UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM SD

_________________________

Specialized Disclosure Report

_________________________

Pitney Bowes Inc.

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | | | | | | | |

| Delaware | | 1-3579 | | 06-0495050 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

World Headquarters

3001 Summer Street

Stamford, Connecticut 06926-0700

(Address of principal executive offices) (Zip Code)

Sylvain Combet, Director, Sustainability and Environment, Health and Safety

(203) 892-1921

(Name and telephone number, including area code, of the person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

☒ Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023.

☐ Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended ____________.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

In accordance with Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”) and Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”), Pitney Bowes Inc. (the “Company”) has determined that it is subject to the reporting requirements under the Act and the Rule and that certain products that Pitney Bowes manufactured or contracted to manufacture during calendar year 2023 contain “conflict minerals” as defined in the Rule (in the form of gold and the derivatives tantalum, tin and tungsten) necessary to the functionality or production of those products. The Company has undertaken a reasonable inquiry into the country of origin of the conflict minerals in our products to assess whether any of those conflict minerals originated in the Democratic Republic of Congo or an “adjoining country” as defined in the Rule or were “conflict minerals from recycled or scrap sources” as defined in the Rule. Our inquiry and due diligence activities are described in the Conflict Minerals Report attached hereto as Exhibit 1.01.

Conflict Minerals Disclosure

A copy of Pitney Bowes Inc.’s Conflict Minerals Report filed for the calendar year ended December 31, 2023 is publicly available at http://www.pitneybowes.com/us/our-company/corporate-responsibility.

Item 1.02 Exhibit

Pitney Bowes Inc.’s Conflict Minerals Report for the calendar year ended December 31, 2023 is filed as Exhibit 1.01 hereto.

Section 2 - Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 - Exhibits

Item 3.01 Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Pitney Bowes Inc. (Registrant) |

| | |

| | /s/ Lauren Freeman-Bosworth |

| | Lauren Freeman-Bosworth |

| Dated: May 24, 2024 | | Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 1.01

Pitney Bowes Inc. Conflict Minerals Report

(as required by Item 1.01 and 1.02 of Form SD)

Pitney Bowes Inc. (“Pitney Bowes,” “we,” “us,” “our,” or the “Company”) submits this report pursuant to Rule 13p-1 and Form SD (the “Rule”) promulgated under the Securities Exchange Act of 1934 and adopted by the Securities and Exchange Commission pursuant to Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Act”). This report describes the inquiry the Company undertook to obtain information from internal and external sources to ascertain whether any Pitney Bowes product contains tantalum, tin, tungsten, or gold (“Conflict Minerals” or “3TG”) that originated in the Democratic Republic of the Congo or adjoining countries, as defined in the Act (collectively, the “Covered Countries”), and the due diligence Pitney Bowes conducted on the source and chain of custody of such minerals. This report covers parts and products manufactured or contracted to manufacture by the Company in the 2023 calendar year. Based on our inquiry, we have found that Conflict Minerals are necessary to the functionality or production of some of our products manufactured or contracted to manufacture in 2023 (“2023 products”).

1. Product Description

Based on our due diligence, we determined that Conflict Minerals were necessary to the functionality or production of various products from our hardware product offerings list, which includes a varied array of equipment that processes direct mail and/or enables transactional mail management and analytics that we manufactured or contracted to manufacture in 2023.

Some examples of these products include: postage meters, low-/medium-/high-volume mailing systems that can weigh, seal and apply postage to envelopes; inserters; folders; mail openers; tabbers; scales; printers; accessories; lockers; and peripherals.

2. Reasonable Country of Origin Inquiry

We conducted a reasonable country of origin inquiry (“RCOI”) to determine whether any of the necessary Conflict Minerals in the 2023 products originated in the Covered Countries or were from recycled or scrap sources. To make this determination, we focused on engaging our direct suppliers to identify the smelters and refiners of necessary Conflict Minerals that may have been contained in the 2023 products and that are recognized by the Responsible Mineral Initiative (“RMI”) to be processors of Conflict Minerals, and reviewing available information on the sourcing of Conflict Minerals by these smelters and refiners.

