As filed with the Securities and Exchange Commission on December 18, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————————

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

———————————

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

———————————

| | | | | | | | | | | |

| Delaware | 74-1753147 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification Number) |

17 South Briar Hollow Lane, Suite 100

Houston, Texas 77027

(713) 881-3600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

———————————

Kevin J. Roycraft

Adams Resources & Energy, Inc.

17 South Briar Hollow Lane, Suite 100

Houston, Texas 77027

(713) 881-3600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

with copies to:

Eugene W. McDermott Jr.

Locke Lord LLP

One Financial Plaza, Suite 2800

Westminster Street

Providence, RI 02903

(401) 274-9200

———————————

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

———————————

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I. D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☑ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Pursuant to Rule 415(a)(6) under the Securities Act, the Registrant is registering on this registration statement an aggregate of $54,534,156 of unsold securities (the “Unsold Securities”) previously registered under the Registrant’s prior registration statement on Form S-3 (File No. 333-251643) filed on December 23, 2020 and declared effective on January 12, 2021 (the “Prior Registration Statement”). Filing fees of $5,949.68 were previously paid with respect to the Unsold Securities. Pursuant to Rule 415(a)(5) under the Securities Act, the Registrant intends to continue to offer and sell the Unsold Securities under the Prior Registration Statement until the earlier of (i) the date on which this registration statement is declared effective by the Securities and Exchange Commission, and (ii) July 11, 2024, which is 180 days after the third-year anniversary of the effective date of the Prior Registration Statement (the “Expiration Date”). Until the Expiration Date, the Registrant may continue to use the Prior Registration Statement and related prospectus supplements for its offerings thereunder. In particular, the Registrant may continue to offer and sell under the Prior Registration Statement its shares of common stock in its “at the market” offerings through B. Riley Securities, Inc. as sales agent, which offerings shall remain registered under the Prior Registration Statement using the prospectus dated January 12, 2021 until the Expiration Date. The Prior Registration Statement and all offers and sales thereunder will be deemed terminated on the Expiration Date, except to the extent covered by this registration statement.

Pursuant to Rule 415(a)(6), on or before the Expiration Date, the Registrant may file a pre-effective amendment to this registration statement to update the amount of unsold securities previously registered by the Prior Registration Statement being registered hereby, and continue to offer and sell such unsold securities under this registration statement, including without limitation by continuing to conduct the “at the market” offerings referenced above. If applicable, such pre-effective amendment shall identify such unsold securities to be included in this registration statement, and the amount of any new securities to be registered on this registration statement.

EXPLANATORY NOTE

This registration statement contains two prospectuses:

•a base prospectus, which covers the offering, issuance and sale by us of up to $60,000,000 of our common stock; and

•a sales agreement prospectus covering the offering, issuance and sale by us of up to a maximum aggregate offering price of $20,000,000 of our common stock that may be issued and sold under a sales agreement with B. Riley Securities, Inc.

The base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will be specified in a prospectus supplement to the base prospectus. The sales agreement prospectus immediately follows the base prospectus. The $20,000,000 of common stock that may be offered, issued and sold under the sales agreement prospectus is included in the $60,000,000 of common stock that may be offered, issued and sold by us under the base prospectus, and if no shares are sold under the sales agreement, the full $60,000,000 of common stock may be sold in other offerings pursuant to the base prospectus and a corresponding prospectus supplement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 18, 2023

PROSPECTUS

Adams Resources & Energy, Inc.

$60,000,000

Common Stock

From time to time, we may offer up to $60,000,000 aggregate dollar amount of shares of our common stock, in one or more offerings, in amounts, at prices and on the terms that we will determine at the time of the offering and which will be set forth in a prospectus supplement and any related free writing prospectus. The prospectus supplement and any related free writing prospectus may also add, update or change information contained in this prospectus. The total amount of these shares of common stock will have an initial aggregate offering price of up to $60,000,000.

You should read this prospectus, the information incorporated, or deemed to be incorporated, by reference in this prospectus, and any applicable prospectus supplement and related free writing prospectus carefully before you invest. This prospectus may not be used to consummate a sale of any securities unless accompanied by a prospectus supplement.

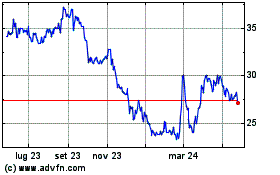

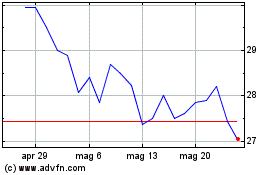

Our common stock is traded on NYSE American LLC under the symbol “AE.” On December 15, 2023, the last reported sales price for our common stock was $26.03 per share.

An investment in our common stock involves a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on page 2 of this prospectus before investing in our common stock.

Common stock may be sold by us to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution” in this prospectus and any applicable prospectus supplement. If any underwriters, dealers or agents are involved in the sale of any securities with respect to which this prospectus is being delivered, the names of such underwriters or agents, the nature of our arrangements with them including any applicable fees, discounts or commissions and details regarding over-allotment options, if any, and the net proceeds to us will be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is , 2024

TABLE OF CONTENTS

| | | | | |

| Page |

| ABOUT THIS PROSPECTUS | |

| SUMMARY | |

| RISK FACTORS | |

| FORWARD-LOOKING STATEMENTS | |

| USE OF PROCEEDS | |

| PLAN OF DISTRIBUTION | |

| DESCRIPTION OF COMMON STOCK | |

| LEGAL MATTERS | |

| EXPERTS | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION BY REFERENCE | |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under this shelf registration process, we may offer to sell the shares of common stock described in this prospectus, in one or more offerings, with a total value of up to $60,000,000. This prospectus provides you with a general description of our common stock.

