Update: Australia's Debt Market Buzzes With New Issues

10 Marzo 2010 - 6:14AM

Dow Jones News

Australia's debt market sparked into life Wednesday with a

succession of bond offers, including the first by a non-financial

corporate since the middle of last year, illustrating the recovery

in credit markets is continuing apace.

The rush to issue comes as investors seek to diversify away from

a steady stream of debt from local banks and borrowers look to

Australia's public debt market as an alternative to other financing

routes.

The cheaper cost of converting Australian dollar borrowings into

their home currency and a more expensive cost of converting foreign

currency into local dollars is also at the core of the rush.

Although banks made up the most of the debt on offer Wednesday,

the list of borrowers included offshore banks, which have been

largely absent from the domestic market, along with non-financial

companies.

Banco Santander, Credit Suisse, BNP Paribas and toll roads

operator Transurban Group were all in talks with investors

Wednesday to sell bonds, market participants said.

Property group Mirvac Group is also said to be close to a debt

issue to replace a bond maturing next week, while Barclays Capital

is considering a possible five year bond offer, priced at 130 basis

points to 140 basis points over the underlying swap rate, market

participants said.

John Manning, credit strategist at Royal Bank of Scotland, said

a desire among investors to mix up their portfolios away form local

banks, coupled with the cross currency basis swap making it more

expensive to borrow offshore is key to the rush of issuance.

"There's a lot of money looking for a home," he said.

Banco Santander SA is considering an offer of three or five-year

bonds, a market participant said, in what would be the banking

group's first issue in the kangaroo bond market. Kangaroo bonds are

sold by offshore issuers in Australia.

Price guidance on the three-year bonds is 120 basis points over

the underlying swap rate, while the five-year discussions center

around 165 basis points. Investment bank JPMorgan is arranging the

discussions.

The bank set up its first Australian dollar debt program last

year and has been linked to various possible acquisitions in

Europe.

Last week, JPMorgan and HSBC broke the kangaroo bond drought by

issuing in Australian dollars, the first outside of supranational

issuers since 2007.

Also Wednesday, Credit Suisse's Sydney branch launched an offer

of four year bonds, fixed and floating rate, with guidance of 120

basis points over swap.

Commonwealth Bank of Australia and Westpac are arranging the

offer.

BNP Paribas is seeking to issue five-year-dated bonds, with

guidance on the offer around 115 basis points over swap, a market

participant said.

On the non bank-side, Transurban Group is considering an offer

of four year dated debt securities, seeking to raise at least A$200

million, market participants said.

The company is speaking with investors about a possible issue

priced around 170 to 180 basis points above the underlying swap

rate, the market participants added.

The fully secured debt carries an extra layer of protection for

buyers in the shape of a step up to a higher coupon in the event of

a credit ratings downgrade for the company.

Public debt issuance in 2009 in Australia, excluding

asset-backed securities, reached A$101 billion - but just A$3.6

billion of this was from non-bank companies. The last issue form a

non-bank company was in the middle of 2009.

In the asset-backed sector, Bendigo and Adelaide Bank Ltd. is

looking to sell around A$650 million in residential mortgage-backed

securities. The pricing will be on or before March 17.

-By Enda Curran, Dow Jones Newswires; 61-2-8272-4687; enda.curran@dowjones.com

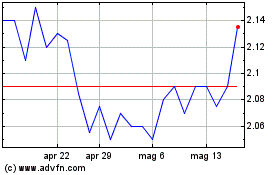

Grafico Azioni Mirvac (ASX:MGR)

Storico

Da Apr 2024 a Mag 2024

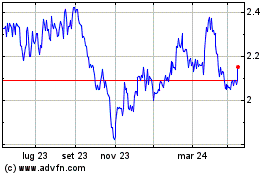

Grafico Azioni Mirvac (ASX:MGR)

Storico

Da Mag 2023 a Mag 2024