As a downstream company, we are several levels removed from mining minerals. We did not buy any minerals directly from mines, smelters, or refiners for use in the 2023 products. We requested data from our Surveyed Suppliers (as defined below) on the smelters or refiners of necessary Conflict Minerals that may have been contained in the 2023 products, which we used for this reporting period to identify the potential countries of origin of 3TG processed by those smelters or refiners. For a list of these potential countries of origin, please refer to Appendix A.

Many of the Surveyed Suppliers identified all of the smelters and refiners potentially associated with all of their product offerings and did not always limit the information provided to products supplied to Pitney Bowes. Thus, Pitney Bowes is unable to confirm whether necessary 3TG metals contained in the 2023 products in fact originated in any of the countries listed in Appendix A.

Our due diligence activities are further described in this report.

3. Pitney Bowes’ Due Diligence Framework

A. Overview

We designed our due diligence to conform, in all material respects, with the framework set out in the “Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas” and related Supplements on Tin, Tantalum and Tungsten and on Gold (“OECD Guidance”), published by the Organisation for Economic Cooperation and Development (the “OECD”). Since Pitney Bowes does not buy Conflict Minerals directly from mines, smelters or refiners, we must rely on our suppliers to provide us with information regarding the source of the Conflict Minerals contained in the products and parts those suppliers provide to us. Our direct suppliers are similarly reliant upon information provided by their suppliers. Accordingly, we have designed our due diligence to leverage the due diligence tools developed by RMI, including a supplier survey based on RMI’s Conflict Minerals Reporting Template, which is designed to help companies identify the smelters and refiners that process the Conflict Minerals in a company’s supply chain. We have incorporated the following five-step, risk-based approach to 3TG due diligence based on OECD Guidance into the design of our Conflict Minerals due diligence program:

| | | | | | | | |

| | |

| • | establish and maintain appropriate internal management systems to identify and manage the 3TG in our global supply chain; |

| | |

| • | identify and assess any risks associated with the use of 3TG in our supply chain by obtaining and evaluating 3TG sourcing information from suppliers; |

| | |

| • | design and implement a strategy to respond to 3TG risks in our supply chain; |

| | | |

| • | supporting independent auditing of smelter and refiner due diligence practices; and |

| | |

| • | report publicly on supply chain due diligence. |

In an effort to continue to identify and mitigate any risk that the use of 3TG in our products going forward may benefit armed groups in the Covered Countries, we have incorporated the relevant aspects of the OECD Guidance (as summarized in the sections that follow) into our risk management program for product stewardship requirements (including Conflict Minerals).

B. Development of an Internal, Strong Management System

i. High-level management oversight

In order to provide effective management support for, and high-level escalation of issues relating to, the Company’s overall supply chain due diligence efforts (inclusive of Conflict Minerals), we formed two cross-functional teams: the Environmental Product Compliance Team (the “Product Compliance Team”) and the Environmental Committee (the “Environmental Committee”).

The Product Compliance Team is comprised of representatives from Procurement, Supply Chain, Quality, Engineering, Environmental Health and Safety (“EHS”), and Global Product Line Management and other support groups. This team is responsible for assisting the Company in meeting the requirements of global product-compliance regulations.

The Environmental Committee is comprised of a group of cross-functional leaders from Procurement, Supply Chain, Quality, Engineering, EHS, Legal, and Global Product Line Management, and oversees the work of the Product Compliance Team. The Environmental Committee is tasked with providing guidance regarding environmental product compliance, authorizing the financial and human resources needed for product compliance, and enforcing corrective action measures within Company operations and within our supply chain. Members of the Environmental Committee report potential issues and company risks to the Company’s senior executives, as well as in connection with the Enterprise Risk Management review process.

ii. Pitney Bowes’ Conflict Minerals policy and procedures

Our established conflict minerals policy guides our communications with and expectations for suppliers regarding Conflict Minerals. It is the Company’s goal that we will not knowingly manufacture or contract to manufacture products that include Conflict Minerals that originate from the Covered Countries, unless they were processed by smelters and refiners that are certified as conformant with the Responsible Minerals Assurance Process (RMAP) or an equivalent cross-recognized standard or came from recycled or scrap sources. We communicate our expectation that our Surveyed Suppliers source products, parts and components from socially responsible sources and conduct reasonable due diligence on their supply chains in an effort to assure that Conflict Minerals are not knowingly sourced from the Covered Countries unless they were processed by smelters and refiners that are conformant with the RMAP or came from recycled or scrap sources.

