Gross Margins

Cost of sales and services were $2.3 million in

Q4 2023, representing an decrease of $0.5 million compared to $2.8

million in Q4, 2022, primarily due to a decrease of $0.1 million in

employee compensation, a decrease of $0.3 million in direct

materials, and a decrease of $0.2 million in foreign exchange on

materials due to the reclassification of the expense from Cost of

Sales and Services to Selling, General and Administrative expenses,

which is in line with the decrease in product and service-related

revenues, but offset by the increase in manufacturing overhead

& other of $0.1 million.

The gross profit for Q4, 2023 was $0.7 million

or 23% of revenue compared to a gross margin of $0.5 million or 15%

of revenue for Q4 2022, the increase in gross margin was mainly

attributable a reduction of manufacturing overhead, employee

compensation and to the impact on foreign exchange charge on

materials.

Fiscal 2023, cost of sales and services were

$8.9 million compared to $10.9 million for the same period in the

prior year, the $2.0 million decrease is primarily due to a

decrease of $0.2 million in employee compensation (twelve-month

period ended December 31, 2022 - $3.7 million), a decrease of $1.1

million in subcontracting (twelve-month period ended December 31,

2022 - $1.3 million) attributed to more work being completed

in-house, a decrease in direct materials and manufacturing overhead

& other of $1.5 million and $0.2 million respectively

(twelve-month period ended December 31, 2022 - $4.7 million and

$1.4 million respectively), due to lower levels of material

required based on the decrease in product and service-related

revenues and the positive impact of the foreign exchange charge on

material of $Nil due to the reclassification of foreign exchange

from Cost of Sales and Services to Selling, General and

Administrative expenses.

The amortization of intangible assets for Q4,

2023 was comparable to Q4, 2022 and during the twelve-month period

ended December 31, 2023, was $0.9 million compared to $0.9 million

for the same period in the prior year. This expense relates mainly

to the intangible assets in connection with the Pyro Green-Gas

acquisition, patents and deferred development costs. These expenses

are non-cash items, and the intangible assets will be amortized

over the expected useful lives.

As a result of the type of contracts being

executed, the nature of the project activity, as well as the

composition of the cost of sales and services, as the mix between

labour, materials and subcontracts may be significantly different.

In addition, due to the nature of these long-term contracts, the

Company has not necessarily passed on to the customer the increased

cost of sales which was attributable to inflation, if any. The

costs of sales and services are in line with management’s

expectations and with the nature of the revenue.

Selling, General

and Administrative

Expenses

Included within Selling, General and

Administrative expenses (“SG&A”) are costs associated with

corporate administration, business development, project proposals,

operations administration, investor relations and employee

training.

SG&A expenses for Q4, 2023 were $9.4

million, representing a decrease of $1.0 million compared to $10.4

million for Q4, 2022. The decrease is primarily due to a decrease

in share-based expenses of $0.6 million (Q4, 2022 - $1.3 million),

a decrease in professional fees of $0.4 million (Q4, 2022 - $1.5

million), a decrease in office and general of $0.1 million (Q4,

2022 - $0.5 million), and a decrease of $4.2 million in expected

credit loss & bad debt (Q4, 2022 - $4.5 million) offset by an

increase in other expenses of $0.9 million (Q4, 2022 - $(0.1)

million), an increase in foreign exchange charge of $0.3 million

(Q4, 2022 - $Nil) and an increase in impairment of goodwill and

changes in assumptions of cash flows of royalty receivables of $3.2

million (Q4, 2022 - $Nil).

During the twelve-month period ended December

31, 2023, SG&A expenses were $31.0 million, representing an

increase of $1.9 million compared to $29.0 million for the same

period in the prior year. The increase is mainly a result of

employee compensation increasing by $1.5 million to $9.6 million

(year ended December 31, 2022 - $8.1 million) mainly caused by

additional headcount. As well, travel increased by $0.1 million to

$0.4 million, the foreign exchange charge on materials was $0.3

million and goodwill impairment and changes in assumptions of

cashflows from royalty receivables increased to $3.2 million. The

expected credit loss and bad debt increased by $0.6 million due to

an additional expense related to doubtful accounts and an amount

related to the Company’s Italian subsidiary and a customer who both

agreed on the final acceptance of a contract which resulted in the

reversal of costs and profits in excess of billings on uncompleted

contract. This was offset by the decrease of $1.0 million in

professional fees, due to less legal, accounting and investor

relation expenses, which are $4.1 million, compared to $5.1 million

in the comparable period, a decrease in office and general, mainly

related to the decrease of office expenses, to $1.0 million from

$1.2 million, a variation of $0.2 million, compared to the year

ended December 31, 2022, and to a decrease in government grants of

$0.2 million.