Each time we offer securities under this prospectus, we will provide a prospectus supplement that will contain more specific information about the terms of that offering. We also may authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement; provided that, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus or any prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement. You should read both this prospectus and any prospectus supplement together with additional information described under the heading “Where You Can Find More Information.”

Neither we, nor any agent, underwriter or dealer have authorized anyone to give you any information or to make any representation other than the information and representations contained in or incorporated by reference into this prospectus or any applicable prospectus supplement. We and any agent, underwriter or dealer take no responsibility for, and can provide no assurance as to the reliability of, any other information others may give you. You may not imply from the delivery of this prospectus and any applicable prospectus supplement, nor from a sale made under this prospectus and any applicable prospectus supplement, that our affairs are unchanged since the date of this prospectus and any applicable prospectus supplement or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus and any applicable prospectus supplement or any sale of a security. This prospectus and any applicable prospectus supplement may only be used where it is legal to sell the securities.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed or will be filed as exhibits to the registration statement of which this prospectus is a part (or will be incorporated by reference from a current report on Form 8-K, quarterly report on Form 10-Q or annual report on Form 10-K that we file with the SEC), and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

THIS PROSPECTUS MAY NOT BE USED TO OFFER AND SELL SECURITIES UNLESS IT IS ACCOMPANIED BY AN ADDITIONAL PROSPECTUS OR A PROSPECTUS SUPPLEMENT. WE ARE NOT MAKING AN OFFER OF THESE SECURITIES, AND ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES, IN ANY JURISDICTION WHERE THE OFFER OR SALE THEREOF IS NOT PERMITTED.

In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our” or “Company” are intended to mean the business and operations of Adams Resources & Energy, Inc. and its consolidated subsidiaries.

SUMMARY

This summary highlights information contained in other parts of this prospectus or incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, and our other filings with the SEC listed below under the heading “Incorporation by Reference.” This summary may not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus and the information incorporated by reference in this prospectus carefully, including “Risk Factors” and the financial data and related notes and other information incorporated by reference, before making an investment decision. See “Forward-Looking Statements.”

Our Company

Adams Resources & Energy, Inc. is a publicly traded Delaware corporation organized in 1973, the common shares of which are listed on the NYSE American LLC (“NYSE American”) under the ticker symbol “AE”. Through our subsidiaries, we are primarily engaged in crude oil marketing, truck and pipeline transportation, terminalling and storage in various crude oil and natural gas basins in the lower 48 states of the United States (“U.S.”). We also conduct tank truck transportation of liquid chemicals, pressurized gases, asphalt and dry bulk primarily in the lower 48 states of the U.S. with deliveries into Canada and Mexico, and with nineteen terminals across the U.S. In addition, we recycle and repurpose off-specification fuels, lubricants, crude oil and other chemicals from producers in the U.S.

We operate and report in four business segments: (i) crude oil marketing, transportation and storage; (ii) tank truck transportation of liquid chemicals, pressurized gases, asphalt and dry bulk; (iii) pipeline transportation, terminalling and storage of crude oil; and (vi) beginning in the third quarter of 2022, interstate bulk transportation logistics of crude oil, condensate, fuels, oils and other petroleum products and recycling and repurposing of off-specification fuels, lubricants, crude oil and other chemicals, which includes the businesses we acquired in August 2022.

Our headquarters are located in 27,932 square feet of office space located at 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027, and the telephone number of that address is (713) 881-3600. Our website can be accessed at www.adamsresources.com. The information contained on, connected to or that can be accessed via our website is not a part of, and is not incorporated into, this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

We are a smaller reporting company as defined in the Exchange Act and we may take advantage of certain of the scaled disclosures available to smaller reporting companies for so long as our voting and non-voting common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and nonvoting common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties referenced below and described in the documents incorporated by reference in this prospectus and any prospectus supplement before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of many factors, including the risks described in the documents incorporated herein by reference, including (i) our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and our Quarterly Report on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, which are on file with the SEC and incorporated by reference into this prospectus, and (ii) other documents we file with the SEC that are deemed incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. When used in this document, words such as “anticipate,” “project,” “expect,” “plan,” “seek,” “goal,” “estimate,” “forecast,” “intend,” “could,” “should,” “would,” “will,” “believe,” “may,” “potential” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. All statements other than statements of historical facts included in this prospectus and the documents incorporated by reference herein regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Although we believe that our expectations reflected in such forward-looking statements are reasonable, we cannot give any assurances that such expectations will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions as described in more detail in this prospectus and the documents incorporated by reference herein under the caption “Risk Factors;” and risks and uncertainties described in documents incorporated by reference into this prospectus and the documents incorporated by reference herein. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, estimated, projected or expected. You should not put undue reliance on any forward-looking statements. We caution you not to place undue reliance on our forward-looking statements. The forward-looking statements in this prospectus speak only as of the date hereof. Except as required by federal and state securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or any other reason.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of any securities offered under this prospectus for general corporate purposes and/or as indicated in the applicable prospectus supplement. Such purposes may include working capital, capital expenditures, repayment and refinancing of debt, acquisitions, stock repurchases and the payment of dividends. We have not determined the amount of net proceeds to be used specifically for any such purposes. As a result, management will retain broad discretion over the allocation of the net proceeds. We expect to temporarily invest the net proceeds in short-term investments until they are used for their intended purpose.

