General Accident PLC Announcement of Results (3720S)

09 Marzo 2023 - 9:00AM

UK Regulatory

TIDMGACA

RNS Number : 3720S

General Accident PLC

09 March 2023

INFORMATION FOR GENERAL ACCIDENT PLC PREFERENCE SHAREHOLDERS

GENERAL ACCIDENT PLC

Announcement of results for the year ended 31 December 2022

These results are published for the benefit of preference

shareholders of General Accident plc ("the Company") for the year

ended 31 December 2022. The preference shares have remained listed

on the London Stock Exchange following the merger of the Company

with Commercial Union plc, in June 1998 to form CGU plc ("CGU"),

and the subsequent merger of CGU with Norwich Union plc in May 2000

to form Aviva plc (formerly CGNU plc).

The Company transferred its interest in its subsidiaries to its

parent company, Aviva plc, in 2005, in return for an inter-company

loan. The income of the Company for the year ended 31 December 2022

consists of interest received on this loan.

The principal risks and uncertainties facing the Company

are:

- Credit risk: The net asset value of the Company's financial

resources is exposed to the potential default on the loan and

short-term receivables due from its parent, Aviva plc. The external

issuer credit rating of Aviva plc (representing an issuer's ability

to meet its overall financial commitments as they fall due) is A,

and as such the risk of counterparty default is considered remote.

In addition, the loan amounting to GBP9,439 million ( 2021:

GBP9,484 million) is secured by a legal charge against the ordinary

share capital of Aviva Group Holdings Limited mitigating the risk

of loss in the event of Aviva plc defaulting. Due to the nature of

the loan, and the fact that it is intended to be held until settled

by Aviva plc (on maturity or earlier if redeemed before maturity)

and not traded, the Company is not exposed to the risk of changes

to the market value caused by changing perceptions of the credit

worthiness of Aviva plc. There were no financial assets that were

past due or impaired at either 31 December 2022 or 31 December

2021.

- Interest rate risk: The net asset value of the Company's

financial resources is exposed to potential fluctuations in

interest rates impacting investment income.

Exposure to credit risk and interest rate risk is managed

through the monitoring of several risk measures.

The Company is part of the Aviva group ("Group"), and Aviva plc

owns 100% of the Company's ordinary issued share capital.

Summarised income statement Audited Audited

results results

12 months to 12 months to

31 December 31 December

Statutory results 2022 2021

GBPm GBPm

Investment income 66 66

------------------------------------- ----------------------------- ------------------------------

Total income 66 66

Profit on ordinary activities before

tax 66 66

Tax on profit on ordinary activities - -

------------------------------------- ----------------------------- ------------------------------

Profit for the period 66 66

------------------------------------- ----------------------------- ------------------------------

Basic earnings per share (pence) 0.24 0.24

------------------------------------- ----------------------------- ------------------------------

Summarised statement of financial Audited Audited

position

31 December 31 December

2022 2021

GBPm GBPm

Total assets 13,932 13,932

---------------------------------- ----------------------------- ------------------------------

Equity attributable to ordinary

shareholders 13,682 13,682

Preference share capital 250 250

Total equity 13,932 13,932

Liabilities - -

Total equity and liabilities 13,932 13,932

---------------------------------- ----------------------------- ------------------------------

Statement of changes in equity Audited Audited

results results

12 months to 12 months to

31 December 31 December

2022 2021

GBPm GBPm

Total equity at 1 January 13,932 13,932

Profit for the period 66 66

---------------------------------- ----------------------------- ------------------------------

Total comprehensive income for

the period 66 66

Dividends (66) (66)

Total equity at 31 December 13,932 13,932

---------------------------------- ----------------------------- ------------------------------

Summarised statement of cash flows Audited Audited

results results

12 months 12 months to

to

31 December 31 December

2022 2021

GBPm GBPm

Cash flows from financing activities - -

---------------------------------------- ------------------------ ------------------------------

Net cash from financing activities - -

---------------------------------------- ------------------------ ------------------------------

Total net increase/(decrease) in - -

cash and cash

---------------------------------------- ------------------------ ------------------------------

Cash and cash equivalents at 1 January - -

---------------------------------------- ------------------------ ------------------------------

Cash and cash equivalents at 31 December - -

(1)

---------------------------------------- ------------------------ ------------------------------

(1) The closing balance as at 31 December 2022 is GBP355 ( 2021:

GBP195 ). The majority of the Company's cash requirements are met

by fellow Group companies.

Basis of preparation

The results announcement for the year ended 31 December 2022 was

approved by the Board of Directors on 8 March 2023. The results

announcement for the year ended 31 December 2022 is prepared on the

basis of the accounting policies set out in the annual accounts.

Audited statutory accounts, together with the auditor's report

thereon, will be filed with the Registrar of Companies when

approved and published.

The Company's Annual Report and Accounts for 2022 will be filed

with the Registrar of Companies. The results for the year ended 31

December 2022 and 2021 were audited by PricewaterhouseCoopers LLP.

The auditor's report was unqualified and did not contain a

statement under section 498(2) or section 498(3) of the Companies

Act 2006.

The audited annual reports and accounts of both the Company and

of Aviva plc for the year ended 31 December 2022, once published,

will be available on application to the Group General Counsel and

Company Secretary, Aviva plc, St Helen's, 1 Undershaft, London,

EC3P 3DQ. Copies will be made available on the Aviva plc website

once published at http://www.aviva.com/investor-relations/reports/

.

Enquiries: Rupert Taylor Rea, Investor Relations Director, Aviva

plc, rupert.taylorrea@aviva.com , +44 (0)7385 494 440

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SSWSFUEDSESD

(END) Dow Jones Newswires

March 09, 2023 03:00 ET (08:00 GMT)

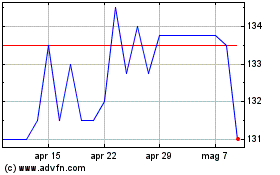

Grafico Azioni Gen.acc.8se.pf (LSE:GACA)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Gen.acc.8se.pf (LSE:GACA)

Storico

Da Mag 2023 a Mag 2024