0001422142FALSE00014221422023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2023

_____________________

AADI BIOSCIENCE, INC.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | |

Delaware | | 001-38560 | | 61-1547850 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

17383 Sunset Boulevard, Suite A250 Pacific Palisades, California | | 90272 |

(Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (424) 744-8055

(Former name or former address, if changed since last report.)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | | AADI | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 9, 2023, Aadi Bioscience, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

All of the information furnished in this Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| August 9, 2023 | /s/ Scott Giacobello |

| Scott Giacobello |

| Interim Chief Executive Officer and President, and Chief Financial Officer |

Exhibit 99.1

Aadi Bioscience Announces Financial Results for the Second Quarter 2023 and Provides

Corporate Update

Continued growth in total revenue on FYARRO® with sales of $6.2 million for 2Q 2023

On-track for interim analysis on 40 patients in PRECISION1 trial before the end of 2023

Expanding pipeline to include programs in Endometrial Cancer and Neuroendocrine Tumors (NETs)

Conference call to be held today at 8:30 am EST

LOS ANGELES, CA, August 9, 2023 – Aadi Bioscience, Inc. (NASDAQ: AADI), a biopharmaceutical company focused on developing and commercializing precision therapies for genetically defined cancers with alterations in mTOR pathway genes, today provided a corporate update and announced financial results for the second quarter of 2023.

“We are seeing continued growth in FYARRO sales and are pleased with the positive feedback we are receiving from the treatment community,” said Scott Giacobello, Interim CEO and President and CFO of Aadi. “The PRECISION1 trial is progressing well, and we are looking forward to providing results of an interim analysis on 40 patients with appropriate follow-up before the end of the year. We expect to complete enrollment as planned in the spring of 2024.”

“With PRECISION1 on track, we are excited to announce the expansion of our pipeline to further investigate mTOR pathway inhibition in endometrial cancer and NETs,” continued Giacobello. “We are encouraged by the positive feedback received from clinicians, and we believe our preclinical data supporting these programs is promising. We look forward to harnessing the unique pharmacology of nab-sirolimus, both in combination and as monotherapy, to provide enhanced therapeutic benefit in these indications with meaningful patient populations and high unmet need.”

Second Quarter 2023 Updates and Recent Operational Highlights

•Interim analysis from PRECISION1 expected before the end of 2023. An interim analysis from the tumor agnostic PRECISION1 trial on 40 patients with appropriate follow-up is on track with data expected before the end of 2023. Enrollment continues to be well-balanced between the two arms, and as previously reported, more than 15 discrete tumor types have been enrolled, supporting the thesis that TSC1 and TSC2 alterations occur broadly across different solid tumors.

•FYARRO net product sales were $6.2 million in the second quarter, reflecting growth of approximately 6% over Q1 2023 and 80% over the prior year quarter.

•Planned initiation of Phase 2 combination trial in endometrial cancer. The Company is initiating a Phase 2 trial investigating the combination of nab-sirolimus with letrozole for the treatment of advanced or recurrent endometrioid-type endometrial cancer (EEC). This is a Phase 2 open-label, multi-institutional study to evaluate the efficacy and safety of nab-sirolimus and letrozole in patients with advanced or recurrent endometrioid endometrial carcinoma. Prior clinical studies with mTOR inhibitors and letrozole in endometrial cancer patients have yielded promising results. In preclinical models, intravenous nab-sirolimus demonstrates significantly higher tumor growth inhibition, intra-tumoral drug accumulation, and greater mTOR target suppression compared with oral inhibitors. The Company is exploring whether the combination of nab-sirolimus with endocrine therapy may produce synergistic anti-tumor activity in patients with EEC. Initiation of this trial is expected in the fourth quarter of 2023.

•Planned initiation of Phase 2 study in neuroendocrine tumors (NETs). The Phase 2 study is a multicenter, open-label, single-arm trial that is evaluating adult patients with functional or non-functional, well-differentiated, locally advanced unresectable or metastatic NETs of the GI tract, lung, or pancreas who have received no more than two prior lines of therapy. In preclinical animal models, nab-sirolimus demonstrated improved target suppression relative to similar weekly doses of sirolimus and everolimus, supporting further exploration of nab-sirolimus in NETs. Initiation of this trial is expected in the fourth quarter of 2023.

•Initiated Phase 1/2 trial in KRASG12C in collaboration with Mirati Therapeutics. The first patient has been dosed in a Phase 1/2 trial evaluating the combination of adagrasib with nab-sirolimus in this collaborative study. The open-label Phase 1/2 trial is intended to determine the optimal dose and recommended Phase 2 dose in patients with KRASG12C mutant solid tumors.

•Multiple posters presented at ASCO Annual Meeting 2023. Aadi presented a company-sponsored TIP update from the PRECISION1 Phase 2 study and combination data of nab-sirolimus and pazopanib (PAZO) from an ongoing Investigator Initiated Trial at ASCO 2023. The posters are available on the investor relations page of the Aadi website at www.aadibio.com.