PLAN OF DISTRIBUTION

We may sell the securities being offered by us in this prospectus:

•directly to purchasers;

•through agents;

•through dealers;

•through underwriters; or

•through a combination of any of these methods of sale.

We may directly solicit offers to purchase securities, or agents may be designated to solicit such offers. In the prospectus supplement relating to such offering, we will name any agent that could be viewed as an underwriter under the Securities Act and describe any commissions that we must pay to any such agent. Any such agent will be acting on a best efforts basis for the period of its appointment or, if indicated in the applicable prospectus supplement, on a firm commitment basis. This prospectus may be used in connection with any offering of our securities through any of these methods or other methods described in the applicable prospectus supplement.

The distribution of the securities may be effected from time to time in one or more transactions:

•at a fixed price or prices, which may be changed;

•at market prices prevailing at the time of sale;

•at prices related to the prevailing market prices; or

•at negotiated prices.

The prospectus supplement with respect to the securities of a particular series will describe the terms of the offering of the securities, including the following:

•the name of the agent or any underwriters;

•the public offering or purchase price;

•any discounts and commissions to be allowed or paid to the agent or underwriters;

•all other items constituting underwriting compensation; and

•any discounts and commissions to be allowed or paid to dealers.

If any underwriters or agents are used in the sale of the securities in respect of which this prospectus is delivered, we will enter into an underwriting agreement, sales agreement or other agreement with them at the time of sale to them, and we will set forth in the prospectus supplement relating to such offering the names of the underwriters or agents and the terms of the related agreement with them.

In connection with the offering of securities, we may grant to the underwriters an option to purchase additional securities with an additional underwriting commission, as may be set forth in the accompanying prospectus supplement. If we grant any such option, the terms of such option will be set forth in the prospectus supplement for such securities.

If a dealer is used in the sale of the securities in respect of which the prospectus is delivered, we will sell such securities to the dealer, as principal. The dealer, who may be deemed to be an “underwriter” as that term is defined in the Securities Act, may then resell such securities to the public at varying prices to be determined by such dealer at the time of resale.

Agents, underwriters, dealers and other persons may be entitled under agreements which they may enter into with us to indemnification by us against certain civil liabilities, including liabilities under the Securities Act, and may be customers of, engage in transactions with or perform services for us in the ordinary course of business.

If so indicated in the applicable prospectus supplement, we will authorize underwriters or other persons acting as our agents to solicit offers by certain institutions to purchase securities from us pursuant to delayed delivery contracts providing for payment and delivery on the date stated in the prospectus supplement. Each contract will be for an amount not less than, and the aggregate amount of securities sold pursuant to such contracts shall not be less nor more than, the respective amounts stated in the prospectus supplement. Institutions with whom the contracts, when authorized, may be made include commercial and savings banks, insurance companies, pension funds, investment companies, educational and charitable institutions and other institutions, but shall in all cases be subject to our approval. Delayed delivery contracts will not be subject to any conditions except that:

•the purchase by an institution of the securities covered under that contract shall not at the time of delivery be prohibited under the laws of the jurisdiction to which that institution is subject; and

•if the securities are also being sold to underwriters acting as principals for their own account, the underwriters shall have purchased such securities not sold for delayed delivery. The underwriters and other persons acting as our agents will not have any responsibility in respect of the validity or performance of delayed delivery contracts.

Offered securities may also be offered and sold, if so indicated in the prospectus supplement, in connection with a remarketing upon their purchase, in accordance with a redemption or repayment pursuant to their terms, or otherwise, by one or more remarketing firms, acting as principals for their own accounts or as agents for us. Any remarketing firm will be identified and the terms of its agreement, if any, with us and its compensation will be described in the applicable prospectus supplement. Remarketing firms may be deemed to be underwriters in connection with their remarketing of offered securities.

Certain agents, underwriters and dealers, and their associates and affiliates, may be customers of, have borrowing relationships with, engage in other transactions with, or perform services, including investment banking services, for us or one or more of our respective affiliates in the ordinary course of business.

In order to facilitate the offering of securities, any underwriters may engage in transactions that stabilize, maintain or otherwise affect the price of the securities or any other securities the prices of which may be used to determine payments on such securities. Specifically, any underwriters may overallot in connection with the offering, creating a short position for their own accounts. In addition, to cover overallotments or to stabilize the price of the securities or of any such other securities, the underwriters may bid for, and purchase, the securities or any such other securities in the open market. Finally, in any offering of the securities through a syndicate of underwriters, the underwriting syndicate may reclaim selling concessions allowed to an underwriter or a dealer for distributing the securities in the offering if the syndicate repurchases previously distributed securities in transactions to cover syndicate short positions, in stabilization transactions or otherwise. Any of these activities may stabilize or maintain the market price of the securities above independent market levels. Any such underwriters are not required to engage in these activities and may end any of these activities at any time.

We may engage in at the market offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. In addition, we may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

Under Rule 15c6-1 of the Exchange Act, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise or the securities are sold by us to an underwriter in a firm commitment underwritten offering. The applicable prospectus supplement may provide that the original issue date for your securities may be more than two scheduled business days after the trade date for your securities. Accordingly, in such a case, if you wish to trade securities on any date prior to the second business day before the original issue date for your securities, you will be required, by virtue of the fact that your securities initially are expected to settle in more than two scheduled business days after the trade date for your securities, to make alternative settlement arrangements to prevent a failed settlement. Beginning May 28, 2024, recently adopted

rules of the SEC will require a one business day settlement cycle for most transactions.

