UPDATE: BlueScope To Write Down A$900 Million; Warns On Economy, Costs

12 Agosto 2011 - 3:00AM

Dow Jones News

Full-year net profits at Australia's largest steelmaker

BlueScope Steel Ltd. (BSL.AU) will be hit by a roughly A$900

million writedown in the value of some of its assets as a result of

the economic challenges facing the country, the company said

Friday.

It was already expected to report a small net loss, and

BlueScope said it had "performed in line with this guidance" in the

year to June 30. Its shares fell 4.1% to A$0.94 early in Australian

trading.

The news is a further sign of the stresses that Australia's

two-speed economy is causing. A wave of resources investment set to

hit the economy in the next two years, plus the country's image as

a safe-haven in contrast to other struggling developed countries,

has pushed up the Australian dollar and interest rates to

4.75%.

That has put pressure on other sectors of the economy, and

BlueScope has reported moribund domestic demand for its products

and difficult trading overseas, where the strong Australian dollar

makes its product prices uncompetitive.

Australia's unemployment rate unexpectedly rose to 5.1% in July

from 4.9% the previous month, the Australian Bureau of Statistics

said Thursday, while the Reserve Bank of Australia cut its forecast

for 2011 economic growth to 3.25% from 4.25% last week.

BlueScope said the carrying values of its Australian coated and

industrial products division and its distribution business would be

written down due to the strong Australian dollar, high raw

materials costs and low product prices.

"Directors have decided to inform the market, given a material

impairment is likely," the company said. It added that the

writedowns were "accommodated within the company's financial

covenants with its lenders."

The company also said it was "reviewing options to align

BlueScope's domestic steelmaking capacity to Australian domestic

market demand." Analysts in recent days have predicted that the

company could close one of its two blast furnaces to save

costs.

Each ton of steel requires around 1.5 tons of iron ore and 0.6

ton of coking coal. The prices of both materials have risen

strongly in recent years on the back of strong demand from Asian

steelmakers.

At half-year results in February, Chief Executive Paul O'Malley

said that the cost of raw materials, which BlueScope largely buys

from its former parent company BHP Billiton Ltd. (BHP), had risen

to A$2.5 billion from A$400 million when it was spun out of BHP in

2002.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

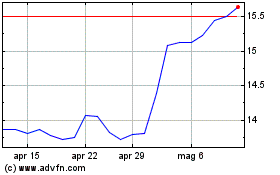

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Ott 2024 a Nov 2024

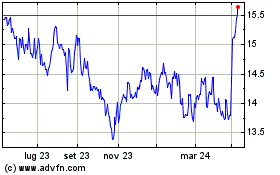

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Nov 2023 a Nov 2024