British American Tobacco 1st Half Pretax Profit Rose as Revenue Beat Consensus; Backs Guidance

26 Luglio 2023 - 9:02AM

Dow Jones News

By Anthony O. Goriainoff

British American Tobacco said Wednesday that first-half pretax

profit rose as revenue beat consensus driven by new categories, and

backed its guidance for the year.

The FTSE 100 cigarette maker--which houses the Kent, Dunhill and

Lucky Strike brands--said pretax profit was 5.3 billion pounds

($6.84 billion) compared with GBP3.06 billion for the first half of

2022.

Revenue for the period rose to GBP13.44 billion from GBP12.87

billion the year before. The company provided consensus of GBP13.32

billion.

Revenue from the company's new categories segment--which

includes vaping products and oral tobacco--rose 29% to GBP1.66

billion, beating company-provided consensus of GBP1.57 billion.

The company said that revenue from non-combustibles now made up

17% of group revenue, up 180 basis points from 2022.

Still the company said that revenue in the U.S. fell 5.4% as

cigarette volumes fell 5.7%. The market was negatively impacted by

macroeconomic pressures affecting the industry, as well as the

implementation of the flavor ban in California, it said.

The company said it expects organic constant currency revenue

growth in the 3% to 5% range in 2023.

"While more focus is required in the U.S., our sequential

performance improvement in the critical premium U.S. combustibles

business since January 2023 is encouraging," Chief Executive Tadeu

Marroco said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

July 26, 2023 02:47 ET (06:47 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

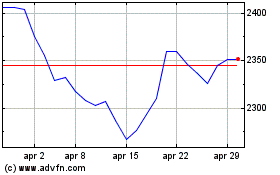

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Giu 2024 a Lug 2024

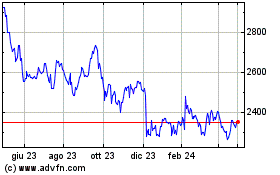

Grafico Azioni British American Tobacco (LSE:BATS)

Storico

Da Lug 2023 a Lug 2024