The specific terms of any lock-up provisions in respect of any given offering will be described in the applicable prospectus supplement.

Any shares of common stock sold pursuant to a prospectus supplement would be listed on the NYSE American, subject to official notice of issuance. The anticipated date of delivery of offered securities will be set forth in the applicable prospectus supplement relating to each offer.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business for which they receive compensation.

In no event will the commission or discount received by any Financial Industry Regulatory Authority (“FINRA”) member or independent broker-dealer participating in a distribution of securities exceed eight percent of the aggregate principal amount of the offering of securities in which that FINRA member or independent broker-dealer participates.

DESCRIPTION OF COMMON STOCK

The following description of the Company’s common stock does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the applicable provisions of Delaware General Corporation Law, the Company’s certificate of incorporation, as amended, and bylaws.

The Company’s authorized common stock consists of 7,500,000 shares of common stock, par value $0.10 per share, and 960,000 shares of preferred stock, par value $1.00 per share. As of November 1, 2023, 2,546,441 shares of common stock were issued and outstanding and an aggregate of approximately 89,181 shares were reserved for issuance under outstanding restricted stock units and performance share units. No shares of preferred stock were outstanding.

Voting Rights

The holders of the Company’s common stock are entitled to one vote per share on all matters to be voted on by stockholders generally, including the election of directors. There are no cumulative voting rights, meaning that the holders of a majority of the shares voting for the election of directors can elect all of the candidates standing for election. The holders of a majority of the stock issued and outstanding and entitled to vote shall constitute a quorum at all meetings of the stockholders for the transaction of business except as otherwise provided by statute.

Dividends

Holders of the Company’s common stock will be entitled to receive such dividends as may from time to time be declared by the Company’s board of directors out of funds legally available for the payment of dividends. Dividends may be paid in cash, in property, or in shares of capital stock, subject to the provisions of the certificate of incorporation, as amended. If the Company issues preferred stock in the future, payment of dividends to holders of common stock may be subject to the rights of holders of preferred stock with respect to payment of preferential dividends, if any.

Liquidation Rights

If the Company is liquidated, dissolved or wound up, the holders of the Company’s common stock will share pro rata in the Company’s assets after satisfaction of all of its liabilities and the prior rights of any outstanding class of preferred stock.

Miscellaneous

The outstanding shares of common stock are fully paid and nonassessable. The common stock has no preemptive or conversion rights and there are no redemption or sinking fund provisions applicable thereto.

Anti-Takeover Provisions

Delaware Anti-Takeover Law

We are subject to Section 203 of the Delaware General Corporation Law, an anti-takeover law. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years following the date the person became an interested stockholder, unless the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Generally, a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally, an “interested stockholder” is a person who, together with affiliates and associates, owns or within three years before the determination of interested stockholder status, did own, 15% or more of the corporation's voting stock. The existence of this provision may have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including

discouraging attempts that might result in a premium over the market price for the outstanding shares of our common stock.

Undesignated Preferred Stock

We could issue preferred stock that could have other rights, including economic rights senior to our common stock, so that the issuance of the preferred stock could adversely affect the market value of our common stock. The issuance of the preferred stock may also have the effect of delaying, deferring or preventing a change in control of the Company without any action by the stockholders. The effects of issuing preferred stock could include one or more of the following:

•restricting dividends on the common stock;

•diluting the voting power of the common stock;

•impairing the liquidation rights of the common stock; or

•discouraging, delaying or preventing changes in control or management of the Company.

Trading Symbol

The Company’s common stock is listed on the New York Stock Exchange under the symbol “AE.”

Transfer Agent and Registrar

The transfer agent and registrar for the Company’s common stock is Broadridge Corporate Issuer Solutions, Inc.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon by Locke Lord LLP, Providence, Rhode Island, our counsel. Additional legal matters may be passed upon for us or any underwriters or agents by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Adams Resources & Energy, Inc. as of December 31, 2022 and 2021, and for each of the years in the three-year period ended December 31, 2022, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2022 have been incorporated by reference herein in reliance upon the reports of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report on the effectiveness of internal control over financial reporting as of December 31, 2022, contains an explanatory paragraph that states that management excluded from its assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022, Firebird and Phoenix’s internal control over financial reporting associated with total assets of $48.4 million, or 12.6% of total assets, and total revenues of $22.3 million, or 0.7% of total revenue, included in the consolidated financial statements of Adams Resources & Energy, Inc. as of and for the year ended December 31, 2022. The audit of internal control over financial reporting of the Adams Resources & Energy, Inc. also excluded an evaluation of the internal control over financial reporting of Firebird and Phoenix.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the information contained in this prospectus, in the registration statement or in documents incorporated by reference in this prospectus. We have not authorized anyone else to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

Copies of certain information filed by us with the SEC are also available on our website at www.adamsresources.com. Information contained in or accessible through our website does not constitute a part of this prospectus and is not incorporated by reference in this prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede the information already incorporated by reference. We are incorporating by reference the documents listed below, which we have already filed with the SEC, and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than Current Reports on Form 8-K furnished under Item 2.02 or Item 7.01 and exhibits filed on such form that are related to such items), including all filings made after the date of the filing of this registration statement and prior to the effectiveness of this registration statement, except as to any portion of any future report or document that is not deemed filed under such provisions, after the date of this prospectus and prior to the termination of this offering:

•our Annual Report on Form 10-K (“Annual Report”) for the fiscal year ended December 31, 2022, filed with the SEC on March 16, 2023, including the information specifically incorporated by reference in the Annual Report on Form 10-K from our definitive proxy statement for the 2023 Annual Meeting of Stockholders, filed with the SEC on April 3, 2023;

•our Quarterly Reports on Form 10-Q for the period ended March 31, 2023, filed with the SEC on May 9, 2023, for the period ended June 30, 2023, filed with the SEC on August 9, 2023, and for the period ended September 30, 2023, filed with the SEC on November 8, 2023;

•our Current Reports on Form 8-K filed with the SEC on May 9, 2023 and August 2, 2023;

•the description of the common stock contained in our Certificate of Incorporation filed as Exhibit 3.1 to our Annual Report, and any further amendment or report filed hereafter for the purpose of updating such description, including Exhibit 4.3 to our Annual Report.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits that are specifically incorporated by reference into such documents. You may request a copy of these filings, and any exhibits we have specifically incorporated by reference as an exhibit in this prospectus, at no cost, by writing or telephoning us at:

Adams Resources & Energy, Inc.

Attn: Investor Relations

17 South Briar Hollow Lane, Suite 100

Houston, Texas 77027

(713) 881-3600

Any statement contained in this prospectus or contained in a document incorporated or deemed to be incorporated by reference herein or therein will be deemed to be modified or superseded to the extent that a statement contained in this prospectus or any subsequently filed supplement to this prospectus, or document deemed to be incorporated by reference into this prospectus, modifies or supersedes such statement. You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with different information. You should not assume that the information in this prospectus or in the documents incorporated by reference is accurate as of any date other than the date on the front of this prospectus or those documents.

Common Stock

———————————

PROSPECTUS

———————————

, 2024

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 18, 2023

PROSPECTUS

Adams Resources & Energy, Inc.

Up to $20,000,000

Common Stock

We entered into an At Market Issuance Sales Agreement (the “sales agreement”) with B. Riley Securities, Inc.. (“B. Riley Securities” or our “sales agent”), as our sales agent, relating to the shares of common stock of Adams Resources & Energy, Inc., par value $0.10 per share, on December 23, 2020. In accordance with the terms of the sales agreement, we may offer and sell shares of common stock having an aggregate offering price of up to $20,000,000 from time to time through or to our sales agent under this prospectus, as sales agent or as principal.

Sales of common stock under this prospectus, if any, may be made by any method deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act. Our common stock is traded on NYSE American LLC under the symbol “AE.” On December 15, 2023, the last reported sales price for our common stock was $26.03 per share.

The compensation of our sales agent for sales of common stock shall be a commission rate equal to 4.5% of the gross sales price per share of common stock. The net proceeds from any sales under this prospectus will be used as described under “Use of Proceeds” in this prospectus. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

In connection with the sale of the common stock on our behalf, B. Riley Securities will be deemed to be an “underwriter” within the meaning of the Securities Act, and their compensation will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to B. Riley Securities with respect to certain civil liabilities, including liabilities under the Securities Act.

The sales agent is not required to sell any specific number or dollar amount of common stock but will use its commercially reasonable efforts, as our agent and subject to the terms of the sales agreement, to sell the common stock offered, as instructed by us. The offering of common stock pursuant to the sales agreement will terminate upon the earlier of (i) the sale of all common stock subject to the sales agreement or (ii) the termination of the sales agreement by us or by the sales agent pursuant to the terms of the sales agreement.

An investment in our common stock involves a high degree of risk. You should carefully consider the information under the heading “Risk Factors” beginning on page 3 of this prospectus before investing in our common stock. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

B. Riley Securities

The date of this prospectus is , 2024

TABLE OF CONTENTS

Prospectus

| | | | | |

| Page |

| ABOUT THIS PROSPECTUS | |

| PROSPECTUS SUMMARY | |

| THE OFFERING | |

| RISK FACTORS | |

| FORWARD-LOOKING STATEMENTS | |

| USE OF PROCEEDS | |

| PLAN OF DISTRIBUTION | |

| DESCRIPTION OF COMMON STOCK | |

| LEGAL MATTERS | |

| EXPERTS | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION BY REFERENCE | |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (“SEC”) utilizing a “shelf” registration process. By using a shelf registration statement, we may offer our common stock having an aggregate offering price of up to $20,000,000 from time to time under this prospectus at prices and on terms to be determined by market conditions at the time of offering.

If information in this prospectus is inconsistent with the base prospectus included in the registration statement of which this prospectus is also a part, you should rely on this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference in this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in this prospectus, or incorporated by reference herein or therein. Neither we nor the sales agent have authorized anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You should not rely on any unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus is accurate only as of the date of this prospectus and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the date of delivery of this prospectus, or any sale of a security. It is important for you to read and consider all information contained or incorporated by reference in this prospectus in making your investment decision. You should read this prospectus, as well as the documents incorporated by reference herein, the additional information described under the section titled “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus and any free writing prospectus that we may, if eligible, from time to time authorize for use in connection with this offering, before investing in our common stock.