Share-based compensation expense for the three

and twelve-month periods ended December 31, 2023, was $0.7 million

and $3.1 million, respectively (three and twelve-month period ended

December 31, 2022 - $1.3 million and $5.5 million, respectively), a

decrease of $0.6 million and $2.4 million respectively, which is a

non-cash item and relates mainly to 2021, 2022 and 2023 grants.

Share-based payments expenses as explained

above, are non-cash expenses and are directly impacted by the

vesting structure of the stock option plan whereby options vest

between 10% and up to 100% on the grant date and may require an

immediate recognition of that cost.

Depreciation on Property and

Equipment

The depreciation on property and equipment for

the three and twelve-month periods ended December 31, 2023,

remained stable at $0.1 million and $0.6 million, respectively,

compared with $0.2 million and $0.6 million for the same periods in

the prior year. The expense is determined by the nature and useful

lives of the property and equipment being depreciated.

Research and

Development (“R&D”)

Expenses

During the three-months ended December 31, 2023,

the Company incurred $0.5 million of R&D costs on internal

projects, a decrease of $0.3 million as compared with $0.7 million

in Q4, 2022. The decrease in Q4, 2023 is primarily related to a

decrease of $0.1 million in materials and equipment (Q4, 2022 -

$0.3 million), and a decrease of $0.2 million in other expenses, to

$0.04 million (Q4, 2022 - $0.2 million).

During the twelve-months ended December 31,

2023, the Company incurred $2.2 million of R&D costs on

internal projects, compared to $2.3 million for the same period in

the prior year. The decrease is mainly due to lower levels of

R&D activities requiring less materials, equipment and

subcontracting, decreasing to $0.6 million as compared with $1.2

million, offset by the increase in employee compensation to $1.1

million compared to $0.8 million for the same period in the prior

year and the increase in other expenses to $0.5 million compared to

$0.4 million for the same period in the prior year.

In addition to internally funded R&D

projects, the Company also incurred R&D expenditures during the

execution of client funded projects. These expenses are eligible

for Scientific Research and Experimental Development (“SR&ED”)

tax credits. SR&ED tax credits on client funded projects are

applied against cost of sales and services (see “Cost of Sales”

above).

Financial Expenses

Finance costs for Q4 2023 represent an expense

of $0.3 million, representing an increase year-over-year of

approximately $0.3 million. The increase in finance expenses in Q4

2023 is primarily due to the interest and accretion related to the

convertible debenture, convertible loan, and the increase in

penalties and other interest.

During the twelve-month period ended December

31, 2023, the finance costs represent an income of $1.3 million

compared to an expense of $0.6 million for the 2022 comparable

period, representing a favourable variation of $1.9 million

year-over-year. The decrease in finance expenses is primarily due

to the revaluation of the balance due on business combination due

to negotiations between the Company’s Italian subsidiary and a

customer who both agreed on the final acceptance of a contract,

prior to final completion and the Company determined that a

milestone related to the business combination would not be

achieved. As a result, the contract did not attain the

pre-determined milestone in connection with the balance due on

business combination, and reversals of the liabilities were

recorded offset by the increase in interest and accretion related

to the convertible debenture and convertible loan. Finance expenses

for fiscal 2023 also increased due to the convertible debenture,

convertible loan, and the increase in penalties and other

interest.

Strategic Investments

During the three-months ended December 31, 2023,

the adjustment to fair market value of strategic investments for

Q4, 2023 resulted in a loss of $0.5 million compared to a loss in

the amount of $0.2 million in Q4, 2022, a variation of $0.3

million.

