Arbutus Biopharma Corporation (Nasdaq: ABUS) (“Arbutus” or the

“Company”), a clinical-stage biopharmaceutical company leveraging

its extensive virology expertise to develop a functional cure for

people with chronic hepatitis B virus (cHBV) infection, today

reports first quarter 2024 financial results and provides a

corporate update.

“We continued to make progress in the first

quarter of 2024 in advancing our pipeline of HBV assets,” said

Michael J. McElhaugh, Interim President and Chief Executive Officer

of Arbutus Biopharma. “Along with imdusiran, which we see as a

potential cornerstone therapeutic, we believe an immune modulator

also plays an important role in the treatment regimen to

functionally cure cHBV. In pursuit of this goal, we have initiated

our third Phase 2a trial combining imdusiran with an immune

modulator and are reporting the first part of the Phase 1a/1b trial

with AB-101, our oral proprietary PD-L1 checkpoint inhibitor. The

end-of-treatment data from our two ongoing Phase 2a combination

trials with imdusiran and other immune modulators will be presented

at the EASL conference upcoming in June. With an expected cash

runway now through the second quarter of 2026, we are well funded

to move our existing clinical trials forward to achieve meaningful

data and advance into a later stage clinical trial.”

Clinical Development Update

Imdusiran (AB-729, RNAi

Therapeutic)

- AB-729-201 is a

Phase 2a clinical trial that is evaluating the safety, tolerability

and antiviral activity of the combination of imdusiran,

nucleos(t)ide analogue (NA) therapy and pegylated interferon

alfa-2a (IFN) in patients with cHBV. Preliminary data presented at

the EASL Congress in June 2023 suggest that the addition of IFN to

imdusiran was generally well-tolerated and appears to result in

continued HBsAg declines in some patients. End-of-treatment data

from this trial will be shared at the upcoming EASL Congress in

June.

- AB-729-202 is a

Phase 2a clinical trial that is evaluating the safety and

immunogenicity of imdusiran, NA therapy and Barinthus Bio’s

VTP-300, an HBV antigen-specific

immunotherapy. Preliminary data presented at AASLD – The

Liver Meeting in November 2023 showed that the combination of

imdusiran and VTP-300 provided a meaningful reduction of HBsAg

levels that are maintained well below baseline. End-of-treatment

data from this portion of the trial will be shared at the upcoming

EASL Congress in June.

- AB-729-202 was

amended to include an additional cohort of 20 patients who will

receive imdusiran plus NA therapy for 24 weeks followed by VTP-300

plus up to two low doses of nivolumab, an approved anti-PD-1

monoclonal antibody. Preliminary end-of-treatment data from this

additional cohort are expected in the second half of

2024.

- AB-729-203 is a

Phase 2a clinical trial evaluating the safety, tolerability and

antiviral activity of imdusiran and NA therapy in combination with

intermittent low doses of durvalumab, an approved anti-PD-L1

monoclonal antibody. Patients are being screened in this clinical

trial. The clinical trial is designed to enroll 30 patients in

three separate cohorts. All patients will receive 60mg of imdusiran

every 8 weeks for 48 weeks and 2 doses of durvalumab given via IV

infusion at pre-specified times during the imdusiran treatment

period that will differ by cohort. After completion of

treatment, all patients will be assessed for NA discontinuation and

followed for at least 24 to 48 weeks.

AB-101 (Oral PD-L1

Inhibitor)

- AB-101-001 is a

Phase 1a/1b double-blind, randomized, placebo-controlled clinical

trial designed to investigate the safety, tolerability,

pharmacokinetics (PK), and pharmacodynamics (PD) of single- and

multiple-ascending oral doses of AB-101 for up to 28 days in

healthy subjects and patients with cHBV. Part 1 of the clinical

trial has enrolled four sequential cohorts of eight healthy

subjects each (6 active:2 placebo) to date, each receiving a single

dose of AB-101 at increasing dose levels up to 25mg or placebo. In

this trial, AB-101 was generally well-tolerated with evidence of

dose-dependent receptor occupancy. In the 25mg cohort, all five

evaluable subjects showed evidence of receptor occupancy between

50-100%. Arbutus has moved into Part 2 of this clinical trial which

evaluates multiple-ascending doses of AB-101 in healthy subjects

and expects to report preliminary data in the second half of this

year.