In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our” or “Company” are intended to mean the business and operations of Adams Resources & Energy, Inc. and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights information contained in other parts of this prospectus or incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, and our other filings with the SEC listed below under the heading “Incorporation by Reference.” This summary may not contain all the information that you should consider before investing in our common stock. You should read the entire prospectus and the information incorporated by reference in this prospectus carefully, including “Risk Factors” and the financial data and related notes and other information incorporated by reference, before making an investment decision. See “Forward-Looking Statements.”

Our Company

Adams Resources & Energy, Inc. is a publicly traded Delaware corporation organized in 1973, the common shares of which are listed on the NYSE American LLC (“NYSE American”) under the ticker symbol “AE”. Through our subsidiaries, we are primarily engaged in crude oil marketing, truck and pipeline transportation, terminalling and storage in various crude oil and natural gas basins in the lower 48 states of the United States (“U.S.”). We also conduct tank truck transportation of liquid chemicals, pressurized gases, asphalt and dry bulk primarily in the lower 48 states of the U.S. with deliveries into Canada and Mexico, and with nineteen terminals across the U.S. In addition, we recycle and repurpose off-specification fuels, lubricants, crude oil and other chemicals from producers in the U.S.

We operate and report in four business segments: (i) crude oil marketing, transportation and storage; (ii) tank truck transportation of liquid chemicals, pressurized gases, asphalt and dry bulk; (iii) pipeline transportation, terminalling and storage of crude oil; and (vi) beginning in the third quarter of 2022, interstate bulk transportation logistics of crude oil, condensate, fuels, oils and other petroleum products and recycling and repurposing of off-specification fuels, lubricants, crude oil and other chemicals, which includes the businesses we acquired in August 2022.

Our headquarters are located in 27,932 square feet of office space located at 17 South Briar Hollow Lane, Suite 100, Houston, Texas 77027, and the telephone number of that address is (713) 881-3600. Our website can be accessed at www.adamsresources.com. The information contained on, connected to or that can be accessed via our website is not a part of, and is not incorporated into, this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

We are a smaller reporting company as defined in the Exchange Act and we may take advantage of certain of the scaled disclosures available to smaller reporting companies for so long as our voting and non-voting common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and nonvoting common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

THE OFFERING

| | | | | |

| Common stock offered by us | Shares of our common stock, par value $0.10 per share, having an aggregate offering price of up to $20,000,000. |

| |

| Common stock to be outstanding immediately after this offering | Up to 3,314,785 shares of common stock after the completion of this offering (as more fully described in the notes following this table), assuming that we sell the maximum dollar value of shares available to be sold in the offering at a price of $26.03 per share, which was the closing price of our common stock on NYSE American on December 15, 2023. The actual number of shares outstanding after this offering will vary depending on the number of shares sold and issued and the sale prices of such shares. |

| |

| Plan of Distribution | “At the market offering” that may be made from time to time through or to our sales agent, B. Riley Securities, as sales agent or principal. See “Plan of Distribution” in this prospectus. |

| |

| Use of Proceeds | We intend to use the net proceeds from this offering for general corporate purposes, which may include working capital, capital expenditures, repayment and refinancing of debt, acquisitions, stock repurchases and the payment of dividends. See “Use of Proceeds” in this prospectus. |

| |

| Risk Factors | Investing in our common stock involves a high degree of risk, and the purchasers of our common stock may lose all or part of their investment. Before deciding to invest in our securities, please carefully read the section entitled “Risk Factors,” and the accompanying prospectus. |

| |

| NYSE American trading symbol | “AE” |

The number of shares of our common stock shown above to be outstanding after this offering is based on 2,546,441 shares of our common stock issued and outstanding as of November 1, 2023, and excludes:

•89,181 shares of common stock issuable upon the settlement of restricted stock units and performance share units as of November 1, 2023; and

•125,570 shares of common stock reserved and available for future issuance as of November 1, 2023, under our long-term incentive plan.

RISK FACTORS

Investment in the common stock offered pursuant to this prospectus involves risks. You should carefully consider the risk factors described below and in our Annual Report on Form 10-K for the year ended December 31, 2022 and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, incorporated by reference in this prospectus, any amendment or update thereto reflected in subsequent filings with the SEC, including in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and all other information contained or incorporated by reference in this prospectus, including any subsequent supplement thereto, as updated by our subsequent filings under the Exchange Act. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Additional Risks Related to this Offering

Our management will have broad discretion as to the use of proceeds from this offering and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering, if any, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will be relying on the judgment of our management concerning these uses and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately. The failure of our management to apply these funds effectively could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

There may be future dilution of our common stock as a result of future sales of our common stock, which could adversely impact our stock price.

The issuance of shares of our common stock from time to time, pursuant to the sales agreement, in connection with the vesting of restricted stock units and performance share units, or otherwise, may have a dilutive effect on our earnings per share, which could adversely impact the market price of our common stock. The actual amount of dilution and the effect on the market price of our common stock, if any, will be based on numerous factors, particularly the actual number of shares issued pursuant to the sales agreement, the use of proceeds and the return generated by the investments acquired with the net proceeds, and cannot be determined at this time. In addition, the issuance and sale of substantial amounts of our common stock, or the perception that such issuances and sales may occur, could adversely affect the market price of our common stock and impair our ability to raise capital through the sale of additional equity securities.

The shares of our common stock offered under this prospectus may be sold in “at the market” offerings, and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares under this prospectus at different times will likely pay different prices, and so may experience different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold, and to determine the minimum sales price for shares sold. Investors may experience declines in the value of their shares as a result of share sales made in connection with “at the market” offerings at prices lower than the prices they paid.