During the twelve-months ended December 31,

2023, the adjustment to fair market value of strategic investments

resulted in a loss of $0.3 million compared to a loss in the amount

of $8.3 million for the same period in the prior year, a favorable

variation of $8.0 million. The decrease in loss for the

twelve-month periods ended December 31, 2023, is attributable to

the variation of the market value of the common shares owned by the

Company of HPQ Silicon Inc.

Comprehensive (Loss) Income

The comprehensive loss for Q4, 2023 of $9.8

million compared to a loss of $10.8 million, in Q4, 2022,

represents a variation of $1.0 million, and is primarily

attributable to the factors described above, which have been

summarized as follows:

- a decrease in product and

service-related revenue of $0.3 million arising in Q4, 2023, but

with a higher gross margin of 23%, and thus a gross profit of $0.7

million, as opposed to $0.5 million in Q4 of 2022,

- a decrease in SG&A expenses of

$1.0 million arising in Q4, 2023 primarily due to a decrease in the

allowance for credit loss of $4.2 million, decrease in professional

fees, office and general, offset by increases in travel, other

expenses, foreign exchange charge on materials, impairments and

changes in assumptions in cashflows of royalty receivables,

- a decrease in share-based expenses

of $0.6 million,

- a decrease in R&D expenses of

$0.3 million primarily due to a decrease in subcontracting,

materials and equipment, and other expenses, offset by an increase

in employee compensation,

- an increase in finance costs of

$0.3 million in Q4, 2023 primarily due to the interest and

accretion on the convertible debenture, convertible loan, balance

due on business combination and royalty receivable,

- a variation in the fair market

value of strategic investments of $0.3 million.

The comprehensive loss for the twelve-month

period ended December 31, 2023, of $28.5 million compared to a loss

of $32.2 million, for the same period in the prior year, represents

a variation of $3.7 million, and is primarily attributable to the

factors described above, which have been summarized as follows:

- a decrease in product and

service-related revenue of $6.7 million, and annual gross margin of

28%, thus generating a gross profit of $3.4 million, as opposed to

43% margins in 2022 which generated $8.1 million in gross

profit,

- an increase in SG&A expenses of

$1.9 million was primarily due to an increase in employee

compensation, travel, depreciation in property and equipment,

depreciation of right-of-use assets, foreign exchange charge on

materials, and the combination of credit loss, impairments and

changes in cashflows of royalty receivables of $3.8 million which

is offset by a decrease in professional fees, office and general,

government grants and, other expenses,

- a decrease in share-based expenses

of $2.4 million

- a decrease in R&D expenses of

$0.1 million primarily due to a decrease in subcontracting,

materials and equipment, and an increase in employee compensation,

investment tax credits and other expenses,

- a decrease in net finance costs

(income) of $1.9 million is primarily due to the revaluation of

balance due on business combination,

- a favourable variation in the fair

market value of strategic investments of $8.0 million

Liquidity and Capital Resources

As at December 31, 2023, the Company had cash of

$1.8 million, included in the net working capital deficiency of

$7.0 million. Certain working capital items such as billings in

excess of costs and profits on uncompleted contracts do not

represent a direct outflow of cash. The Company expects that with

its cash, liquidity position, the proceeds available from the

strategic investment and access to capital markets it will be able

to finance its operations for the foreseeable future.

The Company’s term loan balance at December 31,

2023 was $404,079, and varied only slightly since December 31,

2022. The increase from January 1, 2023, to December 31, 2023, was

mainly attributable to the accretion on the Economic Development

Agency of Canada loan, which is interest free and will remain so,

until the balance is paid over the 60-month period ending March

2029. In July 2023, the Company closed a brokered private placement

for $3,030,000, bearing interest at 10%. During December 31, 2023,

the Company closed a non-brokered private placement of a

convertible loan for gross proceeds of $1,250,000, and bears

interest at 3%. The average interest expense on the other term

loans and convertible debenture is approximately 10%. The Company

does not expect changes to the structure of term loans and

convertible debentures and loans in the next twelve-month period.

The Company maintained one credit facility which bears interest at

a variable rate of prime plus 1%, therefore 8.20% at December 31,

2023. The Company will continue to reimburse the existing credit

facility in 2024.