We have adopted and periodically review certain procedures and maintain the following steps regarding our use of 3TG:

| | | | | | | | |

| | |

| • | Describe our Conflict Minerals and other product compliance requirements in our Supplier Code of Conduct; |

| | |

| • | Incorporate the requirement that suppliers must meet Section 1502(e)(4) of the Dodd Frank Act into our engineering standards and specifications; |

| | |

| • | Include supplier requirements with respect to products containing 3TG in our Quality Assurance audit templates; |

| | |

| • | Incorporate consideration of Conflict Mineral issues within the Pitney Bowes Product Review Process; |

| | |

| • | Periodically update and distribute to all suppliers our contractual language regarding certification that 3TG from Covered Countries is conflict free or came from recycled or scrap sources; |

| | |

| • | Annually publish Conflict Minerals information on our website and in our ESG Report; |

| | |

| • | Include Conflict Minerals in Enterprise Risk Management meetings to ensure regular review by our management; |

| | |

| • | Include review of Conflict Minerals supply chain data and related processes in the Company’s standardized environmental compliance reviews of key suppliers; |

| | |

| • | Complete training classes through our learning management system and via video-conference and in person classes in order to educated relevant employees, where necessary; |

| | |

| • | Educate suppliers and other partners regarding Conflict Minerals during business reviews, where necessary; |

| • | Require Surveyed Suppliers to complete surveys with the goal of identifying the smelters and refineries used to process Conflict Minerals in their supply chain; |

| | |

| • | Maintain internal policies, written procedures, tools and training to ensure effective implementation of our Conflict Minerals management program; |

| | | |

| • | Track and report supplier data in a product compliance information database; and |

| | |

| • | Manage a supplier escalation protocol to ensure consistent and thorough management of unresponsive suppliers when needed – this protocol documents our supplier engagement and how we interact with unresponsive suppliers or suppliers who provide incomplete, questionable, or indeterminable information. |

iii. Pitney Bowes’ system of controls and transparency over the 3TG supply chain

As part of the Company’s broader requirement that our suppliers provide us with accurate and complete information relating to the sources of all substances contained in any product, part or component they provide to us, we require that Surveyed Suppliers provide us with information on Conflict Minerals contained in such products, parts, or components.

Surveyed Suppliers who fail to respond to our request for data are subject to additional evaluation to determine whether further engagement or escalation is necessary.

iv. Pitney Bowes’ engagement with suppliers

The Company has multiple methods to encourage our suppliers to commit to our policies requiring responsible supplier operations. We have communicated our Conflict Minerals requirements to our suppliers and other product stewardship requirements, as applicable, to our global supply chain. In connection with our data collection efforts, we have explained to our suppliers our requirement that they conduct their operations as socially responsible suppliers. In addition, our supplier form contract language includes compliance with our Conflict Minerals efforts. Our supplier contracts have long contained provisions giving us the right to conduct audits of supplier sites and to request documentation to confirm the supplier’s compliance with our policies and contractual requirements. Our Surveyed Suppliers have received information regarding Conflict Minerals requirements and completion of our product compliance database.

v. Pitney Bowes’ Company-level grievance mechanism

For many years, Pitney Bowes has maintained an Ethics Help Line which is available toll-free, 24 hours a day, seven days a week. The Ethics Help Line is operated by an outside firm and enables employees, clients and others to make inquiries and report concerns about potential violations of Company policy or the law, in many languages, without fear of retaliation. Anyone can contact the Ethics Help Line to report any concerns about Conflict Minerals that may be contained in our products.

C. Identification and Assessment of Risk in Our 3TG Supply Chain

In order to determine if products manufactured or contracted to manufacture by Pitney Bowes contain 3TG sourced from Covered Countries, we sought out industry best practices, reviewed current guidance from various associations such as the OECD, and reviewed information published by external experts to assess how other multinational corporations approach Conflict Minerals compliance.

