Ethereum Sees Neutral Netflow On Binance: What Does This Signal?

22 Novembre 2024 - 12:00AM

NEWSBTC

Ethereum (ETH), the second-largest cryptocurrency by market

capitalization, is currently experiencing a phase of neutrality in

its market activity. According to a CryptoQuant analyst known as

Darkfost, Ethereum’s netflow on Binance has reached a balanced

state, with deposits and withdrawals stabilizing. So, what does

this mean for ETH? Related Reading: Is Ethereum Undervalued?

Investors Hold Firm While Price Targets Rise A Signal To Buy Or

Sell? According to the analysis shared by Darkfost, this current

behavior seen in Ethereum’s netflow on Binance might indicate an

“accumulation phase,” where investors refrain from

significant transactions as they await a “catalyst” to guide their

next moves. The CryptoQuant analyst wrote: Ethereum’s netflow on

Binance has recently turned neutral, indicating a balance between

deposits and withdrawals. It could indicates that there is

currently no significant buying or selling pressure. This may

suggest that ETH is in an accumulation phase, with investors

holding their positions and awaiting a catalyst to either buy or

sell. Furthermore, Darkfost pointed out that Ethereum’s Open

Interest—a measure of the total number of outstanding derivative

contracts—has steadily risen. According to the data cited by the

analyst, this ETH metric is approaching an all-time high on

Binance, potentially signaling increased market activity. Darkfost

hinted that this could be the calm before a significant market

shift. The analyst concluded by noting: As Open Interest continues

to rise and approaches an all-time high on Binance, we can wonder

if this is the calm before the storm ? Is Ethereum Gearing For A

Major Rally After several weeks of lagging and failing to keep up

the bullish pace with Bitcoin, the Ethereum price performance in

the past day now signals that the asset may just be ready to

fulfill the anticipated major rally many investors and enthusiasts

may have been expecting. Over the past 24 hours, Ethereum has

surged by 5%, with a trading price of $3,276 at the time of

writing. This price increase has also unsurprisingly spiked the

market cap of the second-largest crypto asset. Ethereum’s market

cap valuation currently sits at $394 billion, a roughly $26 billion

boost from the $368 billion valuation seen in the early hours of

today. Related Reading: Leveraged Bets On Ethereum Soar: What This

Means For Traders and Investors While the exact reason for

Ethereum’s current bullish momentum remains uncertain, aside from

the broader market’s ongoing bull run, analysts suggest that the

long-anticipated alt season may be on the horizon. #Altcoins I

think most people aren’t mentally prepared for what the next few

months will bring for Altcoins. 2017 once again?👀

pic.twitter.com/98n73bK5Mo — 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) November

20, 2024 Featured image created with DALL-E, Chart from TradingView

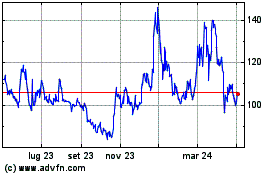

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2025 a Apr 2025

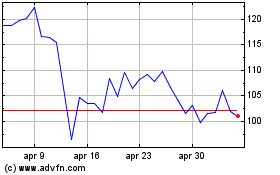

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Apr 2024 a Apr 2025