OUTLOOK

Consistent with the Company’s past practice, and

in view of the early stage of market adoption of our core lines of

business, the Company is not providing specific revenue or net

income (loss) guidance for 2024.

Overall Strategy

PyroGenesis provides technology solutions to

heavy industry that leverage the Company’s expertise in ultra-high

temperature processes. The Company has evolved from its early

beginnings of being a specialty-engineering firm to being a

provider of a robust technology eco-system for heavy industry that

helps address key strategic goals.

The Company believes its strategy to be quite

timely, as multiple heavy industries are committing to major carbon

and waste reduction programs at the same time as many governments

are increasingly funding environmental technologies and

infrastructure projects – all the while both are making it a

strategy to ensure the availability of critical minerals during the

coming decades of increased output demand.

While there can be no guarantees, the Company

believes the evolution of its strategy beyond greenhouse gas

emission reduction, to an expanded focus that encapsulates the key

verticals listed in the section “Q4 Production Highlights”, both

(i) improves the Company’s chances for success while (ii) also

providing a clearer picture of how the Company’s wide array of

offerings work in tandem to support heavy industry goals.

PyroGenesis’ market opportunity is significant,

as major industries such as aluminum, steelmaking, manufacturing,

cement, chemicals, defense, aeronautics, and government require

factory-ready, technology-based solutions to help steer through the

paradoxical landscape of increasing demand and tightening

regulations and material availability.

As more of the Company’s offerings reach full

commercialization, PyroGenesis will remain focused on attracting

influential customers in broad markets while at the same time

ensuring that operating expenses are controlled to achieve

profitable growth.

For 2024, the Company will continue to sharpen

the focus on the strategy that structures the Company’s solution

ecosystem under the three verticals noted previously: (i) energy

transition & emission reduction, (ii) commodity security &

optimization, and (iii) waste remediation, while introducing new

solutions within each category – some self-initiated, and some in

conjunction with (or at the behest of) industry partners.

Cost Controls and

Efficiencies

PyroGenesis is competing hard while closely

scrutinizing both potential and existing projects to ensure that

the utilization of our labour and financial resources are

optimized. As we have shown in the past, we will only engage in

projects if the potential benefits to PyroGenesis is significant

and well-understood. We continue to intensify our focus on project

and budgetary clarity during this persistent period of elevated

global inflationary pressures, by sourcing alternative suppliers

and constantly adjusting project resources. We have also refined

our early-stage project assessment process to allow for faster “go

/ no-go” decisions on project viability.

Enhanced Sales and

Marketing

Against the backdrop of this 3-tiered strategy,

the Company has been increasing sales, marketing, and R&D

efforts in-line with – and in some cases ahead of – the growth

curve for industrial change related to greenhouse gas reduction

efforts.

Macroeconomic Conditions

With some continued uncertainty in the

macroeconomic environment, including ambiguity in the banking

sector with regard to interest rate adjustments, and the continued

inflationary pressures causing shifting demand dynamics across

various industries at different times, it may be difficult to

assess the future impact these events and conditions will have on

our customer base, the end markets we serve and the resulting

effect on our business and operations, both in the short term and

in the long term.

Despite these uncertainties, we continue to

believe there is an accelerated need for our solutions in the

industries we serve as heavy industry looks to continue the now

global trends to decarbonization / energy transition, manufacturing

utilizing both lighter metals (such as aluminum) and additive

manufacturing, and tightening regulations around hazardous

waste.

We expect the uncertainties or other

macroeconomic conditions in the various geographies in which we

operate to continue to cause variability in our revenue quarter to

quarter; however, we believe our diversity in both customer base

and solution set will continue to be a strong asset of the

business.

The various military conflicts in the middle

east and Eastern Europe continue to create some level of global

economic uncertainty, as well as supply chain disruptions that can

change at any time. However, it’s important to note that the

Company does not have any operations, customers or supplier

relationships in Russia, Belarus or Ukraine, and as such are not

directly impacted at a customer level in these countries. The

Company does have customer relationships and projects in Poland and

will continue to monitor the situation in the region regarding

challenges to the completion of current projects, which at this

time are not inhibited.

