FTX New CEO John Ray Reveals More Scandals In Court Filing

17 Novembre 2022 - 4:25PM

NEWSBTC

The new CEO of collapsed crypto exchange FTX, John Ray III, has

filed an initial statement with the U.S. Bankruptcy Court for the

District of Delaware, making a scathing judgment of Sam

Bankman-Fried and his companies. Ray was appointed CEO of FTX less

than a week ago when founder Bankman-Fried filed for bankruptcy

protection for FTX, Alameda and more than 130 related companies and

stepped down as CEO. The new CEO has taken the lead role in several

of the largest corporate collapses in history, exposing criminal

activity and malfeasance such as in the Enron case. So the man has

experience with scandal and mismanagement. Yet, in his first court

filing, he states: Never in my career have I seen such a complete

failure of corporate controls and such a complete absence of

trustworthy financial information as occurred here. “From

compromised systems integrity and faulty regulatory oversight

abroad, to the concentration of control in the hands of a very

small group of inexperienced, unsophisticated and potentially

compromised individuals, this situation is unprecedented,” Ray

said. Related Reading: Paolo Ardoino Talks FTX, Adoption And

Self-Custody With NewsBTC The new CEO also made it known that the

Antigua and Bahamas-based FTX Group companies, in particular, did

not have adequate corporate governance and many had never held a

board meeting. FTX, FTX US and Alameda had virtually “no accounting

department”. In addition, the bankruptcy trustee chalks up the lack

of an accurate list of bank accounts and authorized signatories, as

well as insufficient creditworthiness of bank partners. New FTX CEO

Reveals Deep Swamp Of Bankman-Fried What else is Ray revealing? The

bankruptcy trustee also stated, among other things, that the “fair

value” of all cryptocurrencies held by FTX internationally is only

$659! Further, Ray estimates the total of all consolidated assets

to be around $2.56 billion. Only recently, SBF estimated the value

at $5.5 billion on Twitter. Moreover, Ray also discloses the use of

company funds to pay for houses and other items for employees.

Literally users paid for SBF’s luxury mansion: I understand that

FTX Group corporate funds have been used in the Bahamas to purchase

homes and other personal property for employees and consultants. I

understand that there appear to be no loan records for some of

these transactions and that certain properties have been recorded

in the Bahamian records in the personal names of these employees

and consultants. In addition, it is alleged that there may “be very

substantial transfers of Debtor property in the days, weeks and

months prior to the Petition Date”. If this weren’t scandalous

enough, Ray reveals that Bankman-Fried’s hedge fund has loaned $2.3

billion to… Sam Bankman-Fried himself, to his Paper Bird company.

Want another scandal? The bankruptcy documents also disclose that

FTX coded its liquidation protocol in such a way that Alameda was

excluded from liquidation. Insane! Related Reading: This Firm

Offers 8 To 12 Cents On A Dollar Of FTX User Deposit Claims But

that’s far from all. Thus, under Bankman-Fried, FTX did not include

customer liabilities in FTX’s financial statements. “I do not

believe it appropriate for stakeholders or the Court to rely on the

audited financial statements as a reliable indication,” Ray

asserted. Ray also cannot answer the question of who was on

Bankman-Fried’s company payroll. “The Debtors have been unable to

prepare a complete list of who worked for the FTX Group as of the

Petition Date.” Island Bay Ventures, the company that holds FTX’s

stake in Scaramucci’s SkyBridge, is another major issue. Ray can’t

find the company’s financials. The document also indicates that FTX

loaned FTT token worth $250 million to BlockFi. Why? Possibly to

prop up BockFi…. But there is also good news. The document reveals

that SBF’s role in the bankruptcy is to be investigated.

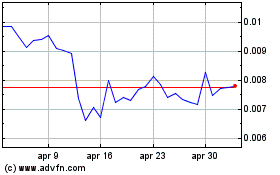

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Amp (COIN:AMPUSD)

Storico

Da Gen 2024 a Gen 2025