Corporate Updates

In a separate press release issued today,

Arbutus announced that Michael J. Sofia, PhD will be retiring as

Chief Scientific Officer at the end of 2024. Dr. Sofia is a

co-founder of Arbutus and a globally recognized, Lasker

award-winning antiviral drug discovery and development

scientist.

The following abstracts were accepted

for presentation at the EASL Congress 2024:

Abstract Title: Imdusiran

(AB-729) administered every 8 weeks in combination with 24 weeks of

pegylated interferon alfa-2a in virally suppressed, HBeAg-negative

subjects with chronic HBV infection leads to HBsAg loss in some

subjects at end of IFN treatment.

Authors: Man-Fung Yuen, Jeong

Heo, Ronald G Nahass, Grace Lai-Hung Wong, Tatiana Burda, Kalyan

Ram Bhamidimarri, Tsung-Hui Hu, Tuan T Nguyen, Young-Suk Lim,

Chi-Yi Chen, Stuart C Gordon, Jacinta Holmes, Wan-Long Chuang,

Anita Kohli, Naim Alkhouri, Kevin Gray, Emily P. Thi, Elina

Medvedeva, Timothy Eley, Sharie C Ganchua, Christina Iott,

Elizabeth Eill, Christine L. Espiritu, Mark Anderson, Tiffany

Fortney, Gavin Cloherty, Karen D Sims

Abstract Title: Imdusiran

(AB-729) administered every 8 weeks for 24 weeks followed by the

immunotherapeutic VTP-300 maintains lower HBV surface antigen

levels in NA-suppressed CHB subjects than 24 weeks of imdusiran

alone.

Authors: Kosh Agarwal, Man-Fung

Yuen, Stuart Roberts, Gin-Ho Lo, Chao-Wei Hsu, Wan-Long Chuang,

Chi-Yi Chen, Pei-Yuan Su, Sam Galhenage, Sheng-Shun Yang, Emily P.

Thi, Katie Anderson, Deana Antoniello, Elina Medvedeva, Timothy

Eley, Tilly Varughese, Louise Bussey, Charlotte Davis, Antonella

Vardeu, Christine L. Espiritu, Sharie C Ganchua, Christina Iott,

Elizabeth Eill, Tom Evans, Karen D Sims

LNP Litigation Update:

- With respect to the

Moderna lawsuit, the claim construction hearing occurred on

February 8, 2024. On April 3, 2024, the Court provided its claim

construction ruling, in which it construed the disputed claim terms

and agreed with Arbutus’ position on most of the disputed claim

terms. Fact discovery is on-going and next steps include expert

reports and depositions. A trial date has been set for April 21,

2025, and is subject to change.

- The lawsuit against

Pfizer/BioNTech is ongoing and a date for a claim construction

hearing has not been set.

Arbutus continues to protect and defend its

intellectual property, which is the subject of the on-going

lawsuits against Moderna and Pfizer/BioNTech. The Company is

seeking fair compensation for Moderna’s and Pfizer/BioNTech’s use

of its patented LNP technology that was developed with great effort

and at a great expense, without which Moderna and Pfizer/BioNTech’s

COVID-19 vaccines would not have been successful.

Financial Results

Cash, Cash Equivalents and

Investments

As of March 31, 2024, the Company had cash,

cash equivalents and investments in marketable securities of $137.9

million compared to $132.3 million as of December 31, 2023.

During the three months ended March 31, 2024, the Company used

$19.3 million in operating activities, which was offset by $21.8

million of net proceeds from the issuance of common shares under

its “at-the-market” offering program (ATM Program). During April

2024, the Company received an additional $22.4 million of net

proceeds under its ATM Program. The Company expects its 2024 net

cash burn to range from between $63 million to $67 million,

excluding any proceeds received from its ATM Program. The

Company believes its cash, cash equivalents and investments in

marketable securities including the additional net proceeds

received under its ATM Program during April 2024, will be

sufficient to fund its operations through the second quarter of

2026.

