Antipodean Currencies Fall Amid Risk Aversion

19 Luglio 2024 - 5:44AM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Friday amid risk aversion, following the broadly

negative cues from Wall Street overnight, as most currencies in the

region weakened against the U.S. dollar on economic concerns amid

prospects of the U.S. administration imposing tougher sanctions on

firms exporting critical chipmaking equipment to China and

suggestions of Taiwan being asked to pay the U.S. for defense.

U.S. election jitters may also keep investors on the sidelines,

with President Joe Biden reportedly facing increased pressure from

senior democratic leaders to pull out of his re-election bid.

Weakness across most sectors led by mining and technology

stocks, also led to downturn of the investor sentiment.

Crude oil prices eased slightly amid concerns about the outlook

for oil demand from China, while the dollar's recovery weighed as

well on prices. West Texas Intermediate Crude oil futures for

August ended down $0.03 at $82.82 a barrel.

In the Asian trading today, the Australian dollar fell to more

than a 2-week low of 0.6695 against the U.S. dollar and nearly a

2-week low of 0.9178 against the Canadian dollar, from yesterday's

closing quotes of 0.6705 and 0.9189, respectively. The aussie may

test support near 0.65 against the greenback and 0.90 against the

loonie.

Against the euro and the yen, the aussie dropped to 1.6275 and

105.20 from Thursday's closing quotes of 1.6244 and 105.69,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.64 against the euro and 104.00 against the

yen.

The NZ dollar fell to more than a 2-month low of 0.6021 against

the U.S. dollar, a 2-day low of 1.1125 against the Australian

dollar and a 2-1/2- month low of 1.8080 against the euro, from

yesterday's closing quotes of 0.6044, 1.1092 and 1.8080,

respectively. If the kiwi extends its downtrend, it is likely to

find support around 0.58 against the greenback, 1.12 against the

aussie and 1.83 against the euro.

Against the yen, the kiwi edged down to 94.79 from Thursday's

closing value of 95.11. The kiwi may test support near the 92.00

region.

Meanwhile, the safe-haven currency or the U.S. dollar advanced

against other major currencies amid risk aversion.

The U.S. dollar rose to a 3-day high of 1.0884 against the euro

and a 1-week high of 1.2927 against the pound, from yesterday's

closing quotes of 1.0896 and 1.2941, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 1.07

against the euro and 1.28 against the pound.

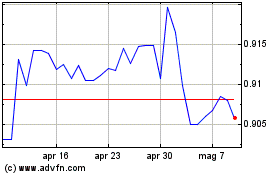

Against the yen and the Swiss franc, the greenback advanced to

2-day highs of 157.88 and 0.8897 from Thursday's closing quotes of

157.37 and 0.8875, respectively. The greenback may test resistance

near 162.00 against the yen and 0.92 against the franc.

The greenback edged up to 1.3715 against the Canadian dollar,

from yesterday's closing value of 1.3704. On the upside, 1.38 is

seen as the next resistance level for the greenback.

Looking ahead, European Central Bank publishes euro area current

account figures for May at 4:00 am ET in the European session.

In the New York session, Canada retail sales data for May, PPI

for June and raw material prices for June and U.S. Baker Hughes

weekly oil rig count data are slated for release.

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Dic 2024 a Gen 2025

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Gen 2024 a Gen 2025