As always, the Company monitors the impact of

macroeconomic events and conditions on the business, operations,

and financial or potential financial conditions.

Generally, the Company believes that broad-based

threats to global supply chains can afford the Company additional

prominence, especially to the minerals and metals industries, as

manufacturers seek alternatives to off-shore suppliers as well as

technology that can optimize output or regain critical material or

minerals from byproducts or waste – solutions that the Company

currently offers.

Business Line Developments

The upcoming milestones which are expected to

confirm the validity of our strategies are outlined below (please

note that these timelines are estimates based on information

provided to us by the clients/potential clients, and while we do

our best to be accurate, timelines can and will shift, due to

protracted negotiations, client technical and resource challenges,

or other unexpected situations beyond our or the clients’

control):

Business Line Developments: Near Term (0

– 3 months)

Energy Transition & Emission Reduction

Aluminum

Remelting Furnaces: As mentioned in the Q2 2023 Outlook,

the Company has been working on the development of aluminum

remelting furnace solutions using plasma, for use by secondary

aluminum producers or any manufacturer of aluminum components that

uses recycled or scrap aluminum.

With gas-fired

furnaces responsible for much of the scope 1 emissions of secondary

aluminum production, aluminum companies have been searching for

solutions that can help in the decarbonization efforts of aluminum

remelting and cast houses.

The Company has two

concepts: the retro-fitting of plasma torches in existing remelting

and cast house furnaces that currently use other forms of heating,

such as natural gas; and the manufacturing and sale of a

PyroGenesis produced furnace based off the Company’s existing

Drosrite™ metal recovery furnace design, which has been in use

commercially for several years.

Also as mentioned in

the Q2 2023 and Q3 2023 Outlooks, the Company has been working with

a number of different companies over the past few years towards

these goals. The results from the conclusion of recent major tests,

conducted in conjunction with these companies, have been very

positive, and negotiations are underway for next step deployments

and/or sales, with more detailed announcements on these projects

expected during Q2 2024.

Aluminum

Furnace Tests: The Company is in final discussions with

two (2) major aluminum companies for live furnace tests of plasma

as a process heat source in melting and holding furnaces. If

confirmed, these companies will each ship aluminum furnaces to

PyroGenesis for installation at PyroGenesis’ factory, where plasma

will be tested within the furnaces as a potential replacement for

natural gas. These tests are similar to furnace tests that occurred

during 2023 on site at PyroGenesis with another client, but these

new potential tests will be conducted using larger furnaces.

Steel

Industry Energy Transition: the Company has received

notice from one of the top 5 largest steelmakers globally of its

intent to engage the Company in respect of a fuel transition study,

to examine the potential use of plasma torches as a heat source at

a major steel production facility. Contractual discussions in this

regard are set to commence in the short term.

New Industry

Contract for Plasma Torches: as noted in the Q3 Outlook,

the Company has been negotiating a large first-phase contract with

a client (whose name is being withheld at present) in excess of $10

million that would signal PyroGenesis’ resumption of work in an

industry that previously showed promise. Important players in this

industry, which shall remain confidential at present, had

previously heralded the potential use of plasma torches in

conducting its primary objective, due to the increased speed and

other advanced criteria at which the projects could be completed by

using plasma torches compared to traditional approaches.

In January 2024, the

Company announced the signing of a framework master agreement with

this client, which included the payment to the Company of a

non-refundable downpayment of $667,000. Negotiations of a first

substantial statement of work are ongoing and remain positive but

depend in large part on the client’s ability to secure funding in a

timely manner. While there is no guarantee this statement of work

will be completed, if successful the Company foresees the potential

for a multi-phase, multi-year partnership with the client that may

result in many additional plasma torch orders over the next few

years.

Iron Ore

Pelletization Torch Trials: as mentioned in previous

Outlooks, the commissioning of the plasma torch systems – for use

in the pelletization furnaces of a client previously identified as

Client B – was underway, with the Company’s engineers onsite at

Client B’s iron ore facility. The commissioning process includes

installation, start-up, and site acceptance testing (SAT). The

Company previously announced that it had shipped four 1 MW plasma

torch systems for use in Client B’s iron ore pelletization

furnaces, for trials toward potentially replacing fossil-fuel

burners with plasma torches in the Client’s furnaces.