Second Quarter 2023 Financial Results

•Total revenue resulting from sales of FYARRO for the quarter ended June 30, 2023, was $6.2 million. This compares to the prior year period of $3.4 million.

•Cash, cash equivalents and short-term investments as of June 30, 2023, were $134.9 million as compared to $172.6 million as of December 31, 2022, which is expected to fund operations into 2025 based on current plans.

•Net loss for the three months ended June 30, 2023, was $18.0 million as compared to $18.3 million for the three months ended June 30, 2022.

Conference Call Information

The Aadi management team is hosting a conference call and webcast today at 8:30 am ET (5:30 am PT) to provide a corporate update and discuss results for the second quarter 2023.

Participants may access a live webcast of the call on the “Investors & News” page of the Aadi Bioscience website at aadibio.com. To participate via telephone, please register in advance at this link. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number along with a unique passcode and registrant ID that can be used to access the call. A replay of the conference call and webcast will be archived on the Company's website for at least 30 days.

About FYARRO®

FYARRO is an mTOR inhibitor indicated for the treatment of adult patients with locally advanced unresectable or metastatic malignant perivascular epithelioid cell tumor (PEComa).

About the PRECISION1 Trial

The PRECISION1 trial is a multi-center, open-label, tumor-agnostic registrational clinical trial of nab-sirolimus. This tumor agnostic study will evaluate approximately 60 mTOR inhibitor naïve patients in each of two independent study arms, or approximately 120 in total, comprised of patients with solid tumors harboring pathogenic inactivating alterations in either TSC1 or TSC2 genes. In November 2021, the FDA granted Fast Track designation to evaluate nab-sirolimus for this patient population.

nab-Sirolimus 100 mg/m2 is given weekly intravenously over 30 minutes on Days 1 and 8 of each 21-day cycle. The primary endpoint is overall response rate per independent radiographic review (IRR) using RECIST v1.1. Other endpoints include duration of response, time to response, progression-free survival by IRR, overall survival, patient-reported quality of life, and safety.

About Aadi Bioscience

Aadi is a commercial-stage biopharmaceutical company focused on precision therapies for genetically defined cancers to bring transformational therapies to cancer patients with mTOR pathway driver alterations. Aadi received FDA approval in November 2021, and in February 2022 commenced commercialization of FYARRO® for the treatment of adult patients with locally advanced unresectable or metastatic malignant perivascular epithelioid cell tumor (PEComa).

Aadi is conducting the PRECISION1 trial, a Phase 2 tumor-agnostic registration-directed study in patients with mTOR inhibitor-naïve malignant solid tumors harboring TSC1 or TSC2 inactivating alterations. More information on Aadi's development pipeline is available on the Aadi website at www.aadibio.com and connect with us on Twitter and LinkedIn.

Forward-Looking Statements

This press release contains certain forward-looking statements regarding the business of Aadi Bioscience that are not a description of historical facts within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding the Company’s current beliefs and expectations; the Company’s anticipated growth and continued advancements, including plans and potential for success relating to commercializing FYARRO; expectations regarding the beneficial characteristics, safety, efficacy and therapeutic effects of FYARRO; plans related to further development and manufacturing of FYARRO; pricing and reimbursement of FYARRO; the rate and degree of market acceptance of FYARRO; anticipated reception of FYARRO in the physician community; the clinical results and timing of additional clinical trials, including the registration-directed trial in patients harboring TSC1 or TSC2 inactivating alterations and the release of data with respect thereto, and the clinical trials in endometrioid-type endometrial cancer and neuroendocrine tumors; the potential of nab-sirolimus to generate improved target suppression in EEC, in combination with letrozole, and NETs; the timing and likelihood of regulatory filings and approvals of FYARRO, including in potential additional indications and potential filings in additional jurisdictions; plans regarding clinical trials, including those in collaboration with Mirati Therapeutics, for the combination of adagrasib and nab-sirolimus in patients with KRASG12C-mutant tumors and related timing and expectations regarding the efficacy of the combination; and the sufficiency of our existing capital resources and the expected timeframe to fund our future operating expenses and capital expenditure requirements. Actual results could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, those associated with the ability to successfully commercialize FYARRO; risks related to reimbursement and pricing of FYARRO; uncertainties associated with the clinical development and regulatory approval of FYARRO in additional indications, including potential delays in the commencement, enrollment and completion of clinical trials for additional indications; the risk that unforeseen adverse reactions or side effects may occur in the course of commercializing, developing and testing FYARRO; risks associated with the failure to realize any value from FYARRO in light of inherent risks and difficulties involved in successfully bringing product candidates to market; risks related to the Company’s collaborations; and risks related to the Company’s estimates regarding future expenses, capital requirements and need for additional financing.

Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including under the caption "Item 1A. Risk Factors," filed on March 29, 2023 and in Aadi’s subsequent Quarterly Reports on Form 10-Q, and elsewhere in Aadi’s reports and other documents that Aadi has filed, or will file, with the SEC from time to time and available at www.sec.gov.

All forward-looking statements in this press release are current only as of the date hereof and, except as required by applicable law, Aadi undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise. All forward-looking statements are qualified in their entirety by this cautionary statement. This cautionary statement is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Contact:

Marcy Graham

IR@aadibio.com

AADI BIOSCIENCE, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| June 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 68,162 | | | $ | 39,019 | |

| Short-term investments | 66,727 | | | 133,541 | |

| Accounts receivable, net | 3,676 | | | 1,862 | |

| Inventory | 3,457 | | | 1,861 | |

| Prepaid expenses and other current assets | 2,901 | | | 3,746 | |

| Total current assets | 144,923 | | | 180,029 | |

| Property and equipment, net | 3,005 | | | 508 | |

| Operating lease right-of-use assets | 1,349 | | | 1,522 | |

| Other assets | 1,951 | | | 2,178 | |

| Total assets | $ | 151,228 | | | $ | 184,237 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,898 | | | $ | 3,519 | |

| Accrued liabilities | 9,685 | | | 14,922 | |

| Operating lease liabilities, current portion | 413 | | | 394 | |

| Total current liabilities | 12,996 | | | 18,835 | |

| Operating lease liabilities, net of current portion | 1,056 | | | 1,267 | |

| Due to licensor (Note 8) | 5,757 | | | 5,757 | |

| Total liabilities | 19,809 | | | 25,859 | |

| Stockholders’ equity: | | | |

| | | |

| Common stock | 2 | | | 2 | |

| Additional paid-in capital | 367,853 | | | 361,689 | |

| Accumulated other comprehensive loss | (44) | | | (115) | |

| Accumulated deficit | (236,392) | | | (203,198) | |

| Total stockholders’ equity | 131,419 | | | 158,378 | |

| Total liabilities and stockholders’ equity | $ | 151,228 | | | 184,237 | |

AADI BIOSCIENCE, INC.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except shares and earnings per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | |

| Revenue | | | | | | | |

| Product sales, net | $ | 6,202 | | | $ | 3,437 | | | $ | 12,069 | | | $ | 5,744 | |

| Total revenue | 6,202 | | | 3,437 | | | 12,069 | | | 5,744 | |

| Operating expenses | | | | | | | |

| Selling, general and administrative | 11,776 | | | 10,006 | | | 22,983 | | | 19,154 | |

| Research and development | 13,315 | | | 7,726 | | | 24,271 | | | 14,519 | |

| Cost of goods sold | 656 | | | 341 | | | 1,185 | | | 520 | |

| Impairment of acquired contract intangible asset | — | | | 3,724 | | | — | | | 3,724 | |

| Total operating expenses | 25,747 | | | 21,797 | | | 48,439 | | | 37,917 | |

| Loss from operations | (19,545) | | | (18,360) | | | (36,370) | | | (32,173) | |

| Other income (expense) | | | | | | | |

| Foreign exchange loss | (3) | | | — | | | (3) | | | — | |

| Interest income | 1,635 | | | 158 | | | 3,295 | | | 171 | |

| Interest expense | (58) | | | (58) | | | (116) | | | (115) | |

| Total other income (expense), net | 1,574 | | | 100 | | | 3,176 | | | 56 | |

| Loss before income tax expense | (17,971) | | | (18,260) | | | (33,194) | | | (32,117) | |

| Income tax expense | — | | | (9) | | | — | | | (9) | |

| Net loss | $ | (17,971) | | | $ | (18,269) | | | $ | (33,194) | | | $ | (32,126) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.67) | | | $ | (0.87) | | | $ | (1.23) | | | $ | (1.53) | |

| Weighted average number of common shares outstanding, basic and diluted | 26,879,089 | | | 20,970,459 | | | 26,878,672 | | | 20,942,804 | |

v3.23.2

Cover

|

Aug. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 09, 2023

|

| Entity Registrant Name |

AADI BIOSCIENCE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38560

|

| Entity Tax Identification Number |

61-1547850

|

| Entity Address, Address Line One |

17383 Sunset Boulevard

|

| Entity Address, Address Line Two |

Suite A250

|

| Entity Address, City or Town |

Pacific Palisades

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90272

|

| City Area Code |

424

|

| Local Phone Number |

744-8055

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

AADI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001422142

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

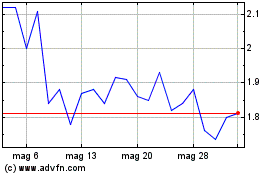

Grafico Azioni Aadi Bioscience (NASDAQ:AADI)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Aadi Bioscience (NASDAQ:AADI)

Storico

Da Mag 2023 a Mag 2024