Working with outside consultants, we developed a Conflict Minerals survey based on the RMI’s Conflict Minerals Reporting Template and guidance from the RMI. To determine which suppliers need to complete the survey, we identify the suppliers involved in the supply chain of the products we manufacture or contracted to manufacture and then remove from consideration for the survey any suppliers of products that either do not contain tin, tantalum, tungsten or gold, or otherwise supplied equipment that is outside the scope of the Rule. We send the Conflict Minerals survey to the remaining suppliers (the “Surveyed Suppliers”). We ask the Surveyed Suppliers to respond with certain information, including their Conflict Minerals policies, usage of 3TG, the smelters and refiners of Conflict Minerals in their supply chains, and the country of origin of the 3TG they used.

The Surveyed Suppliers are asked to attest to the accuracy of their survey responses. The Product Compliance Team monitors supplier responses and contacts the Surveyed Suppliers who submit incomplete responses or who fail to respond. We request updated submittals from the Surveyed Suppliers that submit responses with a less than 75% response rate from their supply chain and suppliers that list smelters with inaccurate information.

We collect and track the survey responses in our product compliance database for consolidation, validation, and further analysis. We also generate periodic status reports to track and review our progress in data collection and evaluate which suppliers need additional help in completing the survey.

D. Strategy for Responding to Identified Risks in Our 3TG Supply Chain

When a Surveyed Supplier reports using a smelter in its supply chain listed as “non-conformant” in the most recent RMAP list, the Product Compliance Team reaches out to the supplier to first confirm the smelter’s status, then asks for the supplier’s plan to address this situation. Based on this initial discussion, the Product Compliance Team works with our Procurement and Legal departments to determine an appropriate engagement strategy. This engagement could include requesting that the supplier encourage any non-conformant smelter to participate in the RMAP, requiring the supplier to implement a risk management plan, or other actions. In the event that a supplier does not make efforts to comply with our requests, this process may ultimately result in disengagement of the supplier. Pitney Bowes recognizes that the intent of

the Rule is not to stop commercial ties with smelters and refiners sourcing Conflict Minerals from the DRC or adjoining countries, but to ensure that these minerals are being responsibly sourced and are not directly or indirectly financing or benefitting armed groups in those countries. Disengagement of suppliers is therefore a measure of last resort following efforts to engage with suppliers to ensure responsible sourcing.

E. Support for Independent Third-Party Audits of 3TG Supply Chain Due Diligence

Since we do not have direct relationships with smelters or refiners, we did not perform direct audits of these entities’ supply chains of Conflict Minerals. However, we supported the development and implementation of smelter and refinery sourcing audits conducted by independent third parties and industry groups, such as the RMI’s RMAP, through our conflict minerals policy and expectations regarding responsible sourcing of minerals from the Covered Countries.

F. Annual Reporting on 3TG Supply Chain Due Diligence

As explained above, we publish Conflict Minerals information on our website and in our ESG Report annually. We also report annually on our due diligence through our Conflict Minerals Report filed with the U.S. Securities and Exchange Commission.

4. Due Diligence Measures Undertaken for the 2023 Products

The Company continued its program of conducting supply chain due diligence and risk assessment on supplier sources of 3TGs as described in Section 1 (Pitney Bowes’ Due Diligence Framework) above. For this reporting period, we sent the survey to 39 suppliers. Information included in responses and updated submittals received from Surveyed Suppliers through April 2024 have been included in this report. We also reported the findings and information gathered through our inquiry and due diligence to Pitney Bowes senior management.

As described above, the Product Compliance Team monitored responses from the Surveyed Suppliers and contacted Surveyed Suppliers who submitted incomplete responses or who failed to respond so that we could understand what was preventing them from submitting a full and final attestation regarding their product line. The Product Compliance Team also reviewed the data from the product compliance database to determine which Surveyed Suppliers had data gaps, had raised questions or had not been responsive. Any Surveyed Suppliers that were considered non-responsive or higher risk were escalated to designated internal teams and management for further evaluation as they were identified.