As mentioned in the

Q3 2023 Outlook, this project continues to move forward, however

the commissioning suffered a series of unforeseeable delays caused

by, among other things, damaging regional torrential rainstorms

that flooded and damaged the facility’s electrical system and

furnace components.

Client B has informed

the Company that they continued to experience technical challenges

of its own at different stages during Q4, and the SAT was not

completed as expected during the quarter. While frustrating, Client

B has assured the Company that the project is not in jeopardy, and

it remains committed to the trials.

As of the date of

this MD&A, Client B has indicated that they were continuing to

move forward in resolving their own technical issues, and that the

acceptance testing, and full trials will regain momentum. Although

the timeframe remains uncertain, it is moving forward, and the

Company believes the series of stops and starts are indicative of

most if not all paradigm-shifting innovations within complex heavy

industry factory settings, where the effects of existing

atmospheric pollutants on new technology installations are unknown

until attempted. In short, the factory settings of these trials are

by nature extremely dirty and hazardous, which can cause a variety

of unplanned, unforeseen challenges, each of which are dealt with

by the committed group of scientists and engineers of both Client B

and PyroGenesis.

The client previously

identified as Client A, a large international mining company which

has also purchased a full plasma torch system for use in trials in

its pelletization furnaces, continues its plasma torch initiative

at its own pace, with no recent developments to report as per

project timing or completion.

Pyro

Green-Gas: The Company’s wholly owned subsidiary, Pyro

Green-Gas, is in advanced discussions with an international steel

company for a project with a value of approximately $1.1

million.

Aluminum Cast

House Decarbonization: The Company is part of a tendered

bid process for the testing of plasma within an aluminum cast house

of a leading global aluminum company.

Mining

Industry Parts Manufacturer Decarbonization: The Company

is in advanced discussions with a global parts manufacturer that

supplies the metals and mining industries, to test plasma as a heat

source in the client’s cast furnaces.

Commodity Security & Optimization

New Laser Cut

Titanium Metal Powder Order: the Company has received

notice from a global organization for a potential initial order of

titanium metal powder “laser cut” that, if completed, is expected

to occur in Q2 2024.

Additive for

Green Cement: the Company had previously announced a

project with client Progressive Planet, for the development of

amorphous silica from crystalline silica, for use as an additive to

replace fly ash in cement, thereby creating green cement. With

recent results announced by the Client showing promise, the Company

expects additional information and next steps to be announced in Q2

2024.

Product

Qualification Process for Global Aerospace Firm: As

mentioned in the Q3 2023 Outlook, based on information flow between

the Company and the aerospace client previously announced, the

Company believes that the 2-year long qualification process to

approve the Company’s titanium metal powers for use by a global

aerospace firm and their suppliers, will conclude in the near term.

The Company continues to have strong confidence in this endeavour

and that the final decision from the client is slated for the very

near future.

Of note, the Company

previously confirmed that the qualification process includes both

PyroGenesis’ “coarse cut” titanium metal powder, in addition to the

“fine cut” titanium metal powder that had been previously discussed

as undergoing the qualification process. The Company has some

expectations that the course cut may receive qualification first,

which would be advantageous to the Company, as the course cut has

been produced and stockpiled in large amounts at the PyroGenesis

facility, so delivery readiness would be enhanced.

“FSR”

Project: Fumed Silica (also known as Pyrogenic Silica) is

a particle-size food-safe additive with a large surface area, used

worldwide as a thickening agent in thousands of products such as

milkshakes, adhesives, powdered foods, paints, inks, cosmetics, and

beverages, to increase strength, viscosity, and flow control.

PyroGenesis, on

behalf of its client HPQ Silicon Inc., developed the Fumed Silica

Reactor (“FSR”), a plasma-based process that creates fumed silica

from quartz in a single and eco-friendly step. By eliminating the

use of harmful chemicals generated by conventional fumed silica

production methods, the groundbreaking FSR approach, if successful,

will help contribute to the repatriation of silica production to

North America while lowering the CO2 emissions and carbon footprint

of the process.