The actual number of shares we will issue under the sales agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the sales agreement and compliance with applicable law, we and our sales agent may mutually agree to sell shares of our common stock under a placement notice at any time throughout the term of the sales agreement. The number of shares that are sold by our sales agent in connection with any placement notice will fluctuate based on the market price of the shares of our common stock during the sales period and limits we set with our sales agent. Because the price per share of each share sold will fluctuate based on the market price of our shares of common stock during the sales period, it is not possible to predict the number of shares that will ultimately be issued.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are intended to be covered by the “safe harbor” created by those sections. When used in this document, words such as “anticipate,” “project,” “expect,” “plan,” “seek,” “goal,” “estimate,” “forecast,” “intend,” “could,” “should,” “would,” “will,” “believe,” “may,” “potential” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. All statements other than statements of historical facts included in this prospectus and the documents incorporated by reference herein regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Although we believe that our expectations reflected in such forward-looking statements are reasonable, we cannot give any assurances that such expectations will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions as described in more detail in this prospectus and the documents incorporated by reference herein under the caption “Risk Factors;” and risks and uncertainties described in documents incorporated by reference into this prospectus and the documents incorporated by reference herein. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, estimated, projected or expected. You should not put undue reliance on any forward-looking statements. We caution you not to place undue reliance on our forward-looking statements. The forward-looking statements in this prospectus speak only as of the date hereof. Except as required by federal and state securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or any other reason.

USE OF PROCEEDS

We may issue and sell shares of our common stock having aggregate sale proceeds of up to $20,000,000 from time to time.

There can be no assurance that we will be able to sell any additional shares under or fully utilize the sales agreement with B. Riley Securities, Inc. as a source of financing. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We currently intend to use the net proceeds from this offering, after deducting the sales agent’s commissions and our offering expenses, for general corporate purposes. Such purposes may include working capital, capital expenditures, repayment and refinancing of debt, acquisitions, stock repurchases and the payment of dividends. The amounts and timing of our use of proceeds will vary depending on many factors, including regulatory developments, the amount of cash generated or used by our operations, and the rate of growth, if any, of our business and other capital requirements. As a result, we will retain broad discretion in the allocation of the net proceeds, if any, we receive in connection with securities offered pursuant to this prospectus and investors will be relying on the judgment of our management regarding the application of the proceeds.

Until we use the net proceeds of this offering, we intend to invest the funds in short-term, investment-grade, interest-bearing securities.

PLAN OF DISTRIBUTION

We have entered into an At Market Issuance Sales Agreement (the “sales agreement”) with B. Riley Securities, Inc. (“B. Riley Securities”), as our sales agent, relating to the shares of common stock of Adams Resources & Energy, Inc., par value $0.10. In accordance with the terms of the sales agreement and under this prospectus, we may offer and sell shares of common stock having an aggregate offering price of up to $20,000,000 from time to time through or to B. Riley Securities, as sales agent or principal. B. Riley Securities may sell the common stock by any method that is deemed to be an “at the market offering” as defined in Rule 415 promulgated under the Securities Act.

Each time we wish to issue and sell common stock under the sales agreement, we will notify B. Riley Securities of the number or dollar value of shares to be issued, the dates on which such sales are anticipated to be made, and any minimum price below which sales may not be made. Once we have so instructed B. Riley Securities, unless B. Riley Securities declines to accept the terms of such notice, they have agreed to use their commercially reasonable efforts consistent with their normal trading and sales practices to sell such shares up to the amount specified on such terms. The obligations of B. Riley Securities under the sales agreement to sell our common stock are subject to a number of customary conditions that we must meet.

Settlement for shares of our common stock will occur on the second trading day following the date on which the sale was made. Sales of our common stock as contemplated in this prospectus will be settled through the facilities of The Depository Trust Company or by such other means as we and B. Riley Securities may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will pay B. Riley Securities a commission of 4.5% of the gross proceeds from each sale. We also agreed to reimburse B. Riley Securities for their legal expenses up to (i) $50,000 in connection with the original filing of the sales agreement, and (ii) $2,500 per calendar quarter thereafter in connection with updates at the time of each representation date. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. In connection with the sale of the common stock on our behalf, B. Riley Securities will be deemed to be an “underwriter” within the meaning of the Securities Act as amended, and their compensation will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution to B. Riley Securities with respect to certain civil liabilities, including liabilities under the Securities Act. We estimate that the total expenses for the offering, excluding compensation payable to B. Riley Securities and expense reimbursement under the terms of the sales agreement, will be up to approximately $50,000.

We offered and sold 158,827 shares of common stock for aggregate proceeds of $5,465,844 under the sales

agreement through our prior shelf registration statement on Form S-3 (No. 333-251643), which the registration

statement of which this prospectus is a part replaces. These amounts are in addition to the amounts covered by this

prospectus.

The offering of our common stock pursuant to the sales agreement will terminate upon the termination of the sales agreement as described therein. We and B. Riley Securities may each terminate the sales agreement at any time upon five days’ prior notice.

This summary of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions. A copy of the sales agreement is filed with the SEC and is incorporated by reference into the registration statement of which this prospectus is a part. See “Where You Can Find More Information” below.

To the extent required by Regulation M under the Exchange Act, B. Riley Securities will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus.