Revenue

Total revenue was $1.5 million for the three

months ended March 31, 2024 compared to $6.7 million for the same

period in 2023. The decrease of $5.2 million was due primarily to:

i) a decrease in license revenue recognized related to the

Company’s progress towards the satisfaction of its performance

obligations with respect to the licensing agreement with Qilu; and

ii) a decrease in license royalty revenue from Alnylam due to lower

sales of ONPATTRO in 2024 compared to 2023.

Operating Expenses

Research and development expenses were $15.4

million for the three months ended March 31, 2024 compared to

$18.3 million for the same period in 2023. The decrease of $2.9

million was due primarily to the discontinuation of the Company’s

AB-161 and coronavirus programs in September 2023 as part of its

efforts to focus its pipeline on its lead HBV product candidates,

partially offset by an increase in clinical expenses for the

Company’s multiple imdusiran Phase 2a clinical trials. General and

administrative expenses were $5.3 million for the three months

ended March 31, 2024 compared to $5.6 million for the same

period in 2023. The decrease of $0.3 million was due primarily to a

decrease in non-cash stock-based compensation expenses.

Net Loss

For the three months ended March 31, 2024,

the Company net loss was $17.9 million, or a loss of $0.10 per

basic and diluted common share, as compared to a net loss of $16.3

million, or a loss of $0.10 per basic and diluted common share, for

the three months ended March 31, 2023.

Outstanding Shares

As of March 31, 2024, the Company had

approximately 180.2 million common shares issued and outstanding.

During April 2024, the Company issued an additional 7.8 million

common shares under its ATM program. In addition, the Company had

approximately 22.6 million stock options and unvested restricted

stock units outstanding as of March 31, 2024. Roivant Sciences Ltd.

owned approximately 20% of our outstanding common shares as of

April 30, 2024.

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF

LOSS |

|

(in thousands, except share and per share

data) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

| Revenue |

|

|

|

|

Collaborations and licenses |

$ |

939 |

|

|

$ |

5,509 |

|

|

Non-cash royalty revenue |

593 |

|

|

1,178 |

|

| Total

revenue |

1,532 |

|

|

6,687 |

|

| Operating

expenses |

|

|

|

|

Research and development |

15,403 |

|

|

18,275 |

|

|

General and administrative |

5,312 |

|

|

5,552 |

|

|

Change in fair value of contingent consideration |

180 |

|

|

273 |

|

| Total operating

expenses |

20,895 |

|

|

24,100 |

|

| Loss from operations |

(19,363 |

) |

|

(17,413 |

) |

| Other income (loss) |

|

|

|

|

Interest income |

1,545 |

|

|

1,268 |

|

|

Interest expense |

(44 |

) |

|

(198 |

) |

| Foreign exchange gain |

(13 |

) |

|

4 |

|

| Total other income |

1,488 |

|

|

1,074 |

|

| Net loss |

$ |

(17,875 |

) |

|

$ |

(16,339 |

) |

| Loss per

share |

|

|

|

|

Basic and diluted |

$ |

(0.10 |

) |

|

$ |

(0.10 |

) |

| Weighted average

number of common shares |

|

|

|

|

Basic and diluted |

175,625,552 |

|

|

161,643,404 |

|

|

|

|

|

|

| Comprehensive

loss |

|

|

|

| Unrealized gain on

available-for-sale securities |

50 |

|

|

854 |

|

|

Comprehensive loss |

$ |

(17,825 |

) |

|

$ |

(15,485 |

) |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(in thousands) |

| |

| |

March 31, 2024 |

|

December 31, 2023 |

|

Cash, cash equivalents and marketable securities, current |

$ |

129,240 |

|

|

$ |

126,003 |

| Accounts receivable and other

current assets |

6,632 |

|

|

6,024 |

|

Total current assets |

135,872 |

|

|

132,027 |

| Property and equipment, net of

accumulated depreciation |

4,414 |

|

|

4,674 |

| Investments in marketable

securities, non-current |

8,677 |

|

|

6,284 |

| Right of use asset |

1,327 |

|

|

1,416 |

|

Total assets |

$ |

150,290 |

|

|

$ |

144,401 |

| Accounts payable and accrued

liabilities |

$ |

8,247 |

|

|

$ |

10,271 |

| Deferred license revenue,

current |

|

11,547 |

|

|

|

11,791 |

| Lease liability, current |

502 |

|

|

425 |

|

Total current liabilities |

20,296 |

|

|

22,487 |

| Liability related to sale of

future royalties |

6,396 |

|

|

6,953 |

| Contingent consideration |

7,780 |

|

|

7,600 |

| Lease liability, non-current |

1,181 |

|

|

1,343 |

| Total stockholders’ equity |

114,637 |

|

|

106,018 |

|

Total liabilities and stockholders’ equity |

$ |

150,290 |

|

|

$ |

144,401 |

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(in thousands) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