In a major step

towards commercial-scale production, PyroGenesis successfully

deployed [news release dated Oct 3, 2023] the FSR on a laboratory

scale to produce fumed silica. A subsequent independent analysis

[news release dated Nov 9, 2023] of the material conducted by

McGill University confirmed the commercial-quality and thickening

efficiency of the fumed silica produced by the FSR.

The build of a pilot

plant has commenced for pre-commercial sample batch production, for

launch in Q2 2024.

In addition to being

the engineering services provider and developer of the forthcoming

pilot plant, PyroGenesis owns a 10% royalty of client HPQ’s

eventual fumed silica sales, with set minimums. This royalty

stream, can, at any time, be converted by PyroGenesis into a 50%

ownership in HPQ Silica Polvere Inc., the wholly owned subsidiary

of HPQ Silicon that controls the fumed silica initiative and

rights.

Waste Remediation

SPARC

Refrigerant Waste Destruction System: The Company is in

the final phase of a tendered bid process for the safe destruction

of hazardous end-of-life refrigerants, such as CFCs, HCFCs, and

HFCs, for a contract amount of approximately $6.5 million. The

Company’s Steam Plasma Refrigerant Cracking (SPARC) system is a

finalist for this Asian client’s initiative.

Financial

Payments for

Outstanding Major Receivables: The Company has remained in

continuous discussions with Radian Oil and Gas Services Company

regarding the outstanding receivable of approximately US$8.0

million under the Company’s existing $25 million+ Drosrite™

contract. As previously announced, PyroGenesis agreed to a

strategic extension of the payment plan, by the customer and its

end-customer, geared to better align the pressures on the

end-user’s operating cash flows created by increased business

opportunities.

These discussions

have been positive, both in regard to the ongoing payment plan, and

in regard to a potential new order of additional Drosrite™ systems,

as the client’s cash flow situation and their new business

opportunities move closer to resolution.

The Company now

expects payment of this receivable to be received in full within Q2

2024.

Innovation

Grants: as mentioned in the Q1 and Q2 Outlooks, the

Company has applied for grants tailored to technology innovation

and/or carbon reduction and expects to have results regarding these

applications. Indications are positive and the Company expects to

be in a position to make an announcement on these grants in Q2

2024. These grants are in the order of $1-2 million.

Business Line Developments: Mid Term (3

– 6 months)

Energy Transition & Emission Reduction

Pyro

Green-Gas: The Company previously announced that its

wholly-owned subsidiary, Pyro Green-Gas, is expected to sign a

contract with a value of approximately between $10-15 million. The

Company has significant doubts that, if the project commences, Pyro

Green-Gas will participate. This project is not reflected in the

stated backlog of either the financial statement or the

MD&A.

Commodity Security & Optimization

Drosrite™ Factory Trials: The

Company is in discussions with multiple aluminum manufacturers to

conduct paid tests of its Drosrite™ aluminum dross processing

systems within client factories, as a first step towards potential

purchase of Drosrite™ systems. These potential clients are in

France, the United States, southern Europe and Central Europe.

Drosrite™ Systems: Separately,

the Company is in various stage discussions with multiple aluminum

manufacturers for potential purchase of Drosrite™ aluminum dross

processing systems.

Waste Remediation

Plasma

Resource Recovery System (PRRS): The Company is in

early-stage discussions for the sale of a PRRS system, to a

European entity, to transform municipal solid waste (MSW) into both

energy and chemical products. PyroGenesis’ PRRS system is designed

to process MSW, industrial waste, and hazardous waste, transforming

them into commercially valuable products. These products include

gaseous fuel for electricity and heat generation, slag, aggregates

suitable for construction, and recoverable metals for recycling.

The value for this potential contract is between approximately $25

to $30 million.

Potential

PAWDS Order: The Company is in initial negotiations with a

company that conducts cleanup and destruction of waste from

seawater. It has also indicated interest in carrying out similar

initiatives on land in remote locations. Negotiations for a

PyroGenesis Plasma Arc Waste Destruction System (PAWDS), similar to

the type the Company designed and built for several of the U.S.

