Bitcoin Is About To See A Historically-Profitable Crossover In This Metric

20 Novembre 2024 - 11:30AM

NEWSBTC

On-chain data shows the Bitcoin Puell Multiple is about to undergo

a crossover that has historically been very bullish for BTC’s

price. Bitcoin Puell Multiple Could Cross Its 365-Day MA In Near

Future As pointed out by an analyst in a CryptoQuant Quicktake

post, the Bitcoin Puell Multiple has been approaching its 365-day

moving average (MA) recently. The “Puell Multiple” here refers to a

popular on-chain indicator that tells us about how the revenue of

the Bitcoin miners compares against its yearly average. BTC miners

earn their income through two sources, the transaction fees and the

block subsidy, but in the context of the Puell Multiple, only the

latter is relevant. Block subsidy is the reward miners receive as

compensation for adding blocks to the network. Related Reading:

Bitcoin Hashrate Falls Off, Miners Expecting Pause In Bull Run?

When the indicator’s value is greater than 1, it means the miners

are currently making a higher revenue than the average for the past

year. On the other hand, it being under the threshold suggests the

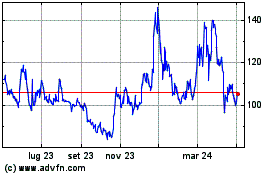

miners are earning less than usual. Now, here is a chart that shows

the trend in the Bitcoin Puell Multiple, as well as its 365-day MA,

over the last few years: As displayed in the above graph, the

Bitcoin Puell Multiple had plunged under the 1 mark earlier in the

year, but recently, its value has seen a sharp rise back towards

the mark. The reason behind the earlier plummet was the occurrence

of the fourth BTC Halving. “Halvings” are events coded into the

blockchain that automatically shave off the asset’s block subsidy

in half every four years. As the Puell Multiple keeps track of the

block subsidy, it naturally makes sense that the Halving would

drastically affect the ratio’s value. Outside of the Halvings, the

block subsidy remains constant in BTC value and is more or less

given out at a constant rate. However, the ratio’s value can still

change at times other than Halvings because it measures the USD

value of the miner revenue. The rewards that miners get are in BTC

and so, their value is also tied to the USD rate of the asset. With

the cryptocurrency observing a sharp rally recently, the miner

revenue seems to be back to the same as the 365-day MA. The 1 mark

isn’t the only important level the Puell Multiple has risen to; it

is now near its 365-day MA. In the chart, the quant highlighted

what happened the last three times the metric broke above this

line. It would appear that the asset went on to rally at least 76%

each time. Related Reading: Is $135,000 Bitcoin’s Current Ceiling?

This Model Says So It remains to be seen whether the Puell Multiple

could break above this line, potentially giving a bullish signal

for Bitcoin, or if the retest would fail. BTC Price Bitcoin has

recently witnessed a cooldown in bullish momentum as its price has

fallen to a sideways movement. At present, BTC is trading at around

$91,900. Featured image from Dall-E, CryptoQuant.com, chart from

TradingView.com

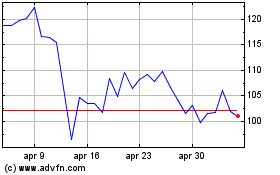

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025