Based on our due diligence for the 2023 products, our suppliers identified a total of 396 potential eligible smelters or refiners in their supply chains that are also identified as smelters or refiners of 3TG in RMI’s Smelter Reference List in the Conflict Minerals Reporting Template:

268 of these 396 smelters, or 67.7%, are listed as “Conformant” with the RMAP as of April 2024

8 of these 396 smelters, or 2.0%, are listed as “Active” with RMAP as of April 2024

120 of these 396 smelters, or 30.0%, are not listed as conformant or active with RMAP as of April 2024

Based on the information provided by the Surveyed Suppliers, Pitney Bowes believes that potential countries of origin for the 3TG contained in our products include the countries listed in Appendix A. As noted above, many of the Surveyed Suppliers identified all of the smelters and refiners potentially associated with all of their product offerings and did not always limit the information provided to products supplied to Pitney Bowes. Thus, Pitney Bowes is unable to confirm whether necessary 3TG metals contained in the 2023 products in fact originated in any of the countries listed in Appendix A.

5. Future Actions to Further Minimize Any Risk of Conflict Minerals Benefitting Armed Groups

The Company will continue to request information from our supply chain in order to meet the requirements of the Rule. Where there is reason to believe that a supplier is not adopting a Conflict Minerals policy or providing the necessary data to us, we will work with the supplier to address the issue. In the event of continued supplier deficiencies, we will consider appropriate measures including, if appropriate, termination of our relationship with a supplier.

6. Publication

We have made public our activities related to Conflict Minerals in our Environmental, Social, and Governance (“ESG”) Report and have posted this Conflict Minerals Report to our website at https://www.pitneybowes.com/us/our-company/esg/environmental-sustainability.html.1

1 References to our website and information available through this website are not incorporated by reference herein unless otherwise noted.

APPENDIX A

Countries of Origin

Based on the data reported by the Surveyed Suppliers as of April 2024, potential countries of origin for 3TG processed by smelters or refiners may include (but are not necessarily limited to):

| | |

| Albania |

| Andorra |

| Angola |

| Argentina |

| Armenia |

| Australia |

| Austria |

| Azerbaijan |

| Belarus |

| Belgium |

| Benin |

| Bermuda |

| Bolivia |

| Botswana |

| Brazil |

| Bulgaria |

| Burkina Faso |

| Burundi |

| Cambodia |

| Canada |

| Central African Republic |

| Chile |

| China |

| Colombia |

| Congo |

| Czech Republic |

| Democratic Republic of Congo |

| Djibouti |

| Dominican Republic |

| Ecuador |

| Egypt |

| El Salvador |

| Eritrea |

| Estonia |

| Ethiopia |

| Finland |

| Georgia |

| Ghana |

| Guinea |

| Guyana |

| | |

| Hong Kong |

| Hungary |

| India |

| Indonesia |

| Ireland |

| Israel |

| Italy |

| Ivory Coast |

| Japan |

| Kazakhstan |

| Korea |

| Kyrgyzstan |

| Laos |

| Liechtenstein |

| Lithuania |

| Luxembourg |

| Madagascar |

| Malaysia |

| Mexico |

| Mongolia |

| Morocco |

| Mozambique |

| Myanmar |

| Namibia |

| Netherlands |

| New Zealand |

| Niger |

| Nigeria |

| Norway |

| Panama |

| Papua New Guinea |

| Peru |

| Philippines |

| Poland |

| Portugal |

| Russian Federation |

| Rwanda |

| Saudi Arabia |

| Sierra Leone |

| Singapore |

| South Africa |

| Spain |

| Sudan |

| Suriname |

| Sweden |

| Switzerland |

| Taiwan |

| Tanzania |

| | |

| Thailand |

| Turkey |

| United Arab Emirates |

| Uzbekistan |

| Vietnam |

| Zambia |

| Zimbabwe |

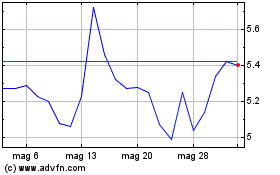

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Nov 2023 a Nov 2024