Navy aircraft carriers, are in early stage. While there is no

guarantee this contract is completed, if successful the Company may

be contracted for multiple PAWDS systems over time.

** Please note that projects or

potential projects previously announced that do not appear in the

above summary updates should not be considered as at risk.

Noteworthy developments can occur at any time based on project

stages, and the information presented above reflects information on

hand. Projects not mentioned may have simply not concluded or not

passed milestones worthy of discussion.

About PyroGenesis Canada

Inc.

PyroGenesis Canada Inc., a high-tech company, is

a proud leader in the design, development, manufacture and

commercialization of advanced plasma processes and sustainable

solutions which reduce greenhouse gases (GHG) and are economically

attractive alternatives to conventional “dirty” processes.

PyroGenesis has created proprietary, patented and advanced plasma

technologies that are being vetted and adopted by multiple

multibillion dollar industry leaders in four massive markets: iron

ore pelletization, aluminum, waste management, and additive

manufacturing. With a team of experienced engineers, scientists and

technicians working out of its Montreal office, and its 3,800 m2

and 2,940 m2 manufacturing facilities, PyroGenesis maintains its

competitive advantage by remaining at the forefront of technology

development and commercialization. The operations are ISO

9001:2015 and AS9100D certified, having been ISO certified since

1997. For more information, please visit:

www.pyrogenesis.com.

Cautionary and Forward-Looking

Statements

This press release contains “forward-looking

information” and “forward-looking statements” (collectively,

“forward-looking statements”) within the meaning of applicable

securities laws. In some cases, but not necessarily in all cases,

forward-looking statements can be identified by the use of

forward-looking terminology such as “plans”, “targets”, “expects”

or “does not expect”, “is expected”, “an opportunity exists”, “is

positioned”, “estimates”, “intends”, “assumes”, “anticipates” or

“does not anticipate” or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might”, “will” or “will be taken”, “occur” or

“be achieved”. In addition, any statements that refer to

expectations, projections or other characterizations of future

events or circumstances contain forward-looking statements.

Forward-looking statements are not historical facts, nor guarantees

or assurances of future performance but instead represent

management’s current beliefs, expectations, estimates and

projections regarding future events and operating performance.

Forward-looking statements are necessarily based

on a number of opinions, assumptions and estimates that, while

considered reasonable by the Company as of the date of this

release, are subject to inherent uncertainties, risks and changes

in circumstances that may differ materially from those contemplated

by the forward-looking statements. Important factors that could

cause actual results to differ, possibly materially, from those

indicated by the forward-looking statements include, but are not

limited to, the risk factors identified under “Risk Factors” in the

Company’s latest annual information form, and in other periodic

filings that the Company has made and may make in the future with

the securities commissions or similar regulatory authorities, all

of which are available under the Company’s profile on SEDAR+ at

www.sedarplus.ca, or at www.sec.gov. These factors are not intended

to represent a complete list of the factors that could affect the

Company. However, such risk factors should be considered carefully.

There can be no assurance that such estimates and assumptions will

prove to be correct. You should not place undue reliance on

forward-looking statements, which speak only as of the date of this

release. The Company undertakes no obligation to publicly update or

revise any forward-looking statement, except as required by

applicable securities laws.

Neither the Toronto Stock Exchange, its

Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) nor the OTCQX Best Market

accepts responsibility for the adequacy or accuracy of this press

release.

For further information please contact: Rodayna

Kafal, Vice President, IR/Comms. and Strategic BDPhone: (514)

937-0002, E-mail: ir@pyrogenesis.com RELATED LINK:

http://www.pyrogenesis.com/

A photo accompanying this announcement is

available at:

https://www.pyrogenesis.com/wp-content/uploads/2023/08/Solution-Ecosystem2.png

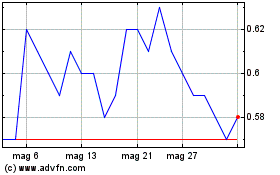

Grafico Azioni PyroGenesis (TSX:PYR)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni PyroGenesis (TSX:PYR)

Storico

Da Mar 2024 a Mar 2025