Tetragon Financial Group Ltd Final Results to Purchase Tetragon Non-Voting Shares

11 Aprile 2022 - 8:00AM

UK Regulatory

TIDMTFG

Tetragon Financial Group Limited Announcement of Final Results of Tender Offer

to Purchase Tetragon Non-Voting Shares

LONDON, 10 April 2022 -- Tetragon announces the final results of the "modified

Dutch auction" tender offer to purchase a portion of the outstanding non-voting

shares of Tetragon for a maximum aggregate payment of $50,000,000 in cash. The

tender offer expired at 11:59 p.m. (ET) on 7 April 2022.

J.P. Morgan Securities plc (which conducts its UK investment banking business

as J.P. Morgan Cazenove) acted as dealer manager for the tender offer and

Computershare Investor Services PLC acted as tender agent for the tender offer.

As dealer manager, J.P. Morgan determined the final purchase price at which

Tetragon will purchase shares in the tender offer. As tender agent,

Computershare determined the final proration factor.

In accordance with the terms of the tender offer, Tetragon has accepted for

purchase 4,291,157 non?voting shares at a purchase price of $9.75 per share.

The aggregate cost of this purchase is $41,838,780.75, excluding fees and

expenses relating to the tender offer. A total of 4,291,157 Tetragon non-voting

shares were properly tendered and not properly withdrawn at or below the

purchase price of $9.75 per share.

Tetragon will promptly make payment for the shares validly tendered and

accepted for purchase, which is expected to occur on or about 14 April 2022.

About Tetragon:

Tetragon is a closed-ended investment company that invests in a broad range of

assets, including public and private equities and credit (including distressed

securities and structured credit), convertible bonds, real estate, venture

capital, infrastructure, bank loans and TFG Asset Management, a diversified

alternative asset management business. Where appropriate, through TFG Asset

Management, Tetragon seeks to own all, or a portion, of asset management

companies with which it invests in order to enhance the returns achieved on its

capital. Tetragon's investment objective is to generate distributable income

and capital appreciation. It aims to provide stable returns to investors across

various credit, equity, interest rate, inflation and real estate cycles. The

company's non-voting shares are traded on Euronext in Amsterdam, a regulated

market of Euronext Amsterdam N.V., and on the Specialist Fund Segment of the

main market of the London Stock Exchange. For more information please visit the

company's website at www.tetragoninv.com.

Tetragon: Press Inquiries:

Yuko Thomas Prosek Partners

Investor Relations Pro-tetragon@prosek.com United Kingdom

ir@tetragoninv.com Henrietta Dehn

United States Alexa Bethell

Ryan FitzGibbon Remy +44 7717 281 665 +44 7940

Marin 166 251

+1 646 818 9298 +1 646

818 9234

This release contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation (2014/596/EU) ("EU MAR") and of the UK version

of EU MAR as it forms part of UK law by virtue of the European Union

(Withdrawal) Act (as amended).

This release does not contain or constitute an offer to sell or a solicitation

of an offer to purchase securities in the United States or any other

jurisdiction. The securities of Tetragon have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States or to U.S. persons unless they are

registered under applicable law or exempt from registration. Tetragon does not

intend to register any portion of its securities in the United States or to

conduct a public offer of securities in the United States. In addition,

Tetragon has not been and will not be registered under the U.S. Investment

Company Act of 1940, as amended, and investors will not be entitled to the

benefits of such Act. Tetragon is registered in the public register of the

Netherlands Authority for the Financial Markets under Section 1:107 of the

Dutch Financial Markets Supervision Act as an alternative investment fund from

a designated state.

J.P. Morgan Securities plc, which is authorised by the UK Prudential Regulation

Authority and regulated by the UK Financial Conduct Authority and the

Prudential Regulation Authority in the United Kingdom, is acting exclusively

for Tetragon and for no one else in connection with the tender offer and will

not be responsible to anyone (whether or not recipient of the tender offer)

other than Tetragon for providing the protections afforded to the clients of

J.P. Morgan Securities plc or for providing advice in relation to the tender

offer.

SOURCE Tetragon Financial Group Limited

END

(END) Dow Jones Newswires

April 11, 2022 02:00 ET (06:00 GMT)

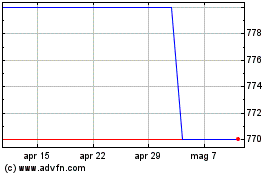

Grafico Azioni Tetragon Financial (LSE:TFGS)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Tetragon Financial (LSE:TFGS)

Storico

Da Nov 2023 a Nov 2024