Net loss |

$ |

(17,875 |

) |

|

$ |

(16,339 |

) |

| Non-cash items |

1,439 |

|

|

1,372 |

|

| Change in deferred license

revenue |

(244 |

) |

|

(4,104 |

) |

| Other changes in working

capital |

(2,615 |

) |

|

(8,230 |

) |

| Net cash used in

operating activities |

(19,295 |

) |

|

(27,301 |

) |

| Net cash provided by

investing activities |

11,694 |

|

|

16,678 |

|

|

Issuance of common shares pursuant to the Open Market Sale

Agreement |

21,765 |

|

|

19,862 |

|

|

Cash provided by other financing activities |

2,665 |

|

|

555 |

|

| Net cash provided by

financing activities |

24,430 |

|

|

20,417 |

|

| Effect of foreign exchange rate

changes on cash and cash equivalents |

(13 |

) |

|

4 |

|

|

Increase in cash and cash equivalents |

16,816 |

|

|

9,798 |

|

| Cash and cash equivalents,

beginning of period |

26,285 |

|

|

30,776 |

|

|

Cash and cash equivalents, end of period |

43,101 |

|

|

40,574 |

|

| Investments in marketable

securities |

94,816 |

|

|

137,944 |

|

|

Cash, cash equivalents and marketable securities, end of

period |

$ |

137,917 |

|

|

$ |

178,518 |

|

|

|

|

|

|

|

|

|

|

Conference Call and Webcast Today

Arbutus will hold a conference call and webcast

today, Thursday, May 2, 2024, at 8:45 AM Eastern Time to provide a

corporate update. To dial-in for the conference call by phone,

please register using the following link: Registration Link. A live

webcast of the conference call can be accessed through the

Investors section of Arbutus' website at

www.arbutusbio.com.

An archived webcast will be available on the

Arbutus website after the event.

About imdusiran (AB-729)

Imdusiran is an RNA interference (RNAi)

therapeutic specifically designed to reduce all HBV viral proteins

and antigens including hepatitis B surface antigen, which is

thought to be a key prerequisite to enable reawakening of a

patient’s immune system to respond to the virus. Imdusiran targets

hepatocytes using Arbutus’ novel covalently conjugated

N-Acetylgalactosamine (GalNAc) delivery technology enabling

subcutaneous delivery. Clinical data generated thus far has shown

single and multiple doses of imdusiran to be generally safe and

well-tolerated, while also providing meaningful reductions in

hepatitis B surface antigen and hepatitis B DNA. Imdusiran is

currently in multiple Phase 2a clinical trials.

About AB-101

AB-101 is our oral PD-L1 inhibitor candidate

that we believe will allow for controlled checkpoint blockade while

minimizing the systemic safety issues typically seen with

checkpoint antibody therapies. Immune checkpoints such as

PD-1/PD-L1 play an important role in the induction and maintenance

of immune tolerance and in T-cell activation. Preclinical data

generated thus far indicates that AB-101 mediates re-activation of

exhausted HBV-specific T-cells from cHBV patients. We believe

AB-101, when used in combination with other approved and

investigational agents, could potentially lead to a functional cure

in patients chronically infected with HBV. AB-101 is currently

being evaluated in a Phase 1a/1b clinical trial.

About HBV

Hepatitis B is a potentially life-threatening

liver infection caused by the hepatitis B virus (HBV). HBV can

cause chronic infection which leads to a higher risk of death from

cirrhosis and liver cancer. Chronic HBV infection represents a

significant unmet medical need. The World Health Organization

estimates that over 290 million people worldwide suffer from

chronic HBV infection, while other estimates indicate that

approximately 2.4 million people in the United States suffer from

chronic HBV infection. Approximately 820,000 people die every year

from complications related to chronic HBV infection despite the

availability of effective vaccines and current treatment

options.