B. Riley Securities and its affiliates may in the future provide various investment banking and/or other financial services for us and/or our affiliates, for which services they may in the future receive customary fees.

In addition, the sales agreement provides that we will not (i) take any action designed to cause or result in, or that constitutes or would reasonably be expected to constitute, the stabilization or manipulation of the price of any of our securities to facilitate the sale or resale of common stock, or (ii) sell, bid for, or purchase common stock in violation of Regulation M, or pay anyone any compensation for soliciting purchases of the common stock under the sales agreement other than B. Riley Securities.

DESCRIPTION OF COMMON STOCK

The following description of the Company’s common stock does not purport to be complete and is subject to, and is qualified in its entirety by reference to, the applicable provisions of Delaware General Corporation Law, the Company’s certificate of incorporation, as amended, and bylaws.

The Company’s authorized common stock consists of 7,500,000 shares of common stock, par value $0.10 per share, and 960,000 shares of preferred stock, par value $1.00 per share. As of November 1, 2023, 2,546,441 shares of common stock were issued and outstanding and an aggregate of approximately 89,181 shares were reserved for issuance under outstanding restricted stock units and performance share units. No shares of preferred stock were outstanding.

Voting Rights

The holders of the Company’s common stock are entitled to one vote per share on all matters to be voted on by stockholders generally, including the election of directors. There are no cumulative voting rights, meaning that the holders of a majority of the shares voting for the election of directors can elect all of the candidates standing for election. The holders of a majority of the stock issued and outstanding and entitled to vote shall constitute a quorum at all meetings of the stockholders for the transaction of business except as otherwise provided by statute.

Dividends

Holders of the Company’s common stock will be entitled to receive such dividends as may from time to time be declared by the Company’s board of directors out of funds legally available for the payment of dividends. Dividends may be paid in cash, in property, or in shares of capital stock, subject to the provisions of the certificate of incorporation, as amended. If the Company issues preferred stock in the future, payment of dividends to holders of common stock may be subject to the rights of holders of preferred stock with respect to payment of preferential dividends, if any.

Liquidation Rights

If the Company is liquidated, dissolved or wound up, the holders of the Company’s common stock will share pro rata in the Company’s assets after satisfaction of all of its liabilities and the prior rights of any outstanding class of preferred stock.

Miscellaneous

The outstanding shares of common stock are fully paid and nonassessable. The common stock has no preemptive or conversion rights and there are no redemption or sinking fund provisions applicable thereto.

Anti-Takeover Provisions

Delaware Anti-Takeover Law

We are subject to Section 203 of the Delaware General Corporation Law, an anti-takeover law. In general, Section 203 prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years following the date the person became an interested stockholder, unless the business combination or the transaction in which the person became an interested stockholder is approved in a prescribed manner. Generally, a “business combination” includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally, an “interested stockholder” is a person who, together with affiliates and associates, owns or within three years before the determination of interested stockholder status, did own, 15% or more of the corporation’s voting stock. The existence of this provision may have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including

discouraging attempts that might result in a premium over the market price for the outstanding shares of our common stock.

Undesignated Preferred Stock

We could issue preferred stock that could have other rights, including economic rights senior to our common stock, so that the issuance of the preferred stock could adversely affect the market value of our common stock. The issuance of the preferred stock may also have the effect of delaying, deferring or preventing a change in control of the Company without any action by the stockholders. The effects of issuing preferred stock could include one or more of the following:

• restricting dividends on the common stock;

•diluting the voting power of the common stock;

•impairing the liquidation rights of the common stock; or

•discouraging, delaying or preventing changes in control or management of the Company.

Trading Symbol

The Company’s common stock is listed on the New York Stock Exchange under the symbol “AE.”

Transfer Agent and Registrar

The transfer agent and registrar for the Company’s common stock is Broadridge Corporate Issuer Solutions, Inc.

LEGAL MATTERS

The validity of the securities offered hereby will be passed upon by Locke Lord LLP, Providence, Rhode Island, our counsel. Duane Morris LLP, New York, New York, is acting as counsel to the sales agent in connection with this offering.

EXPERTS

The consolidated financial statements of Adams Resources & Energy, Inc. as of December 31, 2022 and 2021, and for each of the years in the three-year period ended December 31, 2022, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2022 have been incorporated by reference herein in reliance upon the reports of KPMG LLP, an independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report on the effectiveness of internal control over financial reporting as of December 31, 2022, contains an explanatory paragraph that states that management excluded from its assessment of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022, Firebird and Phoenix’s internal control over financial reporting associated with total assets of $48.4 million, or 12.6% of total assets, and total revenues of $22.3 million, or 0.7% of total revenue, included in the consolidated financial statements of Adams Resources & Energy, Inc. as of and for the year ended December 31, 2022. The audit of internal control over financial reporting of the Adams Resources & Energy, Inc. also excluded an evaluation of the internal control over financial reporting of Firebird and Phoenix.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of a registration statement we filed with the SEC. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities we are offering under this prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the information contained in this prospectus, in the registration statement or in documents incorporated by reference in this prospectus. We have not authorized anyone else to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus is accurate as of any date other than the date on the front page of this prospectus, regardless of the time of delivery of this prospectus or any sale of the securities offered by this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov.

Copies of certain information filed by us with the SEC are also available on our website at www.adamsresources.com. Information contained in or accessible through our website does not constitute a part of this prospectus and is not incorporated by reference in this prospectus.

INCORPORATION BY REFERENCE