About Arbutus

Arbutus Biopharma Corporation (Nasdaq: ABUS) is

a clinical-stage biopharmaceutical company leveraging its extensive

virology expertise to identify and develop novel therapeutics with

distinct mechanisms of action, which can be combined to provide a

functional cure for patients with chronic hepatitis B virus (cHBV).

We believe the key to success in developing a functional cure

involves suppressing HBV DNA, reducing surface antigen, and

boosting HBV-specific immune responses. Our pipeline of internally

developed, proprietary compounds includes an RNAi therapeutic,

imdusiran (AB-729), and an oral PD-L1 inhibitor, AB-101. Imdusiran

has generated meaningful clinical data demonstrating an impact on

both surface antigen reduction and reawakening of the HBV-specific

immune response. Imdusiran is currently in three Phase 2a

combination clinical trials. AB-101 is currently being evaluated in

a Phase 1a/1b clinical trial. For more information, visit

www.arbutusbio.com.

Forward-Looking Statements and

Information

This press release contains forward-looking

statements within the meaning of the Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934,

and forward-looking information within the meaning of Canadian

securities laws (collectively, forward-looking statements).

Forward-looking statements in this press release include statements

about our future development plans for our product candidates; the

expected cost, timing and results of our clinical development plans

and clinical trials with respect to our product candidates; our

expectations with respect to the release of data from our clinical

trials and the expected timing thereof; our expectations and goals

for our collaborations with third parties and any potential

benefits related thereto; the potential for our product candidates

to achieve success in clinical trials; our expectations regarding

our pending litigation matters; and our expected financial

condition, including our anticipated net cash burn, the anticipated

duration of cash runways and timing regarding needs for additional

capital.

With respect to the forward-looking statements

contained in this press release, Arbutus has made numerous

assumptions regarding, among other things: the effectiveness and

timeliness of preclinical studies and clinical trials, and the

usefulness of the data; the timeliness of regulatory approvals; the

continued demand for Arbutus’ assets; and the stability of economic

and market conditions. While Arbutus considers these assumptions to

be reasonable, these assumptions are inherently subject to

significant business, economic, competitive, market and social

uncertainties and contingencies, including uncertainties and

contingencies related to patent litigation matters.

Additionally, there are known and unknown risk

factors which could cause Arbutus’ actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements contained herein. Known risk factors

include, among others: anticipated pre-clinical studies and

clinical trials may be more costly or take longer to complete than

anticipated, and may never be initiated or completed, or may not

generate results that warrant future development of the tested

product candidate; Arbutus may elect to change its strategy

regarding its product candidates and clinical development

activities; Arbutus may not receive the necessary regulatory

approvals for the clinical development of Arbutus’ products;

economic and market conditions may worsen; uncertainties associated

with litigation generally and patent litigation specifically; and

Arbutus and its collaborators may never realize the expected

benefits of the collaborations; market shifts may require a change

in strategic focus.

A more complete discussion of the risks and

uncertainties facing Arbutus appears in Arbutus’ Annual Report on

Form 10-K, Arbutus’ Quarterly Reports on Form 10-Q and Arbutus’

continuous and periodic disclosure filings, which are available at

www.sedar.com and at www.sec.gov. All forward-looking statements

herein are qualified in their entirety by this cautionary

statement, and Arbutus disclaims any obligation to revise or update

any such forward-looking statements or to publicly announce the

result of any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

except as required by law.

Contact Information

Investors and MediaLisa M. CaperelliVice

President, Investor RelationsPhone: 215-206-1822Email:

lcaperelli@arbutusbio.com

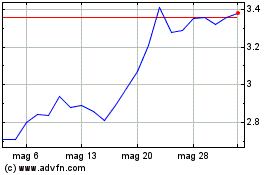

Grafico Azioni Arbutus Biopharma (NASDAQ:ABUS)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Arbutus Biopharma (NASDAQ:ABUS)

Storico

Da Gen 2024 a Gen 2025